2025 BANANA Price Prediction: Market Analysis and Future Outlook for the Global Fruit Economy

Introduction: BANANA's Market Position and Investment Value

Banana Gun (BANANA), as a trading bot platform on Ethereum, Solana, Base, and Blast, has established itself as a notable player in the automated trading sector since its inception. As of 2025, BANANA's market capitalization has reached $63.94 million, with a circulating supply of approximately 4,016,552 tokens, and a price hovering around $15.92. This asset, known as a "cross-chain trading solution," is playing an increasingly crucial role in the field of decentralized finance and automated trading.

This article will comprehensively analyze BANANA's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. BANANA Price History Review and Current Market Status

BANANA Historical Price Evolution

- 2024: BANANA reached its all-time high of $79.62 on July 20, marking a significant milestone for the project

- 2025: The token experienced a sharp decline, hitting its all-time low of $10.26 on March 11

- 2025: BANANA's price has shown some recovery, currently trading at $15.92 as of September 29

BANANA Current Market Situation

BANANA is currently trading at $15.92, with a 24-hour trading volume of $78,701.58. The token has seen a slight increase of 0.95% in the last 24 hours. However, it's down 10.29% over the past week and 19.75% over the last month. The market capitalization stands at $63,943,518.31, ranking BANANA at 602nd position in the cryptocurrency market. With a circulating supply of 4,016,552.66 BANANA tokens out of a total supply of 8,900,000, the circulating ratio is approximately 45.13%. The fully diluted market cap is $141,688,000.

Click to view the current BANANA market price

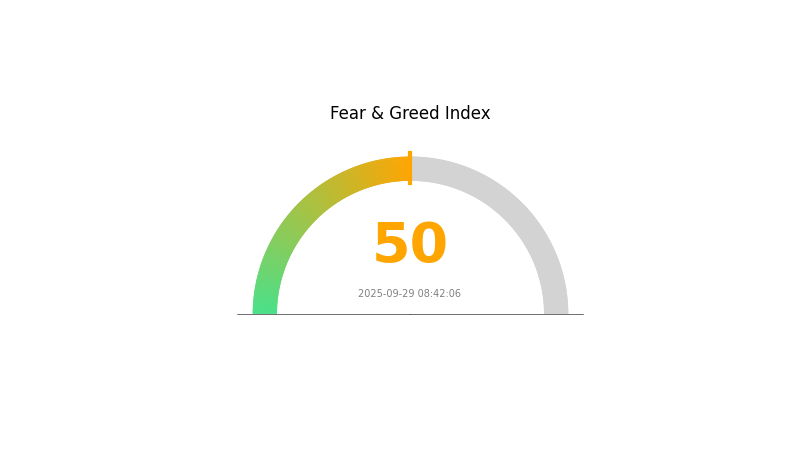

BANANA Market Sentiment Indicator

2025-09-29 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently in a state of equilibrium, with the Fear and Greed Index sitting at 50, indicating a neutral sentiment. This balanced position suggests that investors are neither overly pessimistic nor excessively optimistic about the market's prospects. It's an opportune time for traders to reassess their strategies and for newcomers to explore the market with caution. Remember, while the sentiment is neutral, market conditions can change rapidly, so stay informed and trade wisely on Gate.com.

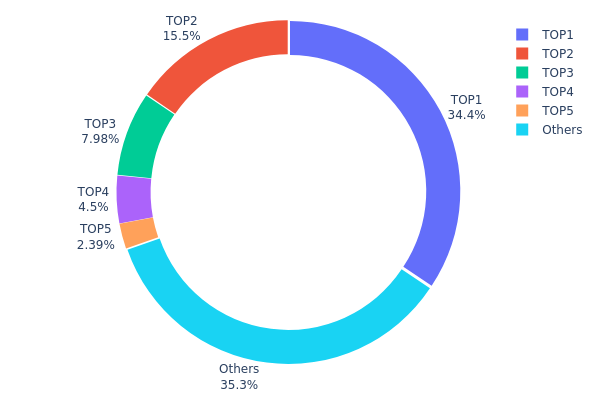

BANANA Holdings Distribution

The address holdings distribution data reveals a significant concentration of BANANA tokens. The top address holds 34.36% of the total supply, while the top 5 addresses collectively control 64.67% of all tokens. This high level of concentration indicates a potentially centralized ownership structure.

Such concentration could have substantial implications for market dynamics. The presence of large holders, often referred to as "whales," may lead to increased price volatility if they decide to buy or sell significant portions of their holdings. Moreover, this concentration raises concerns about potential market manipulation, as these major holders could potentially influence token price movements.

From a broader perspective, this distribution pattern suggests a relatively low level of decentralization in BANANA's on-chain structure. While some concentration is common in many cryptocurrency projects, the extent observed here may raise questions about the token's resilience to large-scale sell-offs and its overall market stability.

Click to view the current BANANA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xdba6...c25caf | 3436.55K | 34.36% |

| 2 | 0x0000...00dead | 1546.90K | 15.46% |

| 3 | 0xf977...41acec | 797.64K | 7.97% |

| 4 | 0xf32e...573a8e | 450.00K | 4.50% |

| 5 | 0x43de...b5b5c6 | 238.88K | 2.38% |

| - | Others | 3530.03K | 35.33% |

II. Key Factors Influencing BANANA's Future Price

Supply Mechanism

- Meme Culture Penetration: As a global internet meme, "banana for scale" has the potential for cross-sector transmission, which could drive demand and price.

Institutional and Whale Dynamics

- Corporate Adoption: Some companies may integrate BANANA into their operations or hold it as a reserve asset, potentially impacting price.

Macroeconomic Environment

- Regulatory Uncertainty: Global regulatory attitudes towards meme coins could significantly affect BANANA's development and price.

Technical Development and Ecosystem Building

- Ecosystem Diversification: Long-term potential may depend on developing a diverse ecosystem, potentially integrating NFTs and DeFi, which could drive the price to $0.02-0.03 by 2030.

- Community-Driven Development: BANANA's unique economic model and community-driven development path continue to influence price fluctuations and market sentiment.

III. BANANA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $11.766 - $15.9

- Neutral prediction: $15.9 - $16.377

- Optimistic prediction: $16.377 - $20.33451 (requires sustained market growth)

2026-2027 Outlook

- Market stage expectation: Potential bullish trend with increasing adoption

- Price range forecast:

- 2026: $15.65435 - $20.33451

- 2027: $17.50704 - $26.80766

- Key catalysts: Increasing institutional investment and wider cryptocurrency acceptance

2028-2030 Long-term Outlook

- Base scenario: $22.52208 - $25.54455 (assuming steady market growth)

- Optimistic scenario: $25.54455 - $34.74058 (assuming strong bullish momentum)

- Transformative scenario: $34.74058 - $40.00000 (assuming breakthrough in BANANA technology and mass adoption)

- 2030-12-31: BANANA $34.74058 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 16.377 | 15.9 | 11.766 | 0 |

| 2026 | 20.33451 | 16.1385 | 15.65435 | 1 |

| 2027 | 26.80766 | 18.23651 | 17.50704 | 14 |

| 2028 | 25.67518 | 22.52208 | 13.51325 | 41 |

| 2029 | 26.99047 | 24.09863 | 19.76088 | 51 |

| 2030 | 34.74058 | 25.54455 | 13.53861 | 60 |

IV. BANANA Professional Investment Strategies and Risk Management

BANANA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operation suggestions:

- Accumulate BANANA during market dips

- Set price targets for partial profit-taking

- Store in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Use stop-loss orders to manage downside risk

- Take profits at predetermined resistance levels

BANANA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. BANANA Potential Risks and Challenges

BANANA Market Risks

- High volatility: Significant price fluctuations common in cryptocurrency markets

- Liquidity risk: Potential difficulty in exiting large positions

- Correlation risk: May be affected by overall crypto market trends

BANANA Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting trading bots

- Cross-border compliance: Varying legal status in different jurisdictions

- Tax implications: Evolving tax treatment of crypto assets and trading profits

BANANA Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: High fees or delayed transactions on Ethereum during peak times

- Interoperability challenges: Risks associated with cross-chain functionality

VI. Conclusion and Action Recommendations

BANANA Investment Value Assessment

BANANA presents potential as an innovative trading bot platform, but carries significant risks due to market volatility and regulatory uncertainty. Long-term value depends on adoption and technological advancements, while short-term risks include high price fluctuations and potential technical issues.

BANANA Investment Recommendations

✅ Beginners: Start with small positions, focus on education and risk management ✅ Experienced investors: Consider as part of a diversified crypto portfolio, actively monitor market conditions ✅ Institutional investors: Conduct thorough due diligence, consider OTC options for large positions

BANANA Trading Participation Methods

- Spot trading: Buy and hold BANANA tokens on Gate.com

- Staking: Participate in staking programs if available

- Utilize trading bot: Explore BANANA's trading bot features for automated strategies

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of the banana coin?

BananaCoin's future looks promising, with potential for significant growth by 2026. Experts predict increased adoption and value, driven by innovative blockchain applications in the agricultural sector.

Will bananas go up in price?

Yes, banana prices are likely to increase. A 10% tariff could raise costs by $250 million annually, affecting market prices.

Is banana a good crypto?

Banana crypto shows limited potential with a low market cap of $35K and price of $0.00003554. More sells than buys indicate weak investor confidence.

What is the price prediction for banana for scale coin in 2030?

The price prediction for Banana for Scale (BANANA) in 2030 is between $0.000142 and $0.000236, based on current market trends.

Where Can I Join a Crypto Pump? Risks, Reality, and Safer Alternatives

What Is the Price Prediction for Starknet Token (STRK) in 2025?

How to Interpret Crypto Technical Indicators: MACD, RSI, and Volume Trends?

Is Kryll (KRL) a good investment?: Analyzing the Potential and Risks of This Automated Trading Platform Token

APP vs CRO: Maximizing User Engagement and Conversion Rates in Mobile Marketing

2025 KRL Price Prediction: Market Analysis and Growth Potential in the Evolving Crypto Landscape

How Does Macroeconomic Policy Impact Cryptocurrency Prices: Fed Rates, Inflation Data, and Market Correlation in 2026

Liquidation in Crypto: What It Is, Causes, and How to Avoid It

What Are Crypto Derivatives Market Signals: Futures Open Interest, Funding Rates, and Long-Short Ratio Explained

What is ACE (Fusionist): Whitepaper Logic, Tencent Team Background, and Long-term Growth Potential Explained

Airdrops