#BitMineAcquires20,000ETH

#BitMineAcquires20,000ETH story — institutional crypto treasury firm BitMine has executed a significant Ethereum accumulation move by purchasing 20,000 ETH, highlighting continued confidence in Ethereum and institutional participation in digital assets. Today’s developments show this transaction in the context of BitMine’s broader strategy and its impact on the market.

What Happened

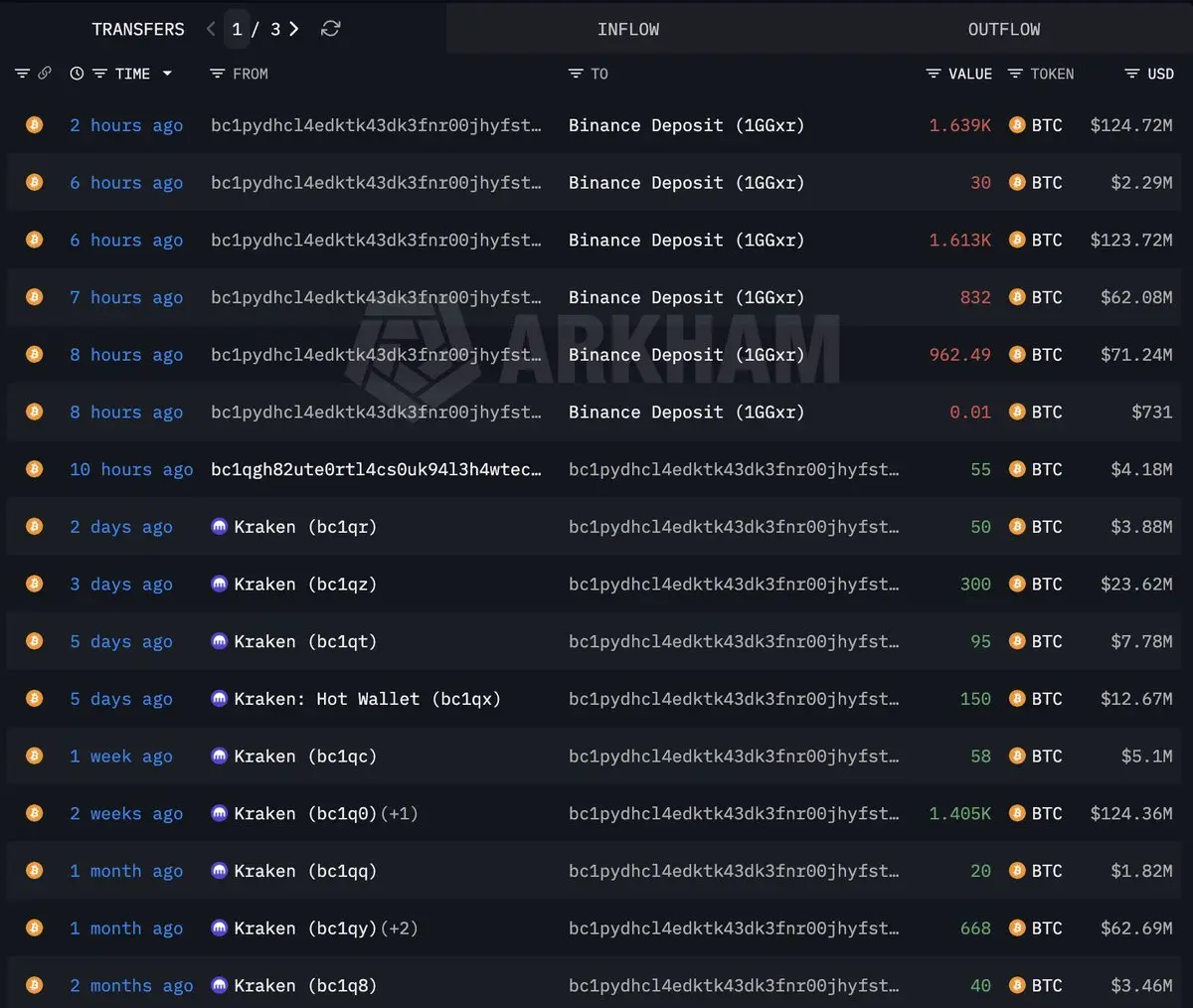

BitMine executed a purchase of 20,000 ETH, valued at approximately 46 million USD, through the institutional trading platform FalconX. This transaction was monitored by on-chain analysts and took place recently as part of BitMine’s ongoing accumulation strategy. The purchase was confirmed within a short time window and was noticeable on on-chain data feeds due to its size and market timing.

The purchase adds to a pattern of aggressive Ethereum accumulation by BitMine and reinforces the firm’s role as one of the largest corporate holders of ETH. The amount acquired, while small relative to BitMine’s total holdings, is still a significant institutional buy and sends a strong message about confidence in Ethereum’s long-term prospects.

BitMine’s Broader Accumulation Strategy

This 20,000 ETH purchase is part of a larger accumulation trend. In recent weeks BitMine expanded its Ethereum holdings substantially, including previous acquisitions of tens of thousands more ETH and staking large quantities of the asset. This adds to the firm’s already massive treasury which ranks among the largest in the crypto industry.

BitMine’s strategy can be broken down into two core elements:

1. Accumulation of ETH as a core reserve asset

BitMine has been steadily buying ETH during market dips and using institutional liquidity channels to build size. The plan appears to be long-term, viewing ETH as a foundational layer of digital finance with potential for compounded returns and future utility.

2. ETH Staking and Network Participation

In addition to buying ETH, BitMine has also staked large amounts of the asset. Staking not only supports network security and proof-of-stake consensus but also generates yield for the treasury. Recent data suggests BitMine’s staked ETH position is among the largest in the ecosystem, illustrating a dual focus on both accumulation and participation.

Why This Matters

This acquisition matters for several reasons:

Institutional confidence in Ethereum

Institutional or corporate treasury buys of this size indicate confidence from larger entities that Ethereum remains a core asset worth holding and integrating into long-term balance sheet strategies.

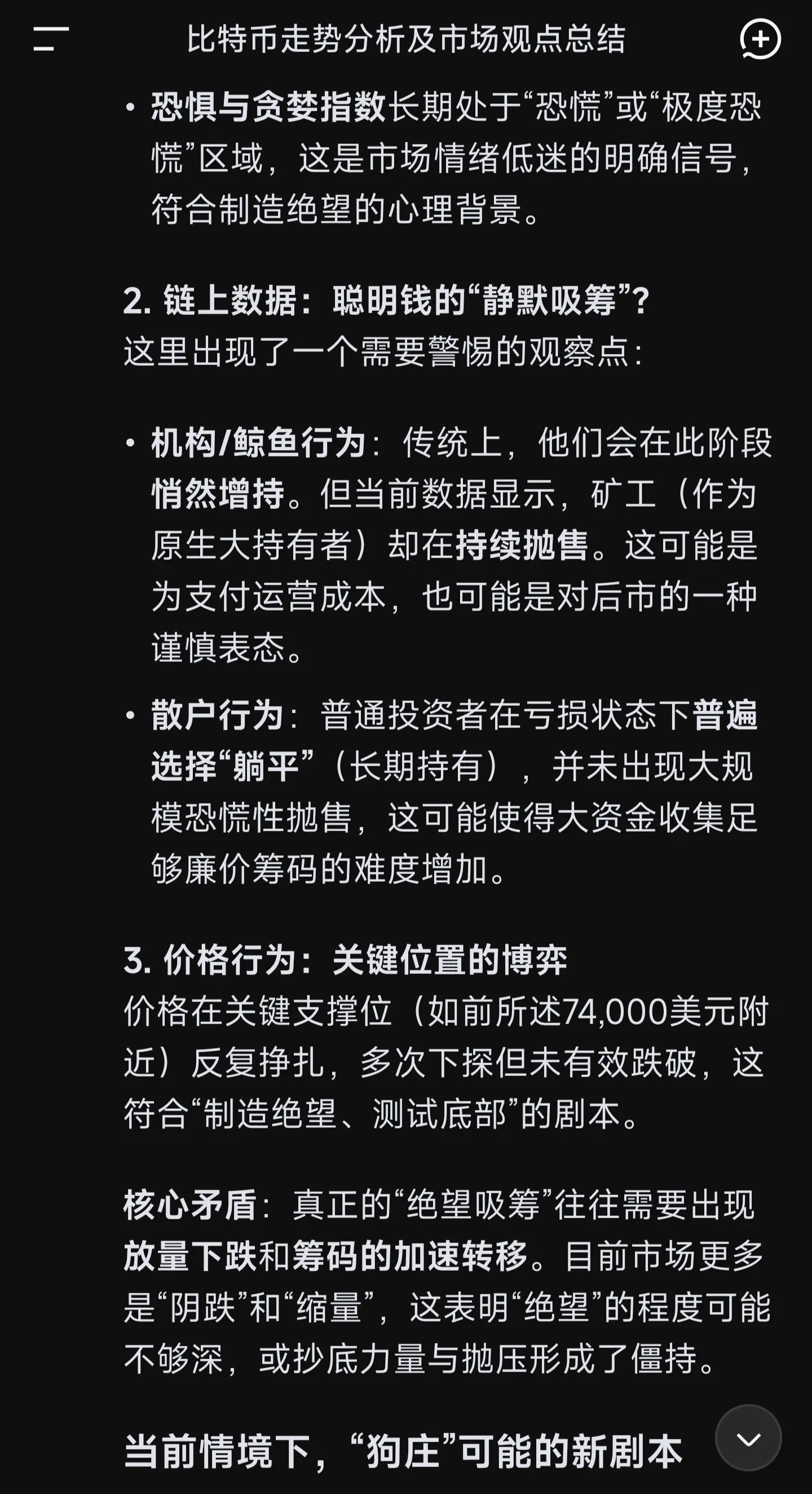

Supply dynamics and market psychology

BitMine’s accumulation can contribute to tighter available supply, especially when paired with staking, which removes tokens from active circulation. This dynamic may contribute to bullish sentiment over the long term.

Integration of traditional investment models

A firm like BitMine treating ETH similarly to traditional treasury assets underscores the evolving perception of crypto among institutional players. This signals a shift from viewing digital assets strictly as speculative tools to seeing them as strategic reserve components.

Market Reaction

In general ETH price reactions to these accumulation moves have been muted in the short term, as the crypto market continues to be driven by broader macro trends, trader positioning, and global liquidity conditions. However large institutional buys often influence sentiment, as they get interpreted as signals of long-term institutional confidence in the asset despite short-term price volatility.

Strategic Positioning and Future Implications

BitMine’s ongoing strategy suggests several key implications for the broader crypto market:

Long Term Accumulation

This 20,000 ETH purchase is one of many moves that indicate BitMine could be accumulating toward a larger strategic target, potentially increasing its share of the total ETH supply significantly over time.

Staking and Yield Strategy

By combining accumulation with staking, BitMine’s model demonstrates a hybrid approach that captures both capital appreciation and network yield — a strategy that many institutional investors may find attractive.

Institutional Influence on Supply

As corporate holders like BitMine increase their treasury sizes, the amount of ETH available on exchanges may tighten, which can affect liquidity and trader behavior, especially during periods of market stress or high volatility.

Conclusion

The #BitMineAcquires20,000ETH news highlights a clear message from one of Ethereum’s largest institutional participants — accumulate and hold. BitMine’s acquisition reinforces Ethereum’s narrative as a long-term core crypto asset rather than a short-term speculative instrument.

While any single purchase of 20,000 ETH might not move markets dramatically on its own, when seen as part of a larger pattern of institutional accumulation and staking growth, it reflects deepening institutional commitment to Ethereum’s ecosystem. For investors and observers, this suggests that large players are positioning for long term Ethereum adoption, supply defense, and potential future network growth rather than short term trading gains.

#BitMineAcquires20,000ETH story — institutional crypto treasury firm BitMine has executed a significant Ethereum accumulation move by purchasing 20,000 ETH, highlighting continued confidence in Ethereum and institutional participation in digital assets. Today’s developments show this transaction in the context of BitMine’s broader strategy and its impact on the market.

What Happened

BitMine executed a purchase of 20,000 ETH, valued at approximately 46 million USD, through the institutional trading platform FalconX. This transaction was monitored by on-chain analysts and took place recently as part of BitMine’s ongoing accumulation strategy. The purchase was confirmed within a short time window and was noticeable on on-chain data feeds due to its size and market timing.

The purchase adds to a pattern of aggressive Ethereum accumulation by BitMine and reinforces the firm’s role as one of the largest corporate holders of ETH. The amount acquired, while small relative to BitMine’s total holdings, is still a significant institutional buy and sends a strong message about confidence in Ethereum’s long-term prospects.

BitMine’s Broader Accumulation Strategy

This 20,000 ETH purchase is part of a larger accumulation trend. In recent weeks BitMine expanded its Ethereum holdings substantially, including previous acquisitions of tens of thousands more ETH and staking large quantities of the asset. This adds to the firm’s already massive treasury which ranks among the largest in the crypto industry.

BitMine’s strategy can be broken down into two core elements:

1. Accumulation of ETH as a core reserve asset

BitMine has been steadily buying ETH during market dips and using institutional liquidity channels to build size. The plan appears to be long-term, viewing ETH as a foundational layer of digital finance with potential for compounded returns and future utility.

2. ETH Staking and Network Participation

In addition to buying ETH, BitMine has also staked large amounts of the asset. Staking not only supports network security and proof-of-stake consensus but also generates yield for the treasury. Recent data suggests BitMine’s staked ETH position is among the largest in the ecosystem, illustrating a dual focus on both accumulation and participation.

Why This Matters

This acquisition matters for several reasons:

Institutional confidence in Ethereum

Institutional or corporate treasury buys of this size indicate confidence from larger entities that Ethereum remains a core asset worth holding and integrating into long-term balance sheet strategies.

Supply dynamics and market psychology

BitMine’s accumulation can contribute to tighter available supply, especially when paired with staking, which removes tokens from active circulation. This dynamic may contribute to bullish sentiment over the long term.

Integration of traditional investment models

A firm like BitMine treating ETH similarly to traditional treasury assets underscores the evolving perception of crypto among institutional players. This signals a shift from viewing digital assets strictly as speculative tools to seeing them as strategic reserve components.

Market Reaction

In general ETH price reactions to these accumulation moves have been muted in the short term, as the crypto market continues to be driven by broader macro trends, trader positioning, and global liquidity conditions. However large institutional buys often influence sentiment, as they get interpreted as signals of long-term institutional confidence in the asset despite short-term price volatility.

Strategic Positioning and Future Implications

BitMine’s ongoing strategy suggests several key implications for the broader crypto market:

Long Term Accumulation

This 20,000 ETH purchase is one of many moves that indicate BitMine could be accumulating toward a larger strategic target, potentially increasing its share of the total ETH supply significantly over time.

Staking and Yield Strategy

By combining accumulation with staking, BitMine’s model demonstrates a hybrid approach that captures both capital appreciation and network yield — a strategy that many institutional investors may find attractive.

Institutional Influence on Supply

As corporate holders like BitMine increase their treasury sizes, the amount of ETH available on exchanges may tighten, which can affect liquidity and trader behavior, especially during periods of market stress or high volatility.

Conclusion

The #BitMineAcquires20,000ETH news highlights a clear message from one of Ethereum’s largest institutional participants — accumulate and hold. BitMine’s acquisition reinforces Ethereum’s narrative as a long-term core crypto asset rather than a short-term speculative instrument.

While any single purchase of 20,000 ETH might not move markets dramatically on its own, when seen as part of a larger pattern of institutional accumulation and staking growth, it reflects deepening institutional commitment to Ethereum’s ecosystem. For investors and observers, this suggests that large players are positioning for long term Ethereum adoption, supply defense, and potential future network growth rather than short term trading gains.