2025 AMP Price Prediction: Strategic Analysis and Market Outlook for Cryptocurrency Investors

Introduction: AMP's Market Position and Investment Value

Amp (AMP), as the native collateral token of the Flexa payment network, has made significant strides since its inception. As of 2025, Amp's market capitalization has reached $266,171,055, with a circulating supply of approximately 84,231,346,590 tokens, and a price hovering around $0.00316. This asset, often referred to as the "payment collateral innovator," is playing an increasingly crucial role in facilitating secure and instant cryptocurrency transactions.

This article will provide a comprehensive analysis of Amp's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. AMP Price History Review and Current Market Status

AMP Historical Price Evolution

- 2020: AMP token launched, price started at $0.00167

- 2021: Reached all-time high of $0.120813 on June 17

- 2023: Market downturn, price hit all-time low of $0.00140933 on October 13

AMP Current Market Situation

As of September 23, 2025, AMP is trading at $0.00316, with a 24-hour trading volume of $13,333.35. The token has experienced a slight decline of 0.22% in the past 24 hours. AMP's market capitalization stands at $266,171,055, ranking it 252nd in the crypto market. The circulating supply is 84,231,346,590 AMP tokens, which represents 84.51% of the total supply of 99,669,205,040 AMP. The token is currently trading 97.38% below its all-time high and 124.22% above its all-time low.

Click to view the current AMP market price

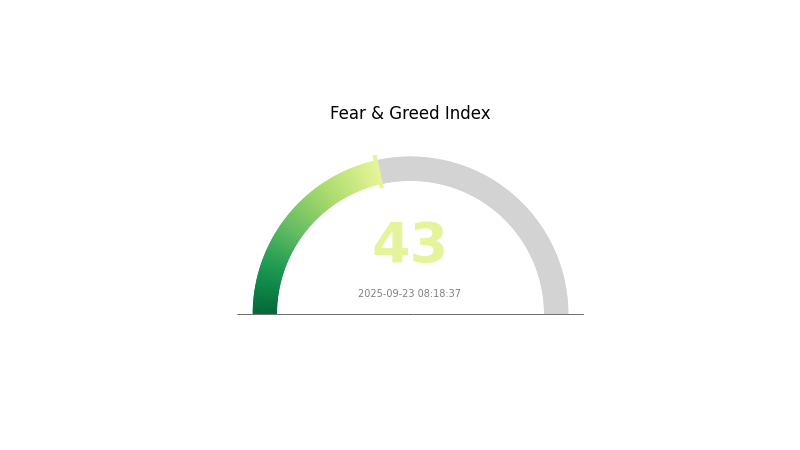

AMP Market Sentiment Indicator

2025-09-23 Fear and Greed Index: 43 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 43, indicating a state of fear. This suggests investors are wary and potentially looking for buying opportunities. However, it's crucial to remember that market sentiment can shift rapidly. While fear may present potential entry points for long-term investors, it's essential to conduct thorough research and manage risks carefully before making any investment decisions in the volatile crypto market.

AMP Holdings Distribution

The address holdings distribution data for AMP reveals a moderate level of concentration among top holders. The largest address holds 24.82% of the total supply, indicating significant influence from a single entity. The top five addresses collectively control 46.44% of AMP tokens, while the remaining 53.56% is distributed among other holders.

This distribution pattern suggests a semi-centralized structure, which could potentially impact market dynamics. The concentration of tokens in a few hands may lead to increased volatility if large holders decide to make significant moves. However, with over half of the supply distributed among smaller holders, there is still a considerable degree of decentralization, which could help maintain some market stability.

The current address distribution reflects a balanced market structure for AMP, with elements of both centralization and wider distribution. This setup may provide a foundation for organic price discovery while also presenting the possibility of coordinated market actions by major holders. Ongoing monitoring of this distribution will be crucial for assessing AMP's long-term market health and potential risks.

Click to view the current AMP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5d27...1d675f | 24754917.16K | 24.82% |

| 2 | 0x9eda...69fd62 | 7000000.00K | 7.01% |

| 3 | 0x0c3a...60c7bd | 5938990.20K | 5.95% |

| 4 | 0x706d...e7c578 | 4767234.15K | 4.78% |

| 5 | 0xafcd...45c5da | 3874174.72K | 3.88% |

| - | Others | 53384651.04K | 53.56% |

II. Core Factors Affecting AMP's Future Price

Supply Mechanism

- Fixed Supply: AMP has a fixed maximum supply of 100 billion tokens.

- Historical Pattern: The fixed supply mechanism has historically contributed to price stability and scarcity value.

- Current Impact: As the circulating supply approaches the maximum, it may create upward pressure on the price due to increased scarcity.

Technical Development and Ecosystem Building

- Collateral Manager: Implementation of a new collateral manager to enhance AMP's utility in decentralized finance applications.

- Cross-Chain Compatibility: Development of cross-chain bridges to expand AMP's use cases across multiple blockchain networks.

- Ecosystem Applications: Integration with major payment platforms and e-commerce solutions to facilitate instant, fraud-proof transactions.

III. AMP Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00231 - $0.00317

- Neutral forecast: $0.00317 - $0.00377

- Optimistic forecast: $0.00377 - $0.00437 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00413 - $0.00465

- 2028: $0.00266 - $0.00671

- Key catalysts: Increased adoption of AMP in payment networks

2029-2030 Long-term Outlook

- Base scenario: $0.00561 - $0.00659 (assuming steady market growth)

- Optimistic scenario: $0.00659 - $0.00810 (assuming widespread adoption)

- Transformative scenario: $0.00810+ (extreme favorable conditions in crypto payments)

- 2030-12-31: AMP $0.00810 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00437 | 0.00317 | 0.00231 | 0 |

| 2026 | 0.00493 | 0.00377 | 0.0035 | 18 |

| 2027 | 0.00465 | 0.00435 | 0.00413 | 37 |

| 2028 | 0.00671 | 0.0045 | 0.00266 | 41 |

| 2029 | 0.00757 | 0.00561 | 0.00499 | 76 |

| 2030 | 0.0081 | 0.00659 | 0.00454 | 107 |

IV. AMP Professional Investment Strategies and Risk Management

AMP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operational suggestions:

- Accumulate AMP tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor AMP's correlation with broader crypto market trends

- Set stop-loss orders to manage downside risk

AMP Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-8% of crypto portfolio

- Professional investors: Up to 10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance AMP holdings with other crypto assets and traditional investments

- Options strategies: Consider using options to protect against downside risk

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official AMP wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for AMP

AMP Market Risks

- Volatility: High price fluctuations common in the crypto market

- Liquidity: Potential challenges in large-volume trading

- Competition: Other payment-focused cryptocurrencies may impact AMP's market share

AMP Regulatory Risks

- Uncertain regulations: Changing government policies may affect AMP's adoption

- Compliance challenges: Potential issues with integrating into traditional payment systems

- Tax implications: Evolving tax laws may impact AMP holders

AMP Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the AMP token contract

- Scalability issues: Challenges in handling increased transaction volumes

- Network congestion: Ethereum network issues may affect AMP transactions

VI. Conclusion and Action Recommendations

AMP Investment Value Assessment

AMP presents a unique value proposition in the crypto payment sector, with potential for long-term growth. However, short-term volatility and regulatory uncertainties pose significant risks.

AMP Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market dynamics ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Explore partnerships with Flexa network and conduct thorough due diligence

AMP Trading Participation Methods

- Spot trading: Buy and sell AMP tokens on Gate.com

- Staking: Participate in AMP staking programs for potential passive income

- DeFi integration: Explore decentralized finance protocols that support AMP

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can AMP crypto reach $1?

While ambitious, AMP reaching $1 is possible in the long term with increased adoption and market growth. However, it would require significant developments in the crypto ecosystem and Flexa network's expansion.

Does AMP Coin have a future?

Yes, AMP coin has a promising future. As a collateral token for the Flexa network, it's poised for growth in digital payments and DeFi. Its utility and partnerships suggest potential for long-term value appreciation.

What is the AMP stock price forecast for 2025?

Based on current market trends and expert analysis, the AMP price forecast for 2025 is estimated to reach $0.15 to $0.20 per token, potentially offering significant growth from its current value.

What is the AMP price prediction for 2025?

Based on market analysis and current trends, AMP price is predicted to reach around $0.15 to $0.20 by 2025, showing potential for significant growth in the coming years.

2025 REQPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Request Network

2025 WPAY Price Prediction: Analyzing Future Growth Potential and Market Trends for the Digital Payment Token

2025 UTKPrice Prediction: Analyzing Growth Potential and Market Trends for UTRUST Token in the Evolving Digital Payment Ecosystem

P vs XLM: A Comprehensive Analysis of Investment Performance in Emerging Markets

UNA vs XLM: Comparing Two Innovative Blockchain Protocols for Cross-Border Transactions

MOVE vs XLM: Comparing Two Innovative Blockchain Programming Languages

How does TAO compare to other AI-powered crypto coins in market cap and performance?

Sàn DEX là gì?

Main Differences Between TradFi and DeFi: A Complete Guide in 2026

How to Buy Bitcoin ETF? A Complete Guide in 2026

What are on-chain data analysis metrics for Monad (MON): active addresses, whale movements, and transaction trends in 2026?