2025 BLOK Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Metaverse Token

Introduction: BLOK's Market Position and Investment Value

Bloktopia (BLOK), as a pioneering project in the cryptocurrency VR experience sector, has made significant strides since its inception in 2021. As of 2025, BLOK's market capitalization stands at $3,910,213, with a circulating supply of approximately 25,017,359,648 tokens, and a price hovering around $0.0001563. This asset, often referred to as the "VR Hub for Crypto," is playing an increasingly crucial role in providing immersive virtual reality experiences for the cryptocurrency community.

This article will comprehensively analyze BLOK's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. BLOK Price History Review and Current Market Status

BLOK Historical Price Evolution Trajectory

- 2021: BLOK launched, price reached an all-time high of $0.178281 on October 31

- 2022-2024: Gradual price decline amid broader crypto market downturn

- 2025: Price hit an all-time low of $0.00013019 on October 11

BLOK Current Market Situation

As of October 13, 2025, BLOK is trading at $0.0001563, with a 24-hour trading volume of $18,603. The token has experienced a slight decline of 0.63% in the past 24 hours. BLOK's market capitalization stands at $3,910,213, ranking it 1914th in the cryptocurrency market.

Over the past week, BLOK has seen a significant drop of 22.78%, while the 30-day decline is even more pronounced at 31.69%. The yearly performance shows a substantial decrease of 78.7%, indicating a prolonged bearish trend.

The current price is 99.91% below its all-time high and 20.05% above its recent all-time low, suggesting that the token is in a recovery phase from its bottom but still far from its peak values.

With a circulating supply of 25,017,359,648 BLOK and a total supply of 77,388,071,935 BLOK, the token has a circulation ratio of 12.51%. The fully diluted market cap is $31,260,000.

Click to view the current BLOK market price

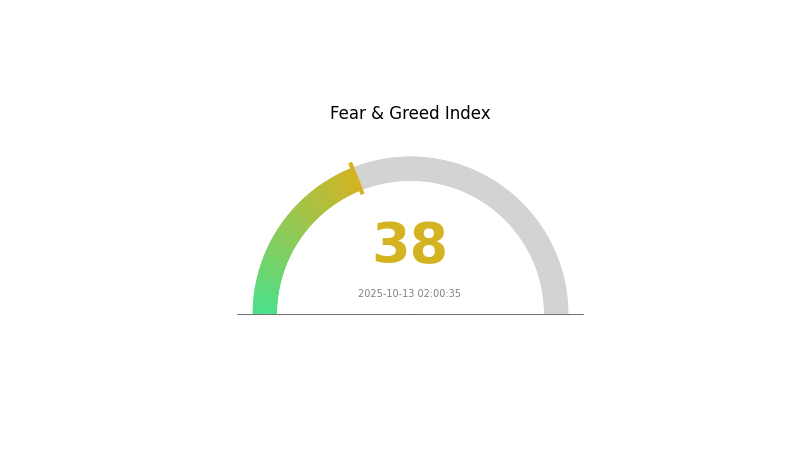

BLOK Market Sentiment Indicator

2025-10-13 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index registering at 38. This indicates a cautious sentiment among investors, potentially signaling an opportune moment for strategic entry into the market. However, it's crucial to approach with caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and diversification remains key in navigating the volatile crypto landscape.

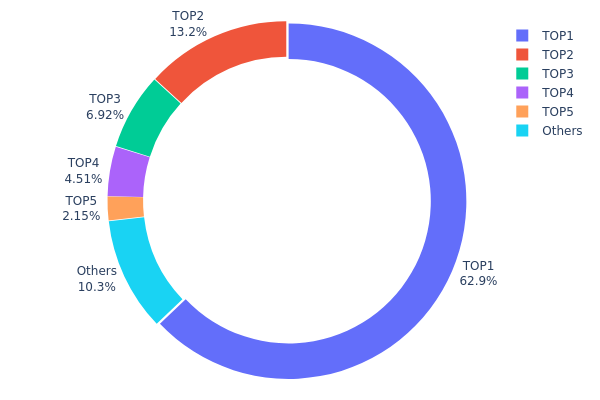

BLOK Holding Distribution

The address holding distribution data for BLOK reveals a highly concentrated ownership structure. The top address, likely a burn address (0x0000...00dead), holds a substantial 62.88% of the total supply, effectively removing these tokens from circulation. The second largest holder possesses 13.20%, while the third and fourth largest addresses control 6.92% and 4.51% respectively. This concentration pattern indicates that over 87% of BLOK tokens are held by just four addresses.

Such a concentrated distribution raises concerns about market liquidity and potential price volatility. With a significant portion of tokens held by a few entities, the market may be susceptible to large price swings if these major holders decide to sell or transfer their holdings. Additionally, this concentration could potentially impact the decentralization ethos of the project, as a small number of addresses wield considerable influence over the token's supply.

The current holding distribution suggests a relatively centralized on-chain structure for BLOK. While this may provide some stability in terms of reduced selling pressure from the largest holders, it also presents risks in terms of market manipulation and reduced free float. Investors and traders should be aware of this concentration when considering BLOK's market dynamics and potential future price movements.

Click to view the current BLOK holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 122611928.06K | 62.88% |

| 2 | 0x24de...82234b | 25742889.69K | 13.20% |

| 3 | 0x3b72...a5926f | 13500000.00K | 6.92% |

| 4 | 0x9616...9ea870 | 8800000.00K | 4.51% |

| 5 | 0x6878...d2fa0b | 4200000.00K | 2.15% |

| - | Others | 20119414.05K | 10.34% |

II. Key Factors Influencing BLOK's Future Price

Supply Mechanism

- Halving: The reduction in block rewards from 6.25 BTC to 3.125 BTC in 2024 will significantly decrease new Bitcoin supply, potentially driving prices up.

- Historical Pattern: Historically, Bitcoin prices tend to surge to new highs about a year after each halving event.

- Current Impact: The upcoming halving in 2024 is expected to create scarcity and potentially push BLOK's price higher in 2025.

Institutional and Whale Dynamics

- Institutional Holdings: Increasing adoption by traditional financial institutions is driving demand and establishing Bitcoin as a macro hedging tool.

- Corporate Adoption: Companies like MicroStrategy continue to invest heavily in Bitcoin, boosting market confidence.

- National Policies: The U.S. political landscape, including crypto-friendly appointments to regulatory positions, is sending positive signals to the market.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly those of the Federal Reserve, continue to influence Bitcoin's attractiveness as an inflation hedge.

- Inflation Hedging Properties: Bitcoin is increasingly viewed as "digital gold" and a store of value during economic uncertainties.

- Geopolitical Factors: Global economic and political events are affecting Bitcoin's role in the international financial system.

Technological Development and Ecosystem Building

- ETF Introduction: The launch of Bitcoin ETFs has lowered entry barriers for retail and institutional investors, significantly boosting demand.

- Network Upgrades: Ongoing improvements to Bitcoin's underlying technology enhance its utility and attract more users.

- Ecosystem Applications: The growth of Layer 2 solutions and new asset paradigms in the crypto ecosystem indirectly supports BLOK's value proposition.

III. BLOK Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00008 - $0.00014

- Neutral forecast: $0.00014 - $0.00018

- Optimistic forecast: $0.00018 - $0.0002 (requires favorable market conditions)

2026-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2026: $0.00013 - $0.00021

- 2027: $0.00014 - $0.00025

- 2028: $0.00015 - $0.0003

- Key catalysts: Technological advancements, expanded use cases, and market sentiment improvement

2029-2030 Long-term Outlook

- Base scenario: $0.00026 - $0.00029 (assuming steady market growth)

- Optimistic scenario: $0.00029 - $0.00033 (with increased adoption and positive market trends)

- Transformative scenario: $0.00033+ (under extremely favorable conditions and breakthrough innovations)

- 2030-12-31: BLOK $0.00033 (potential peak price for the period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0002 | 0.00016 | 0.00008 | 0 |

| 2026 | 0.00021 | 0.00018 | 0.00013 | 14 |

| 2027 | 0.00025 | 0.00019 | 0.00014 | 24 |

| 2028 | 0.0003 | 0.00022 | 0.00015 | 42 |

| 2029 | 0.00033 | 0.00026 | 0.00017 | 66 |

| 2030 | 0.00033 | 0.00029 | 0.00016 | 87 |

IV. Professional Investment Strategies and Risk Management for BLOK

BLOK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate BLOK tokens during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit potential losses

BLOK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Use of stop-loss orders: Limit potential losses on individual trades

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BLOK

BLOK Market Risks

- High volatility: BLOK price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Market sentiment: Heavily influenced by overall crypto market trends

BLOK Regulatory Risks

- Uncertain regulatory environment: Potential for unfavorable regulations

- Cross-border compliance: Varying regulations across different jurisdictions

- Tax implications: Evolving tax laws regarding crypto assets

BLOK Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Possible network congestion during high demand

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

BLOK Investment Value Assessment

BLOK presents a high-risk, high-potential investment in the VR-based crypto ecosystem. While it offers innovative features, investors should be prepared for significant volatility and regulatory uncertainties.

BLOK Investment Recommendations

✅ Beginners: Allocate a small portion (1-2%) of your crypto portfolio, focus on learning ✅ Experienced investors: Consider a 5-10% allocation, actively manage positions ✅ Institutional investors: Conduct thorough due diligence, potentially allocate up to 15% for diversification

BLOK Trading Participation Methods

- Spot trading: Buy and sell BLOK tokens on Gate.com

- Staking: Participate in BLOK staking programs if available

- DeFi integration: Explore decentralized finance opportunities involving BLOK tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Blok a good investment?

Yes, Blok shows promise as an investment. As an actively managed ETF focused on digital assets, it offers exposure to the growing blockchain sector. With its strategic portfolio, Blok is well-positioned for potential gains in the evolving crypto market.

What is the price prediction for Blockdag in 2025?

Based on long-term analysis, the price of Blockdag is predicted to reach $3,421.87 by 2025.

How volatile is Blok's stock price?

Blok's stock price shows low volatility, with a beta coefficient of 0.00. As of 2025-10-13, it exhibits minimal price fluctuations.

What are analysts' price targets for Blok?

Analysts' current 12-month price target for Blok is $88.87, based on the average consensus among analysts.

2025 BLOK Price Prediction: Analyzing Market Trends and Growth Potential for the Metaverse Token

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 ETH Price Prediction: Analyzing Market Trends and Institutional Adoption Factors

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

What is Kinto (K) – Rising Star of Modular Exchange

What is Reef?

What is Pi Coin? Complete Guide to Pi Network Value, Price & How to Sell Pi Coin

How Cryptocurrencies Are Taxed in Germany

How to Unlock Daily Cipher Codes in Hamster Kombat