Прогноз ціни RUNE на 2025 рік: основні драйвери зростання та чинники, що впливають на майбутню вартість THORChain

Вступ: ринкова позиція та інвестиційна привабливість RUNE

RUNE (RUNE), як один із провідних активів мультичейн-екосистеми, з моменту запуску у 2019 році демонструє суттєвий прогрес. Станом на 2025 рік ринкова капіталізація RUNE становить 296 669 805 доларів США, в обігу перебуває близько 351 254 802 токенів, а ціна коливається поблизу 0,8446 долара США. Актив, відомий як «основа ліквідності», відіграє все вагомішу роль у кросчейн-обмінах активів і децентралізованих фінансах (DeFi).

У цьому матеріалі здійснюється всебічний аналіз цінової динаміки RUNE з 2025 до 2030 року, з урахуванням історичних тенденцій, балансу попиту й пропозиції, розвитку екосистеми та макроекономічних факторів. Також наведено професійні прогнози цін і практичні інвестиційні стратегії для інвесторів.

I. Історія ціни RUNE та поточний стан ринку

Динаміка ціни RUNE у ретроспективі

- 2019: Запуск, стартова ціна — 0,00851264 долара США

- 2021: Пік бичачого ринку, історичний максимум — 20,87 долара США

- 2025: Ринкова корекція, ціна впала до 0,8446 долара США

Поточний ринковий стан RUNE

Станом на 18 жовтня 2025 року RUNE торгується по 0,8446 долара США. За минулий рік токен продемонстрував помітне зниження — зміна становить -82,41%. Протягом останніх 24 годин зафіксовано незначне зниження на -1,56%. Ринкова капіталізація наразі становить 296 669 805 доларів США, що відповідає 218 місцю у глобальному рейтингу криптовалют.

24-годинний обсяг торгів RUNE складає 945 351 долар США, що свідчить про помірну ринкову активність. В обігу перебуває 351 254 802 RUNE, або 70,25% від максимальної емісії у 425 308 068 RUNE. Повністю розведена ринкова капіталізація — 422 300 000 доларів США.

Попри нещодавній спад, у короткостроковій перспективі RUNE продемонстрував зростання на 0,6% за останню годину. Проте за довших часових інтервалів токен зберігає ведмежу динаміку: -5,27% за 7 днів і -36,77% за 30 днів.

Натисніть, щоб переглянути поточну ринкову ціну RUNE

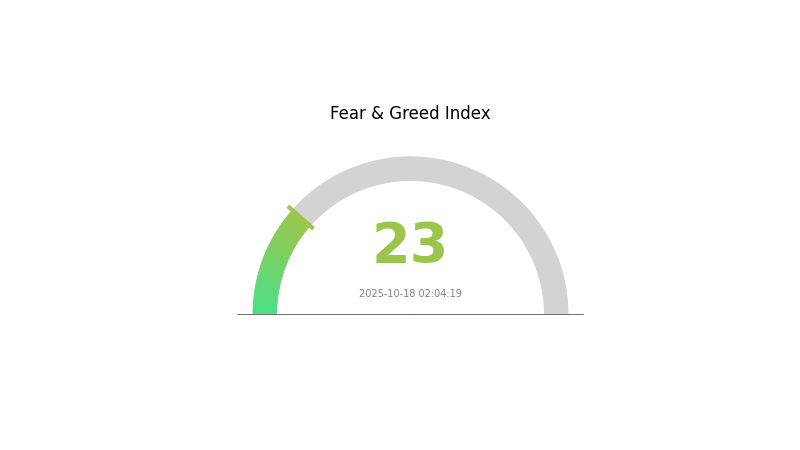

Індикатор ринкових настроїв RUNE

18 жовтня 2025 року, Індекс страху та жадібності: 23 (екстремальний страх)

Натисніть, щоб переглянути поточний Індекс страху та жадібності

Криптовалютний ринок охоплений екстремальним страхом — індекс на позначці 23. Такий рівень часто сигналізує про потенційну можливість для довгострокових інвесторів. Водночас ринкові низи можуть тривати. Одні вважають це шансом для накопичення, інші — очікують ознак відновлення. У будь-якому разі, ретельний аналіз і управління ризиками залишаються ключовими під час навігації цими волатильними умовами.

Розподіл володінь RUNE

Дані про розподіл володінь RUNE за адресами наразі недоступні, що обмежує можливості глибокого аналізу концентрації активу. Це ускладнює оцінку рівня централізації чи децентралізації структури власності RUNE.

У відсутності інформації про найбільших власників і їхні частки складно оцінити потенційний вплив на ринкову динаміку, волатильність або ризик маніпуляцій. Брак цих даних також перешкоджає комплексній оцінці ончейн-стійкості та ринкових характеристик активу.

У такій ситуації інвесторам і аналітикам варто звертатись до додаткових джерел або очікувати оновлення інформації перед формуванням висновків щодо структури ринку і потенційних ризиків або можливостей RUNE.

Натисніть, щоб переглянути поточний розподіл володінь RUNE

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Ключові чинники, що впливають на майбутню ціну RUNE

Механізм пропозиції

- Графік емісії: RUNE має попередньо визначений графік випуску з поступовим зниженням нової пропозиції.

- Історичний досвід: Раніше скорочення пропозиції, як правило, підвищувало ціновий тиск унаслідок зменшення ліквідності на продаж.

- Поточний вплив: Поточне скорочення емісії, за умови стабільного чи зростаючого попиту, і надалі підтримуватиме ціну RUNE.

Технічний розвиток і розбудова екосистеми

- Оновлення Thorchain: Безперервне вдосконалення протоколу Thorchain підвищує безпеку, ефективність і масштабованість, що сприяє зростанню цінності та практичності RUNE.

- Кросчейн-функціональність: Орієнтація Thorchain на безперешкодні кросчейн-обміни може розширити аудиторію і підвищити попит на RUNE.

- Додатки екосистеми: Розвиток DeFi-додатків на інфраструктурі Thorchain стимулює впровадження та використання RUNE.

III. Прогноз ціни RUNE на 2025–2030 роки

Прогноз на 2025 рік

- Консервативний сценарій: 0,67–0,80 долара США

- Нейтральний сценарій: 0,80–0,90 долара США

- Оптимістичний сценарій: 0,90–0,95 долара США (за умови позитивних ринкових настроїв і розвитку проєкту)

Прогноз на 2027–2028 роки

- Очікуване ринкове середовище: потенційна фаза зростання та ширшого впровадження

- Діапазон прогнозу:

- 2027: 0,76–1,24 долара США

- 2028: 1,08–1,50 долара США

- Ключові рушії: розширення екосистеми, технологічні інновації, загальне відновлення ринку

Довгостроковий прогноз на 2029–2030 роки

- Базовий сценарій: 1,30–1,40 долара США (за стабільного розвитку й впровадження)

- Оптимістичний сценарій: 1,40–1,60 долара США (за сильної ринкової динаміки й успіху проєкту)

- Трансформаційний сценарій: 1,60–1,70 долара США (за виняткових ринкових умов і проривних інновацій)

- 31 грудня 2030 року: RUNE — 1,62 долара США (потенційний максимум за оптимістичним прогнозом)

| Рік | Максимальна ціна (прогноз) | Середня ціна (прогноз) | Мінімальна ціна (прогноз) | Динаміка (%) |

|---|---|---|---|---|

| 2025 | 0,91379 | 0,8461 | 0,67688 | 0 |

| 2026 | 1,19672 | 0,87994 | 0,50157 | 4 |

| 2027 | 1,23562 | 1,03833 | 0,76837 | 22 |

| 2028 | 1,50081 | 1,13698 | 1,08013 | 34 |

| 2029 | 1,47716 | 1,31889 | 0,80452 | 56 |

| 2030 | 1,62171 | 1,39803 | 0,96464 | 65 |

IV. Професійні інвестиційні стратегії та управління ризиками для RUNE

Методологія інвестування в RUNE

(1) Стратегія довгострокового утримання

- Рекомендовано для: інвесторів із високим рівнем толерантності до ризику

- Операційні поради:

- Накопичуйте RUNE під час ринкових спадів

- Утримуйте актив щонайменше 2–3 роки, щоб мінімізувати вплив волатильності

- Зберігайте надійно в апаратному гаманці

(2) Стратегія активної торгівлі

- Інструменти технічного аналізу:

- Скользькі середні: для визначення трендів і можливих розворотів

- RSI: для моніторингу перекупленості/перепроданості

- Ключові моменти для свінг-трейдингу:

- Встановлюйте чіткі стоп-лоси

- Фіксуйте прибуток на попередньо визначених рівнях

Система управління ризиками для RUNE

(1) Принципи розподілу активів

- Консервативні інвестори: 1–3%

- Агресивні інвестори: 5–10%

- Професійні інвестори: до 15%

(2) Інструменти хеджування ризиків

- Диверсифікація: розподіляйте інвестиції між різними криптоактивами

- Стоп-лоси: використовуйте для обмеження можливих збитків

(3) Безпечне зберігання активів

- Рекомендація з апаратного гаманця: Gate Web3 Wallet

- Холодне зберігання: паперовий гаманець для довгострокових вкладень

- Заходи безпеки: не розголошуйте приватні ключі, використовуйте 2FA, регулярно оновлюйте програмне забезпечення

V. Потенційні ризики та виклики для RUNE

Ринкові ризики RUNE

- Висока волатильність: значні коливання ціни RUNE

- Конкуренція: інші кросчейн-протоколи можуть збільшити свою ринкову частку

- Ліквідність: можливі труднощі з швидким продажем великих обсягів

Регуляторні ризики RUNE

- Невизначене регуляторне поле: можливе посилення вимог до DeFi-проєктів

- Кроскордонна відповідність: складнощі з дотриманням вимог різних юрисдикцій

- Податки: зміни у податковому законодавстві можуть вплинути на операції із RUNE

Технічні ризики RUNE

- Уразливості смарт-контрактів: ризик експлойтів або багів у протоколі

- Масштабованість: можливе перевантаження мережі під час пікового попиту

- Інтероперабельність: ризики, пов’язані з кросчейн-транзакціями

VI. Висновки та рекомендації до дій

Оцінка інвестиційної привабливості RUNE

RUNE може бути перспективним кросчейн-протоколом ліквідності у довгостроковій перспективі, але наразі стикається з ризиками через ринкову волатильність і регуляторну невизначеність.

Рекомендації щодо інвестування в RUNE

✅ Початківцям: починайте з невеликих сум, приділяйте увагу освіті

✅ Досвідченим інвесторам: виділяйте частину портфеля, використовуйте інструменти управління ризиками

✅ Інституційним інвесторам: здійснюйте повний due diligence, розглядайте OTC-угоди для великих обсягів

Як брати участь у торгівлі RUNE

- Спотова торгівля: купуйте й продавайте RUNE на Gate.com

- Стейкінг: беріть участь у пулах ліквідності для отримання винагород

- DeFi-взаємодія: використовуйте RUNE у DeFi-додатках екосистеми THORChain

Інвестиції у криптовалюти супроводжуються надзвичайно високими ризиками. Ця стаття не є інвестиційною порадою. Інвестуйте обачно, враховуючи власну толерантність до ризику, та звертайтеся до професійних фінансових консультантів. Ніколи не вкладайте кошти, які не готові втратити.

FAQ

Чи є RUNE вигідною інвестицією?

Так, RUNE має значний потенціал. Інноваційна кросчейн-технологія і розбудова екосистеми формують перспективу для довгострокового зростання у сфері DeFi.

Чи відновиться курс Rune?

Так, ймовірність відновлення велика. Зі стабілізацією крипторинку та розвитком THORChain ціна Rune може суттєво зрости до 2025 року.

Яким буде майбутнє монети Rune?

Монета Rune має перспективи значного зростання. З поширенням DeFi і кросчейн-рішень роль Rune у екосистемі THORChain може стимулювати її впровадження і зростання вартості до 2025 року.

Якою буде ціна THORChain у 2030 році?

Враховуючи ринкові тенденції та потенціал зростання, ціна THORChain (RUNE) може сягати 50–100 доларів США до 2030 року. Однак ціни на криптоактиви залишаються надзвичайно волатильними й непередбачуваними.

Що таке ціна SRP: Аналіз вартості Токена та ринкових тенденцій у 2025 році

Прогноз ціни DBR на 2025 рік: аналіз ринкових тенденцій та перспективи майбутньої вартості Digital Bond Reserves

Що таке Dexscreener Як відстежувати Токени на Децентралізованих біржах

Прогноз вартості AERO у 2025 році: аналіз ринкових трендів і можливих драйверів зростання

Як аналіз ончейн-даних дозволяє виявити ризики маніпуляцій ринком AUCTION у 2025 році?

Яким чином рух криптовалютних фондів визначає динаміку ринку?

Ознайомлення з основами BTC Bull Meme Coin

Вичерпний посібник з децентралізованої торгівлі з використанням протоколів, таких як UniswapX

Аналіз рядків приватного ключа у транзакціях криптовалюти

Дослідження криптографії: ключові принципи для технології блокчейн

Аналіз патерна Triple Top у торгівлі криптовалютами