2025年AURA価格予測:市場動向および成長要因の分析

はじめに:AURAの市場ポジションと投資価値

Aura Network(AURA)は、スケーラビリティと機動性を兼ね備えたLayer 1ブロックチェーンエコシステムとして、設立以来NFTのグローバル普及を推進してきました。2025年時点で、AURAの時価総額は3,141,409ドル、流通供給量は約407,393,284トークン、価格はおよそ0.007711ドルとなっています。「NFTアダプション・アクセラレーター」として認知されるこのアセットは、ブロックチェーンおよびNFT分野でますます重要な役割を果たしています。

本記事では、2025年から2030年にかけてのAURAの価格動向について、過去の推移、市場の需給、エコシステムの発展、マクロ経済要因を総合的に分析し、投資家に向けて専門的な価格予測と実践的な投資戦略を提示します。

I. AURA価格の推移と現状

AURAの過去価格推移

- 2024年:1月6日にAURAは過去最高値0.06798ドルを記録し、価格史における重要な節目となりました。

- 2025年:トークンは大きく下落し、5月14日に過去最安値0.003149ドルに到達するなど、市場の高いボラティリティを示しました。

AURAの現状

2025年10月13日時点で、AURAは0.007711ドルで取引され、時価総額は3,141,409.62ドルです。トークンのパフォーマンスは期間によって異なり、過去24時間では0.45%の下落、直近30日間では72.35%の大幅な上昇、年初来では42.33%の大幅下落となっています。

現在の流通供給量は407,393,284.655983トークンで、総供給量10億トークンの40.74%を占めています。完全希薄化後評価額は7,711,000ドルで、全供給量が流通した場合の成長余地を示しています。

直近24時間の取引高は47,607.42ドルで、市場活動は中程度の水準です。市場占有率は0.00018%にとどまり、AURAは暗号資産市場において比較的小規模な銘柄であることがわかります。

現在のAURA市場価格はこちら

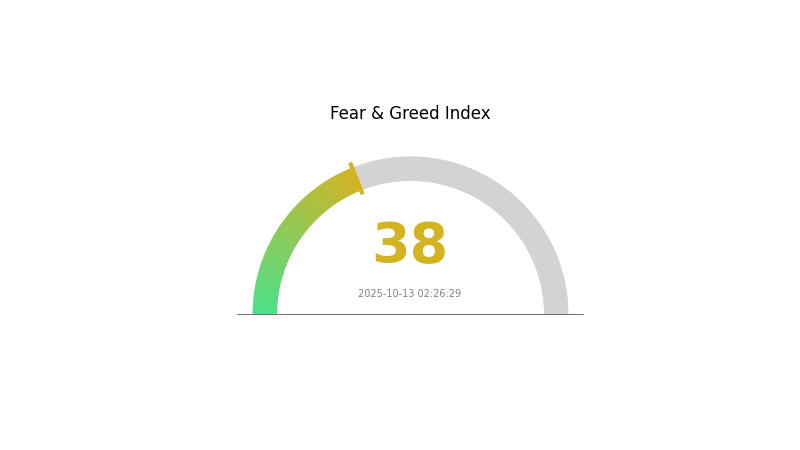

AURA市場センチメント指標

2025年10月13日 恐怖・強欲指数:38(恐怖)

現在の恐怖・強欲指数はこちら

暗号資産市場のセンチメントは慎重で、恐怖・強欲指数は38と投資家心理が恐怖に傾いています。これは低価格での参入を検討する投資家にとって買いの好機となる場合がありますが、投資判断には十分なリサーチと慎重な姿勢が不可欠です。市場心理は急激に変動するため、最新の動向を常に確認することが重要です。

AURA保有状況分布

AURAのアドレス保有分布チャートでは、大口ウォレットの集中が見られない特異な状況が示されています。このデータの欠如は、トークンの分配が初期段階である、データ取得の技術的課題がある、または独自の流通メカニズムが採用されている可能性を示唆します。

明確な集中パターンがないため、AURAの分散度や市場操作リスクを評価するのは困難です。大口保有者が目立たないことはより均等な分散を示し、市場の安定性につながる場合がありますが、実態解明のためには追加調査が必要です。

現状のデータ、あるいはデータの不在は、トークン分布の透明性の重要性を示しています。AURAの市場特性や構造安定性を正確に把握するためには、さらに包括的なオンチェーン分析が求められます。

現在のAURA保有分布はこちら

| Top | Address | Holding Qty | Holding (%) |

|---|

II. AURAの将来価格に影響する主な要因

供給メカニズム

- トークン供給:投資家はトークン供給量がAuraの今後の上場や市場価値に及ぼす影響を注視しています。

- 現状の影響:Auraトークンの需給動向の分析は、今後の価格動向やステーキング利益の予測に不可欠です。

機関・大口投資家の動向

- 企業導入:LVMHはAuraアライアンスチェーンをローンチし、自社製品へのブロックチェーン技術の活用を推進しています。

マクロ経済環境

- インフレヘッジ特性:AURAは暗号資産として、特定の経済環境下でインフレヘッジ手段となる場合があります。

技術開発とエコシステム構築

- コミュニティ参加:Auraの活発なコミュニティは成長や価格推移に重要な影響を与えています。

- エコシステムアプリケーション:AuraはSolanaブロックチェーン上で展開され、ソーシャルインフルエンスとパーソナルオーラをテーマにしたミームコインとして位置付けられています。

III. 2025~2030年のAURA価格予測

2025年見通し

- 保守的予想:0.00686~0.00771ドル

- 中立予想:0.00771~0.00867ドル

- 強気予想:0.00867~0.00964ドル(市場心理が良好な場合)

2027~2028年見通し

- 市場フェーズ予想:成長局面への移行が期待される

- 価格レンジ予想:

- 2027年:0.00581~0.01549ドル

- 2028年:0.00814~0.01562ドル

- 主な要因:普及拡大と技術進化

2029~2030年 長期見通し

- ベースシナリオ:0.01437~0.01538ドル(市場の着実な成長を想定)

- 強気シナリオ:0.01538~0.01661ドル(市場が好調に推移した場合)

- 変革シナリオ:0.01661ドル超(極めて好条件下)

- 2030年12月31日:AURA 0.01538ドル(平均予測に基づくピークの可能性)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00964 | 0.00771 | 0.00686 | 0 |

| 2026 | 0.01284 | 0.00867 | 0.00573 | 12 |

| 2027 | 0.01549 | 0.01076 | 0.00581 | 39 |

| 2028 | 0.01562 | 0.01312 | 0.00814 | 70 |

| 2029 | 0.01638 | 0.01437 | 0.00805 | 86 |

| 2030 | 0.01661 | 0.01538 | 0.01169 | 99 |

IV. AURAのプロ向け投資戦略とリスク管理

AURA投資手法

(1) 長期保有戦略

- 対象:長期投資家やNFT愛好家

- 運用ポイント:

- 市場下落時にAURAトークンを積立て

- Aura NetworkエコシステムやNFTプロジェクトに参加

- トークンは安全なコールドウォレットで管理

(2) アクティブトレード戦略

- テクニカル分析ツール:

- 移動平均線:50日線・200日線によるトレンド判定

- RSI(相対力指数):買われすぎ・売られすぎの判別に利用

- スイングトレードの要点:

- 厳格なストップロスで下落リスクを管理

- 事前に設定したレジスタンス水準で利益確定

AURAリスク管理フレームワーク

(1) 資産配分の原則

- 保守的投資家:暗号資産ポートフォリオの1~3%

- 積極的投資家:5~10%

- プロ投資家:最大15%まで

(2) リスクヘッジ対策

- 分散投資:複数のLayer 1ブロックチェーンプロジェクトに分散

- ストップロス:損失限定のため必ず設定

(3) セキュアな保管対策

- ホットウォレット推奨:Gate Web3ウォレット

- コールドストレージ:長期保有はハードウェアウォレットを利用

- セキュリティ対策:2段階認証の利用、秘密鍵の漏洩防止

V. AURAの潜在リスクと課題

AURA市場リスク

- 高いボラティリティ:暗号資産市場の変動による大幅な価格変動

- 競合:他Layer 1やNFTプラットフォームとの競争によるAura Networkのシェア低下リスク

- 市場心理:暗号資産全体のセンチメント変化による価格影響

AURA規制リスク

- 規制の不透明さ:世界的な暗号資産規制の変化がAURAの普及に影響

- NFT特有の規制:NFT対象の新規法整備によるAura Networkへの影響

- 国際コンプライアンス:各国規制の違いによりグローバル展開が制限されるリスク

AURA技術リスク

- スマートコントラクトの脆弱性:システムのバグによるセキュリティリスク

- スケーラビリティの課題:NFT普及拡大に伴うネットワーク拡張性の確保

- 相互運用性の問題:他ブロックチェーンとの連携課題による成長制約

VI. 結論とアクション推奨

AURA投資価値評価

Aura NetworkはNFT特化型Layer 1ブロックチェーンとして高い成長可能性を持つ一方、競合の激化や市場変動リスクが存在します。長期的な価値はNFT普及とエコシステムの発展にかかっており、短期的リスクには市場の変動性や規制不確実性が含まれます。

AURA投資推奨事項

✅ 初心者:分散型暗号資産ポートフォリオの一部として少額・長期保有を検討 ✅ 経験者:ドルコスト平均法の実践とAuraエコシステムへの積極参加 ✅ 機関投資家:十分なデューデリジェンスを実施し、広範なブロックチェーン投資戦略の一環としてAURAを組み入れ

AURA取引参加方法

- 現物取引:Gate.comでAURAトークンの購入

- ステーキング:ステーキングプログラムへの参加によるパッシブインカムの獲得

- NFTマーケットプレイスの活用:Aura Network NFTエコシステム内でのAURAトークン利用

暗号資産投資は極めて高リスクであり、本記事は投資助言ではありません。投資判断はご自身のリスク許容度を踏まえて慎重に行い、専門の金融アドバイザーへご相談されることを推奨します。また、余剰資金以上の投資は厳禁です。

FAQ

Auraコインの予測は?

Auraコインは2025年に0.055~0.079ドルで推移し、3.75%の上昇が見込まれます。

Auraの目標価格は?

Auraの目標価格は19.00~24.00ドルと予測されており、平均目標値から271%の上昇余地が示されています。

Aureal Oneの2030年価格予測は?

Aureal Oneの2030年価格予測は0.10358~0.28874ドル、平均値は0.19616ドルで、最大7,867.69%の上昇が見込まれます。

Auraコインの現在価値は?

2025年10月13日現在、Auraコインは0.0817ドルです。過去24時間で5.3%下落し、前日比で28.2%のマイナスとなっています。

IMX vs RUNE:NFTスケーラビリティを巡るLayer-2ソリューションの比較

Aptos vs Giants: パフォーマンス分析とこの急成長しているレイヤー1 ブロックチェーンの市場シェア

2025年SUI価格予測:ブロックチェーン新興銘柄の今後の発展と投資価値の分析

KAS(Key Agreement Scheme)とは何か:現代暗号技術における鍵合意方式の基礎理解

AVAXとは:Avalancheが提供するネイティブ暗号資産の全体像と詳細ガイド

CFXとは何か:Computational Fluid Dynamics eXchange(CFX)の基本概念とその応用分野について解説

オンチェーンデータ分析とは何か、アクティブアドレスはどのようにして暗号資産市場のトレンドを明らかにするのか?

暗号資産は現金に換金することが可能ですか?

暗号資産におけるAPR(Annual Percentage Rate)の意味と、その本当の仕組みを解説

# CARVトークンにおけるセキュリティリスクやスマートコントラクトの脆弱性とは?

CARVコインとは何か、そのゲーミングおよびAIデータレイヤープロトコルがどのように機能するのかをご説明します。