Dogecoin Price

What Is Dogecoin (DOGE)?

Dogecoin is a cryptocurrency that operates on a Proof-of-Work (PoW) consensus mechanism using the Scrypt algorithm. Launched in 2013, Dogecoin draws inspiration from the popular "doge" meme, positioning itself as a fun and approachable digital currency ideal for microtransactions and online tipping. Dogecoin features a block time of approximately one minute, offering low transaction fees and fast confirmation speeds.

What Is the Current Price, Market Cap, and Circulating Supply of Dogecoin (DOGE)?

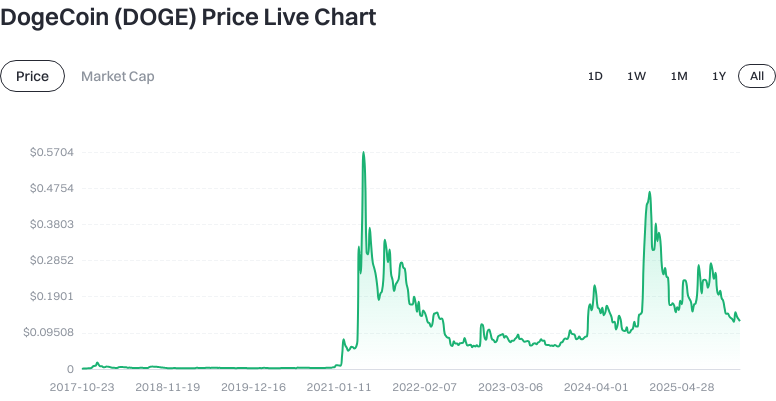

As of January 22, 2026, Dogecoin is trading at approximately $0.126180 per DOGE, with a circulating supply of about 168,376,333,126.579102 DOGE. The total supply stands at roughly 168,420,003,126.579010 DOGE, and there is no maximum cap on issuance. This brings the circulating market capitalization to about $21,251,235,994.511738, with the same value for fully diluted market capitalization, representing roughly 0.65% market dominance. Price changes are approximately -0.04% over the last hour, +0.97% over 24 hours, -12.55% over 7 days, and -3.37% over 30 days. The 24-hour trading volume is around $27,770,270.213032 (data source: input information as of January 22, 2026).

Click to view the DOGE/USDT price

Market capitalization is calculated by multiplying price by circulating supply; fully diluted market cap projects value based on total supply. Since Dogecoin has no supply cap, ongoing issuance affects the relationship between these metrics.

Who Created Dogecoin (DOGE) and When?

Dogecoin was created in December 2013 by Billy Markus and Jackson Palmer, inspired by the community-driven "doge" meme. Their goal was to build a more approachable cryptocurrency culture and payment experience for mainstream users. The early Dogecoin community became known for tipping and donations, including fundraising for charity and sports events, fostering a highly interactive user base (source: Dogecoin official website and Wikipedia, as of January 22, 2026).

How Does Dogecoin (DOGE) Work?

Dogecoin utilizes Proof-of-Work (PoW) consensus, where miners solve computational puzzles to compete for block validation rights and earn block rewards. Its Scrypt algorithm is memory-intensive and supports merged mining with Litecoin—allowing shared mining power and improved security. With a block time of around one minute, Dogecoin confirms transactions faster than networks with ten-minute blocks. The block reward is fixed at approximately 10,000 DOGE per block; with no supply limit, this reward continues indefinitely. The annual new issuance amounts to several billion DOGE, meaning the nominal inflation rate gradually decreases as the total supply grows (sources: Dogecoin Core developer documentation and community resources as of January 22, 2026).

Key terms: Scrypt is a cryptographic hashing algorithm; PoW secures the network through computing power and electricity costs; merged mining enables simultaneous block production on compatible chains for enhanced security and efficiency.

What Can You Do With Dogecoin (DOGE)?

Dogecoin is widely used for tipping creators on social platforms and for small payments thanks to its low fees and quick confirmations—ideal for frequent microtransactions. Merchants can integrate DOGE as a payment method to reduce friction in cross-border purchases of digital services or goods. The community also organizes fundraising and charity events with DOGE, highlighting its community-driven applications.

What Wallets and Expansion Solutions Exist in the Dogecoin (DOGE) Ecosystem?

Users can choose Dogecoin Core—a full-node wallet that downloads the entire blockchain for direct transaction verification—or opt for lightweight mobile wallets that offer convenience but rely on remote nodes. For enhanced self-custody security, many use cold wallets (offline hardware or paper private keys), minimizing theft risks; hot wallets (online wallets) are suitable for daily transactions but should enable two-factor authentication (2FA). Payment plugins and merchant gateways allow DOGE integration into websites or e-commerce stores; merged mining tools and pool software support miners. If storing assets within a Gate account, activate all security settings and understand the platform's risk controls.

Key terms: A private key is a secret string used to sign transactions and control ownership; cold storage wallets store keys offline for enhanced safety; hot wallets remain online for convenience; two-factor authentication (2FA) requires a second verification code during login or withdrawal.

What Are the Main Risks and Regulatory Issues with Dogecoin (DOGE)?

Price Volatility: Dogecoin's price is highly sensitive to market sentiment and liquidity, leading to rapid short-term swings. Inflation Mechanism: With no supply cap and fixed block rewards driving continuous issuance, Dogecoin’s long-term value depends more on utility than scarcity. Narrative & Celebrity Influence: Social media trends and celebrity endorsements can amplify volatility. Technical & Security Risks: A drop in merged mining participation could theoretically weaken network security and decentralization; users also face threats from phishing sites and malware. Platform & Regulation: Always stay informed about local crypto regulations and tax policies; when using custodial platforms, enable security features and review asset segregation and risk policies.

How to Buy and Securely Store Dogecoin (DOGE) on Gate?

Step 1: Register a Gate account. Visit gate.com to sign up using your email or phone number. Set a strong password and store it securely.

Step 2: Complete identity verification and security setup. Go through KYC procedures (submit documents as required by regulations), enable two-factor authentication (2FA), and set up withdrawal whitelists.

Step 3: Deposit funds. Transfer assets via fiat channels or on-chain deposits into your Gate account. Pay attention to deposit networks, arrival times, fees, and limits.

Step 4: Place an order on the spot market. Search for "DOGE" on the spot trading page—choose either a market order (executes at current price) or limit order (set your preferred price). Enter the amount to buy, review fees and totals, then submit your order.

Step 5: Asset storage strategy. For short-term trading, keep assets in your Gate account with enabled risk controls and alerts; for long-term holding, transfer to a self-managed wallet, securely back up your seed phrase or private key, test small withdrawals before transferring larger sums.

Step 6: Ongoing security checks. Regularly review account login history and update security settings; use small test trades to get familiar with processes and understand fee structures and market volatility.

How Does Dogecoin (DOGE) Compare With Bitcoin (BTC)?

Supply Model: Bitcoin has a maximum supply of 21 million coins—supporting a deflationary narrative; Dogecoin has no supply cap, with ongoing fixed rewards leading to perpetual issuance. Over time, Dogecoin’s nominal inflation rate decreases as total supply increases. Consensus & Algorithm: Both use Proof-of-Work but Bitcoin uses SHA-256 while Dogecoin uses Scrypt and supports merged mining with Litecoin. Performance & Fees: Dogecoin features one-minute blocks and low fees—ideal for frequent microtransactions; Bitcoin’s ten-minute blocks are suited for store-of-value and large settlements. Narrative & Use Cases: Dogecoin focuses on community tipping and easy payments; Bitcoin emphasizes censorship resistance and scarcity. Security & Ecosystem: Bitcoin’s hashrate is higher with more mature network security; Dogecoin’s security relies more on community engagement and merged mining participation.

Summary of Dogecoin (DOGE)

Dogecoin fosters community consensus through its lighthearted culture combined with fast transactions and low fees. Technically, it employs Scrypt-based PoW with one-minute blocks; it has no maximum supply limit and maintains constant issuance—making it well-suited for tipping and high-frequency microtransactions. Always refer to up-to-date data for DOGE’s price, market cap, and circulating supply; consider how inflation affects long-term value. If you plan to purchase DOGE on Gate, complete KYC verification, manage exposure carefully, and enhance account security; for long-term storage, prioritize self-custody of private keys with reliable backups. Given market volatility and changing narratives, build your strategy based on your risk tolerance—focusing on clear use cases, strong risk controls, and staying updated with data.

FAQ

What Causes Dogecoin’s Price Volatility?

Dogecoin’s price mainly fluctuates due to market sentiment, community activity, and macro factors. Social media buzz, celebrity endorsements, and overall crypto market trends directly drive DOGE’s ups and downs.

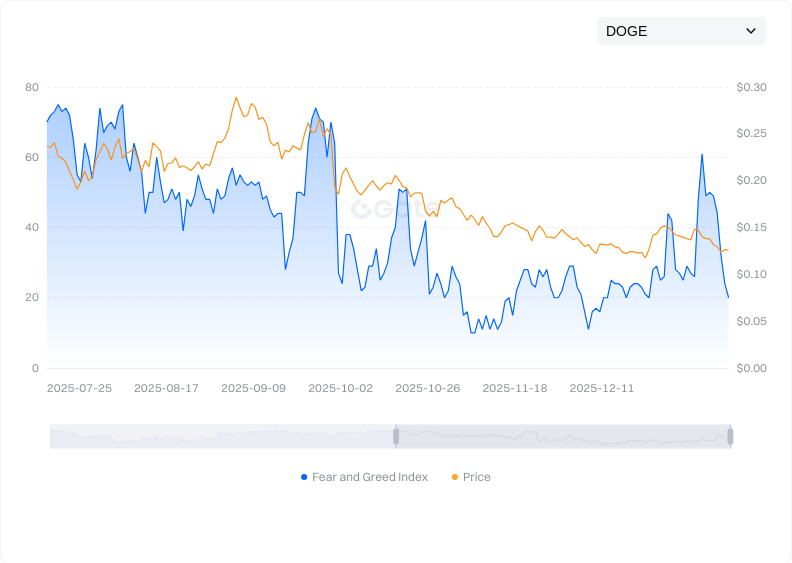

Click to view DOGE Fear & Greed Index

Beginners are advised to understand fundamentals before making trades—avoid chasing pumps or panic selling.

Where Can I Check Real-Time Dogecoin Prices?

Platforms like Gate, CoinMarketCap, CoinGecko, etc., provide real-time DOGE price data. Gate offers not only price tracking but also candlestick charts, order book depth tools, etc., making it easy to monitor trends. Cross-check prices across several platforms for accuracy.

Are Dogecoin Prices Correlated With Bitcoin?

Dogecoin prices are highly correlated with Bitcoin’s trends—when Bitcoin rises, DOGE often follows due to BTC’s role as the crypto market benchmark influencing capital flows and investor sentiment across the industry. However, DOGE often shows higher volatility than BTC.

Click to view Latest DOGE Market Data

Is Dogecoin Suitable for Long-Term Holding?

Dogecoin is considered a high-risk asset with significant price swings—not recommended as a stable investment vehicle. If you consider holding it long-term, use only discretionary funds and be mentally prepared for major volatility. Try small trades on Gate first before committing more capital.

How Can You Tell If Dogecoin Is Overvalued or Undervalued?

You can reference metrics like market cap, circulating supply, or compare current prices to historical averages for a rough assessment. However, there’s no unified valuation standard in crypto—prices are mainly driven by supply-demand dynamics and market sentiment. Beginners should follow professional analyst insights—for example in Gate’s market analysis section—to inform their views.

Dogecoin (DOGE) Glossary

- Proof-of-Work (PoW): A consensus mechanism where miners solve complex math problems to validate transactions and create new blocks.

- Mining: The process by which miners contribute computing power to validate network transactions in exchange for newly minted DOGE rewards.

- Blockchain: A distributed ledger recording all DOGE transactions in interconnected data blocks.

- Wallet: A tool for storing and managing DOGE private keys—used to send or receive transactions.

- Transaction Confirmation: The process where miners bundle transactions into blocks for verification—typically requiring multiple confirmations.

Dogecoin (DOGE) References & Further Reading

-

Official Website / Whitepaper:

-

Development / Documentation:

-

Authoritative Media / Research:

Related Articles

Top 10 Meme Coin Trading Platforms

Review of the Top Ten Meme Bots