Previsão de preço BIGTIME para 2025: análise do potencial de crescimento e dos factores de mercado que influenciam o valor futuro do token de gaming

Introdução: Posição de Mercado e Valor de Investimento do BIGTIME

Big Time (BIGTIME), enquanto token de jogo multijogador online de interpretação de personagens, registou marcos notáveis desde o seu lançamento. Em 2025, a capitalização bolsista do BIGTIME ascendeu a 88 714 312 $, com uma oferta circulante próxima de 1 908 245 059 tokens e um preço a rondar 0,04649 $. Reconhecido como o "pioneiro dos jogos Web3", este ativo assume um papel cada vez mais relevante na indústria de gaming em blockchain.

Este artigo procede a uma análise detalhada da evolução do preço do BIGTIME entre 2025 e 2030, integrando padrões históricos, dinâmica de oferta e procura, desenvolvimento do ecossistema e contexto macroeconómico, com o objetivo de fornecer aos investidores previsões profissionais e estratégias de investimento pragmáticas.

I. Revisão Histórica do Preço do BIGTIME e Situação de Mercado Atual

Evolução Histórica do Preço do BIGTIME

- 2023: ATH atingido, preço máximo de 500 $ em 12 de outubro

- 2025: Recuo do mercado, preço mínimo (ATL) de 0,04086 $ em 11 de março

Situação de Mercado Atual do BIGTIME

Em 26 de setembro de 2025, o BIGTIME negocia a 0,04649 $. O token registou forte volatilidade ao longo do último ano, acumulando uma desvalorização de 64,07%. Nas últimas 24 horas, o BIGTIME caiu 2,92%, com perdas de 15,5% e 13,51% nos períodos de 7 e 30 dias, respetivamente.

Atualmente, a capitalização bolsista do BIGTIME é de 88 714 312,83 $, ocupando a 472.ª posição no ranking mundial de criptomoedas. A oferta circulante cifra-se em 1 908 245 059,79 BIGTIME, de um total de 5 000 000 000, fixando o rácio de circulação em cerca de 38,16%.

O volume de negociação nas últimas 24 horas é de 387 121,31 $, revelando dinamismo moderado no mercado. A avaliação totalmente diluída do token atinge os 232 450 000 $, sinalizando potencial de valorização caso toda a oferta fique em circulação.

Apesar da tendência negativa recente, o BIGTIME preserva uma dominância de mercado de 0,0058%, ilustrando a sua posição específica no ecossistema global das criptomoedas.

Clique para consultar o preço de mercado atual do BIGTIME

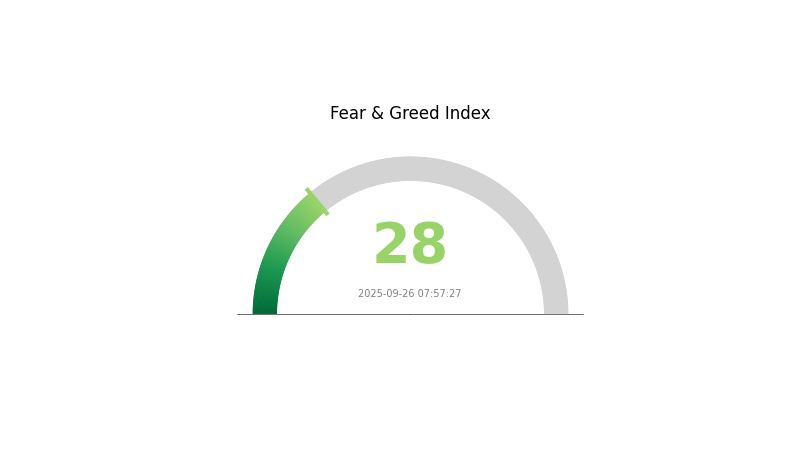

Indicador de Sentimento de Mercado BIGTIME

2025-09-26 Índice Fear and Greed: 28 (Medo)

Clique para consultar o Índice Fear & Greed

O mercado cripto está atualmente marcado por sentimento de medo, refletido pelo Índice Fear and Greed nos 28 pontos. Tal reflete cautela e incerteza por parte dos investidores. Nestes contextos, alguns traders consideram tratar-se de uma oportunidade de compra, seguindo o princípio contrariado de "temer quando os outros são gananciosos, ser ganancioso quando há medo no mercado". Contudo, é indispensável realizar uma análise cuidada e avaliar o perfil de risco antes de investir num mercado volátil.

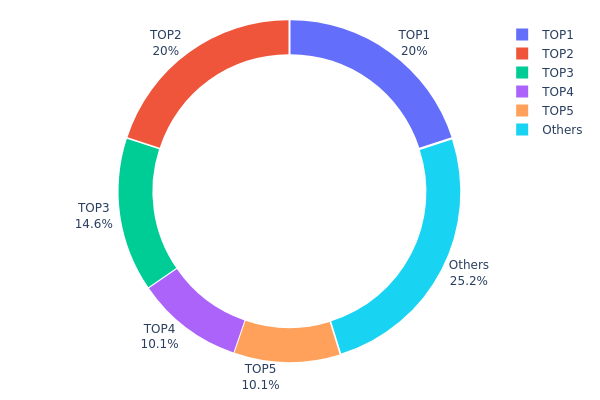

Distribuição de Posses BIGTIME

O gráfico de distribuição de endereços revela a concentração de tokens BIGTIME entre os principais detentores. A análise revela elevada centralização: os 5 maiores endereços detêm 74,77% da oferta total. O endereço principal possui 20% dos tokens, seguido pelo segundo maior com 19,98%, levantando questões de centralização.

Este nível de concentração sugere influência desproporcionada na dinâmica de mercado por parte de poucos grandes detentores. Tal estrutura aumenta a volatilidade dos preços e a exposição à manipulação de mercado. Os volumes significativos em tais endereços podem afetar a liquidez e provocar movimentos bruscos caso ocorram transações volumosas.

Em síntese, a estrutura atual reflete elevada centralização on-chain do BIGTIME. Este padrão representa riscos para a estabilidade do mercado e para os objetivos de descentralização, com impacto na confiança dos investidores e na sustentabilidade do projeto.

Clique para consultar a Distribuição de Posses BIGTIME

| Top | Endereço | Qtde. em posse | Em posse (%) |

|---|---|---|---|

| 1 | 0x0a1b...1f5030 | 1 000 000,05K | 20,00% |

| 2 | 0x533f...c2c098 | 999 333,96K | 19,98% |

| 3 | 0x3691...b29967 | 730 000,05K | 14,60% |

| 4 | 0x549a...5ac1f5 | 507 395,85K | 10,14% |

| 5 | 0x4695...fd7d37 | 502 887,11K | 10,05% |

| - | Outros | 1 260 382,98K | 25,23% |

II. Principais Fatores que Influenciam o Preço Futuro do BIGTIME

Mecanismo de Oferta

- Limite de preço dos NFT: O valor mínimo estabelecido para Time Guardians e Hourglass NFTs regula o fluxo de novos jogadores.

- Taxa de distribuição de ativos: A diminuição da taxa de distribuição tem impacto positivo no valor do token.

Dinâmica Institucional e dos Grandes Detentores

- Adoção empresarial: O BIGTIME despertou o interesse de jogadores tradicionais e de estúdios de desenvolvimento, fruto de uma valorização superior a 20 vezes e de intensos efeitos de yield farming.

Desenvolvimento Técnico e Consolidação do Ecossistema

- Modelo económico do jogo: Mudanças na equipa central, em especial a saída do diretor de produto e do responsável pelo modelo económico, poderão ter influenciado o progresso do projeto.

- Aplicações no ecossistema: BIGTIME é um projeto GameFi, o que determina a dinâmica de preço e o posicionamento de mercado.

III. Previsão de Preço do BIGTIME para 2025-2030

Perspetiva para 2025

- Projeção conservadora: 0,03678 $ - 0,04656 $

- Projeção neutra: 0,04656 $ - 0,05285 $

- Projeção otimista: 0,05285 $ - 0,05913 $ (dependente de conjuntura favorável)

Perspetiva intermédia 2027

- Fase de mercado prevista: Potencial de crescimento

- Intervalo de preço esperado:

- 2026: 0,04175 $ - 0,0724 $

- 2027: 0,04947 $ - 0,06888 $

- Catalisadores principais: Maior adoção e inovação tecnológica

Perspetiva de longo prazo 2030

- Cenário fundamental: 0,06979 $ - 0,07346 $ (assumindo crescimento de mercado constante)

- Cenário otimista: 0,07346 $ - 0,08448 $ (assumindo desempenho robusto do mercado)

- Cenário transformador: 0,08448 $+ (em contexto de avanços excecionais do projeto e mercado)

- 31 de dezembro de 2030: BIGTIME 0,08448 $ (potencial máximo)

| Ano | Valor máximo previsto | Valor médio previsto | Valor mínimo previsto | Variação (%) |

|---|---|---|---|---|

| 2025 | 0,05913 | 0,04656 | 0,03678 | 0 |

| 2026 | 0,0724 | 0,05285 | 0,04175 | 13 |

| 2027 | 0,06888 | 0,06262 | 0,04947 | 34 |

| 2028 | 0,06904 | 0,06575 | 0,03682 | 41 |

| 2029 | 0,07953 | 0,0674 | 0,04179 | 44 |

| 2030 | 0,08448 | 0,07346 | 0,06979 | 58 |

IV. Estratégias Profissionais de Investimento e Gestão de Risco BIGTIME

Metodologia de Investimento BIGTIME

(1) Estratégia de Detenção a Longo Prazo

- Indicado para: Investidores tolerantes ao risco e com visão de longo prazo

- Sugestões operacionais:

- Comprar tokens BIGTIME em períodos de correção

- Manter pelo menos 1-2 anos para absorver a volatilidade

- Guardar tokens numa carteira física segura

(2) Estratégia de Trading Ativo

- Ferramentas para análise técnica:

- Médias móveis: Aplicar médias de 50 e 200 dias para identificar tendências

- Índice de Força Relativa (RSI): Vigiar níveis de sobrecompra/sobrevenda

- Pontos-chave para swing trading:

- Definir limites stop-loss para gerir riscos

- Efetuar tomadas de ganho em pontos de resistência pré-definidos

Referencial de Gestão de Risco BIGTIME

(1) Princípios de Alocação de Ativos

- Perfil conservador: 1-3% da carteira cripto

- Perfil agressivo: 5-10% da carteira cripto

- Profissionais: até 15% da carteira cripto

(2) Soluções de Hedging

- Diversificação: Investir em vários tokens de gaming

- Contratos de opções: Utilizar opções de venda para limitar risco descendente

(3) Soluções de Armazenamento Seguro

- Recomendação hot wallet: Gate Web3 Wallet

- Cold storage: Carteira física para detenção prolongada

- Segurança: Ativar autenticação de dois fatores, utilizar palavras-passe exclusivas

V. Riscos e Desafios Potenciais do BIGTIME

Riscos de Mercado BIGTIME

- Elevada volatilidade: Tokens de gaming apresentam oscilações acentuadas de preço

- Concorrência: Número crescente de projetos de gaming em blockchain

- Adoção do utilizador: Incerteza quanto à manutenção da base de jogadores no longo prazo

Riscos Regulamentares BIGTIME

- Ambiguidade regulatória: Possibilidade de mudanças desfavoráveis

- Classificação do token: Risco de ser enquadrado como valor mobiliário

- Limitações internacionais: Restrição ao acesso global

Riscos Técnicos BIGTIME

- Vulnerabilidade de smart contracts: Suscetibilidade a ataques cibernéticos

- Problemas de escalabilidade: Dificuldades na expansão para mais utilizadores

- Interoperabilidade: Barreiras à integração com outras redes blockchain

VI. Conclusão e Recomendações

Avaliação do Potencial de Investimento BIGTIME

O BIGTIME constitui uma aposta de elevado risco e potencial de recompensa no segmento de gaming blockchain. Ainda que apresente margem para crescimento significativo, exige dos investidores capacidade para enfrentar elevada volatilidade e incerteza regulatória.

Recomendações de Investimento BIGTIME

✅ Iniciantes: Alocar apenas 1-2% da carteira cripto, privilegiar a aprendizagem.

✅ Investidores experientes: Considerar alocação entre 5% e 10% e gestão ativa das posições.

✅ Institucionais: Avaliar parcerias estratégicas com o ecossistema BIGTIME.

Formas de Participação no Mercado BIGTIME

- Negociação spot: Compra e manutenção de tokens BIGTIME na Gate.com

- Staking: Adesão a programas de staking, se disponíveis

- Compras in-game: Aquisição de tokens BIGTIME para utilização no ecossistema de jogo

O investimento em criptomoedas é altamente arriscado e este artigo não configura aconselhamento financeiro. Avalie cuidadosamente o seu perfil de risco e consulte profissionais antes de investir. Nunca invista mais do que pode perder.

FAQ

Qual é a previsão de preço da criptomoeda BIGTIME?

Prevê-se que o preço do BIGTIME oscile entre 0,40 $ e 0,55 $ até 2030, tendo por base o envolvimento dos jogadores e a monetização do jogo. As tendências atuais apontam para uma volatilidade moderada.

BIGTIME irá valorizar?

Sim, as previsões indicam que o BIGTIME pode atingir 0,07332 $ a curto prazo e potencialmente subir até 0,1372 $.

Vale a pena apostar no BIGTIME?

Sim, o BIGTIME demonstra potencial, com um valor líquido de 64 900 $ e 42 conteúdos carregados, comprovando crescente notoriedade e valor no universo Web3.

Qual memecoin pode destacar-se em 2025?

BONK deverá registar crescimento marcante em 2025, impulsionado por forte apoio comunitário e tendências virais. Dogwifhat e FARTCOIN apresentam igualmente potencial, de acordo com a dinâmica das redes sociais.

Previsão de preço GAME2 para 2025: Análise das tendências do mercado e do potencial de valorização futura do token de gaming

Previsão do Preço MAVIA para 2025: Análise do Crescimento Futuro e Potencial de ROI para Investidores

Previsão de Preço FOREST para 2025: Análise das tendências de mercado e dos fatores ambientais que vão definir o futuro da silvicultura sustentável

Previsão de Preço WOD para 2025: Análise das Tendências de Mercado e das Projeções de Especialistas para os Tokens World of Demons

Previsão de Preço LOE 2025: Orientar o Futuro dos Investimentos em Criptomoedas

É Ember Sword (EMBER) um bom investimento?: Análise do potencial e dos riscos deste token MMORPG assente em tecnologia blockchain

Resposta do Xenea Daily Quiz – 13 de dezembro de 2025

Guia para transferência de ativos para a rede Polygon

Guia para Integrar a Polygon Network com a Sua Carteira de Criptomoedas

Guia para Principiantes para Armazenamento Seguro de Ativos Digitais com BEP2

Guia para Transferir Ativos para a Polygon PoS Network