2025 CORE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: CORE'un Piyasadaki Konumu ve Yatırım Değeri

Core DAO (CORE), EVM uyumlu bir L1 blokzinciri olarak kurulduğu günden bu yana önemli gelişmeler kaydetmiştir. 2025 yılı itibarıyla CORE'un piyasa değeri 244.127.970 $’a ulaşmış, dolaşımdaki arz yaklaşık 1.014.663.220 token seviyesinde, fiyatı ise 0,2406 $ civarındadır. "Satoshi Plus konsensüs mekanizması" ile tanınan bu varlık, EVM zincirlerinin esnekliğini Bitcoin’in merkeziyetsizliği ve güvenliğiyle birleştirerek giderek daha önemli bir konuma yerleşmektedir.

Bu makale, CORE’un 2025-2030 dönemindeki fiyat hareketlerini; tarihsel eğilimler, piyasa arz-talep dinamikleri, ekosistem gelişimi ve makroekonomik faktörler üzerinden kapsamlı şekilde inceleyecek, yatırımcılara profesyonel fiyat tahminleri ve uygulamaya dönük yatırım stratejileri sunacaktır.

I. CORE Fiyat Geçmişi ve Güncel Piyasa Durumu

CORE Tarihsel Fiyat Değişim Süreci

- 2023: CORE, 8 Şubat’ta 14,48 $ ile tüm zamanların en yüksek seviyesini görerek fiyat geçmişinde önemli bir kilometre taşına ulaştı.

- 2024: Kripto para piyasası ayı dönemine girerken CORE fiyatı kademeli olarak geriledi.

- 2025: CORE, 10 Ekim’de 0,1069 $ ile en düşük seviyesine inerek sert bir piyasa düşüşünü yansıttı.

CORE Güncel Piyasa Durumu

18 Ekim 2025 tarihi itibarıyla CORE, 0,2406 $ seviyesinden işlem görüyor ve yakın dönemdeki dip seviyesinden hafif bir toparlanma gösteriyor. Token, son 24 saatte %0,7 artışla küçük bir olumlu ivme yakaladı. Ancak uzun vadeli trend hâlâ negatif; son 30 günde %47,61, son bir yılda ise %74,14 oranında değer kaybetti.

CORE’un güncel piyasa değeri 244.127.970,75 $ olup tüm kripto paralar arasında 247. sırada yer alıyor. 24 saatlik işlem hacmi ise 1.021.928,56 $ olarak gerçekleşti ve bu orta düzeyde piyasa aktivitesine işaret ediyor. Dolaşımdaki 1.014.663.220 CORE token, toplam arzın (2.100.000.000) %48,32’sini oluşturuyor; bu da arzın genişleme potansiyelinin sürdüğünü gösteriyor.

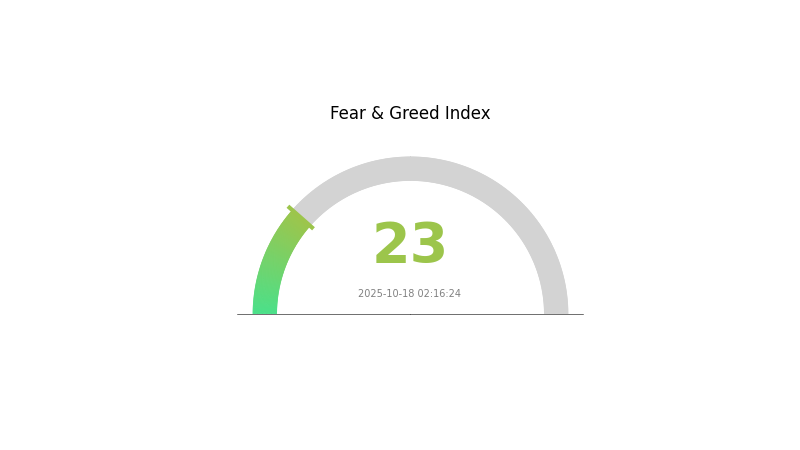

Şu anda kripto piyasasında "Aşırı Korku" hakim ve VIX endeksi 23 seviyesinde bulunuyor. Bu durum, CORE ve diğer dijital varlıklar üzerinde devam eden ayı eğilimine katkı sağlıyor olabilir.

Güncel CORE piyasa fiyatını görüntülemek için tıklayın

CORE Piyasa Duyarlılığı Göstergesi

18 Ekim 2025 Korku ve Açgözlülük Endeksi: 23 (Aşırı Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda aşırı korku hakim; duyarlılık endeksi 23 seviyesinde. Bu, yatırımcılar arasında belirgin bir kötümserliğe işaret ediyor ve zıt stratejiyle hareket edenler için alım fırsatı yaratabilir. Ancak aşırı korku, ek fiyat düşüşleri riskini de taşıyor. Yatırımcılar risk toleransını dikkatle değerlendirmeli, portföylerini çeşitlendirmeli. Her zaman olduğu gibi, detaylı araştırma ve temkinli kararlar bu belirsiz piyasa koşullarında kritik önem taşır.

CORE Varlık Dağılımı

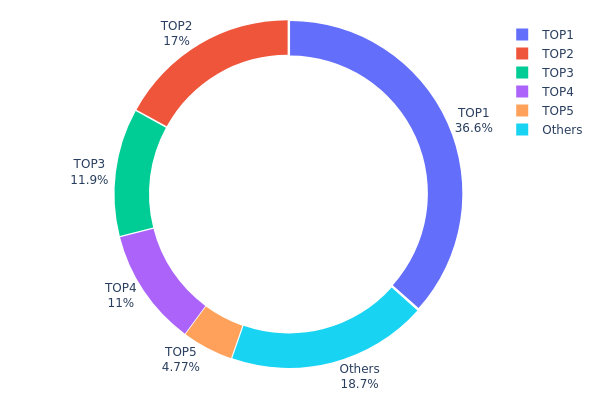

CORE’un adres bazlı varlık dağılımı, son derece yoğunlaşmış bir sahiplik yapısını ortaya koyuyor. En büyük beş adres, toplam arzın %79,86’sını elinde tutuyor ve en büyük adres tek başına %35,97’lik bir hakimiyet sağlıyor. Bu yoğunlaşma, token dağılımında ciddi bir dengesizliği gösteriyor.

Böyle bir dağılım, piyasa kırılganlığı ve olası fiyat manipülasyonu açısından endişe yaratıyor. Tokenlerin %80’e yakın kısmının yalnızca beş adreste bulunması, bu büyük sahiplerin piyasa üzerindeki her hareketinin CORE dinamiklerini ciddi şekilde etkileyebileceği anlamına geliyor. Yüksek yoğunlaşma, merkeziyetsizlik seviyesinin düşük olmasına da işaret ediyor ve pek çok blokzincir projesinin temel prensipleriyle çelişebiliyor.

Ayrıca, bu dağılım modeli CORE fiyatında oynaklığı artırabilir. Büyük sahipler piyasa üzerinde kayda değer bir etki yaratabilir, likiditeyi ve fiyat istikrarını belirleyebilir. Bu güç yoğunlaşması, projenin yönetişim yapısı ve karar alma süreçleriyle ilgili soru işaretleri doğurur; bu da yatırımcı güvenini ve sürdürülebilirliğini etkileyebilir.

Güncel CORE Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x0000...001000 | 755.471,86K | 35,97% |

| 2 | 0x8605...f94f52 | 351.500,00K | 16,74% |

| 3 | 0x0000...001011 | 245.786,48K | 11,70% |

| 4 | 0x3073...e21838 | 226.000,00K | 10,76% |

| 5 | 0x4037...a2404f | 98.399,38K | 4,69% |

| - | Diğer | 386.604,47K | 20,14% |

II. CORE’un Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Makroekonomik Ortam

- Enflasyona Karşı Koruma Potansiyeli: CORE, kripto para olarak bazı ekonomik koşullarda enflasyona karşı koruma sağlayabilir. Ancak bu etkinlik, çeşitli faktörlere ve piyasa koşullarına bağlıdır.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: CORE platformunda çeşitli merkeziyetsiz uygulamalar (DApp) ve ekosistem projeleri yer alabilir; bunlar varlığın genel değeri ve faydasını artırabilir. Bu uygulamaların ayrıntıları ayrıca incelenmelidir.

III. CORE 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,13222 $ - 0,2404 $

- Tarafsız tahmin: 0,2404 $ - 0,27526 $

- İyimser tahmin: 0,27526 $ - 0,31012 $ (olumlu piyasa koşulları ve artan benimseme ile)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Yüksek oynaklık ile büyüme potansiyeli

- Fiyat aralığı tahminleri:

- 2027: 0,22039 $ - 0,47037 $

- 2028: 0,25978 $ - 0,51555 $

- Başlıca katalizörler: Teknolojik yenilikler, piyasa kabulünün artması ve olası düzenleyici açıklık

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,45760 $ - 0,51023 $ (istikrarlı piyasa büyümesi ve benimseme varsayımıyla)

- İyimser senaryo: 0,56285 $ - 0,75004 $ (hızlı benimseme ve olumlu piyasa koşulları ile)

- Dönüştürücü senaryo: 0,75004 $+ (çığır açan kullanım alanları ve ana akım entegrasyon ile)

- 31 Aralık 2030: CORE 0,75004 $ (iyimser projeksiyona göre olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,31012 | 0,2404 | 0,13222 | 0 |

| 2026 | 0,38261 | 0,27526 | 0,25599 | 14 |

| 2027 | 0,47037 | 0,32893 | 0,22039 | 36 |

| 2028 | 0,51555 | 0,39965 | 0,25978 | 66 |

| 2029 | 0,56285 | 0,4576 | 0,25168 | 90 |

| 2030 | 0,75004 | 0,51023 | 0,32144 | 112 |

IV. CORE Profesyonel Yatırım Stratejileri ve Risk Yönetimi

CORE Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Core DAO teknolojisine inanan uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde CORE token biriktirin

- CORE token stake ederek pasif gelir elde edin

- Tokenlarınızı özel anahtar kontrollü güvenli cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama: Trendleri ve olası dönüşleri belirleyin

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım bölgelerini izleyin

- Dalgalı işlemde kritik noktalar:

- Piyasa duyarlılığını ve Core DAO gelişmelerini takip edin

- Zarar durdur emirleriyle düşüş riskini yönetin

CORE Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünde %1-3

- Orta düzey yatırımcılar: Kripto portföyünde %3-7

- Agresif yatırımcılar: Kripto portföyünde %7-15

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımlarınızı birden fazla kripto varlığına dağıtın

- Zarar durdur emirleri: Olası kayıpları sınırlamak için otomatik satış emirleri kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Wallet

- Soğuk saklama çözümü: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü şifre kullanımı

V. CORE Potansiyel Riskler ve Zorluklar

CORE Piyasa Riskleri

- Yüksek oynaklık: CORE fiyatında ciddi dalgalanmalar yaşanabilir

- Rekabet: Diğer L1 blokzincirler Core DAO’nun önüne geçebilir

- Piyasa duyarlılığı: Olumsuz haberler CORE fiyatını etkileyebilir

CORE Düzenleyici Riskler

- Belirsiz düzenlemeler: Kripto düzenlemeleri CORE’un benimsenmesini etkileyebilir

- Uyum sorunları: Core DAO düzenleyici incelemeyle karşılaşabilir

- Sınır ötesi kısıtlamalar: Uluslararası düzenlemeler CORE kullanımını sınırlayabilir

CORE Teknik Riskler

- Akıllı sözleşme açıkları: Core DAO kodunda potansiyel hatalar

- Ölçeklenebilirlik sorunları: Yoğun talep dönemlerinde ağ tıkanıklığı

- Konsensüs mekanizması sorunları: "Satoshi Plus" mekanizmasında olası kusurlar

VI. Sonuç ve Eylem Önerileri

CORE Yatırım Değeri Değerlendirmesi

Core DAO, EVM uyumluluğunu Bitcoin’in güvenliğiyle birleştiren özgün bir L1 blokzincir çözümü sunar. Uzun vadeli potansiyeli olsa da kısa vadede oynaklık ve rekabet önemli riskler barındırıyor.

CORE Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, Core DAO teknolojisini öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Düzenli DCA ve staking ile dengeli strateji uygulayın ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın, OTC opsiyonları değerlendirin

CORE İşlem Katılım Yöntemleri

- Spot işlem: Gate.com üzerinde CORE alım-satımı

- Staking: Pasif gelir için CORE staking programları

- DeFi: Core DAO ekosistemindeki merkeziyetsiz finans olanaklarını keşfedin

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk toleranslarına göre vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Core coin’in geleceği nedir?

Core coin’in geleceği umut vaat ediyor; Web3 ekosisteminde belirgin büyüme ve benimseme potansiyeli var. Yenilikçi teknolojisi ve güçlü topluluk desteğiyle 2025’e kadar değer ve fayda artışı sağlayabilir.

Bir Core coin ne kadar değerli olacak?

Piyasa eğilimleri ve benimseme hızına bağlı olarak, bir CORE coin 2025’e kadar blockchain kullanımı ve ekosistem büyümesiyle potansiyel olarak 50-75 $ değerine ulaşabilir.

2030’da Core coin ne kadar değerli olacak?

Mevcut eğilimler ve piyasa analizlerine göre, CORE coin 2030’a kadar Web3 alanındaki benimseme ve teknolojik gelişmelerle 50-75 $ seviyesine ulaşabilir.

Core DAO iyi bir proje mi?

Evet, Core DAO yenilikçi konsensüs mekanizması ve güçlü topluluk desteğiyle olumlu bir tablo çiziyor. Ölçeklenebilirlik ve sürdürülebilirlik odağıyla blokzincir ekosisteminde uzun vadeli yatırım için potansiyel sunuyor.

2025 yılında 1,5 milyon token sahibine ulaşan Polkadot topluluğu ne kadar aktif?

Token ekonomisi modelinde token dağıtım mekanizması nasıl işler?

KIM nedir: Devrim yaratan Bilgi ve Bilgi Yönetim Sistemi

FTR nedir: Finansal piyasalarda Future Trading Reference (FTR) kavramının anlaşılması

SDEX nedir: Stellar varlıklarına yönelik merkeziyetsiz borsa hakkında bilgi edinme

MOVE nedir: Yeni Blockchain Programlama Dili Hakkında Kapsamlı Bir Rehber

Blokzincir güvenliği açısından 51% saldırısını anlamak: riskler ve etkileri

Spot Kripto Para Ticareti Temelleri: Başlangıç Seviyesi Rehberi

Hamster Kombat Günlük Kombinasyon ve Şifre Yanıtı 14 Aralık 2025

Yeni başlayanlar için en uygun ERC20 cüzdanları

Curve'nin merkeziyetsiz likidite havuzlarıyla kazancınızı en üst düzeye çıkarın