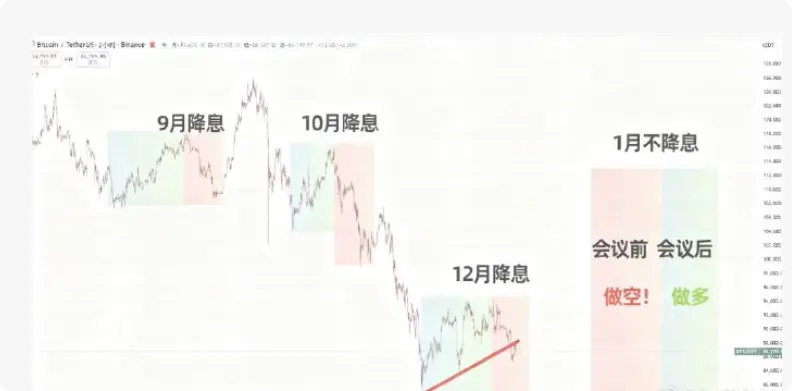

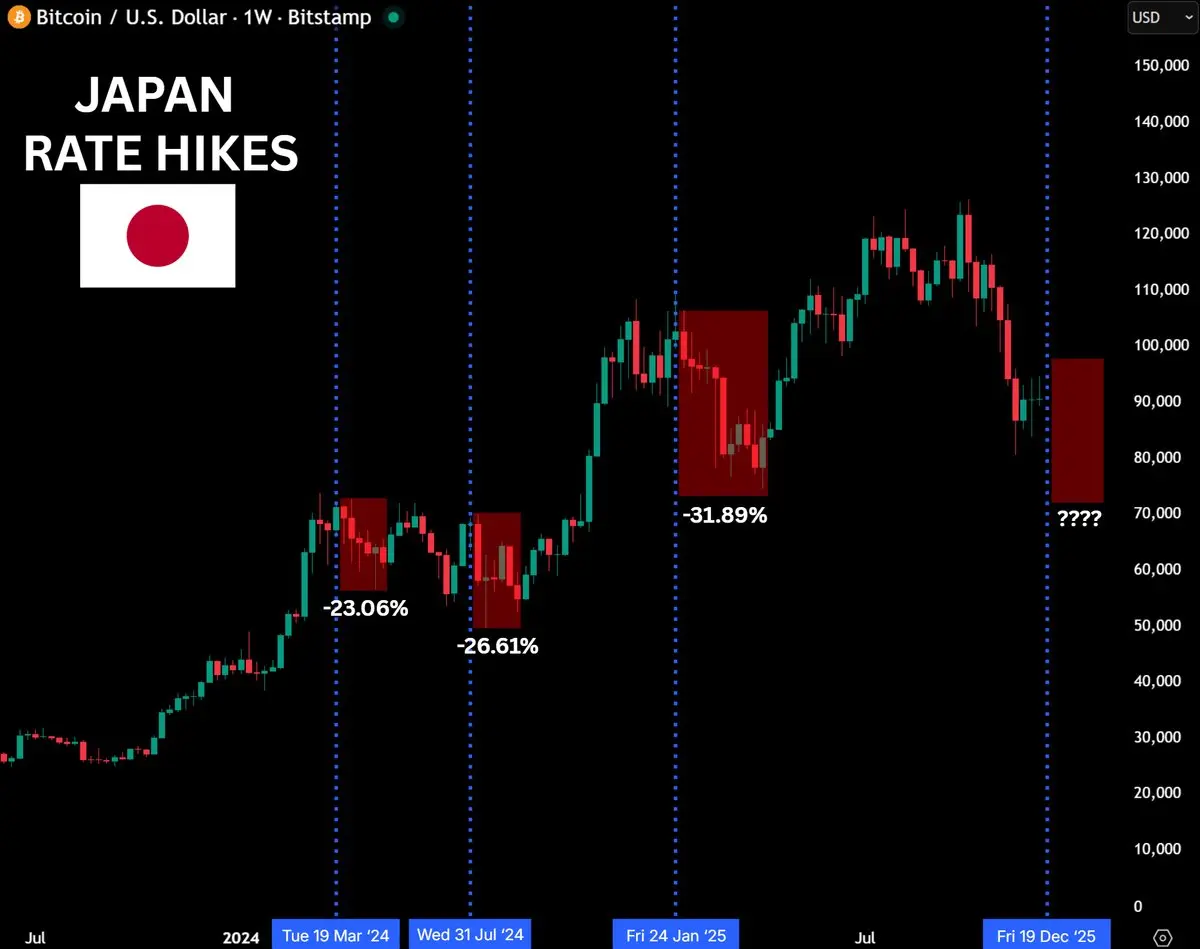

The crypto market is highly sensitive to liquidity. It itself is an index of overall market liquidity. Price movements in this market are primarily determined by the direction and volume of the opposing side.

When the market shows positive news, institutions will chase the long side first, and lagging retail investors will also follow. However, if liquidity does not improve and the positive news cannot be sustained, the original game-theoretic balance needs to be rebalanced.

The bulls become the opposing side, turning it into a game of painting doors.

#2025Gate年度账单 #今日你看涨还是看跌? $BTC $ETH

View OriginalWhen the market shows positive news, institutions will chase the long side first, and lagging retail investors will also follow. However, if liquidity does not improve and the positive news cannot be sustained, the original game-theoretic balance needs to be rebalanced.

The bulls become the opposing side, turning it into a game of painting doors.

#2025Gate年度账单 #今日你看涨还是看跌? $BTC $ETH