2025 BOMEPrice Prediction: Navigating Market Trends and Investment Opportunities in a Volatile Economy

Introduction: BOME's Market Position and Investment Value

BOOK OF MEME (BOME), as a meme coin on the Solana Chain, has been making waves since its inception in 2024. As of 2025, BOME's market capitalization has reached $110,875,552, with a circulating supply of approximately 68,999,659,569 tokens, and a price hovering around $0.0016069. This asset, known as the "Doodle Master's Token," is playing an increasingly crucial role in the world of digital art and meme culture.

This article will comprehensively analyze BOME's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. BOME Price History Review and Current Market Status

BOME Historical Price Evolution

- 2024: Project launch, price surged to all-time high of $0.028312 on March 16

- 2025: Market correction, price dropped to all-time low of $0.00089 on April 7

- 2025: Gradual recovery, current price stabilized around $0.0016069

BOME Current Market Situation

As of September 26, 2025, BOME is trading at $0.0016069. The token has experienced a 2.5% decrease in the past 24 hours, with a trading volume of $2,626,365. BOME's market capitalization stands at $110,875,552, ranking it 415th in the cryptocurrency market. The token has seen significant volatility, with a 22.68% decline over the past week and a 19.78% drop in the last 30 days. The current price represents a 94.32% decrease from its all-time high and a 80.55% increase from its all-time low. The circulating supply of 68,999,659,569 BOME tokens is equal to its total and maximum supply, indicating no further token issuance is planned.

Click to view current BOME market price

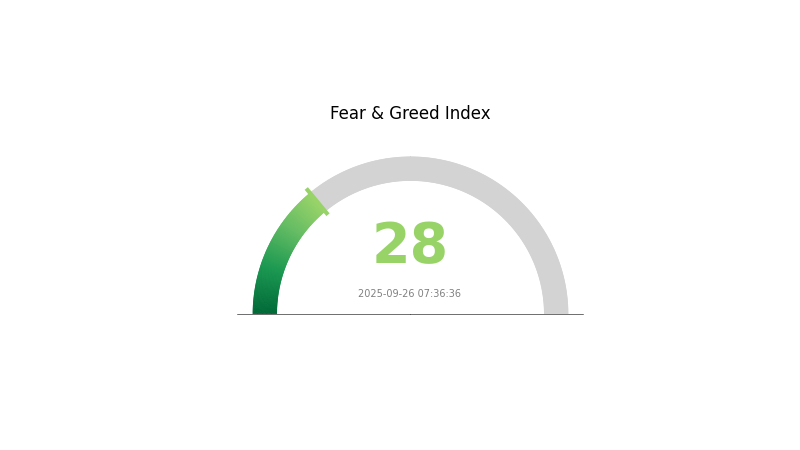

BOME Market Sentiment Indicator

2025-09-26 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 28, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. While fear can lead to further price drops, it often precedes market rebounds. Savvy traders might consider this an opportune moment to accumulate, adhering to the adage "be greedy when others are fearful." However, always conduct thorough research and manage risks carefully in this volatile market.

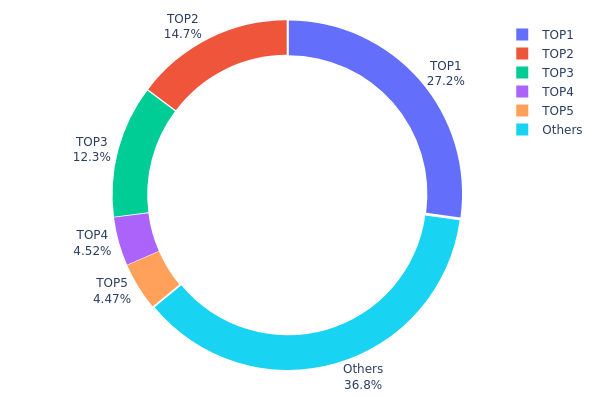

BOME Holdings Distribution

The address holdings distribution chart provides insight into the concentration of BOME tokens among different wallet addresses. Based on the data, we observe a significant concentration of BOME tokens among the top holders. The top address holds 27.16% of the total supply, while the top five addresses collectively control 63.16% of BOME tokens.

This high concentration raises concerns about potential market manipulation and volatility. With such a large portion of tokens held by a few addresses, any significant movement or selling pressure from these whales could have a substantial impact on BOME's price and market dynamics. Furthermore, this concentration suggests a relatively low level of decentralization, which may be a point of concern for investors seeking a more distributed token ecosystem.

However, it's worth noting that 36.84% of BOME tokens are held by addresses outside the top five, indicating some level of distribution among smaller holders. This distribution could provide some stability to the market structure, but the overall concentration remains a key factor to monitor for potential market risks and long-term sustainability of the BOME ecosystem.

Click to view the current BOME Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 3gd3dq...hCkW2u | 18722716.50K | 27.16% |

| 2 | 9WzDXw...YtAWWM | 10162887.35K | 14.74% |

| 3 | 5Q544f...pge4j1 | 8471006.99K | 12.29% |

| 4 | CBEADk...sebkVG | 3111594.03K | 4.51% |

| 5 | 5LZkAT...mtboT2 | 3077603.91K | 4.46% |

| - | Others | 25370254.56K | 36.84% |

II. Key Factors Influencing BOME's Future Price

Market Demand and Ecosystem Development

- Community Growth: The development of BOME's ecosystem will become a major factor influencing its price. A growing and engaged community can drive demand and price appreciation.

- Current Impact: BOME's price is heavily influenced by market sentiment and the project's ability to capitalize on emerging trends in the crypto space.

Institutional and Whale Dynamics

- Corporate Adoption: The adoption of BOME by well-known companies could significantly impact its price and mainstream acceptance.

Macroeconomic Environment

- Inflation Hedge Properties: BOME's performance in inflationary environments could affect its attractiveness as a potential hedge against economic uncertainties.

- Geopolitical Factors: International situations and conflicts may influence the overall crypto market, including BOME.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development of DApps and ecosystem projects built on or utilizing BOME could drive its utility and value.

III. BOME Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0011 - $0.00159

- Neutral prediction: $0.00159 - $0.00189

- Optimistic prediction: $0.00189 - $0.00218 (requires favorable market conditions)

2026-2028 Outlook

- Market stage expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.00162 - $0.0024

- 2027: $0.00189 - $0.0024

- 2028: $0.0015 - $0.00266

- Key catalysts: Increasing adoption, technological advancements, and market maturity

2029-2030 Long-term Outlook

- Base scenario: $0.00246 - $0.00294 (assuming steady market growth)

- Optimistic scenario: $0.00294 - $0.00342 (assuming strong bullish trends)

- Transformative scenario: $0.00342+ (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: BOME $0.00294 (potential year-end target)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00218 | 0.00159 | 0.0011 | 0 |

| 2026 | 0.0024 | 0.00189 | 0.00162 | 17 |

| 2027 | 0.0024 | 0.00214 | 0.00189 | 33 |

| 2028 | 0.00266 | 0.00227 | 0.0015 | 41 |

| 2029 | 0.00342 | 0.00246 | 0.002 | 53 |

| 2030 | 0.0033 | 0.00294 | 0.00183 | 83 |

IV. Professional Investment Strategies and Risk Management for BOME

BOME Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors interested in meme coins

- Operation suggestions:

- Allocate only a small portion of portfolio to BOME

- Dollar-cost average into positions over time

- Store tokens in a secure Solana-compatible wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short and long-term trends

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to limit downside risk

- Take profits at predetermined price targets

BOME Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 0-1% of crypto portfolio

- Moderate investors: 1-3% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance BOME with more established cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage option: Hardware wallet supporting Solana

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BOME

BOME Market Risks

- High volatility: Meme coins are subject to extreme price swings

- Limited utility: Lack of fundamental use case may impact long-term value

- Market sentiment: Heavily influenced by social media trends and hype

BOME Regulatory Risks

- Increased scrutiny: Regulators may target meme coins for investor protection

- Potential restrictions: Future regulations could limit trading or marketing

- Legal uncertainty: Unclear regulatory status in many jurisdictions

BOME Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Solana network issues: Dependent on Solana's performance and stability

- Limited development: Lack of active technical improvements or upgrades

VI. Conclusion and Action Recommendations

BOME Investment Value Assessment

BOME presents a high-risk, speculative investment opportunity within the meme coin sector. While it may offer short-term trading potential, its long-term value proposition remains uncertain due to limited utility and reliance on community enthusiasm.

BOME Investment Recommendations

✅ Beginners: Avoid or limit to a very small portion of portfolio (< 1%) ✅ Experienced investors: Consider for short-term trading with strict risk management ✅ Institutional investors: Approach with caution, suitable only for high-risk allocations

BOME Trading Participation Methods

- Spot trading: Available on Gate.com and other exchanges

- Limit orders: Use to enter positions at desired price levels

- DCA strategy: Gradually build positions to mitigate timing risk

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can bome coin reach $1?

While possible, it's unlikely BOME will reach $1 soon. Its current market position doesn't support such a projection.

Why is the bome coin falling?

BOME coin is falling due to fading hype after the December Trump Pump peak, reduced market interest, and increased competition in the meme coin space.

What is the purpose of BOME coin?

BOME coin aims to facilitate fast, secure peer-to-peer transactions and serve as a decentralized digital currency, offering an alternative to traditional financial systems.

How much is the Bome coin worth?

As of September 2025, the Bome coin is worth approximately $0.0017 USD. This price reflects current market conditions and may change rapidly.

2025 POPCAT Price Prediction: Exploring Future Market Trends and Investment Potential in the Digital Feline Economy

2025 PNUT Price Prediction: Navigating Growth Potential and Market Dynamics in the Evolving Digital Asset Landscape

2025 MYRO Price Prediction: Evaluating Growth Potential and Market Trends in the Evolving Cryptocurrency Landscape

Is XAI gork (GORK) a good investment?: Analyzing the Potential and Risks of GORK Tokens in the Explainable AI Market

2025 PUNDU Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is dogwifhat (WIF) a good investment?: Evaluating the potential and risks of the latest meme coin craze

Has Bitcoin's 2025 Bull Run Restarted?

Dogecoin Faucet

Why Strategy (MSTR) Stock Rallies Upto 5% After MSCI Index Decision

Grayscale Pays First Ethereum Staking Rewards to U.S. ETF Investors

Bitcoin Circuit