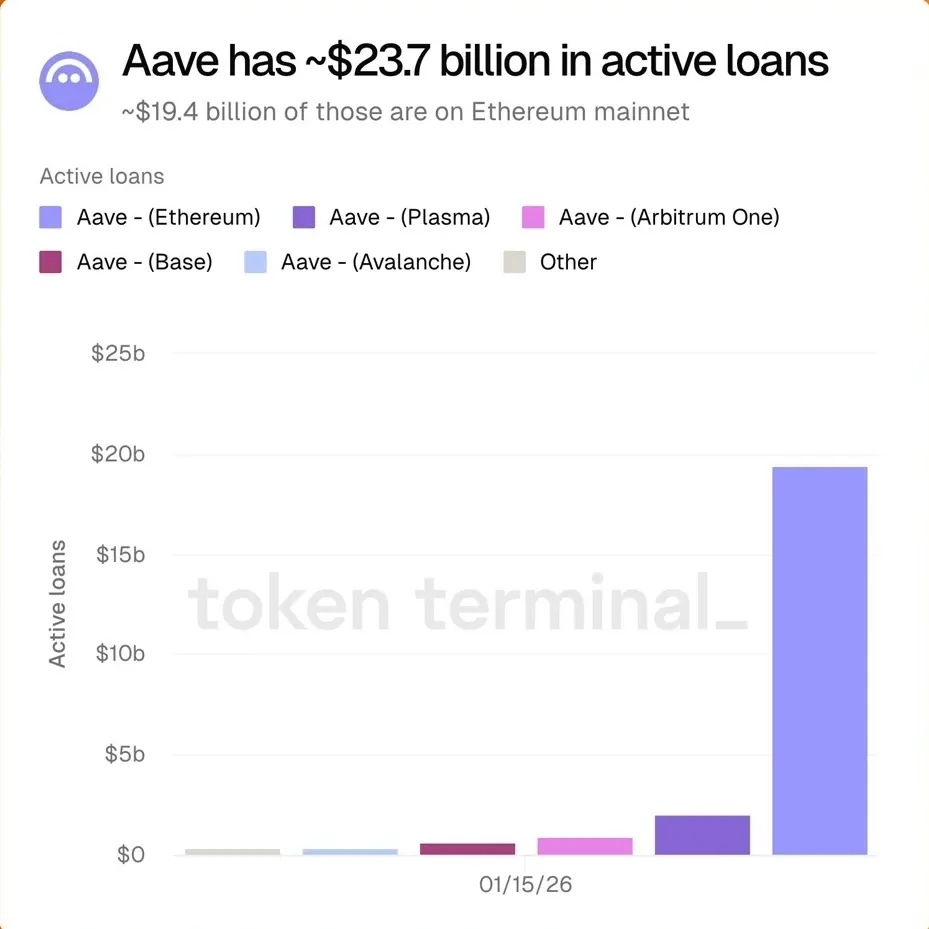

Aave 圖表展望2026年的雄心藍圖,包含三大支柱路線圖 📜

Aave Labs 公布了其2026年的全面願景,聚焦於三個核心計劃,旨在擴展協議的覆蓋範圍與功能。

1. Aave V4:統一流動性架構

即將推出的版本是一次完整的協議重塑,引入中心-輻射模型。此舉旨在取代碎片化的流動性池,建立每個網絡的統一資本樞紐,並打造專門的“輻射”以滿足定制化的借貸市場。此更新目標是處理兆級資產,以滿足機構和金融科技的需求。

2. Horizon:擴展機構RWA借貸

專門的實物資產(RWA)市場,目前存款額為(百萬,目標在2026年突破)十億。Horizon專注於吸引主要金融機構,允許以代幣化資產(如美國國債)作為抵押品,合作夥伴包括Circle和Franklin Templeton。

3. Aave App:主流手機優先採用

旗艦手機應用程式,結合推送的進出場功能,被定位為大眾用戶採用的特洛伊木馬。該應用旨在抽象化DeFi的複雜性,吸引傳統金融科技領域的用戶。

在一個顯著的協調展現中,Aave創始人Stani Kulechov也披露了個人$550 百萬購買$1 代幣的消息。這份路線圖強調Aave的$10 $AAVE

$AAVE 策略,旨在演變成鏈上經濟的基礎全球信用層。