2025 ACE Price Prediction: Analyzing Future Trends and Potential Growth Factors in the Cryptocurrency Market

Introduction: ACE's Market Position and Investment Value

Fusionist (ACE), as a pioneering Web3 gaming token, has made significant strides since its inception in 2023. As of 2025, ACE's market capitalization has reached $35,489,817.95, with a circulating supply of approximately 74,936,271 tokens, and a price hovering around $0.4736. This asset, often referred to as the "AAA Web3 Gaming Token," is playing an increasingly crucial role in the blockchain gaming industry.

This article will provide a comprehensive analysis of ACE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ACE Price History Review and Current Market Status

ACE Historical Price Evolution Trajectory

- 2023: Launch and initial surge, price reached all-time high of $15.659 on December 22

- 2024: Market correction phase, price experienced significant volatility

- 2025: Prolonged bearish trend, price dropped to all-time low of $0.4272 on April 9

ACE Current Market Situation

As of October 2, 2025, ACE is trading at $0.4736, showing a 4.75% increase in the last 24 hours. The token has a market capitalization of $35,489,817.95 and a fully diluted valuation of $69,619,200. ACE's circulating supply stands at 74,936,271 tokens, which is 50.98% of its total supply of 146,307,870 tokens.

Despite the recent 24-hour gain, ACE has experienced negative performance over longer time frames. It has declined by 2.93% in the past week and 5.88% over the last 30 days. The most significant drop is observed in the yearly performance, with a substantial 77.51% decrease.

The token's trading volume in the past 24 hours is $17,559.11, indicating moderate market activity. ACE currently ranks 842nd in the cryptocurrency market, with a market dominance of 0.0016%.

Click to view the current ACE market price

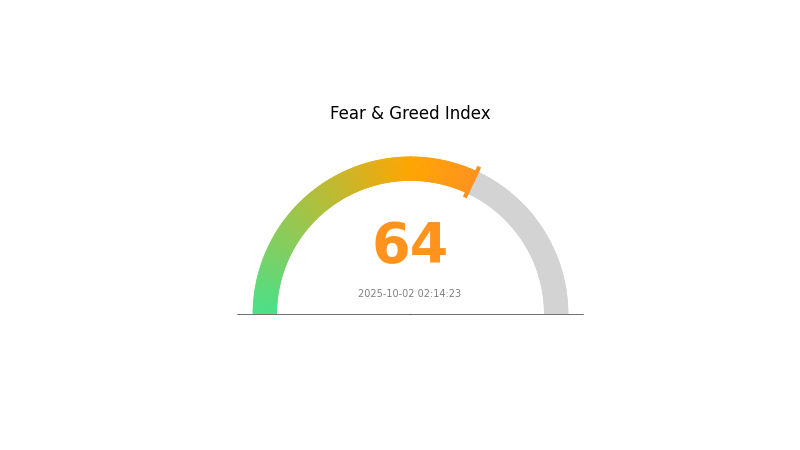

ACE Market Sentiment Indicator

2025-10-02 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of exuberance with a Fear and Greed Index of 64, indicating greed. This suggests investors are becoming increasingly optimistic, potentially driving prices higher. However, it's crucial to remain cautious as extreme greed can lead to market corrections. Diversification and risk management are key in such market conditions. Keep an eye on fundamental factors and consider taking profits if you've seen significant gains. As always, do your own research and invest responsibly.

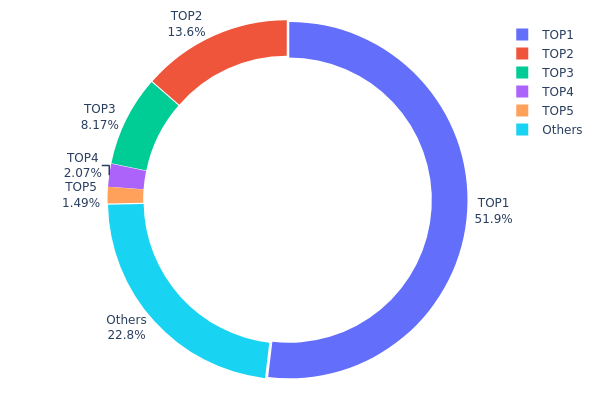

ACE Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of ACE tokens among various wallet addresses. Analysis of this data reveals a highly concentrated distribution pattern, with the top address holding a significant 51.89% of the total supply. The top five addresses collectively control 77.19% of ACE tokens, indicating a substantial centralization of ownership.

This level of concentration raises concerns about market stability and potential price manipulation. The dominant address, holding over half of the supply, could exert considerable influence on market dynamics if large quantities were to be moved or sold. Furthermore, the second and third largest holders, with 13.58% and 8.17% respectively, also possess substantial market power.

Such a centralized distribution suggests a relatively low level of decentralization for ACE, which may impact its resilience to market shocks and its overall on-chain structural stability. While the remaining 22.81% distributed among other addresses provides some diversification, the overwhelming control by a few major holders indicates a need for careful monitoring of token movements and potential market impacts.

Click to view the current ACE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa399...14b71c | 12729.47K | 51.89% |

| 2 | 0x8894...e2d4e3 | 3332.78K | 13.58% |

| 3 | 0xf977...41acec | 2004.90K | 8.17% |

| 4 | 0x97b9...b68689 | 507.58K | 2.06% |

| 5 | 0x4982...6e89cb | 365.86K | 1.49% |

| - | Others | 5590.21K | 22.81% |

II. Key Factors Influencing ACE's Future Price

Supply Mechanism

- Endurance Blockchain: ACE is the native token of the Endurance blockchain, which supports the Fusionist ecosystem.

- Current Impact: The supply and distribution of ACE tokens are closely tied to the growth and adoption of the Fusionist platform and its associated games.

Institutional and Whale Dynamics

- Corporate Adoption: Fusionist has received seed funding from major investment firms, indicating growing institutional interest in the project and its native token ACE.

Macroeconomic Environment

- Geopolitical Factors: Global conflicts and energy price fluctuations may indirectly affect the crypto market, including ACE's price.

Technical Development and Ecosystem Building

- Mainnet 2.0: The potential launch of Mainnet 2.0 could significantly impact ACE's price, with expectations of a possible increase to $0.80-$1.20 if successful.

- GameFi Ecosystem: Fusionist's focus on creating a sustainable and scalable Web 3.0 gaming platform may drive demand for ACE tokens.

- Ecosystem Applications: The growth of decentralized applications (dApps) and services within the Fusionist ecosystem could increase ACE's utility and value.

- NFT Integration: Fusionist's incorporation of NFTs into its products provides additional use cases for ACE tokens, potentially influencing their demand and price.

III. ACE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.41 - $0.45

- Neutral prediction: $0.45 - $0.50

- Optimistic prediction: $0.50 - $0.58 (requires positive market sentiment and project developments)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2026: $0.45 - $0.59

- 2027: $0.48 - $0.64

- Key catalysts: Project milestones, ecosystem expansion, and overall crypto market recovery

2030 Long-term Outlook

- Base scenario: $0.60 - $0.75 (assuming steady growth and adoption)

- Optimistic scenario: $0.75 - $0.85 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.85 - $1.00 (with breakthrough technology implementation and mass adoption)

- 2030-12-31: ACE $0.73153 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.57995 | 0.4715 | 0.41492 | 0 |

| 2026 | 0.59407 | 0.52572 | 0.45212 | 11 |

| 2027 | 0.64388 | 0.55989 | 0.48151 | 18 |

| 2028 | 0.638 | 0.60189 | 0.43938 | 27 |

| 2029 | 0.84312 | 0.61994 | 0.51455 | 30 |

| 2030 | 0.84858 | 0.73153 | 0.51207 | 54 |

IV. Professional Investment Strategies and Risk Management for ACE

ACE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate ACE tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit potential losses

ACE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Dollar-Cost Averaging: Regularly invest fixed amounts to reduce timing risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ACE

ACE Market Risks

- High volatility: ACE price can fluctuate significantly in short periods

- Limited liquidity: May face challenges in executing large trades

- Competition: Other gaming tokens may impact ACE's market share

ACE Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on gaming tokens

- Cross-border compliance: Varying regulations across different jurisdictions

- Tax implications: Evolving tax laws may affect ACE holders

ACE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Blockchain scalability: Limitations of the underlying blockchain could affect performance

- Cybersecurity threats: Risk of hacks or attacks on the Fusionist platform

VI. Conclusion and Action Recommendations

ACE Investment Value Assessment

ACE shows potential as a gaming token with its AAA-quality game and innovative features. However, it faces significant competition and regulatory uncertainties. The token's value is closely tied to the success and adoption of the Fusionist game.

ACE Investment Recommendations

✅ Beginners: Consider small, experimental positions to understand the market ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider ACE as part of a diversified gaming token portfolio

ACE Trading Participation Methods

- Spot trading: Buy and sell ACE tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- In-game purchases: Use ACE tokens within the Fusionist game ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for AXS in 2030?

Based on statistical models, AXS is predicted to reach around $0.40 by the end of 2030. However, actual prices may vary significantly.

What is the price prediction for Cardano in 2025?

Cardano is predicted to trade between $0.80 and $1.45 in 2025, based on current market trends and analysis as of October 2, 2025.

What is the value of ace coin?

As of 2025, ACE coin's value has shown significant growth, reflecting its increased adoption in the Web3 gaming ecosystem and the success of the Endurance Mainnet.

What is the max supply of ace coins?

The max supply of ACE coins is 147 million. This is the total number of ACE tokens that can ever be created.

2025 UNA Price Prediction: Bullish Trends and Key Factors Driving UNA's Future Value

2025 TGT Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 DELABS Price Prediction: Will This Emerging Crypto Asset Reach New Heights?

2025 CHEEL Price Prediction: Analysis and Market Forecast for Blockchain's Emerging Asset

Is Yooldo Games (ESPORTS) a Good Investment?: Analyzing Market Potential and Growth Prospects in the Competitive Gaming Industry

Is Gomble (GM) a good investment?: Analyzing the automaker's financial performance and future prospects

How to Use MACD, RSI, and KDJ Technical Indicators for Crypto Trading Signals

What are the regulatory and compliance risks for crypto projects in 2026?

What is EVAA Protocol's On-Chain Data Analysis: Active Addresses, Whale Movements, and Transaction Trends in 2026?

What are the main smart contract vulnerabilities and security risks in DeFi protocols like EVAA?

What is Altseason and Why Everyone is Waiting for It