2025 BSV Price Prediction: Bullish Outlook as Adoption and Scalability Drive Growth

Introduction: BSV's Market Position and Investment Value

Bitcoin SV (BSV), as a cryptocurrency aiming to fulfill the original vision of Bitcoin, has made significant strides since its inception in 2018. As of 2025, BSV's market capitalization has reached $433,172,542, with a circulating supply of approximately 19,934,309 coins, and a price hovering around $21.73. This asset, often referred to as "Satoshi's Vision," is playing an increasingly crucial role in enterprise-level blockchain applications and as a peer-to-peer electronic cash system.

This article will comprehensively analyze BSV's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. BSV Price History Review and Current Market Status

BSV Historical Price Evolution

- 2018: BSV emerged from a hard fork of Bitcoin Cash, initial price volatility

- 2021: Reached all-time high of $489.75 on April 17, 2021

- 2025: Experienced significant decline, price dropped to all-time low of $18.95 on October 11, 2025

BSV Current Market Situation

As of October 17, 2025, Bitcoin SV (BSV) is trading at $21.73, showing a 1.35% decrease in the last 24 hours. The cryptocurrency is currently ranked 173rd by market capitalization, with a total market cap of $433,174,579. BSV's 24-hour trading volume stands at $453,020, indicating moderate market activity.

The current price represents a significant drop from its all-time high, with BSV down 95.56% from its peak. The market sentiment appears bearish, as evidenced by the negative price trends across various timeframes. Over the past week, BSV has declined by 13.43%, while the 30-day and 1-year changes show losses of 16.36% and 56.84%, respectively.

BSV's circulating supply is 19,934,309 BSV, which is 94.93% of its maximum supply of 21,000,000 BSV. The fully diluted market cap is $456,330,000, suggesting limited room for supply expansion.

Click to view the current BSV market price

BSV Market Sentiment Indicator

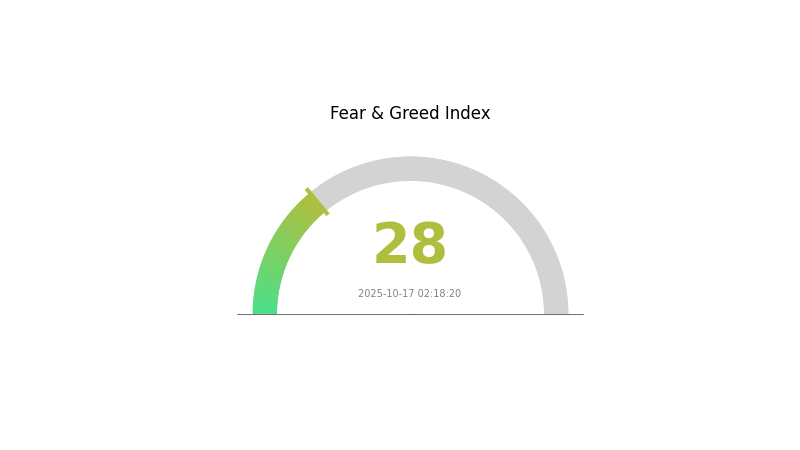

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, as indicated by the Fear and Greed Index reading of 28. This suggests that investors are cautious and potentially pessimistic about the short-term prospects of BSV and the broader crypto market. During such times, some traders view it as an opportunity to "buy the dip," while others remain wary of further downside. It's crucial for investors to conduct thorough research and consider their risk tolerance before making any investment decisions in this uncertain climate.

BSV Holdings Distribution

The address holdings distribution data for BSV reveals an interesting pattern in the cryptocurrency's ownership structure. This metric provides insight into the concentration of BSV holdings across different addresses on the blockchain.

Based on the provided data, it appears that the BSV network currently exhibits a relatively decentralized distribution of tokens. The absence of any single address holding a significant percentage of the total supply suggests that the risk of market manipulation by large individual holders, often referred to as "whales," is potentially lower than in some other cryptocurrencies. This distribution pattern may contribute to a more stable market structure and potentially reduce the likelihood of sudden, large-scale price movements triggered by the actions of a few major holders.

However, it's important to note that this snapshot of address holdings does not necessarily reflect the true distribution of ownership, as individuals or entities may control multiple addresses. Nonetheless, the current distribution suggests a healthier ecosystem in terms of decentralization and may indicate a more robust on-chain structure for BSV.

Click to view the current BSV Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing BSV's Future Price

Supply Mechanism

- Historical Patterns: Past supply changes have shown significant impact on BSV's price, with halving events often leading to increased scarcity and potential price appreciation.

- Current Impact: The recent halving event is expected to reduce the rate of new BSV entering the market, potentially creating upward pressure on price if demand remains constant or increases.

Institutional and Whale Dynamics

- National Policies: Regulatory clarity in various countries regarding cryptocurrencies will play a crucial role in BSV's adoption and price movement.

Macroeconomic Environment

- Inflation Hedging Properties: BSV's performance in inflationary environments will be closely watched, as some investors view cryptocurrencies as potential hedges against fiat currency devaluation.

- Geopolitical Factors: International tensions and economic uncertainties may influence investors' appetite for alternative assets like BSV.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development of DApps and other ecosystem projects on the BSV blockchain will be crucial for its long-term value proposition and adoption.

III. BSV Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $11.92 - $15.00

- Neutral prediction: $21.68 - $25.00

- Optimistic prediction: $28.00 - $32.09 (requires significant adoption in enterprise blockchain solutions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased institutional interest

- Price range forecast:

- 2027: $28.23 - $39.02

- 2028: $21.22 - $43.51

- Key catalysts: Improved scalability, integration with IoT devices, and regulatory clarity

2030 Long-term Outlook

- Base case scenario: $45.35 - $50.00 (assuming steady growth in real-world applications)

- Optimistic scenario: $50.00 - $58.51 (assuming widespread adoption in big data management)

- Transformative scenario: $60.00 - $70.00 (assuming BSV becomes a leading platform for enterprise blockchain solutions)

- 2030-12-31: BSV $58.51 (potential peak if market conditions remain favorable)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 32.0864 | 21.68 | 11.924 | 0 |

| 2026 | 36.56115 | 26.8832 | 13.97926 | 23 |

| 2027 | 39.01828 | 31.72218 | 28.23274 | 45 |

| 2028 | 43.50538 | 35.37023 | 21.22214 | 62 |

| 2029 | 51.26914 | 39.4378 | 20.50766 | 81 |

| 2030 | 58.50598 | 45.35347 | 34.92217 | 108 |

IV. BSV Professional Investment Strategies and Risk Management

BSV Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Value investors and believers in BSV's long-term potential

- Operational advice:

- Accumulate BSV during market dips

- Set a fixed percentage of portfolio for BSV

- Store in secure cold wallets for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Helps in identifying overbought or oversold conditions

- Key points for swing trading:

- Monitor BSV's correlation with broader crypto market trends

- Set strict stop-loss orders to manage downside risk

BSV Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-7% of crypto portfolio

- Aggressive investors: 7-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallets for long-term, offline storage

- Security precautions: Always verify transactions, use two-factor authentication, and keep private keys secure

V. Potential Risks and Challenges for BSV

BSV Market Risks

- High volatility: BSV price can experience significant fluctuations

- Limited adoption: Compared to other major cryptocurrencies, BSV has lower market acceptance

- Competition: Faces strong competition from other Bitcoin forks and cryptocurrencies

BSV Regulatory Risks

- Uncertain regulatory environment: Cryptocurrencies face evolving regulatory landscapes globally

- Potential restrictions: Some countries may impose limitations on BSV trading or usage

- Legal challenges: Ongoing disputes within the BSV community could impact its legal standing

BSV Technical Risks

- Scalability concerns: Despite claims of high scalability, real-world stress tests are limited

- Network security: As a minority fork, BSV may be more vulnerable to 51% attacks

- Development centralization: Heavy influence from a small group of developers could impact decentralization

VI. Conclusion and Action Recommendations

BSV Investment Value Assessment

BSV presents a high-risk, potentially high-reward investment. Its long-term value proposition lies in its aim to fulfill the original Bitcoin vision, but it faces significant short-term risks due to market volatility, regulatory uncertainties, and technical challenges.

BSV Investment Recommendations

✅ Beginners: Consider small, experimental positions after thorough research ✅ Experienced investors: Implement strict risk management and consider BSV as part of a diversified crypto portfolio ✅ Institutional investors: Conduct comprehensive due diligence and consider BSV for speculative allocations

BSV Trading Participation Methods

- Spot trading: Buy and sell BSV on Gate.com's spot market

- Futures trading: Engage in BSV futures contracts on Gate.com for leveraged exposure

- Staking: Participate in BSV Staking programs if available on Gate.com for passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high can BSV go?

BSV could reach $28.52 by the end of 2025, with potential for further growth in the long term. However, exact future prices remain uncertain.

What is the price prediction for Bitcoin SV in 2040?

Based on current trends, Bitcoin SV is predicted to reach between $1,222 and $3,291 by 2040.

Is BSV better than BTC?

BSV aims for enterprise-grade blockchain, while BTC prioritizes decentralization. Neither is objectively better; it depends on specific use cases.

What is happening with BSV?

BSV faces ongoing challenges. Binance threatens delisting due to Craig Wright's claims, while Coinbase removed it in 2021. Despite controversies, BSV continues to operate in the crypto market.

Share

Content