#CryptoMarketWatch

⚡ تزايد تقلبات السوق — الثيران مقابل الدببة

شهدت الأسابيع الأخيرة ارتفاعًا في تقلبات العملات المشفرة، مع تزايد التباين بين المشاعر الصاعدة والهابطة. التقلبات الحادة في بيتكوين، إيثريوم، والعملات البديلة ذات القيمة السوقية العالية تتحدى المتداولين لإعادة التفكير في الأساليب التكتيكية والاستراتيجية.

1️⃣ الملاحظات الفنية وعلى السلسلة

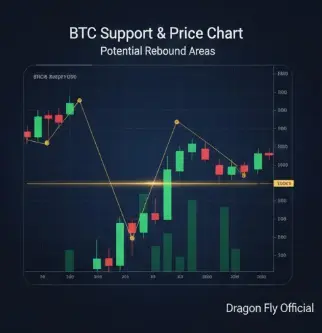

مستويات الدعم والمقاومة: يتداول بيتكوين حول 76 ألف دولار و$78K وإيثريوم حول 2000–2050 دولار، وتعمل كمناطق تراكم حاسمة.

إشارات المشتقات: تظهر أسواق العقود الآجلة والخيارات زيادة في عمليات التصفية، مما يعزز تقلبات قصيرة الأمد.

التدفقات على السلسلة: تدفقات العملات المستقرة وتحركات الحيتان تشير إلى تراكم انتقائي من قبل المؤسسات، مما يوحي بأن الأموال الذكية تستغل الانخفاضات للدخول في مراكز.

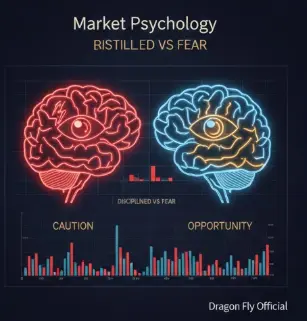

2️⃣ التباين بين الثيران والدببة

وجهة النظر الصاعدة: المتداولون الذين يركزون على التراكم على المدى الطويل يرون الانخفاضات فرصًا، مدعومة بتبني الشبكة، ونشاط الطبقة الثانية، وتدفقات المؤسسات.

وجهة النظر الهابطة: المتداولون على المدى القصير يسلطون الضوء على عدم اليقين الاقتصادي، وارتفاع أسعار الفائدة، وارتباطات الأسهم كأسباب للبقاء حذرين.

هذا التباين يعكس نضوج السوق، حيث يتفوق المراقبة الاستراتيجية على التداول التفاعلي.

3️⃣ الدروس المستفادة استراتيجيًا

تابع الأموال الذكية: تظهر تراكمات المؤسسات والمؤشرات على السلسلة أين تتجه السيولة.

إدارة المخاطر: استخدم أوامر وقف تكتيكية، وتدرج في الدخول، وحجم المراكز للتنقل في تقلبات السوق.

دمج التحليل الفني والإشارات الاقتصادية الكلية: تواصل معدلات الفائدة، وبيانات التضخم، وتحركات سوق الأسهم التأثير على سلوك العملات المشفرة.

الفرص للدخول الاستراتيجي: يمكن أن توفر الانعكاسات عند مناطق حجم تداول عالية ومناطق دعم إعدادات جيدة للمخاطر والمكافأة.

4️⃣ الخلاصة

التقلبات ليست ضوضاء عشوائية؛ فهي تعكس الدوران المستمر لرأس المال بين الأصول، والمشاعر قصيرة الأمد، والضغوط الاقتصادية الكلية. المتداولون الذين يدمجون التحليل الفني، ومؤشرات السلسلة، والوعي الاقتصادي الكلي يكونون في وضع أفضل للتنقل في تباين الثيران والدببة والاستفادة من الفرص الاستراتيجية.

⚡ تزايد تقلبات السوق — الثيران مقابل الدببة

شهدت الأسابيع الأخيرة ارتفاعًا في تقلبات العملات المشفرة، مع تزايد التباين بين المشاعر الصاعدة والهابطة. التقلبات الحادة في بيتكوين، إيثريوم، والعملات البديلة ذات القيمة السوقية العالية تتحدى المتداولين لإعادة التفكير في الأساليب التكتيكية والاستراتيجية.

1️⃣ الملاحظات الفنية وعلى السلسلة

مستويات الدعم والمقاومة: يتداول بيتكوين حول 76 ألف دولار و$78K وإيثريوم حول 2000–2050 دولار، وتعمل كمناطق تراكم حاسمة.

إشارات المشتقات: تظهر أسواق العقود الآجلة والخيارات زيادة في عمليات التصفية، مما يعزز تقلبات قصيرة الأمد.

التدفقات على السلسلة: تدفقات العملات المستقرة وتحركات الحيتان تشير إلى تراكم انتقائي من قبل المؤسسات، مما يوحي بأن الأموال الذكية تستغل الانخفاضات للدخول في مراكز.

2️⃣ التباين بين الثيران والدببة

وجهة النظر الصاعدة: المتداولون الذين يركزون على التراكم على المدى الطويل يرون الانخفاضات فرصًا، مدعومة بتبني الشبكة، ونشاط الطبقة الثانية، وتدفقات المؤسسات.

وجهة النظر الهابطة: المتداولون على المدى القصير يسلطون الضوء على عدم اليقين الاقتصادي، وارتفاع أسعار الفائدة، وارتباطات الأسهم كأسباب للبقاء حذرين.

هذا التباين يعكس نضوج السوق، حيث يتفوق المراقبة الاستراتيجية على التداول التفاعلي.

3️⃣ الدروس المستفادة استراتيجيًا

تابع الأموال الذكية: تظهر تراكمات المؤسسات والمؤشرات على السلسلة أين تتجه السيولة.

إدارة المخاطر: استخدم أوامر وقف تكتيكية، وتدرج في الدخول، وحجم المراكز للتنقل في تقلبات السوق.

دمج التحليل الفني والإشارات الاقتصادية الكلية: تواصل معدلات الفائدة، وبيانات التضخم، وتحركات سوق الأسهم التأثير على سلوك العملات المشفرة.

الفرص للدخول الاستراتيجي: يمكن أن توفر الانعكاسات عند مناطق حجم تداول عالية ومناطق دعم إعدادات جيدة للمخاطر والمكافأة.

4️⃣ الخلاصة

التقلبات ليست ضوضاء عشوائية؛ فهي تعكس الدوران المستمر لرأس المال بين الأصول، والمشاعر قصيرة الأمد، والضغوط الاقتصادية الكلية. المتداولون الذين يدمجون التحليل الفني، ومؤشرات السلسلة، والوعي الاقتصادي الكلي يكونون في وضع أفضل للتنقل في تباين الثيران والدببة والاستفادة من الفرص الاستراتيجية.