2025 BID Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of BID

Creator Bid (BID) is an innovative platform designed to help creators develop, monetize, and co-own AI Creator Agents, leveraging cutting-edge artificial intelligence and blockchain technology to establish a new model of digital content creation and ownership. As of December 23, 2025, BID has achieved a market capitalization of approximately $6.97 million with a circulating supply of 272.29 million tokens, trading at $0.02561 per token. This emerging asset is playing an increasingly vital role in the intersection of AI-driven content creation and decentralized ownership models.

This comprehensive analysis examines BID's price dynamics and market trends for 2025, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasting and actionable investment strategies. By understanding these multifaceted elements, investors can make informed decisions regarding their exposure to this innovative creator economy platform.

Creator Bid (BID) Market Analysis Report

I. BID Price History Review and Current Market Status

BID Historical Price Movement Trajectory

- 2025 (March): Project launched with significant market interest, BID reached its all-time high of $0.5 on March 26, 2025

- 2025 (December): Bearish market conditions, BID declined sharply, hitting its all-time low of $0.02447 on December 22, 2025, representing a 95.1% drop from peak

BID Current Market Position

As of December 23, 2025, BID is trading at $0.02561 with the following key metrics:

Price Performance:

- 1-hour change: -0.47%

- 24-hour change: +1.54%

- 7-day change: -9.42%

- 30-day change: -27.93%

- Year-to-date change: -91.033%

Market Capitalization Metrics:

- Current market capitalization: $6,973,379.75

- Fully diluted valuation (FDV): $25,609,486.26

- 24-hour trading volume: $63,412.67

- Market share: 0.00079%

Supply Information:

- Circulating supply: 272,291,282.86 BID (27.23% of total)

- Total supply: 999,979,940 BID

- Maximum supply: 1,000,000,000 BID

- Current holders: 6,848

Recent Price Range:

- 24-hour high: $0.02587

- 24-hour low: $0.02447

The token is currently trading near its recent lows, with the FDV-to-market cap ratio indicating that the majority of tokens remain unlocked. The current market sentiment reflects extreme fear conditions in the broader cryptocurrency market.

Click to view current BID market price

BID Market Sentiment Index

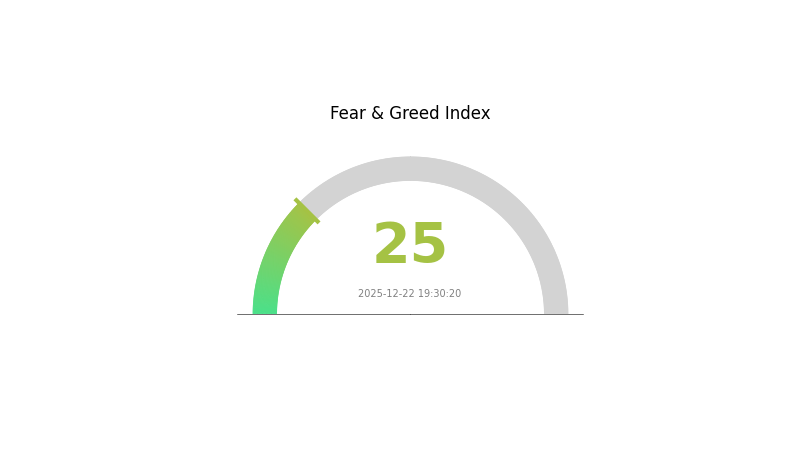

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index plummeting to 25. This reading signals heightened market anxiety and risk aversion among investors. During such periods, asset prices often face downward pressure as panic selling dominates trading activity. However, contrarian investors view extreme fear as a potential buying opportunity, as markets tend to eventually recover from oversold conditions. Traders should exercise caution and conduct thorough risk management. On Gate.com, you can monitor real-time market sentiment and adjust your investment strategy accordingly.

BID Holdings Distribution

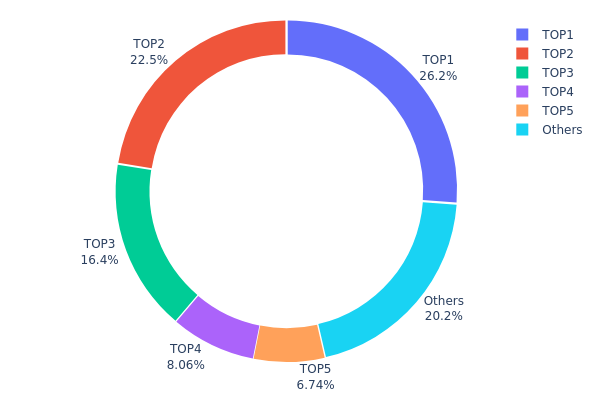

The address holdings distribution chart illustrates the concentration of BID tokens across blockchain addresses, providing critical insights into the token's ownership structure and potential market dynamics. By analyzing the top holders and their proportional stakes, this metric reveals the degree of decentralization and identifies key stakeholders who may influence token price movements and ecosystem governance.

BID exhibits pronounced concentration characteristics, with the top five addresses controlling approximately 79.79% of the total token supply. The leading address alone commands 26.19% of holdings, while the second-largest holder accounts for 22.46%. This distribution pattern indicates significant centralization risk, as decision-making power and token liquidity are concentrated among a limited number of entities. Only 20.21% of tokens are distributed across all remaining addresses, suggesting a fragmented long-tail of smaller holders. Such extreme concentration at the apex of the distribution hierarchy raises concerns about potential price manipulation and governance vulnerability, as coordinated actions by top holders could substantially impact market sentiment and trading dynamics.

The current address distribution structure presents material implications for market stability and decentralization metrics. With nearly four-fifths of the supply held by five entities, BID demonstrates characteristics typically associated with projects in early distribution phases or those with significant institutional allocation. This concentration level constrains organic price discovery and increases susceptibility to large-scale liquidations or coordinated token movements. While the persistence of a distributed long-tail suggests some retail participation, the overwhelming dominance of top-tier holders fundamentally shapes the token's on-chain structure and suggests limited practical decentralization relative to mature blockchain assets.

Click to view current BID Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x563f...6ef2ec | 190000.00K | 26.19% |

| 2 | 0xd01e...fabc69 | 162903.02K | 22.46% |

| 3 | 0x5702...416e64 | 118630.95K | 16.35% |

| 4 | 0xaa54...35a4e1 | 58489.58K | 8.06% |

| 5 | 0x4b5e...05e076 | 48860.42K | 6.73% |

| - | Others | 146357.87K | 20.21% |

Core Factors Influencing BID's Future Price

Supply Mechanism

-

Token Distribution and Scarcity: BID's supply mechanism and scarcity represent key factors in determining its investment value. The token's allocation structure directly impacts market availability and price dynamics.

-

Historical Price Patterns: In 2025, BID reached a historical high of $0.50 on March 26th, then declined to a historical low of $0.02995 on April 9th. In the recent market cycle, BID dropped from $0.50 to $0.03534, demonstrating significant volatility characteristic of emerging cryptocurrencies.

-

Current Market Conditions: As of May 13, 2025, BID was priced at approximately $0.056 according to real-time data on Gate.com. Recent gains present notable pullback risks, requiring cautious trading strategies.

Institutional and Market Adoption

-

Enterprise Application Status: BID's institutional adoption and enterprise applications remain in early development stages, contrasting with more mature ecosystems. The project is actively working to expand its adoption base and real-world use cases.

-

Ecosystem Development: BID focuses on auction mechanisms as its core feature and is continuously refining its ecosystem while planning integration with Ethereum. The platform aims to help creators develop, monetize, and co-own AI creator agents through on-chain bidding and zero-knowledge auction mechanisms.

Technology Development and Ecosystem Building

-

AI Creator Agent Integration: BID emphasizes on-chain competitive bidding and ZK auction mechanisms designed to drive the future of creator economy and AI agent economy. This technological focus positions BID within the growing intersection of AI and blockchain applications.

-

Ecosystem Evolution: The project's continued development of its auction-based infrastructure and planned Ethereum integration represent key technological advancement vectors. The ecosystem is expanding to support more complex creator monetization scenarios and agent interactions.

III. 2025-2030 BID Price Forecast

2025 Outlook

- Conservative Forecast: $0.01992 - $0.02554

- Base Case Forecast: $0.02554

- Optimistic Forecast: $0.03295 (requires sustained market momentum)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with incremental appreciation driven by ecosystem development and increased adoption.

- Price Range Predictions:

- 2026: $0.02807 - $0.03655 (14% upside potential)

- 2027: $0.025 - $0.0431 (28% upside potential)

- 2028: $0.03116 - $0.04066 (48% upside potential)

- Key Catalysts: Expansion of platform utility, increased network participation, strategic partnerships, and positive regulatory developments within the cryptocurrency sector.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.03933 - $0.04444 by 2029, potentially reaching $0.04188 - $0.05277 by 2030 (assumes continued protocol improvements and market adoption)

- Optimistic Scenario: $0.04444 - $0.05277 range by 2030 (assumes accelerated institutional adoption and ecosystem expansion)

- Transformational Scenario: Breakthrough above $0.05277 by 2030 (requires major technological innovations, significant market capitalization growth, or transformative macroeconomic conditions)

The forecast demonstrates a cumulative upside potential of approximately 53-63% from current levels through 2029-2030, reflecting a measured but consistent growth trajectory contingent upon sustained market conditions and ecosystem development.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03295 | 0.02554 | 0.01992 | 0 |

| 2026 | 0.03655 | 0.02924 | 0.02807 | 14 |

| 2027 | 0.0431 | 0.0329 | 0.025 | 28 |

| 2028 | 0.04066 | 0.038 | 0.03116 | 48 |

| 2029 | 0.04444 | 0.03933 | 0.02084 | 53 |

| 2030 | 0.05277 | 0.04188 | 0.02806 | 63 |

Creator Bid (BID) Professional Investment Strategy and Risk Management Report

IV. BID Professional Investment Strategy and Risk Management

BID Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in AI-powered creator economy and blockchain-based content ownership models, medium to long-term growth investors

- Operation Recommendations:

- Dollar-cost averaging (DCA) approach: Regular purchases at fixed intervals to mitigate volatility exposure, particularly relevant given BID's -91.03% one-year performance

- Fundamental thesis validation: Monitor Creator.bid platform adoption metrics, AI creator agent development milestones, and ecosystem expansion

- Portfolio allocation: Position BID as a speculative growth allocation (2-5% of total crypto portfolio) given its early-stage status and market cap rank of 1354

(2) Active Trading Strategy

- Price Action Analysis:

- Support and Resistance Levels: Current price $0.02561 with 24H range $0.02447-$0.02587; historical support at $0.02447 (ATL date: 2025-12-22)

- Volume Analysis: Daily volume of $63,412.67 indicates modest liquidity; monitor volume spikes during platform announcements or ecosystem milestones

- Wave Trading Key Points:

- Entry opportunities: Consider accumulation during market downturns when sentiment is bearish, aligning with the 7-day -9.42% and 30-day -27.93% declines

- Exit management: Establish profit-taking targets at resistance levels, particularly near the historical ATH of $0.50 (ATH date: 2025-03-26)

BID Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% maximum allocation in BID within overall crypto holdings

- Active Investors: 3-5% allocation, with defined stop-loss levels at -20% from entry price

- Professional Investors: 5-10% allocation with hedging strategies and systematic rebalancing

(2) Risk Hedging Solutions

- Volatility Management: Pair BID positions with stablecoin holdings; given the -0.47% one-hour and -9.42% seven-day declines, maintain sufficient cash reserves for opportunities

- Position Hedging: Use trailing stop-losses to protect against rapid drawdowns in this early-stage token with demonstrated downward pressure over multiple timeframes

(3) Secure Storage Solutions

- Self-Custody Approach: Transfer BID tokens to personal wallets after purchase from Gate.com to maintain full control of private keys

- Cold Storage Consideration: For large holdings, periodic transfers to hardware-secured storage reduce exchange counterparty risk

- Security Best Practices: Enable all available security features on Gate.com account (two-factor authentication, IP whitelisting); never share private keys or seed phrases; verify contract address (0xa1832f7f4e534ae557f9b5ab76de54b1873e498b on BSC) before transfers

V. BID Potential Risks and Challenges

BID Market Risks

- Significant Historical Drawdown: BID has declined -91.03% over one year, indicating substantial downward pressure and potential market skepticism regarding the project's value proposition

- Low Trading Liquidity: Daily volume of $63,412.67 on a fully diluted market cap of $25.6 million suggests limited liquidity, creating potential for slippage during larger trades

- Low Holder Concentration: With only 6,848 token holders, the distribution remains relatively concentrated, presenting risks of sudden selling pressure or manipulation

BID Regulatory Risks

- Classification Uncertainty: AI-powered creator platforms with blockchain integration may face evolving regulatory scrutiny regarding content moderation, creator compensation, and token classification across different jurisdictions

- Compliance Complexity: Creator.bid's business model involving monetization and shared ownership of AI agents may intersect with securities regulations, requiring careful legal navigation

- Platform Risk: Regulatory actions against similar AI or creator platforms could indirectly impact sentiment and adoption for Creator.bid

BID Technical Risks

- Smart Contract Exposure: BID operates as a BEP-20 token on BSC; vulnerabilities in the token contract or Creator.bid's smart contracts could result in fund loss or service disruption

- Platform Dependency: The token's value is intrinsically tied to Creator.bid platform adoption; technical failures, scalability issues, or platform vulnerabilities could severely impact token utility

- Ecosystem Maturity: As an early-stage project, the platform may face development delays, feature limitations, or inability to achieve projected AI agent adoption rates

VI. Conclusion and Action Recommendations

BID Investment Value Assessment

Creator Bid represents a speculative investment in the emerging intersection of AI technology, blockchain, and creator economics. The project's innovative positioning addresses genuine demand for decentralized creator monetization and shared AI agent ownership. However, the severe -91.03% one-year decline, modest market cap of $25.6 million, limited liquidity (6,848 holders), and early-stage operational status present substantial risks. Success depends on rapid platform adoption, achievement of AI creator agent milestones, and sustained market interest in decentralized creator infrastructure. This is an asymmetric risk/reward opportunity suitable only for sophisticated investors with high risk tolerance.

BID Investment Recommendations

✅ Beginners: Start with micro-positions (0.1-0.5% of crypto portfolio) exclusively through Gate.com to familiarize yourself with the project before increasing exposure; conduct thorough research on Creator.bid's roadmap and technology before committing capital

✅ Experienced Investors: Implement DCA strategies during market weakness; set strict stop-losses at -20% to -25% from entry; monitor quarterly platform adoption metrics and ecosystem developments; position as a speculative growth allocation within a diversified crypto portfolio

✅ Institutional Investors: Conduct comprehensive due diligence on Creator.bid's technical infrastructure, team credentials, and regulatory compliance framework; consider BID as part of a thematic allocation to AI-powered applications; require governance participation and transparent developmental reporting

BID Trading Participation Methods

- On-exchange Trading: Execute all spot trading through Gate.com, which provides BID trading pairs, secure custody options, and comprehensive market data

- Direct Acquisition: Purchase BID directly on Gate.com using multiple fiat entry points and crypto trading pairs to optimize entry prices

- Portfolio Integration: Incorporate BID into balanced crypto portfolios using Gate.com's portfolio tracking tools to monitor performance against benchmark indexes and personal allocation targets

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their own risk tolerance and financial situation. It is strongly recommended to consult with professional financial advisors before investing. Never invest more capital than you can afford to lose completely.

FAQ

How much will BitTorrent be worth in 2025?

BitTorrent is projected to reach approximately $0.000064 by the end of 2025. This forecast reflects current market dynamics and development trends in the BitTorrent ecosystem.

What factors influence BID token price predictions?

BID token price is influenced by market demand and supply dynamics, trading volume, market sentiment, overall crypto market trends, project developments, and macroeconomic factors affecting the broader digital asset ecosystem.

Is it possible to accurately predict cryptocurrency prices like BID?

Yes, through technical analysis, fundamental analysis, and market sentiment evaluation, you can make informed price predictions for BID. Analyzing trading volume, market trends, and project developments helps identify potential price movements and investment opportunities.

What is the historical price trend of BitTorrent (BID)?

BitTorrent (BID) has experienced significant volatility since its launch. The token peaked during the 2021 bull market, then declined through the bear market. Recently, BID has shown recovery potential with increased adoption. Long-term, BID demonstrates strong fundamental growth prospects.

How does BID compare to other cryptocurrencies in terms of price potential?

BID demonstrates strong price potential with growing trading volume and market adoption. Its unique positioning in the prediction market ecosystem offers differentiated value compared to traditional cryptocurrencies, with scalability advantages and increasing institutional interest supporting long-term appreciation prospects.

Is AVA (AVAAI) a good investment?: Analyzing the Potential Returns and Risks of the Emerging AI Token

AIV vs CRO: A Comparative Analysis of AI-Driven Value and Conversion Rate Optimization Strategies

Is ai16z (AI16Z) a good investment?: Analyzing the potential and risks of this emerging AI fund

Is Holoworld AI (HOLO) a good investment?: Analyzing the potential and risks of this emerging AI cryptocurrency

Is VaderAI by Virtuals (VADER) a good investment?: Analyzing the Potential and Risks of this Emerging AI Token in Today's Crypto Market

Is Wisdomise AI (WSDM) a good investment?: Analyzing the Potential and Risks of this Emerging AI Stock

What is Mango Network? A Complete Guide to MGO Token and Multi-VM Blockchain Infrastructure

What Are Crypto Whales and How to Identify Them?

What is TON Coin? A complete guide to the Open Network’s features, tokenomics, and future prospects

Types of Cryptocurrencies: An In-Depth Overview of Key Features and Top Picks from Bitcoin to Altcoins

Stablecoins Explained: A Complete Beginner's Guide to Their Mechanisms, How to Choose the Right One, and How to Start