MAB350

用户暂无简介

MAB350

在充满变数的区块链世界中,炒作常常超越现实,Dusk Network 正在用硬数据悄然引起关注。他们的测试网刚刚突破了900万笔交易的大关,令人不禁发问:Dusk 的“合规机器”是否终于进入了黄金时段?别再听信推特的回音室——让我们深入探讨那些真正重要的链上指标。

DUSK-1.55%

- 赞赏

- 1

- 评论

- 转发

- 分享

2026年我绝对喜欢的3个功能

查看原文- 赞赏

- 点赞

- 评论

- 转发

- 分享

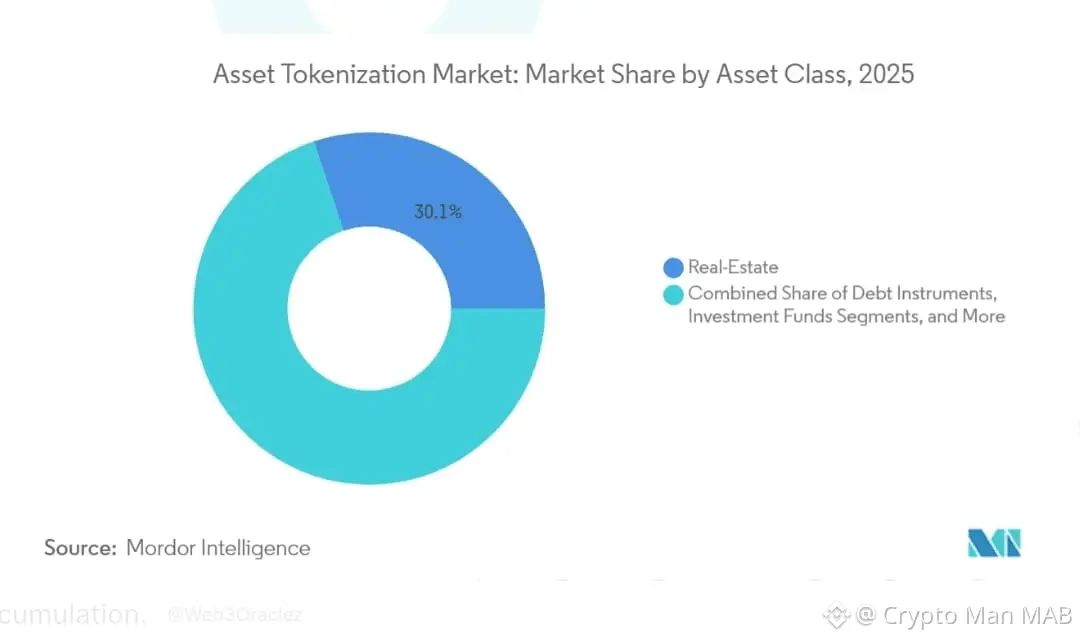

流动性碎片化简介在金融世界中,流动性指的是资产在不显著影响其价格的情况下,能够多容易被买卖。然而,传统金融市场中一个持续存在的挑战是流动性碎片化。这发生在交易活动分散在多个交易所、平台或场所,导致流动性池分散的情况下。因此,投资者通常面临更高的交易成本、更宽的买卖差价以及执行速度变慢等问题。

查看原文- 赞赏

- 点赞

- 评论

- 转发

- 分享

你好,加密货币家族!希望你们今天过得愉快,享受这个星期天

查看原文- 赞赏

- 点赞

- 评论

- 转发

- 分享

👇DYOR,保持警惕——混乱孕育机遇🔥

查看原文- 赞赏

- 点赞

- 评论

- 转发

- 分享

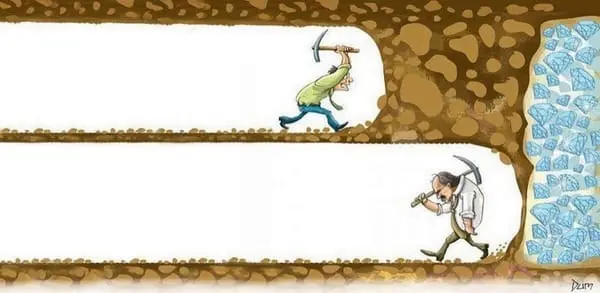

一致性是关键

查看原文

- 赞赏

- 点赞

- 评论

- 转发

- 分享

突发:白银价格首次突破$100 。

查看原文- 赞赏

- 点赞

- 评论

- 转发

- 分享

Vanar Chain的一个突出的协议定制是其交易排序机制,优先考虑简洁性和可预测性,

查看原文- 赞赏

- 点赞

- 评论

- 转发

- 分享

热门话题

查看更多3.74万 热度

2342 热度

1838 热度

932 热度

698 热度

置顶

截至2026年1月26日,XRP已达到一个关键的技术交叉点,经过一个周末的急剧下跌,资产价格最低至1.81美元。在突破长期上升趋势线后,“支付之王”现在正努力在分析师描述为最终“成败关头”区域的狭窄走廊中保持其立足点。

Gate 广场 “内容挖矿” 焕新季公测正式开启!🚀

立即报名:https://www.gate.com/questionnaire/7358

主要亮点:

🔹 发布合格内容并引导用户完成交易,即可解锁最高 60% 交易手续费返佣

🔹 10% 基础返佣保障,达成互动或发帖指标可额外获得 10% 返佣加成

🔹 每周互动排行榜 — 前 100 名创作者可额外获得返佣

🔹 新入驻或回归创作者,公测期间可享返佣双倍福利

为进一步激活内容生态,让优质创作真正转化为收益,Gate 广场持续将内容创作、用户互动与交易行为紧密结合,打造更清晰、更可持续的价值循环,为创作者与社区创造更多价值。

了解更多:https://www.gate.com/announcements/article/49480

活动详情:https://www.gate.com/announcements/article/49475马年大吉,抽奖行大运!成长值新年抽奖第 1️⃣6️⃣ 期盛大来袭!

抓住新年的好运,立即参与👉 https://www.gate.com/activities/pointprize?now_period=16

🌟 如何参与?

1️⃣ 在广场发帖、评论、点赞,完成任务赚取成长值

2️⃣ 每积攒 300 积分,即可参与超值抽奖!

🎁 新年好运等你拿!奖品包括 iPhone 17、新年周边、代币等心动大礼!

活动时间:1 月 21 日 16:00 -- 1 月 31 日 24:00 (UTC+8)

活动详情: https://www.gate.com/announcements/article/49388

#BTC #ETH #GTGate 广场创作者新春激励正式开启,发帖解锁 $60,000 豪华奖池

如何参与:

报名活动表单:https://www.gate.com/questionnaire/7315

使用广场任意发帖小工具,搭配文字发布内容即可

丰厚奖励一览:

发帖即可可瓜分 $25,000 奖池

10 位幸运用户:获得 1 GT + Gate 鸭舌帽

Top 发帖奖励:发帖与互动越多,排名越高,赢取 Gate 新年周边、Gate 双肩包等好礼

新手专属福利:首帖即得 $50 奖励,继续发帖还能瓜分 $10,000 新手奖池

活动时间:2026 年 1 月 8 日 16:00 – 1 月 26 日 24:00(UTC+8)

详情:https://www.gate.com/announcements/article/49112每天看行情、刷大佬观点,却不发声?你的观点可能比你想的更有价值!

广场新人 & 回归福利进行中!首次发帖或久违回归,直接送你奖励!

每月 $20,000 奖金等你瓜分!

在广场带 #我在广场发首帖 发布首帖或回归帖即可领取 $50 仓位体验券

月度发帖王和互动王还将各获额外 50U 奖励

你的加密观点可能启发无数人,开始创作之旅吧!

👉️ https://www.gate.com/post