# WhenisBestTimetoEntertheMarket

844.33K

HighAmbition

#WhenisBestTimetoEntertheMarket

#WhenIsBestTimeToEnterTheMarket? 🚨🔥💎

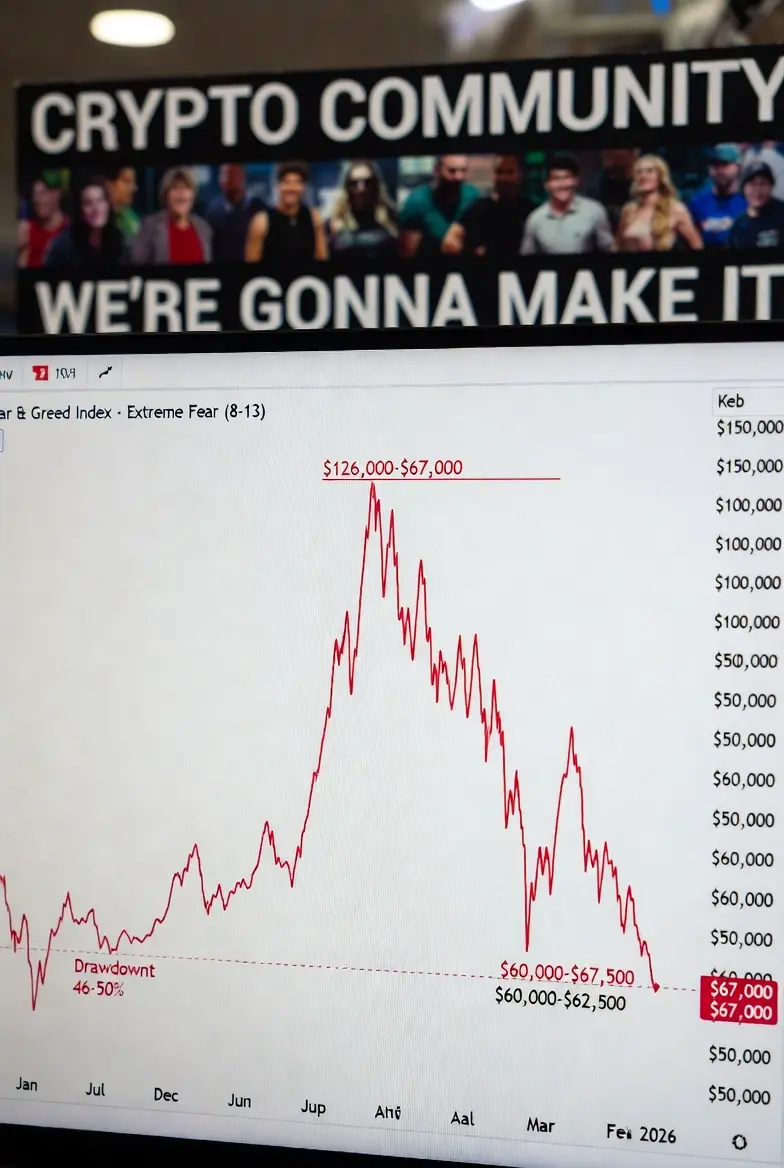

Crypto fam, the million-dollar question right now: "Is THIS the dip to buy? Should I wait for lower? Or just sit in stables/fiat?"

Market's bleeding—Extreme Fear everywhere, liquidations flying, FUD at max—but history shows these moments often become legendary entry points for patient winners.

Today: Full deep-dive masterclass with fresh data (Feb 18, 2026), technicals, macro, on-chain, psychology, and clear action plan. No hype, just real talk to help you decide smart. Let's break it down! 🧵

1️⃣ What "Best Time to Enter

#WhenIsBestTimeToEnterTheMarket? 🚨🔥💎

Crypto fam, the million-dollar question right now: "Is THIS the dip to buy? Should I wait for lower? Or just sit in stables/fiat?"

Market's bleeding—Extreme Fear everywhere, liquidations flying, FUD at max—but history shows these moments often become legendary entry points for patient winners.

Today: Full deep-dive masterclass with fresh data (Feb 18, 2026), technicals, macro, on-chain, psychology, and clear action plan. No hype, just real talk to help you decide smart. Let's break it down! 🧵

1️⃣ What "Best Time to Enter

- Reward

- 4

- 4

- Repost

- Share

Discovery :

:

LFG 🔥View More

#WhenisBestTimetoEntertheMarket Timing the market is one of the most common questions in crypto, but the truth is, it’s less about a “perfect moment” and more about strategy, risk management, and market context. Here’s a clear, structured view:

📊 1️⃣ Identify Market Structure

Look for higher lows and strong support zones — these often indicate the market is holding key levels.

Avoid chasing pumps; entering near confirmed support reduces downside risk.

Check technical indicators like moving averages, RSI, and MACD for early signs of trend reversals.

💹 2️⃣ Assess Sentiment & Capital Flows

Watc

📊 1️⃣ Identify Market Structure

Look for higher lows and strong support zones — these often indicate the market is holding key levels.

Avoid chasing pumps; entering near confirmed support reduces downside risk.

Check technical indicators like moving averages, RSI, and MACD for early signs of trend reversals.

💹 2️⃣ Assess Sentiment & Capital Flows

Watc

BTC-2,27%

- Reward

- 4

- 10

- Repost

- Share

Peacefulheart :

:

Ape In 🚀View More

MARKET UPDATE: $HYPE

$HYPE still respecting the daily ascending trendline that we previously marked.

After the impulsive move toward the $35–$38 region, price has been consolidating and compressing around $30–$31. Despite the pullback, the structure remains constructive while the trendline and the ~$29–$30 zone hold.

A clean breakdown below that area would shift momentum and open room for a deeper correction. Until then, this looks like consolidation within an overall higher-low structure.

#WhenisBestTimetoEntertheMarket #HYPE $HYPE

$HYPE still respecting the daily ascending trendline that we previously marked.

After the impulsive move toward the $35–$38 region, price has been consolidating and compressing around $30–$31. Despite the pullback, the structure remains constructive while the trendline and the ~$29–$30 zone hold.

A clean breakdown below that area would shift momentum and open room for a deeper correction. Until then, this looks like consolidation within an overall higher-low structure.

#WhenisBestTimetoEntertheMarket #HYPE $HYPE

HYPE-6,01%

- Reward

- like

- Comment

- Repost

- Share

🔥BTC Position Building Logic Exposure: Betting on US capital inflow! Year-end tax-loss harvesting selling pressure → Key BTC ETF under wash sale rule restrictions at the end of last year → Can only buy back after 30 days, continuous buying pressure in January with no gap in spot market → Selling pressure in January is directly eliminated, reducing downward constraints. Recently, BTC has outperformed US stocks, and the logic has been validated! 📝Trading Plan: Build position on January 1, take profit in early February, betting on a rebound driven by January capital inflow. 🌪️What do you think

BTC-2,27%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

186.36K Popularity

1.99K Popularity

37.69K Popularity

79.17K Popularity

844.33K Popularity

285.29K Popularity

395.81K Popularity

29.98K Popularity

18.79K Popularity

16.93K Popularity

16.7K Popularity

15.53K Popularity

15.61K Popularity

43.66K Popularity

News

View MoreMarket Report: Top 5 cryptocurrencies by decline on February 18, 2026, with the largest drop being pippin

21 m

Anthropic expects to pay at least $80 billion within three years to Amazon, Google, and Microsoft to run Claude AI on cloud servers.

24 m

Data: US SOL spot ETF's total net inflow for the day is $2,193,800

42 m

On Polymarket, the probability that USD.AI's FDV exceeds $150 million on the day after launch is 84%

42 m

Data: Hyperliquid platform whales currently hold positions worth $2.869 billion, with a long-short position ratio of 0.98.

50 m

Pin