Previsão de Preço do RSR em 2025: Explorando o Futuro do Reserve Rights Token em um Mercado Cripto Volátil

Introdução: Posição de Mercado e Valor de Investimento do RSR

O ReserveRights (RSR), token criado para sustentar a estabilidade do sistema de stablecoins Reserve, tem apresentado avanços significativos desde sua origem em 2019. Em 2025, o ReserveRights conta com capitalização de mercado de US$377.100.005, oferta circulante de cerca de 60.607.522.512 tokens e preço por volta de US$0,006222. Conhecido como “guardião da estabilidade” do ecossistema Reserve, esse ativo assume papel cada vez mais estratégico no universo de finanças descentralizadas e nos sistemas digitais de pagamentos estáveis.

Neste artigo, você confere uma análise completa sobre a trajetória de preços do ReserveRights entre 2025 e 2030, reunindo padrões históricos, dinâmica de oferta e demanda, evolução do ecossistema e fatores macroeconômicos. O objetivo é apresentar previsões profissionais de preço e estratégias de investimento práticas para o investidor de perfil exigente.

I. Histórico de Preço do RSR e Situação Atual do Mercado

Evolução Histórica do Preço do RSR

- 2020: Lançamento do projeto, preço oscilando em torno de US$0,001

- 2021: Pico do ciclo de alta, preço atinge máxima histórica de US$0,117424 em 17 de abril

- 2022-2023: Inverno cripto, cotação recua para mínimas de US$0,003 a US$0,004

Situação Atual do Mercado RSR

Em 17 de outubro de 2025, o RSR é negociado a US$0,006222. O token acumula queda de 10,11% nas últimas 24 horas, com volume transacionado de US$2.901.754. Sua capitalização de mercado está em US$377.100.005, classificando-o na 184ª posição entre as criptomoedas. Circulam 60.607.522.512 unidades de RSR, equivalentes a 60,61% do total de 100 bilhões de tokens. Apesar das perdas recentes de curto prazo, o RSR valorizou 4,87% na última semana, sinalizando algum fôlego positivo. No horizonte mais longo, porém, o desempenho segue negativo: queda de 16,91% nos últimos 30 dias e retração de 8,87% em 12 meses.

Clique para consultar o preço atual do RSR

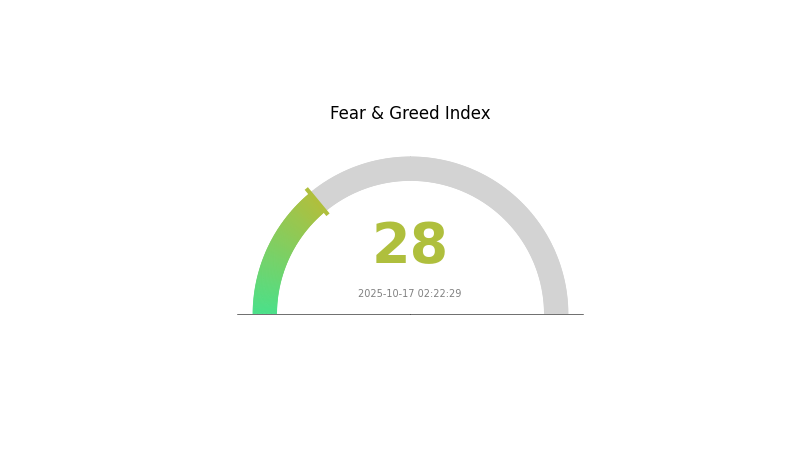

Indicador de Sentimento do Mercado RSR

17/10/2025 — Índice de Medo e Ganância: 28 (Medo)

Clique para visualizar o Índice de Medo & Ganância

O sentimento do mercado cripto para o RSR está atualmente em território de medo, com o Índice de Medo e Ganância marcando 28. Isso reflete postura cautelosa dos investidores, o que pode abrir oportunidades para quem busca acumular tokens RSR. Ainda assim, é fundamental avaliar o cenário com rigor, considerando múltiplos fatores antes de investir. Acompanhe tendências do mercado e atualizações do RSR para tomar decisões bem fundamentadas nesse contexto volátil.

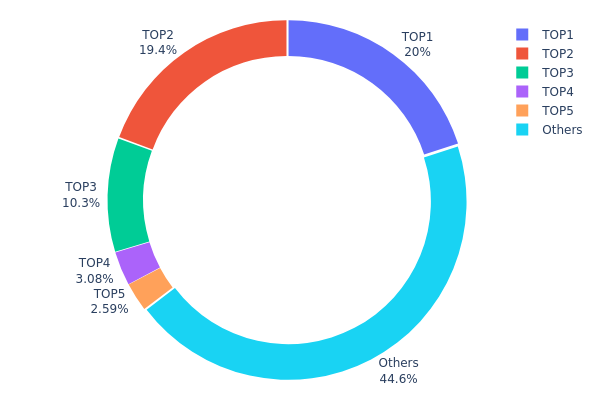

Distribuição das Detenções de RSR

O levantamento da distribuição dos endereços do RSR evidencia forte concentração de tokens em poucas carteiras. O endereço principal detém 20% da oferta total, enquanto os cinco maiores concentram juntos 55,35% dos tokens RSR. Essa concentração elevada aponta para um possível risco de centralização no ecossistema.

Uma distribuição tão concentrada pode impactar fortemente a dinâmica do mercado. A presença de grandes volumes em poucas carteiras aumenta a volatilidade e a exposição a manipulações de preço. Caso um desses grandes detentores decida liquidar parte relevante de suas posições, o mercado do RSR pode enfrentar oscilações expressivas.

Esse cenário também traz questionamentos sobre a descentralização efetiva e a estabilidade on-chain do RSR. Ainda que 44,65% dos tokens estejam dispersos em outros endereços, a dominância dos principais detentores reforça a necessidade de aprimorar a distribuição dos tokens para fortalecer a resiliência da rede e mitigar riscos de centralização.

Clique para conferir a Distribuição das Detenções de RSR

| Top | Endereço | Quantidade Detida | Participação (%) |

|---|---|---|---|

| 1 | 0x6bab...ad81c1 | 20.000.000,00K | 20,00% |

| 2 | 0x0774...7f7ef8 | 19.398.992,45K | 19,39% |

| 3 | 0xf977...41acec | 10.300.000,00K | 10,30% |

| 4 | 0x3154...0f2c35 | 3.077.723,34K | 3,07% |

| 5 | 0x18ba...1ae7b8 | 2.592.401,58K | 2,59% |

| - | Outros | 44.630.882,63K | 44,65% |

II. Principais Fatores que Influenciam o Preço Futuro do RSR

Mecanismo de Oferta

- Oferta e Demanda de Mercado: O comportamento de preço no longo prazo é ditado fundamentalmente pela relação entre oferta e demanda. Em cenários de oferta restrita ou demanda aquecida, a tendência é de valorização.

Dinâmica Institucional e de Grandes Detentores

- Sentimento de Mercado: A confiança e o sentimento dos investidores exercem influência direta sobre a cotação do RSR.

Ambiente Macroeconômico

- Influência de Políticas: Diretrizes regulatórias e decisões de órgãos governamentais podem impactar fortemente o mercado de criptoativos, inclusive o RSR.

Desenvolvimento Tecnológico e Expansão do Ecossistema

- Aplicações no Ecossistema: O avanço e a adoção de DApps e projetos no universo Reserve Rights tendem a influenciar o valor do RSR.

Nota: É essencial que investidores monitorem de perto as tendências do preço do Reserve Rights, ajustando suas estratégias conforme as movimentações de mercado e levando em conta todos esses fatores de influência.

III. Previsão de Preço do RSR para 2025-2030

Perspectivas para 2025

- Projeção conservadora: US$0,00466 – US$0,00621

- Projeção neutra: US$0,00621 – US$0,00683

- Projeção otimista: US$0,00683 – US$0,00745 (dependente de sentimento positivo e avanços do projeto)

Perspectiva de Médio Prazo para 2027

- Estágio esperado do mercado: Fase de crescimento potencial com maior adoção

- Previsão de faixa de preço:

- 2026: US$0,00587 – US$0,00854

- 2027: US$0,00684 – US$0,00868

- Catalisadores principais: Expansão do ecossistema, inovações tecnológicas e aumento da utilidade do token RSR

Perspectiva de Longo Prazo para 2030

- Cenário base: US$0,00675 – US$0,00964 (em ambiente de crescimento e desenvolvimento contínuo)

- Cenário otimista: US$0,00964 – US$0,0106 (com desempenho superior e adoção ampla)

- Cenário transformador: Acima de US$0,0106 (em condições excepcionais e casos de uso disruptivos)

- 31/12/2030: RSR US$0,0106 (pico potencial em projeções otimistas)

| Ano | Preço Máximo Previsto | Preço Médio Previsto | Preço Mínimo Previsto | Variação (%) |

|---|---|---|---|---|

| 2025 | 0,00745 | 0,00621 | 0,00466 | 0 |

| 2026 | 0,00854 | 0,00683 | 0,00587 | 9 |

| 2027 | 0,00868 | 0,00768 | 0,00684 | 23 |

| 2028 | 0,01072 | 0,00818 | 0,00532 | 31 |

| 2029 | 0,00983 | 0,00945 | 0,00728 | 51 |

| 2030 | 0,0106 | 0,00964 | 0,00675 | 54 |

IV. Estratégias Profissionais de Investimento e Gestão de Risco para RSR

Metodologia de Investimento em RSR

(1) Estratégia de Holding de Longo Prazo

- Indicada para: Investidores de longo prazo com foco em valor

- Recomendações operacionais:

- Acumule RSR durante baixas de mercado

- Defina metas de realização parcial de lucros

- Mantenha os tokens em carteiras não-custodiais seguras

(2) Estratégia de Trading Ativo

- Ferramentas de análise técnica:

- Médias móveis: Identifique reversões de tendência

- RSI: Detecte situações de sobrecompra ou sobrevenda

- Pontos-chave para swing trade:

- Use ordens de stop loss para limitar perdas

- Realize lucros em zonas de resistência

Estrutura de Gestão de Riscos para o RSR

(1) Princípios de Alocação de Ativos

- Investidores conservadores: 1-3%

- Investidores arrojados: 5-10%

- Investidores profissionais: 10-15%

(2) Soluções para Proteção de Risco

- Diversifique: Distribua seu capital entre vários criptoativos

- Use ordens de stop loss: Limite possíveis perdas

(3) Soluções de Armazenamento Seguro

- Carteira hot recomendada: Gate Web3 Wallet

- Armazenamento frio: Utilize hardware wallet para manter grandes volumes por longos períodos

- Práticas de segurança: Ative autenticação em dois fatores e use senhas robustas

V. Riscos e Desafios Potenciais para o RSR

Riscos de Mercado do RSR

- Alta volatilidade: Oscilações expressivas são frequentes no mercado cripto

- Concorrência: Outros projetos de stablecoin podem reduzir a participação de mercado do RSR

- Risco de liquidez: Possíveis obstáculos para realização de operações em grande volume

Riscos Regulatórios do RSR

- Regulação de stablecoins: Mudanças legislativas podem impactar o funcionamento do RSR

- Restrições internacionais: Divergências regulatórias entre países

- Desafios de compliance: Adaptação contínua a normas financeiras globais

Riscos Técnicos do RSR

- Vulnerabilidades em smart contracts: Possibilidade de exploits ou bugs

- Escalabilidade: Desafios para suportar volumes elevados de transação

- Interoperabilidade: Dificuldades na integração com outras blockchains

VI. Conclusão e Recomendações de Ação

Avaliação do Valor de Investimento do RSR

O RSR oferece uma proposta diferenciada entre as stablecoins, mas enfrenta volatilidade relevante e incertezas regulatórias no curto prazo. Seu potencial de longo prazo depende da capacidade da Reserve em concretizar sua visão de projeto.

Recomendações de Investimento em RSR

✅ Iniciantes: Priorize aportes pequenos e regulares para conhecer o mercado ✅ Investidores experientes: Busque equilíbrio e defina pontos claros de entrada e saída ✅ Institucionais: Considere o RSR como parte de uma carteira diversificada de criptoativos

Formas de Participação nas Negociações de RSR

- Spot trading: Negocie RSR na Gate.com

- Staking: Participe de programas de staking, se disponíveis

- Integração DeFi: Explore oportunidades em DeFi envolvendo RSR

Investir em criptomoedas envolve riscos muito elevados. Este artigo não é recomendação de investimento. Decida com cautela, conforme seu perfil de risco, e consulte sempre um assessor financeiro especializado. Nunca invista mais do que pode perder.

FAQ

Qual o potencial máximo de valorização do RSR?

O RSR pode chegar a US$0,08614 até 2025, segundo projeções e análises de mercado atuais.

O RSR é uma stablecoin?

Não, o RSR não é uma stablecoin. Ele é um token de governança destinado a garantir a estabilidade do sistema Reserve de stablecoins.

Qual a previsão de preço para o RSR em 2026?

Com base no atual sentimento de mercado, a projeção para o RSR em 2026 é de US$0,006639. Atualização de 17 de outubro de 2025.

O que explica a alta recente do RSR?

A valorização do RSR decorre da especulação levantada por grandes influenciadores do segmento cripto. Suas publicações destacando o potencial do Reserve atraíram forte interesse e movimentação no mercado.

Previsão de preço RESOLV para 2025: análise das tendências do mercado e potencial de valorização futura

ENA vs CRO: Comparação Entre Dois dos Mais Importantes Repositórios de Dados Genômicos

Como está o panorama de mercado atual para ENA em 2025?

FeiUSD (FEI) é um bom investimento?: Avaliando o potencial e os riscos desta stablecoin no dinâmico e volátil mercado de criptoativos

GHO (GHO) é um bom investimento?: Avaliando o potencial e os riscos da nova stablecoin da Aave

JST vs SNX: Uma análise comparativa de dois protocolos de ativos sintéticos em DeFi

Entendendo o Funcionamento da Tecnologia Blockchain Proof-of-Stake

Um Estudo Abrangente sobre o Modelo Stock-to-Flow do Bitcoin

Entenda o Layer Zero: O Futuro da Interoperabilidade Blockchain

Principais Canais Gratuitos de Criptomoedas para Obter Ativos Digitais

Entenda o Ataque de 51% em Criptomoedas: Riscos e Implicações