2025 CCD Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: CCD's Market Position and Investment Value

Concordium (CCD), as a pioneering proof-of-stake blockchain with integrated self-sovereign identity, has achieved significant milestones since its inception in 2021. As of 2025, Concordium's market capitalization has reached $207,196,227, with a circulating supply of approximately 11,705,340,208 CCD, and a price hovering around $0.017701. This asset, often referred to as the "regulatory-compliant blockchain," is playing an increasingly crucial role in unlocking business transactions through blockchain technology.

This article will provide a comprehensive analysis of Concordium's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment, offering professional price predictions and practical investment strategies for investors.

I. CCD Price History Review and Current Market Status

CCD Historical Price Evolution Trajectory

- 2024: Project launch, price reached a low of $0.0015

- 2025: Market recovery, price surged to an all-time high of $0.025

CCD Current Market Situation

As of October 18, 2025, CCD is trading at $0.017701, with a market capitalization of $207,196,227. The token has experienced significant volatility in recent periods:

- 1-hour change: +0.069%

- 24-hour change: -4.68%

- 7-day change: +54.73%

- 30-day change: +87.96%

- 1-year change: +387.86%

CCD's current price represents a 29.2% decrease from its all-time high of $0.025 set on September 25, 2025. However, it's still up 1080% from its all-time low of $0.0015 recorded on June 14, 2024.

The token's 24-hour trading volume stands at $144,842.54, indicating moderate market activity. CCD's circulating supply is 11,705,340,208 tokens, which is 89.39% of its total supply of 13,094,191,218 tokens.

Click to view the current CCD market price

CCD Market Sentiment Indicator

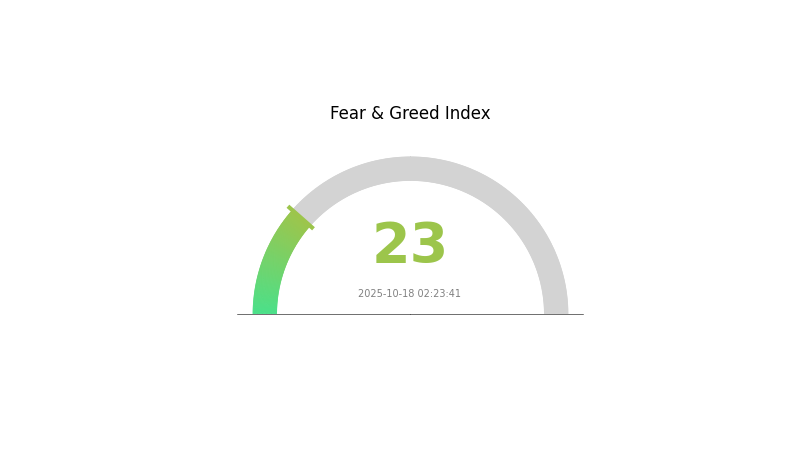

2025-10-18 Fear and Greed Index: 23 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 23. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Seasoned traders might consider dollar-cost averaging strategies to mitigate risks. Remember, market cycles are natural, and extreme fear doesn't last forever. Stay informed, manage your risk, and consider your long-term investment goals before making any decisions.

CCD Holdings Distribution

The address holdings distribution data for CCD reveals a highly decentralized ownership structure. With no individual addresses holding significant percentages of the total supply, the concentration risk appears minimal. This distribution pattern suggests a diverse and widespread ownership base, which is generally considered a positive indicator for the project's decentralization efforts.

The absence of large holders, often referred to as "whales," reduces the likelihood of market manipulation through sudden large-scale sell-offs or accumulations. This evenly distributed ownership structure may contribute to more stable price movements and reduced volatility in the CCD market. Furthermore, it potentially enhances the network's resilience against coordinated actions that could adversely affect smaller stakeholders.

Overall, the current address distribution of CCD reflects a healthy market structure with a high degree of decentralization. This characteristic not only aligns with blockchain ethos but also suggests a robust on-chain stability, which could be attractive to long-term investors and supporters of decentralized ecosystems.

Click to view the current CCD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing CCD's Future Price

Supply Mechanism

- Inflationary Model: CCD follows an inflationary supply model with no maximum cap.

- Historical Pattern: The increasing supply has historically put downward pressure on the price.

- Current Impact: The continuous issuance of new tokens is expected to maintain a moderate inflationary effect on CCD's price.

Technological Development and Ecosystem Building

- Concordium Blockchain: CCD is the native token of the Concordium blockchain, which focuses on providing a regulatory-compliant platform for decentralized applications.

- Ecosystem Applications: The Concordium ecosystem supports various DApps and projects, particularly those requiring identity verification and regulatory compliance.

III. CCD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01654 - $0.01779

- Neutral prediction: $0.01779 - $0.02000

- Optimistic prediction: $0.02000 - $0.02401 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.01851 - $0.02605

- 2028: $0.02142 - $0.02747

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.02686 - $0.03000 (assuming steady market growth)

- Optimistic scenario: $0.03000 - $0.03438 (assuming strong market performance)

- Transformative scenario: $0.03438 - $0.04000 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: CCD $0.03438 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02401 | 0.01779 | 0.01654 | 0 |

| 2026 | 0.0278 | 0.0209 | 0.01484 | 18 |

| 2027 | 0.02605 | 0.02435 | 0.01851 | 37 |

| 2028 | 0.02747 | 0.0252 | 0.02142 | 42 |

| 2029 | 0.02739 | 0.02634 | 0.01422 | 48 |

| 2030 | 0.03438 | 0.02686 | 0.01558 | 51 |

IV. CCD Professional Investment Strategies and Risk Management

CCD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Concordium's technology

- Operational suggestions:

- Accumulate CCD during market dips

- Stake CCD to earn passive income

- Store in a secure hardware wallet or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps in identifying overbought or oversold conditions

- Key points for swing trading:

- Monitor regulatory news closely

- Set stop-loss orders to manage downside risk

CCD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for CCD

CCD Market Risks

- Volatility: High price fluctuations common in cryptocurrency markets

- Competition: Other identity-focused blockchain projects may gain market share

- Liquidity: Limited trading pairs and exchanges may affect liquidity

CCD Regulatory Risks

- Regulatory scrutiny: Increased focus on identity solutions may lead to regulatory challenges

- Compliance costs: Adhering to evolving regulations may increase operational costs

- Cross-border issues: Differing regulatory approaches across jurisdictions

CCD Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the blockchain's code

- Scalability challenges: Possible network congestion as adoption increases

- Interoperability issues: Challenges in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

CCD Investment Value Assessment

Concordium (CCD) presents a unique value proposition with its focus on regulatory compliance and identity solutions. While it offers long-term potential in enterprise adoption, short-term volatility and regulatory uncertainties pose significant risks.

CCD Investment Recommendations

✅ Newcomers: Start with small, regular investments to understand the market dynamics ✅ Experienced investors: Consider a moderate allocation, focusing on long-term potential ✅ Institutional investors: Explore partnerships and use cases within regulatory frameworks

CCD Participation Methods

- Direct purchase: Buy CCD on Gate.com

- Staking: Participate in Concordium's proof-of-stake network for passive income

- Project involvement: Engage with the Concordium ecosystem through development or governance

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can cro coin reach $5?

While ambitious, CRO reaching $5 is possible in the long term with strong adoption, market growth, and ecosystem expansion. However, it would require significant market cap increase and broader crypto market bullishness.

What is the future of Concordium coin?

Concordium coin has a promising future with potential for significant growth. Its focus on regulatory compliance and identity solutions may drive adoption in enterprise and government sectors, potentially increasing its value and market position by 2025.

Does Orchid Coin have a future?

Yes, Orchid Coin has a promising future. Its innovative privacy-focused VPN technology and growing user base suggest potential for long-term growth and adoption in the decentralized internet space.

What will crypto be worth in 2025?

Crypto market cap could reach $5 trillion by 2025, with Bitcoin potentially hitting $100,000 and Ethereum $10,000. Altcoins may see significant growth too.

Share

Content