2025 BMB Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of BMB

Beamable Network (BMB) is a tokenized, on-chain compute capital market built on Solana that transforms computational resources into tradable assets. Since its launch in 2025, BMB has achieved significant traction with billions of monthly API calls already processing on its platform. As of December 2025, BMB maintains a market capitalization of approximately $1,785,141 with a circulating supply of 196,666,441 tokens, trading at around $0.009077. This innovative asset, recognized as a "decentralized alternative to hyperscale cloud services," is playing an increasingly critical role in democratizing access to compute resources for AI applications, software programs, and infrastructure workloads.

This article will provide a comprehensive analysis of BMB's price trajectory from 2025 through 2030, integrating historical price movements, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to the emerging decentralized compute market.

Beamable Network (BMB) Market Analysis Report

I. BMB Price History Review and Market Status

BMB Historical Price Movement

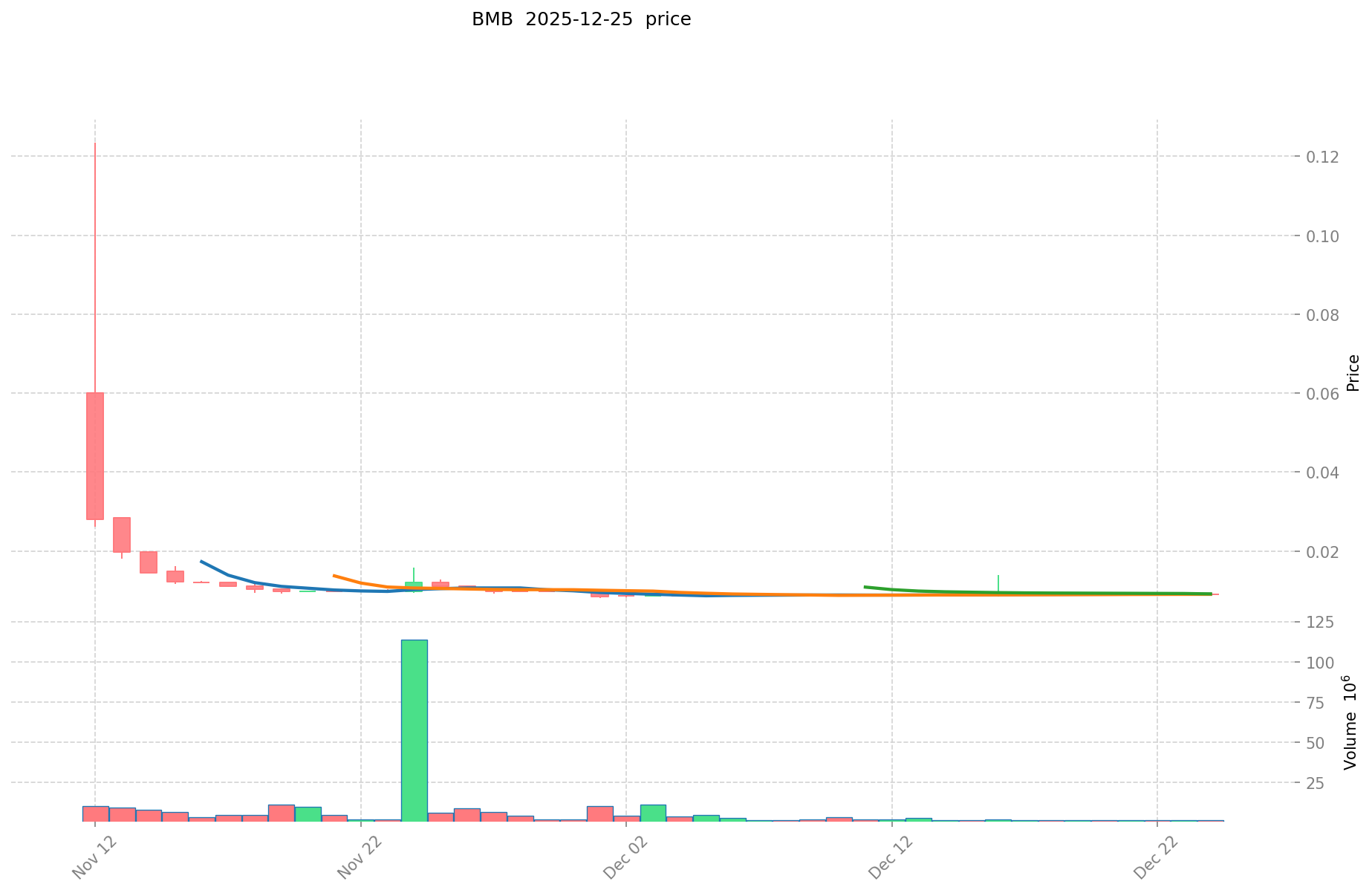

Based on available data as of December 25, 2025:

- November 12, 2025: All-Time High (ATH) reached at $0.12349, representing peak market valuation during the period.

- December 1, 2025: All-Time Low (ATL) recorded at $0.00801, marking the lowest point in the token's trading history.

- December 25, 2025: Current price at $0.009077, reflecting a recovery phase from recent lows.

BMB Current Market Status

BMB is currently trading at $0.009077 with a market capitalization of approximately $1.79 million and a fully diluted valuation of $9.08 million. The token demonstrates modest daily activity with 24-hour trading volume reaching $14,810.93.

Price Performance Metrics:

- 1-Hour Change: +0.03%

- 24-Hour Change: +0.11%

- 7-Day Change: +0.13%

- 30-Day Change: -22.02%

The token has experienced significant volatility over the 30-day period, declining approximately 22% from higher price levels. However, recent short-term indicators show marginal positive momentum across the 1-hour, 24-hour, and 7-day timeframes.

Market Composition:

- Circulating Supply: 196,666,441 BMB

- Total Supply: 1,000,000,000 BMB

- Circulating Supply Ratio: 19.67%

- Active Holders: 1,903

BMB maintains a market dominance of 0.00028%, reflecting its position as a relatively smaller-cap asset within the broader cryptocurrency ecosystem.

Access current BMB market price on Gate.com

BMB Market Sentiment Index

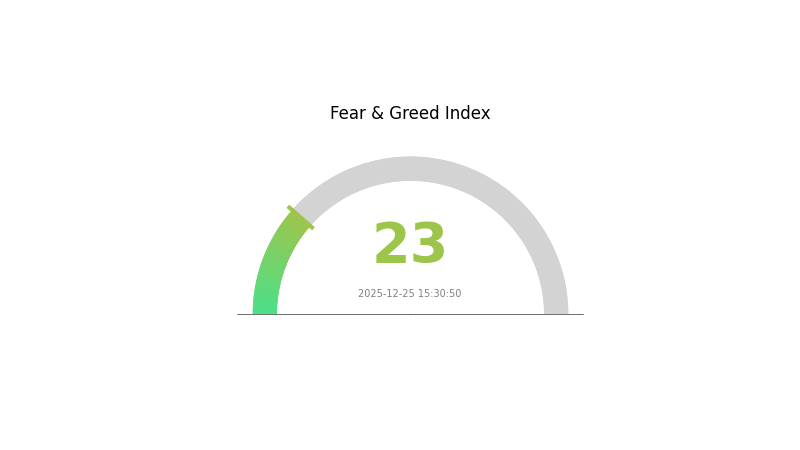

2025-12-25 Fear and Greed Index: 23 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear as the Fear and Greed Index hits 23. This severe sentiment reading indicates heightened market anxiety and pessimism among investors. During periods of extreme fear, assets are often oversold, creating potential buying opportunities for contrarian investors. However, caution remains essential as the market may continue its downward trajectory. Monitor key support levels and consider dollar-cost averaging strategies on Gate.com to manage risk effectively during this volatile period.

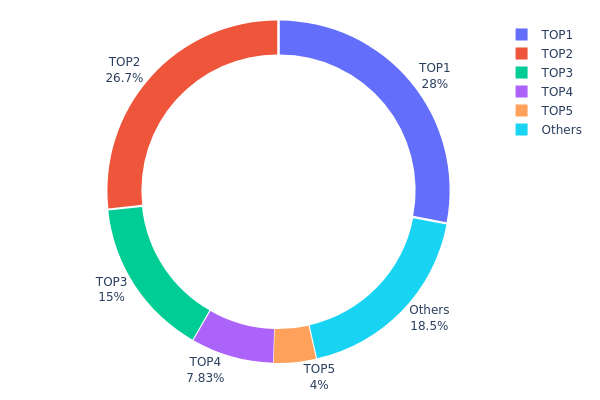

BMB Holdings Distribution

The address holdings distribution map represents the concentration of BMB tokens across on-chain addresses, revealing the degree of decentralization and potential market structure risks. By analyzing the top holders and their respective allocations, this metric provides critical insights into token distribution patterns, liquidity concentration, and governance dynamics within the BMB ecosystem.

Current analysis reveals a pronounced concentration in BMB's holder structure. The top five addresses collectively control 81.53% of total token supply, with the leading two addresses alone accounting for 54.70%. This distribution pattern indicates moderate-to-high centralization, as the largest holder commands 28.00% of circulating supply. While the remaining 18.47% distributed among other addresses provides some level of decentralization, the substantial concentration among top holders creates potential vulnerability to coordinated actions or strategic selling pressure.

The existing holder distribution architecture presents notable implications for market dynamics. High concentration among a limited number of addresses elevates the risk of significant price volatility in response to large-scale transactions, as substantial token movements from top holders could disproportionately impact market liquidity and sentiment. Additionally, the concentration pattern suggests relatively limited decentralization in decision-making power, which may influence the project's governance structure and long-term sustainability. Close monitoring of these major addresses remains essential for assessing potential market manipulation risks and understanding on-chain capital flow patterns.

Click to view current BMB holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | GkqBta...BbgPKH | 280000.00K | 28.00% |

| 2 | NzHcrC...C13LSr | 267000.00K | 26.70% |

| 3 | 7xQVXz...vXHixT | 150000.00K | 15.00% |

| 4 | 88Qish...kiHk8y | 78333.33K | 7.83% |

| 5 | 2cxoaT...FVsjEs | 40000.00K | 4.00% |

| - | Others | 184666.20K | 18.47% |

II. Core Factors Influencing BMB's Future Price

Technology Development and Ecosystem Building

-

Ecosystem Expansion: Increased adoption of Beamable infrastructure by more game developers, creating more use cases and network value.

-

Node Network Growth: Expansion of the distributed node operator network increases overall network utility and decentralization, strengthening the protocol's infrastructure.

-

Ecological Applications: BMB supports diverse applications including payment and transfers, NFT and digital art markets, sports and entertainment partnerships, and decentralized finance (DeFi) activities such as liquidity mining and lending.

Macro Economic Environment

-

Regulatory Development Impact: Global cryptocurrency regulatory policies remain uncertain. Stricter regulatory measures could negatively affect BMB's market performance, while clearer frameworks may provide stability and institutional adoption opportunities.

-

Market Sentiment and Conditions: BMB's price is influenced by overall market conditions, investor sentiment, and general cryptocurrency market trends. As an emerging digital asset, it remains more volatile compared to established cryptocurrencies.

Three、2025-2030 BMB Price Forecast

2025 Outlook

- Conservative Forecast: $0.00771-$0.00907

- Neutral Forecast: $0.00907-$0.01252

- Bullish Forecast: $0.01252 (requires market stability and sustained institutional interest)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Consolidation with gradual accumulation phase, characterized by modest recovery and network adoption expansion

- Price Range Forecast:

- 2026: $0.00755-$0.01306 (18% upside potential)

- 2027: $0.01049-$0.01264 (31% upside potential)

- 2028: $0.01130-$0.01376 (35% upside potential)

- Key Catalysts: Ecosystem development milestones, increased protocol utility, market cycle progression, and enhanced liquidity on platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case: $0.00977-$0.01914 (43% upside by 2029)

- Bullish Case: $0.01302-$0.01914 (assumes accelerated adoption and positive market sentiment)

- Transformative Case: $0.01608-$0.01897 (77% upside by 2030, requires breakthrough technological advancement and mainstream acceptance)

Key Observation: The forecast trajectory demonstrates potential growth from current levels, with 2030 presenting the most significant upside opportunity at $0.01897, contingent upon sustained ecosystem development and favorable macroeconomic conditions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01252 | 0.00907 | 0.00771 | 0 |

| 2026 | 0.01306 | 0.01079 | 0.00755 | 18 |

| 2027 | 0.01264 | 0.01193 | 0.01049 | 31 |

| 2028 | 0.01376 | 0.01228 | 0.0113 | 35 |

| 2029 | 0.01914 | 0.01302 | 0.00977 | 43 |

| 2030 | 0.01897 | 0.01608 | 0.00917 | 77 |

Beamable Network (BMB) Professional Investment Strategy and Risk Management Report

IV. BMB Professional Investment Strategy and Risk Management

BMB Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Infrastructure-focused investors, decentralized computing advocates, and long-term believers in the Web3 compute revolution

- Operational Recommendations:

- Accumulate BMB during market corrections, particularly when 30-day performance declines below -20%, as demonstrated by the current -22.02% monthly downturn

- Hold through network development cycles, capitalizing on BMB's direct tie to network activity and revenue sharing mechanisms

- Participate in staking programs to earn proportional rewards from protocol revenues generated by workloads

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Utilize the all-time high of $0.12349 (set on November 12, 2025) as resistance and the all-time low of $0.00801 (set on December 1, 2025) as support for swing trading opportunities

- Moving Average Analysis: Track 24-hour and 7-day price movements (currently +0.11% and +0.13% respectively) to identify short-term momentum shifts

- Range Trading Key Points:

- Monitor volatility between current trading price of $0.009077 and historical resistance levels

- Execute scalp trades during intraday volatility, as evidenced by the 1-hour price change of +0.03%

BMB Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-5% of crypto portfolio allocation

- Active Investors: 5-10% of crypto portfolio allocation

- Professional Investors: 10-15% of crypto portfolio allocation

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Implement systematic purchases over extended periods to reduce impact of price volatility, particularly relevant given the -22.02% monthly decline

- Position Sizing: Limit individual BMB positions to predetermined portfolio percentages to contain downside exposure

(3) Secure Storage Solutions

- Cold Storage Recommendation: Store significant BMB holdings on hardware wallets with multi-signature security protocols for maximum protection against cyber threats

- Hot Wallet Strategy: Utilize Gate.com Web3 Wallet for smaller trading amounts and active participation in staking mechanisms while maintaining convenience

- Security Precautions: Enable two-factor authentication on all exchange accounts, never share private keys, and regularly verify wallet addresses before transfers

V. BMB Potential Risks and Challenges

BMB Market Risks

- Price Volatility: BMB demonstrates substantial price fluctuations with a 30-day decline of -22.02%, indicating high volatility typical of early-stage infrastructure projects with limited liquidity across only 3 exchanges

- Low Liquidity: With 24-hour trading volume of $14,810.93 and circulation value of $1,785,141.28, the token faces liquidity constraints that could impact large order execution

- Market Adoption Uncertainty: Success depends on widespread adoption of Beamable Network's decentralized compute infrastructure by AI applications and enterprises

BMB Regulatory Risks

- Emerging Framework Ambiguity: Regulatory treatment of decentralized compute networks and tokenized infrastructure services remains unclear across major jurisdictions

- Jurisdiction-Specific Challenges: Potential restrictions on token trading or holding in certain regions could impact global market access

- Compliance Evolution: Changes in crypto-asset regulations could affect BMB's utility and trading accessibility

BMB Technical Risks

- Solana Network Dependency: BMB operates on the Solana blockchain, creating exposure to Solana's technical stability, consensus mechanism changes, and network congestion events

- Smart Contract Vulnerability: Protocol-level bugs or exploits in the on-chain revenue-sharing mechanisms could compromise network integrity and token value

- Scalability Requirements: Achieving billions of monthly API calls while maintaining security and cost efficiency presents ongoing technical challenges

VI. Conclusion and Action Recommendations

BMB Investment Value Assessment

Beamable Network presents a compelling thesis as a decentralized alternative to centralized cloud computing providers, with demonstrated traction of billions of monthly API calls and backing from established venture firms. The project addresses a $1 trillion addressable market opportunity. However, investors must recognize that BMB remains a nascent infrastructure token with significant execution risks, limited market liquidity, and volatility that has resulted in -22.02% monthly decline. The direct correlation between token value and network activity creates both opportunity and risk, as widespread adoption could drive substantial upside while slower adoption could pressure valuations.

BMB Investment Recommendations

✅ Beginners: Start with 2-5% portfolio allocation through small, regular purchases via Gate.com, focusing on understanding the project's technical fundamentals and use case before expanding positions.

✅ Experienced Investors: Consider 5-10% allocations with active participation in staking mechanisms, using technical support/resistance levels for disciplined entry and exit points, and maintaining hedging strategies for downside protection.

✅ Institutional Investors: Evaluate 10-15% allocations with participation in network governance, long-term staking commitments, and direct evaluation of enterprise adoption metrics within enterprise AI and infrastructure workload markets.

BMB Trading Participation Methods

- Spot Trading: Purchase BMB directly through Gate.com's spot markets for long-term accumulation or short-term trading opportunities

- Staking Programs: Participate in the network's revenue-sharing mechanism to earn proportional rewards from protocol income generated by workloads

- Liquidity Provision: Consider providing liquidity on available trading pairs to earn trading fees while supporting market stability

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make cautious decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will BNB reach $10,000?

Reaching $10,000 for BNB is highly improbable in the near future. It would require significant market expansion and adoption growth beyond current trends. While BNB has strong fundamentals, such extreme price levels remain unlikely.

What is the price prediction for BNB in 2030?

By 2030, BNB is predicted to reach approximately $1,424, assuming stable regulatory conditions. This forecast is speculative and based on current market trends and analysis.

Can BNB reach $5000?

Yes, BNB reaching $5,000 is possible in the long term. This would require Binance's continued growth, increased adoption, and favorable market conditions. While speculative, the potential exists given the platform's expansion and utility.

What is the BNB prediction for 2025?

Based on current market analysis, BNB is predicted to reach approximately €708.20 in 2025 under a neutral scenario. Even in bearish conditions, it may still reach €707.80, showing resilience in the market outlook.

Is Nosana (NOS) a good investment?: A Comprehensive Analysis of Market Potential, Tokenomics, and Future Prospects

2025 SHDW Price Prediction: Expert Analysis and Market Forecast for Shadow Token's Growth Potential

2025 RZTO Price Prediction: Expert Analysis and Market Forecast for Razortherapeutics Stock

Is Hivello (HVLO) a good investment?: Analyzing Market Performance, Risk Factors, and Future Potential for Crypto Investors

2025 HVLO Price Prediction: Expert Analysis and Market Forecast for Hivelocity Stock

How to convert SOL to USD: Real-time Solana price calculator

What are take-profit and stop-loss orders? Your automated solution for managing risk and securing profits

What Is Ethereum Staking? Your Guide to ETH Staking Rewards

When Was Dogecoin Created?

Midnight Airdrop Explained: Everything About the Glacier Drop

How to Participate in Polkadot Airdrop