2025 BAT Price Prediction: Will Basic Attention Token Reach $5 in the Next Bull Run?

Introduction: BAT's Market Position and Investment Value

Basic Attention Token (BAT), as a digital asset revolutionizing the digital advertising industry, has made significant strides since its inception in 2017. As of 2025, BAT's market capitalization has reached $293 million, with a circulating supply of approximately 1.5 billion tokens, and a price hovering around $0.1959. This asset, often hailed as the "Attention Economy Token," is playing an increasingly crucial role in reshaping online advertising and user engagement.

This article will provide a comprehensive analysis of BAT's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to offer professional price predictions and practical investment strategies for investors.

I. BAT Price History Review and Current Market Status

BAT Historical Price Evolution

- 2017: ICO launch, price started at $0.035998

- 2021: Bull market peak, price reached all-time high of $1.9 on November 28

- 2022-2023: Crypto winter, price dropped to a low of $0.168

BAT Current Market Situation

As of October 18, 2025, BAT is trading at $0.1959, with a 24-hour trading volume of $1,587,206. The token has shown strong performance recently, with a 4.08% increase in the past 24 hours and a significant 45.43% gain over the last 7 days. The 30-day price change stands at 21.44%, indicating a positive medium-term trend. BAT's market cap currently sits at $293,006,857, ranking it 222nd in the cryptocurrency market. With a circulating supply of 1,495,696,056 BAT tokens, representing 99.71% of the total supply, the project maintains high liquidity and wide distribution among holders.

Click to view the current BAT market price

BAT Market Sentiment Indicator

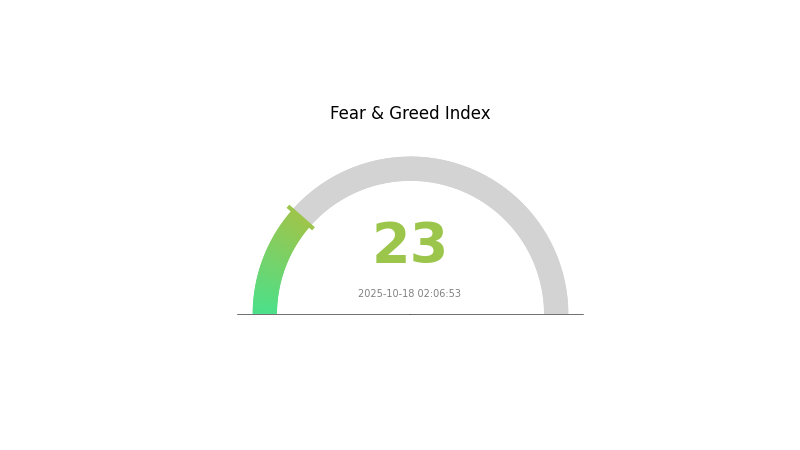

2025-10-18 Fear and Greed Index: 23 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of extreme fear, with the Fear and Greed Index registering a low score of 23. This indicates a high level of pessimism among investors, potentially creating opportunities for contrarian traders. During such times of market anxiety, it's crucial to remain objective and avoid making impulsive decisions. Seasoned investors often view these moments as potential buying opportunities, adhering to the adage "be fearful when others are greedy, and greedy when others are fearful."

BAT Holdings Distribution

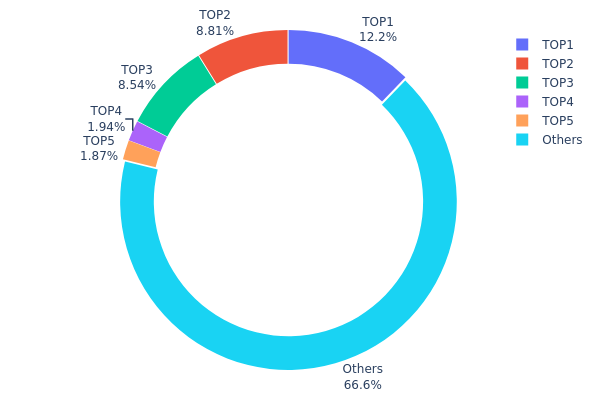

The address holdings distribution data for BAT reveals significant concentration among top holders. The top address controls 12.20% of the total supply, with the top five addresses collectively holding 33.35% of all BAT tokens. This level of concentration indicates a relatively centralized ownership structure, which could potentially impact market dynamics.

Such concentration of holdings raises concerns about market manipulation and price volatility. Large holders, often referred to as "whales," have the capacity to influence token prices through significant buy or sell orders. However, it's worth noting that 66.65% of BAT tokens are distributed among other addresses, suggesting a degree of decentralization beyond the top holders.

This distribution pattern reflects a mixed market structure for BAT, combining elements of both centralization and decentralization. While the presence of large holders may introduce some stability, it also poses risks to the token's price discovery process and overall market resilience. Monitoring changes in this distribution over time will be crucial for assessing BAT's evolving market characteristics and potential investment risks.

Click to view the current BAT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfd82...64a00b | 183079.29K | 12.20% |

| 2 | 0x6c8c...d90e4e | 132179.80K | 8.81% |

| 3 | 0xf977...41acec | 128116.97K | 8.54% |

| 4 | 0x3727...866be8 | 29160.12K | 1.94% |

| 5 | 0xba35...25013b | 27988.38K | 1.86% |

| - | Others | 999475.44K | 66.65% |

II. Key Factors Affecting BAT's Future Price

Supply Mechanism

- Token Burning: BAT implements a token burning mechanism, which reduces the total supply over time.

- Historical Pattern: Previous token burns have generally had a positive impact on BAT's price due to reduced supply.

- Current Impact: The ongoing token burning is expected to continue supporting BAT's value by maintaining scarcity.

Institutional and Whale Dynamics

- Corporate Adoption: Brave Browser, the primary platform utilizing BAT, continues to gain popularity among users and content creators.

Macroeconomic Environment

- Inflation Hedging Properties: As a utility token tied to digital advertising, BAT may offer some protection against inflation in the digital economy.

Technological Development and Ecosystem Building

- Brave Browser Upgrades: Continuous improvements to the Brave browser enhance user experience and potentially increase BAT adoption.

- Ecosystem Applications: The BAT ecosystem includes Brave Browser, Brave Rewards, and partnerships with various content platforms and publishers.

III. BAT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.12018 - $0.2037

- Neutral prediction: $0.2037 - $0.2500

- Optimistic prediction: $0.2500 - $0.2974 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.23054 - $0.41618

- 2028: $0.22541 - $0.52596

- Key catalysts: Technological advancements, wider cryptocurrency adoption, and potential regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $0.44187 - $0.51478 (assuming steady market growth and adoption)

- Optimistic scenario: $0.58769 - $0.7104 (assuming favorable market conditions and increased utility)

- Transformative scenario: $0.7104 - $0.8500 (assuming breakthrough applications and mainstream integration)

- 2030-12-31: BAT $0.51478 (potential stabilization point after significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.2974 | 0.2037 | 0.12018 | 3 |

| 2026 | 0.34827 | 0.25055 | 0.20545 | 27 |

| 2027 | 0.41618 | 0.29941 | 0.23054 | 52 |

| 2028 | 0.52596 | 0.35779 | 0.22541 | 82 |

| 2029 | 0.58769 | 0.44187 | 0.29606 | 125 |

| 2030 | 0.7104 | 0.51478 | 0.45816 | 162 |

IV. BAT Professional Investment Strategies and Risk Management

BAT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operation suggestions:

- Accumulate BAT during market dips

- Set price targets for partial profit-taking

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversals

- RSI: Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor BAT's correlation with overall crypto market trends

- Set strict stop-loss orders to manage downside risk

BAT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, regular security audits

V. Potential Risks and Challenges for BAT

BAT Market Risks

- Volatility: Extreme price fluctuations common in crypto markets

- Liquidity: Potential challenges during market stress

- Competitor projects: Emerging attention economy tokens

BAT Regulatory Risks

- Advertising regulations: Changes could impact BAT's utility

- Privacy concerns: Potential scrutiny of user data collection

- Token classification: Regulatory uncertainty in different jurisdictions

BAT Technical Risks

- Brave browser adoption: BAT's success tied to browser growth

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability: Ethereum network congestion could impact transactions

VI. Conclusion and Action Recommendations

BAT Investment Value Assessment

BAT offers long-term potential in the attention economy, but faces short-term volatility and adoption challenges. The project's success is closely tied to Brave browser growth and overall crypto market sentiment.

BAT Investment Recommendations

✅ Beginners: Start with small, regular purchases to build a position over time ✅ Experienced investors: Consider a core holding with active trading around support/resistance levels ✅ Institutional investors: Evaluate BAT as part of a broader Web3 and attention economy thesis

BAT Trading Participation Methods

- Spot trading: Direct purchase and holding of BAT tokens

- Staking: Explore opportunities to earn yield on BAT holdings

- Brave browser usage: Earn BAT through content engagement and ad viewing

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is bat coin a good investment?

BAT coin shows promise as a solid investment in 2025. With its growing adoption in digital advertising and increasing user base, BAT's value is expected to rise. Analysts predict potential gains, making it an attractive option for crypto investors.

Will bat reach $1000?

It's highly unlikely for BAT to reach $1000 in the foreseeable future. Given its current price and market cap, such a massive increase would require unprecedented growth and adoption.

Does the BAT token have a future?

Yes, BAT has a promising future. Its integration with the Brave browser and growing adoption in digital advertising suggest potential for long-term value and utility in the evolving web3 ecosystem.

How much is the BAT token worth?

As of October 2025, BAT is trading at around $2.50, showing significant growth from its earlier years. The token's value has been driven by increased adoption of the Brave browser and expanding use cases in the attention economy.

Share

Content