GateUser-d7845628

No content yet

GateUser-d7845628

This is why the @brevis_zk x Aster model stands out to me.

It flips the usual trade-off on its head. Execution speed comes first, so users get fast, smooth interactions that feel natural. Then ZK proofs follow right after to guarantee security and privacy without slowing everything down.

From my point of view, this matters because most systems force you to choose between good UX and strong guarantees. This approach removes that choice. You get speed, verifiability, and privacy in one flow.

When security is built in without friction, users don’t have to think about it. That’s how onchain system

It flips the usual trade-off on its head. Execution speed comes first, so users get fast, smooth interactions that feel natural. Then ZK proofs follow right after to guarantee security and privacy without slowing everything down.

From my point of view, this matters because most systems force you to choose between good UX and strong guarantees. This approach removes that choice. You get speed, verifiability, and privacy in one flow.

When security is built in without friction, users don’t have to think about it. That’s how onchain system

- Reward

- like

- Comment

- Repost

- Share

Believe in yourself, that’s the real edge.

I’ve pushed through the noise, the loud KOL takes, and the constant distractions, and what kept me going was the support of real people, especially smaller accounts that show up consistently. That kind of backing matters more than hype.

What I like about @wallchain is that it gives everyone a fair chance to be seen and heard. You don’t need a huge following to contribute or grow. If you stay focused, think clearly, and keep showing up, progress follows.

If I can make it through the noise, so can you. Build your voice, trust your process, and keep lear

I’ve pushed through the noise, the loud KOL takes, and the constant distractions, and what kept me going was the support of real people, especially smaller accounts that show up consistently. That kind of backing matters more than hype.

What I like about @wallchain is that it gives everyone a fair chance to be seen and heard. You don’t need a huge following to contribute or grow. If you stay focused, think clearly, and keep showing up, progress follows.

If I can make it through the noise, so can you. Build your voice, trust your process, and keep lear

- Reward

- like

- Comment

- Repost

- Share

Looking at the numbers, this is why I’m bullish.

Based on fee performance from similar protocols like Polymarket, it’s realistic for @trylimitless to generate well over $36 million in annual revenue. That kind of revenue doesn’t come from hype, it comes from consistent usage and real demand.

For me, revenue projections matter more than narratives. If the platform keeps growing and capturing fees at scale, value has something solid to anchor to. That’s why I’m comfortable thinking long term about $LMTS as it evolves.

It’s not about quick flips. It’s about owning exposure to a protocol with a cl

Based on fee performance from similar protocols like Polymarket, it’s realistic for @trylimitless to generate well over $36 million in annual revenue. That kind of revenue doesn’t come from hype, it comes from consistent usage and real demand.

For me, revenue projections matter more than narratives. If the platform keeps growing and capturing fees at scale, value has something solid to anchor to. That’s why I’m comfortable thinking long term about $LMTS as it evolves.

It’s not about quick flips. It’s about owning exposure to a protocol with a cl

LMTS3.16%

- Reward

- like

- Comment

- Repost

- Share

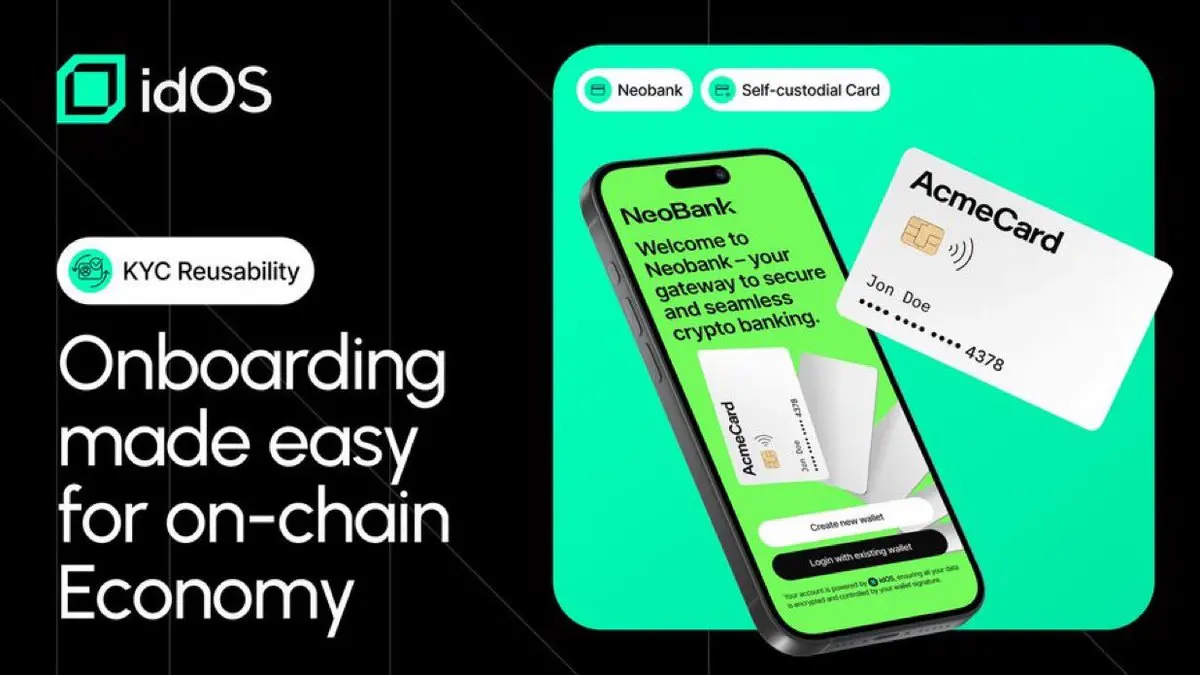

What I like about @idOS_network is how it supports real world finance without breaking the core values of crypto. It doesn’t force you to choose between compliance and control.

With idOS, I can do KYC once and keep ownership of it. Instead of handing my data to every new platform, I decide where it’s used and who gets access. My identity moves with me, not the other way around.

From my point of view, this is the right balance. Institutions get the verification they need, and users keep privacy and decentralization. That’s how Web3 connects to real finance without turning into the old system ag

With idOS, I can do KYC once and keep ownership of it. Instead of handing my data to every new platform, I decide where it’s used and who gets access. My identity moves with me, not the other way around.

From my point of view, this is the right balance. Institutions get the verification they need, and users keep privacy and decentralization. That’s how Web3 connects to real finance without turning into the old system ag

- Reward

- like

- Comment

- Repost

- Share

What stands out to me about Warden @wardenprotocol is the clarity in how its AI agents are designed. Each agent is built for one clear purpose, not a mix of confusing features.

That simplicity matters. When I want to get something done, I don’t need a general AI guessing my intent. I can choose the exact agent that fits the task I want to perform. The right tool for the right job.

From my perspective, this makes AI more usable and more trustworthy. Focused agents mean better results, less friction, and clearer outcomes. It turns AI from a novelty into real infrastructure you can rely on.

That simplicity matters. When I want to get something done, I don’t need a general AI guessing my intent. I can choose the exact agent that fits the task I want to perform. The right tool for the right job.

From my perspective, this makes AI more usable and more trustworthy. Focused agents mean better results, less friction, and clearer outcomes. It turns AI from a novelty into real infrastructure you can rely on.

- Reward

- like

- Comment

- Repost

- Share

With @ClusterProtocol, I’m excited because it lets us trade AI memecoins on Base chain, something I haven’t seen done this seamlessly before. Everything from agents to models to CODE token will be available to bridge and trade in one place.

From my perspective, this makes exploring AI-powered tokens easy and fun, without juggling multiple chains or platforms. Cluster is simplifying access while keeping everything onchain, so I can move, trade, and experiment without friction. For me, it turns what used to be a complicated process into a smooth, unified experience, opening a new space for both

From my perspective, this makes exploring AI-powered tokens easy and fun, without juggling multiple chains or platforms. Cluster is simplifying access while keeping everything onchain, so I can move, trade, and experiment without friction. For me, it turns what used to be a complicated process into a smooth, unified experience, opening a new space for both

- Reward

- like

- Comment

- Repost

- Share

Alignerz is not trying to be everything to everyone in crypto, and that focus shows. At the center of it all is the TVS Marketplace, which actually drives revenue instead of relying on vague narratives.

What’s interesting is how TVS is evolving. It’s no longer just about basic vesting. It now enables collateral usage and real governance participation, which gives vested assets actual utility. From my perspective, that’s a big shift. It turns locked tokens into something functional and meaningful.

By building around one strong core product and expanding it thoughtfully, @AlignerZ_Labs is creati

What’s interesting is how TVS is evolving. It’s no longer just about basic vesting. It now enables collateral usage and real governance participation, which gives vested assets actual utility. From my perspective, that’s a big shift. It turns locked tokens into something functional and meaningful.

By building around one strong core product and expanding it thoughtfully, @AlignerZ_Labs is creati

- Reward

- like

- Comment

- Repost

- Share