2025 CHZ Price Prediction: Analyzing Market Trends and Growth Potential for Chiliz in the Sports Fan Token Ecosystem

Introduction: CHZ's Market Position and Investment Value

Chiliz (CHZ), as a unique token powering fan engagement in sports and e-sports, has made significant strides since its inception in 2018. As of 2025, Chiliz has achieved a market capitalization of $419,219,690, with a circulating supply of approximately 9,995,700,774 tokens, and a price hovering around $0.04194. This asset, often referred to as the "fan token pioneer," is playing an increasingly crucial role in revolutionizing fan participation and engagement in the sports and e-sports industries.

This article will provide a comprehensive analysis of Chiliz's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. CHZ Price History Review and Current Market Status

CHZ Historical Price Evolution

- 2019: Initial launch, price started at $0.00410887 (ATL)

- 2021: Bull market peak, price reached $0.878633 (ATH) on March 13

- 2022-2023: Market downturn, price declined significantly from ATH

CHZ Current Market Situation

As of September 20, 2025, CHZ is trading at $0.04194, ranking 196th in the cryptocurrency market. The token has experienced a slight decline of 1.03% in the past 24 hours, with a trading volume of $273,471.49. CHZ's market capitalization stands at $419,219,690, representing a 0.0097% share of the total crypto market.

In terms of recent price trends, CHZ has shown mixed performance across different time frames. While it has seen a 5.09% increase over the past 30 days, it has experienced declines of 4.56% in the last 7 days and 24.5% over the past year. The current price remains significantly below its all-time high, indicating potential for recovery but also reflecting the overall market conditions.

The token's circulating supply equals its total supply of 9,995,700,774 CHZ, with no maximum supply limit set. This suggests that the project has fully distributed its tokens, which could impact future price dynamics based on supply and demand factors.

Click to view the current CHZ market price

CHZ Market Sentiment Indicator

2025-09-20 Fear and Greed Index: 48 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment for CHZ remains neutral, with the Fear and Greed Index at 48. This balanced state suggests investors are neither overly pessimistic nor excessively optimistic. It's a prime opportunity for traders to reassess their strategies and conduct thorough market analysis. While the neutral sentiment indicates stability, it's crucial to stay vigilant and monitor potential catalysts that could swing the market in either direction. As always, diversification and risk management are key in navigating the crypto landscape.

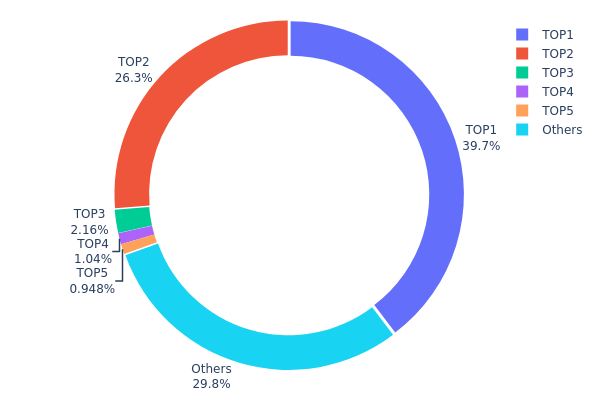

CHZ Holdings Distribution

The address holdings distribution data for CHZ reveals a highly concentrated ownership structure. The top two addresses collectively hold 66.01% of the total supply, with the largest address controlling 39.68% and the second-largest holding 26.33%. This extreme concentration raises concerns about potential market manipulation and volatility.

The top five addresses combined account for 70.14% of CHZ holdings, leaving only 29.86% distributed among other addresses. This skewed distribution indicates a low level of decentralization, which could impact market stability and price movements. Such a concentrated ownership structure may lead to increased volatility, as large holders have the potential to significantly influence market dynamics through their trading activities.

This high concentration of CHZ holdings suggests that the token's on-chain structure is currently unstable and potentially vulnerable to sudden shifts in market sentiment or large-scale sell-offs. Investors should be aware of the risks associated with such a concentrated distribution, as it may impact liquidity and overall market health.

Click to view the current CHZ Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcd38...340bf2 | 3527826.71K | 39.68% |

| 2 | 0x2f1d...12d580 | 2340986.81K | 26.33% |

| 3 | 0x76ec...78fbd3 | 191938.20K | 2.15% |

| 4 | 0x611f...dfb09d | 92456.26K | 1.04% |

| 5 | 0xf977...41acec | 84248.90K | 0.94% |

| - | Others | 2651432.02K | 29.86% |

II. Key Factors Influencing CHZ's Future Price

Supply Mechanism

- Maximum Supply: CHZ has a maximum supply of approximately 8.88 billion tokens.

- Current Impact: The limited token supply could potentially support long-term value appreciation.

Institutional and Whale Dynamics

- Corporate Adoption: Notable sports clubs and entertainment companies have issued fan tokens using the Chiliz platform.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, CHZ may be viewed as a potential hedge against inflation in certain economic conditions.

Technological Development and Ecosystem Building

- Socios.com Platform: The continued development and adoption of the Socios.com platform, which uses CHZ as its native token, is crucial for CHZ's value proposition.

- Ecosystem Applications: Fan tokens for various sports teams and entertainment entities represent the primary use case within the Chiliz ecosystem.

III. CHZ Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.03359 - $0.03999

- Neutral forecast: $0.04000 - $0.04499

- Optimistic forecast: $0.04500 - $0.04997 (requires significant adoption of CHZ in sports fan engagement platforms)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range prediction:

- 2027: $0.03775 - $0.07277

- 2028: $0.05609 - $0.08095

- Key catalysts: Expansion of CHZ ecosystem, partnerships with major sports franchises

2029-2030 Long-term Outlook

- Base scenario: $0.07235 - $0.08609 (assuming steady growth in sports tokenization)

- Optimistic scenario: $0.08610 - $0.09643 (with widespread adoption in sports and entertainment industries)

- Transformative scenario: $0.09644 - $0.09984 (revolutionary integration of CHZ in global sports ecosystems)

- 2030-12-31: CHZ $0.08609 (105% increase from 2025, indicating strong long-term growth potential)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04997 | 0.04199 | 0.03359 | 0 |

| 2026 | 0.06345 | 0.04598 | 0.03402 | 9 |

| 2027 | 0.07277 | 0.05472 | 0.03775 | 30 |

| 2028 | 0.08095 | 0.06374 | 0.05609 | 52 |

| 2029 | 0.09984 | 0.07235 | 0.06511 | 72 |

| 2030 | 0.09643 | 0.08609 | 0.07318 | 105 |

IV. CHZ Professional Investment Strategies and Risk Management

CHZ Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and sports/esports enthusiasts

- Operation suggestions:

- Accumulate CHZ during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store in a secure hardware wallet or reputable custodial service

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

CHZ Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-8% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage option: Paper wallet for long-term hodling

- Security precautions: Enable 2FA, use strong passwords, and regularly update software

V. Potential Risks and Challenges for CHZ

CHZ Market Risks

- Volatility: Crypto market fluctuations can lead to significant price swings

- Competition: Other fan token platforms may emerge and capture market share

- Adoption: Slow uptake by sports teams and leagues could hinder growth

CHZ Regulatory Risks

- Uncertain regulations: Changes in crypto regulations could impact CHZ's operations

- Cross-border compliance: Navigating different regulatory environments in various countries

- Fan token classification: Potential legal challenges regarding the nature of fan tokens

CHZ Technical Risks

- Smart contract vulnerabilities: Potential exploits in the underlying technology

- Scalability issues: Challenges in handling increased network activity

- Blockchain interoperability: Difficulties in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

CHZ Investment Value Assessment

CHZ presents a unique value proposition in the sports and esports fan engagement sector. While it offers long-term potential for growth, short-term volatility and regulatory uncertainties pose significant risks.

CHZ Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about the project

✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading

✅ Institutional investors: Conduct thorough due diligence and consider CHZ as part of a diversified crypto portfolio

CHZ Trading Participation Methods

- Spot trading: Buy and sell CHZ on Gate.com's spot market

- Fan token offerings: Participate in new fan token launches on the Socios platform

- Staking: Explore staking options to earn passive income on CHZ holdings

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does Chiliz Coin have a future?

Yes, Chiliz (CHZ) has a promising future. With a projected price of $0.04199 by 2030, its long-term forecast is positive. Market trends and user adoption will likely drive its future performance.

Can Chiliz reach $10 dollars?

While reaching $10 is ambitious, Chiliz has long-term potential. Market growth and increased adoption in sports and entertainment could drive significant price appreciation over time.

What is the price of Chiliz in 2025?

Based on market analysis, Chiliz is expected to trade at an average price of $0.0431 in September 2025, with a range between $0.0429 and $0.0433.

How high can Chiliz go?

Chiliz could potentially reach $3.51 by 2025, with an average price projection of $2.77, based on favorable market conditions and growth in the sports fan token sector.

OKB vs HBAR: Comparing Two Crypto Assets for Long-Term Investment Potential

How Does TXC Manage Token Holdings and Liquidity Flow in 2025?

INTER vs XLM: Comparing Two Giants in the World of Cryptocurrency Exchanges

DRGN vs BAT: The Battle for Dominance in the Crypto Gaming Industry

How Can On-Chain Data Analysis Predict Litecoin's Price Movements in 2025?

GME vs VET: Comparing the Investment Potential of GameStop and VeChain in the Volatile Crypto Market

What is Fundamental Analysis for Crypto Projects: Whitepaper, Team, and Roadmap Guide?

How Does MELANIA Coin Price Volatility Compare to BTC and ETH in 2025-2026?

What is Just a Chill Guy (CHILLGUY)? Complete Guide to the Viral Meme Coin

How Has GUN Crypto Price Volatility Changed in 2025: From $0.12845 Peak to Current Levels?

Dropee Question of the Day and Daily Combo Guide