2025 BILLY Price Prediction: Analyzing Market Trends and Future Prospects for IKEA's Iconic Bookcase

Introduction: BILLY's Market Position and Investment Value

BILLY (BILLY), positioned as the cutest dog-themed token on Solana, has made significant strides since its inception. As of 2025, BILLY's market capitalization stands at $1,100,000, with a circulating supply of 1,000,000,000 tokens and a price hovering around $0.0011. This asset, dubbed "the cutest dog on Solana," is playing an increasingly crucial role in the meme coin ecosystem within the Solana blockchain.

This article will provide a comprehensive analysis of BILLY's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer investors professional price predictions and practical investment strategies.

I. BILLY Price History Review and Current Market Status

BILLY Historical Price Evolution

- 2024: Project launch, price peaked at $0.2858 on July 21

- 2025: Market downturn, price dropped to an all-time low of $0.000782 on November 19

BILLY Current Market Situation

BILLY is currently trading at $0.0011, which represents a significant decline from its all-time high. Over the past 24 hours, the price has shown a positive movement with a 10.11% increase. However, the longer-term trends indicate a bearish market, with a 41.89% decrease over the past 30 days and a staggering 97.5% drop over the past year.

The token's market capitalization stands at $1,100,000, with a fully diluted valuation matching this figure due to its total supply being in circulation. BILLY's 24-hour trading volume is $7,520.67, indicating relatively low liquidity compared to its market cap.

Despite the recent 24-hour uptick, BILLY's price is still close to its all-time low, suggesting that the token is in a challenging market position. The current price represents a mere fraction of its all-time high, reflecting the severe market correction it has undergone.

Click to view the current BILLY market price

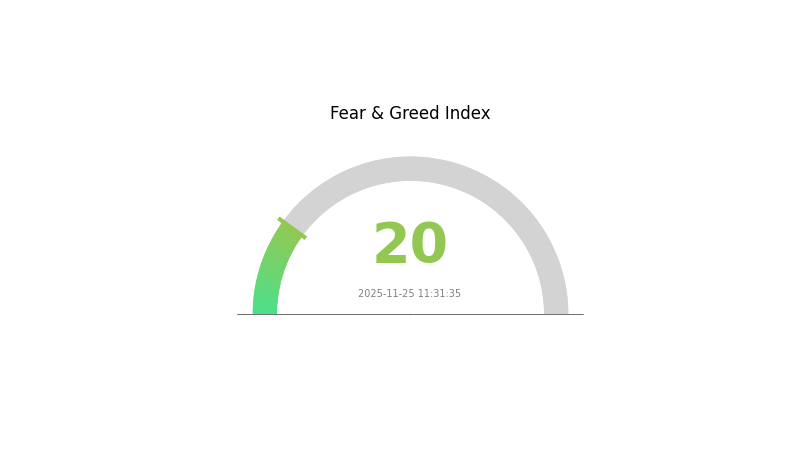

BILLY Market Sentiment Indicator

2025-11-25 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the BILLY index plummeting to 20. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market sentiment can remain negative for extended periods. Traders should consider diversifying their portfolios and setting strict stop-loss orders to manage risk. As always, thorough research and a long-term perspective are crucial in navigating these turbulent market conditions.

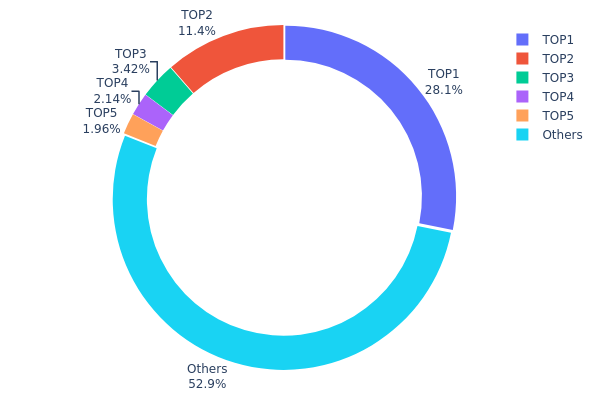

BILLY Holdings Distribution

The address holdings distribution data provides insight into the concentration of BILLY tokens among different wallet addresses. Analyzing this data reveals a significant level of concentration in BILLY's token distribution. The top address holds 28.14% of the total supply, while the top 5 addresses collectively control 47.06% of all BILLY tokens.

This high concentration level raises concerns about potential market manipulation and price volatility. With nearly half of the tokens held by just five addresses, there's a risk of large sell-offs or coordinated actions that could significantly impact BILLY's market price. Furthermore, the top holder's substantial 28.14% stake gives them considerable influence over the token's ecosystem and governance decisions.

Despite these centralization concerns, it's noteworthy that 52.94% of BILLY tokens are distributed among "Others," suggesting a degree of wider distribution. However, the overall picture indicates a relatively centralized token structure, which may impact the project's decentralization goals and market stability.

Click to view the current BILLY Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 276607.22K | 28.14% |

| 2 | u6PJ8D...ynXq2w | 112246.50K | 11.42% |

| 3 | ASTyfS...g7iaJZ | 33585.96K | 3.41% |

| 4 | HDmzpt...731dpD | 21002.62K | 2.13% |

| 5 | DU8W6r...g4DRys | 19282.49K | 1.96% |

| - | Others | 520132.01K | 52.94% |

II. Key Factors Influencing BILLY's Future Price

Supply Mechanism

- Market Volatility: As with most cryptocurrencies, BILLY's price is subject to significant fluctuations, often driven by speculative trading.

- Historical Patterns: Previous supply changes have shown to have a substantial impact on the network and BILLY's price.

- Current Impact: The current supply changes are expected to continue influencing BILLY's price dynamics.

Institutional and Whale Movements

- Corporate Adoption: As more merchants begin to accept BILLY as a payment method, it could lead to wider usage and potentially drive up its price.

Macroeconomic Environment

- Inflation Hedging Properties: BILLY's performance in inflationary environments may impact its price and adoption as a potential hedge against inflation.

Technological Development and Ecosystem Building

- Technological Challenges: As BILLY is based on blockchain technology, any technical challenges or advancements could significantly impact its price.

- Ecosystem Applications: The development of decentralized applications (DApps) and other ecosystem projects built on BILLY could influence its value and adoption.

III. BILLY Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00084 - $0.00110

- Neutral forecast: $0.00110 - $0.00126

- Optimistic forecast: $0.00126 - $0.00142 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth and consolidation period

- Price range predictions:

- 2027: $0.00146 - $0.00195

- 2028: $0.00089 - $0.00204

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00189 - $0.00228 (assuming steady market growth)

- Optimistic scenario: $0.00228 - $0.00258 (with strong ecosystem development)

- Transformative scenario: $0.00258 - $0.00267 (with major breakthroughs in technology and adoption)

- 2030-12-31: BILLY $0.00258 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00142 | 0.0011 | 0.00084 | 0 |

| 2026 | 0.00181 | 0.00126 | 0.00093 | 14 |

| 2027 | 0.00195 | 0.00154 | 0.00146 | 39 |

| 2028 | 0.00204 | 0.00174 | 0.00089 | 58 |

| 2029 | 0.00267 | 0.00189 | 0.00121 | 72 |

| 2030 | 0.00258 | 0.00228 | 0.00135 | 107 |

IV. BILLY Professional Investment Strategies and Risk Management

BILLY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a high appetite for volatility

- Operation suggestions:

- Accumulate BILLY tokens during market dips

- Set a long-term price target and stick to it

- Store tokens in a secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- RSI (Relative Strength Index): Helps in identifying overbought/oversold conditions

- Key points for swing trading:

- Monitor Solana ecosystem developments closely

- Set strict stop-loss orders to manage risk

BILLY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Solana ecosystem projects

- Use of stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BILLY

BILLY Market Risks

- High volatility: BILLY's price can experience significant fluctuations

- Limited liquidity: May affect ability to enter or exit positions quickly

- Correlation with Solana: BILLY's performance may be heavily influenced by Solana's market movements

BILLY Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on meme coins

- Compliance challenges: May face scrutiny from financial authorities

- Cross-border restrictions: Possible limitations on trading in certain jurisdictions

BILLY Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Solana network issues: BILLY may be affected by Solana blockchain congestion or outages

- Wallet security: Risk of loss due to compromised wallets or user error

VI. Conclusion and Action Recommendations

BILLY Investment Value Assessment

BILLY presents a high-risk, high-reward opportunity within the Solana ecosystem. While it offers potential for significant gains, investors should be prepared for extreme volatility and potential losses.

BILLY Investment Recommendations

✅ Beginners: Invest only a small amount you can afford to lose, focus on learning ✅ Experienced investors: Consider as part of a diversified Solana ecosystem portfolio ✅ Institutional investors: Approach with caution, conduct thorough due diligence

BILLY Trading Participation Methods

- Spot trading: Buy and sell BILLY tokens on Gate.com

- Staking: Participate in any available staking programs for potential rewards

- Community engagement: Join BILLY's social media channels for updates and potential airdrops

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

DeepSnitch AI is predicted to 1000x. It's developing AI tools for crypto trading, standing out among other candidates.

Will vet reach $1?

It's possible for VET to reach $1, but it requires significant growth. VeChain's market cap would need to hit $72 billion, which depends on project success and overall crypto market conditions.

How much will $1 Bitcoin be worth in 2025?

Based on current projections, $1 Bitcoin could be worth around $100,000 to $150,000 in 2025, depending on market conditions and adoption rates.

Which crypto boom in 2025 prediction?

Bitcoin, Ethereum, and other major cryptocurrencies are predicted to experience significant growth in 2025. Market trends suggest a potential crypto boom, with substantial price increases expected for top coins.

2025 TRUMPPrice Prediction: Analyzing Market Trends and Potential Growth Factors for the Controversial Asset

2025 SCF Price Prediction: Analyzing Market Trends and Potential Growth Factors for SCF Token

2025 WIF Price Prediction: Bullish Outlook as Adoption and Utility Drive Growth

2025 SMOLE Price Prediction: Will This Crypto Asset Reach New Heights or Face a Downfall?

2025 MOTHER Price Prediction: Analyzing Market Trends and Future Prospects for the Cryptocurrency

2025 JENSOL Price Prediction: Navigating the Future of Decentralized Energy Trading

Is PsyFi (PSY) a good investment?: A comprehensive analysis of tokenomics, market potential, and risk factors for 2024

Is Swan Chain (SWAN) a good investment?: A Comprehensive Analysis of Market Potential, Technology, and Risk Factors for 2024

Is Colend (CLND) a good investment?: A Comprehensive Analysis of Price Potential, Risk Factors, and Market Outlook for 2024

DeFi Là Gì Và Nó Khác Gì So Với Tài Chính Truyền Thống

PORT vs GRT: A Comprehensive Comparison of Two Leading Blockchain Tokens