2025 AIOTPrice Prediction: Market Trends, Investment Opportunities, and Technological Impact Analysis

Introduction: AIOT's Market Position and Investment Value

OKZOO (AIOT), as the world's first urban-scale decentralized environmental data network powered by advanced AIoT machines, has made significant strides since its inception in 2025. As of 2025, OKZOO's market capitalization has reached $110,010,160, with a circulating supply of approximately 111,200,000 tokens, and a price hovering around $0.9893. This asset, hailed as the "environmental data pioneer," is playing an increasingly crucial role in urban environmental monitoring and management.

This article will provide a comprehensive analysis of OKZOO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. AIOT Price History Review and Current Market Status

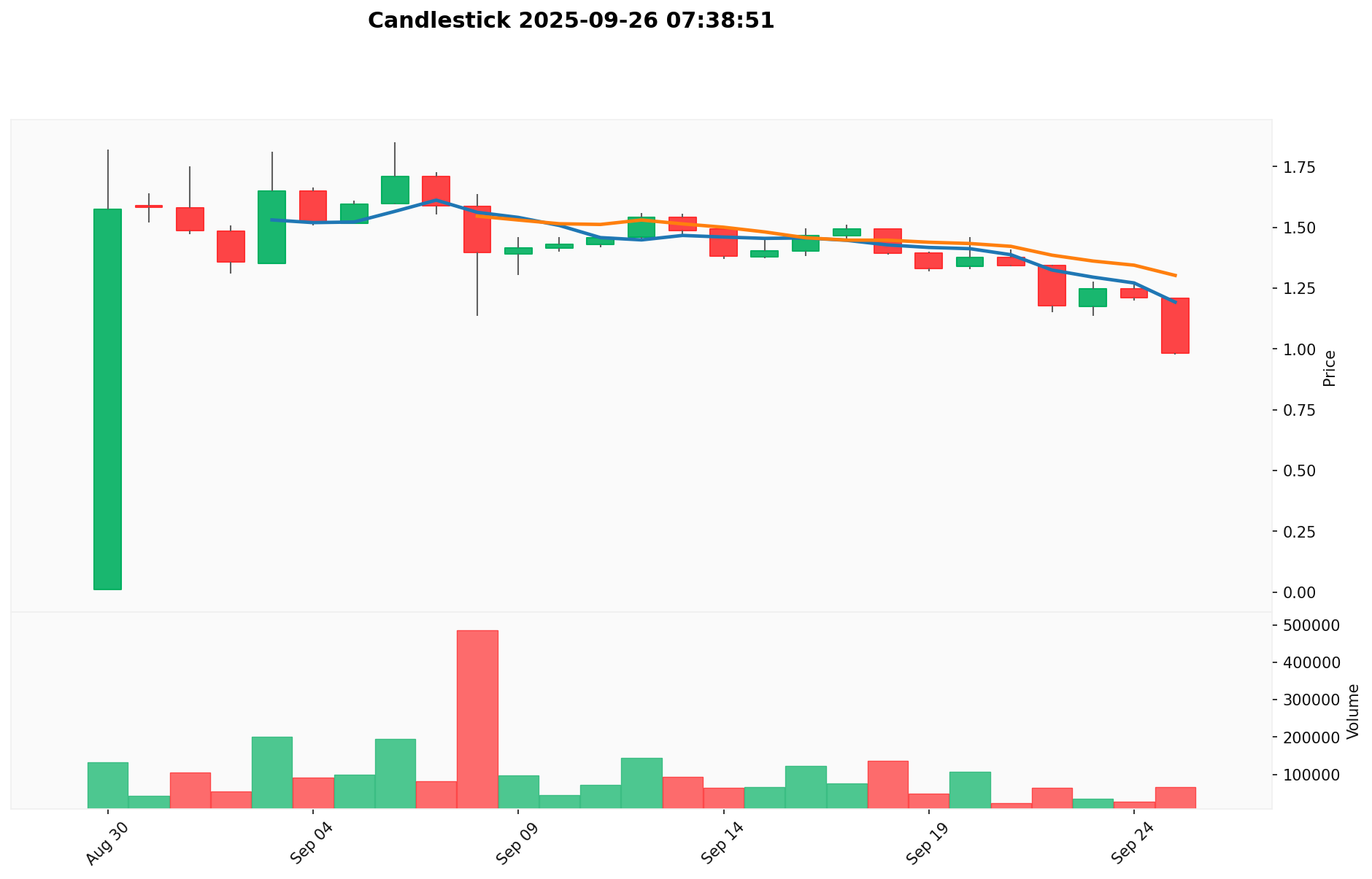

AIOT Historical Price Evolution

- 2025 (August 30): AIOT launched at $0.01, marking its entry into the market

- 2025 (September 6): AIOT reached its all-time high of $1.85, showing significant growth in a short period

- 2025 (September): AIOT experienced a market correction, with price dropping from its peak

AIOT Current Market Situation

AIOT is currently trading at $0.9893, representing a significant increase from its initial price but a decline from its all-time high. The token has shown high volatility in recent periods:

- In the past 24 hours, AIOT has seen a decrease of 16.44%, with a trading volume of $84,813.79

- Over the past 7 days, the price has dropped by 28.9%

- The 30-day trend shows a more substantial decline of 43.29%

- However, on a yearly basis, AIOT has demonstrated remarkable growth of 892.23%

The current market capitalization stands at $110,010,160, ranking AIOT at 418th in the overall cryptocurrency market. With a circulating supply of 111,200,000 tokens out of a total supply of 1,000,000,000, AIOT has a circulation ratio of 11.12%.

The market sentiment for AIOT appears cautious, as indicated by the recent price drops. However, the substantial yearly gains suggest long-term investor interest in the project.

Click to view the current AIOT market price

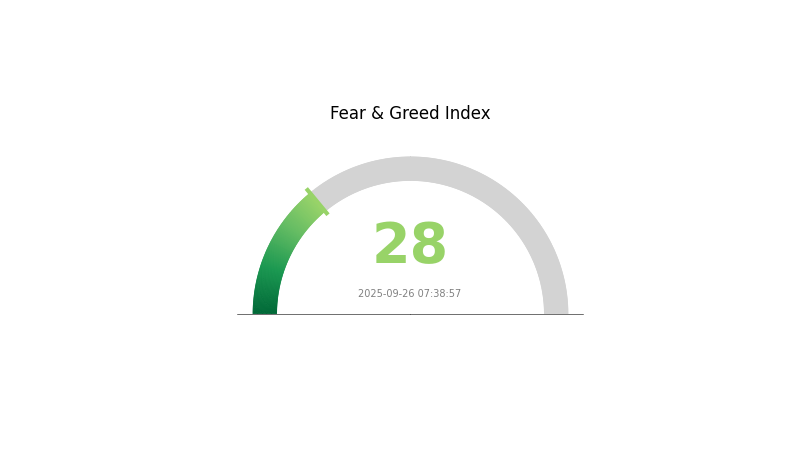

AIOT Market Sentiment Indicator

2025-09-26 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment continues to lean towards fear, with the Fear and Greed Index hovering at 28. This indicates a cautious atmosphere among investors, potentially signaling undervalued market conditions. Historically, periods of fear have often preceded market rebounds. However, traders should remain vigilant and consider diversifying their portfolios. As always, it's crucial to conduct thorough research and manage risks effectively in this volatile market environment.

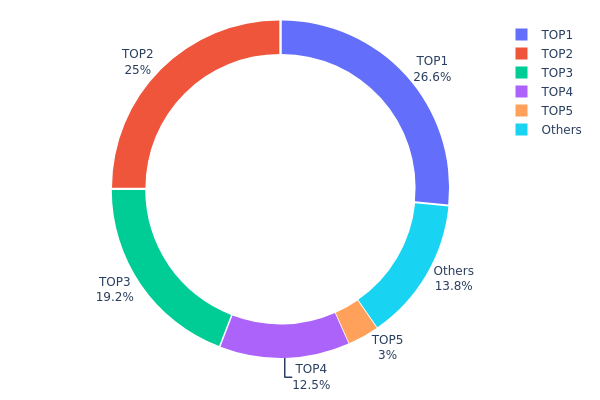

AIOT Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of AIOT tokens among various wallet addresses. Analysis of this data reveals a highly centralized ownership structure, with the top five addresses controlling 86.24% of the total supply.

The top address holds 26.59% of all AIOT tokens, followed closely by the second-largest holder with 25%. This high concentration in a few wallets raises concerns about potential market manipulation and price volatility. With such a significant portion of tokens in the hands of a small number of entities, any large-scale buying or selling activities could have substantial impacts on market dynamics.

This centralized distribution suggests a low level of decentralization within the AIOT ecosystem, which may affect the project's resilience and governance structure. It also indicates a potential risk for smaller investors, as major holders could exert disproportionate influence over the token's price and overall project direction.

Click to view the current AIOT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x71db...c5eb0c | 265916.67K | 26.59% |

| 2 | 0x48a5...9bba8a | 250000.00K | 25.00% |

| 3 | 0xa8c9...d5d526 | 191566.67K | 19.15% |

| 4 | 0xdfc5...f7851c | 125000.00K | 12.50% |

| 5 | 0x1040...90c718 | 30000.00K | 3.00% |

| - | Others | 137516.67K | 13.76% |

II. Core Factors Influencing AIOT's Future Price

Supply Mechanism

- Device Distribution: The promotion and distribution of P-mini devices directly impact the demand for AIOT tokens.

- Current Impact: As AIOT is primarily used for environmental data collection, the widespread adoption of these devices is expected to drive token demand.

Technical Development and Ecosystem Building

- Environmental Data Collection: AIOT's main application is in collecting environmental data, which forms the basis of its ecosystem.

- P-mini Devices: Users can earn AIOT tokens through P-mini devices, linking the token's value to the practical application of the technology.

Macroeconomic Environment

- Industry Growth: The global automotive industry's expansion and accelerated penetration of intelligent connectivity are driving demand for smart in-vehicle terminals, with a market size CAGR of approximately 36%.

- Technological Trends: The future market size of AIoT is expected to expand further, riding on the wave of digitalization.

III. AIOT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.59615 - $0.9773

- Neutral prediction: $0.9773 - $1.42686

- Optimistic prediction: $1.42686 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.67316 - $1.34633

- 2027: $0.98114 - $1.5163

- Key catalysts: Increased adoption of IoT technologies, market recovery

2028-2030 Long-term Outlook

- Base scenario: $1.39525 - $1.98265 (assuming steady market growth)

- Optimistic scenario: $1.98265 - $2.35936 (with accelerated IoT integration)

- Transformative scenario: $2.35936+ (with breakthrough IoT applications)

- 2030-12-31: AIOT $2.35936 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.42686 | 0.9773 | 0.59615 | -1 |

| 2026 | 1.34633 | 1.20208 | 0.67316 | 21 |

| 2027 | 1.5163 | 1.2742 | 0.98114 | 28 |

| 2028 | 1.84173 | 1.39525 | 0.78134 | 41 |

| 2029 | 2.34682 | 1.61849 | 0.92254 | 63 |

| 2030 | 2.35936 | 1.98265 | 1.30855 | 100 |

IV. AIOT Professional Investment Strategies and Risk Management

AIOT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate AIOT tokens during market dips

- Set price targets and review holdings periodically

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to AIOT and AIoT industry

- Set clear stop-loss and take-profit levels

AIOT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. AIOT Potential Risks and Challenges

AIOT Market Risks

- High volatility: AIOT price can experience significant fluctuations

- Liquidity risk: Limited trading volume may affect ability to enter/exit positions

- Market sentiment: Susceptible to broader cryptocurrency market trends

AIOT Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting AIOT

- Cross-border restrictions: Varying legal status in different jurisdictions

- Compliance challenges: Adapting to evolving regulatory requirements

AIOT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Network scalability: Challenges in handling increased transaction volume

- Technological obsolescence: Risk of being outpaced by newer AIoT solutions

VI. Conclusion and Action Recommendations

AIOT Investment Value Assessment

AIOT presents a unique opportunity in the decentralized environmental data sector, with potential long-term growth. However, investors should be aware of high short-term volatility and regulatory uncertainties.

AIOT Investment Recommendations

✅ Beginners: Start with small positions and focus on education about AIoT technology ✅ Experienced investors: Consider a balanced approach with both long-term holdings and active trading ✅ Institutional investors: Conduct thorough due diligence and consider AIOT as part of a diversified crypto portfolio

AIOT Trading Participation Methods

- Spot trading: Buy and sell AIOT tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance options involving AIOT tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is AIOT's stock forecast?

AIOT stock is projected to reach $8.10 high in August and $5.39 low in May, with an average price of $6.37 in 2027. Current trends indicate no immediate price change.

What is the top crypto price prediction in 2025?

Bitcoin (BTC) is predicted to reach $100,000, while Ethereum (ETH) is expected to hit $5,000 by 2025.

What is the price prediction for XRP in 2030?

Analysts predict XRP could reach between $4.67 and $26.97 in 2030, depending on institutional adoption, regulatory developments, and Ripple's expansion in cross-border payments.

What is the current price of AIOT stock?

As of September 26, 2025, the current price of AIOT stock is $5.16. It has decreased by 3.19% in the past 24 hours.

What are AliExpress Coin

2025 BLESS Price Prediction: Analyzing Market Trends and Future Potential for Investors

2025 HONEYPrice Prediction: Market Analysis and Future Outlook for the Sweet Commodity

Is Roam (ROAM) a Good Investment?: Analyzing Market Potential and Long-Term Prospects for this Digital Nomad Token

Is Pocket Network (POKT) a Good Investment?: Analyzing the Long-term Potential of This Decentralized Infrastructure Protocol

ATH vs ICP: Comparing Two Blockchain Technologies for Decentralized Applications

Two-Factor Authentication (2FA): A Comprehensive Security Guide

# What Are On-Chain Data Analysis Metrics and How Do Whales, Active Addresses, and Transaction Volume Impact Crypto Markets?

How to Use MACD, RSI, and KDJ Technical Indicators for Crypto Trading Signals

What are the regulatory and compliance risks for crypto projects in 2026?

What is EVAA Protocol's On-Chain Data Analysis: Active Addresses, Whale Movements, and Transaction Trends in 2026?