2025 CTA Price Prediction: Analyzing Future Trends and Growth Potential for Chicago Transit Authority Fares

Introduction: CTA's Market Position and Investment Value

Cross The Ages (CTA), as a free-to-play game featuring digital trading cards as non-fungible tokens (NFTs), has made significant strides since its inception. As of 2025, CTA's market capitalization has reached $20,415,000, with a circulating supply of approximately 500,000,000 tokens, and a price hovering around $0.04083. This asset, often referred to as a "gaming ecosystem token," is playing an increasingly crucial role in the blockchain gaming and NFT sectors.

This article will provide a comprehensive analysis of CTA's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. CTA Price History Review and Current Market Status

CTA Historical Price Evolution Trajectory

- 2024: CTA reached its all-time high of $0.462 on May 17, marking a significant milestone for the project.

- 2025: The market experienced a downturn, with CTA hitting its all-time low of $0.01307 on February 3.

- 2025: Recent months have shown signs of recovery, with the price rising to $0.04083 as of October 5.

CTA Current Market Situation

As of October 5, 2025, CTA is trading at $0.04083, representing a 24-hour decrease of 0.24%. The token has shown positive momentum over longer timeframes, with a 7-day increase of 2.51% and a 30-day gain of 14.08%. However, CTA is still down 62.41% compared to its price one year ago. The current market capitalization stands at $20,415,000, with a circulating supply of 500,000,000 CTA tokens. The 24-hour trading volume is $7,027.09, indicating moderate market activity. Despite recent gains, CTA is still trading significantly below its all-time high, suggesting potential for further recovery if market conditions remain favorable.

Click to view the current CTA market price

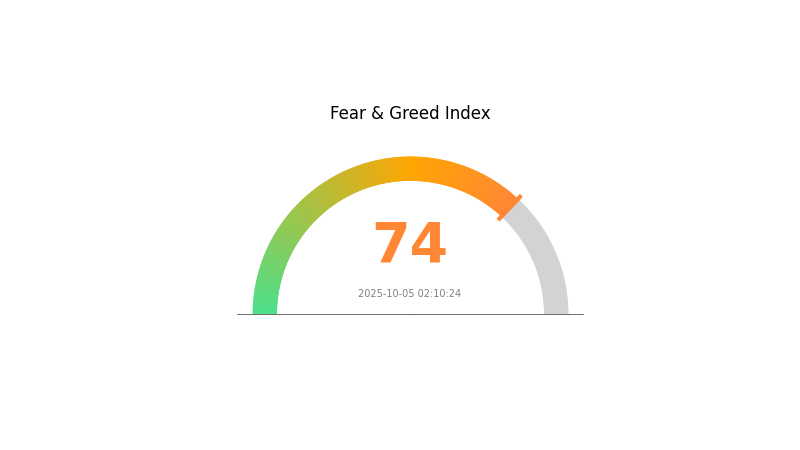

CTA Market Sentiment Indicator

2025-10-05 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 74. This high level of greed suggests that investors are becoming overly optimistic, potentially leading to overbought conditions. While the market sentiment is positive, it's crucial for traders to remain cautious and consider potential market corrections. As always, diversification and risk management are key in such market conditions. Keep an eye on market trends and be prepared for possible volatility.

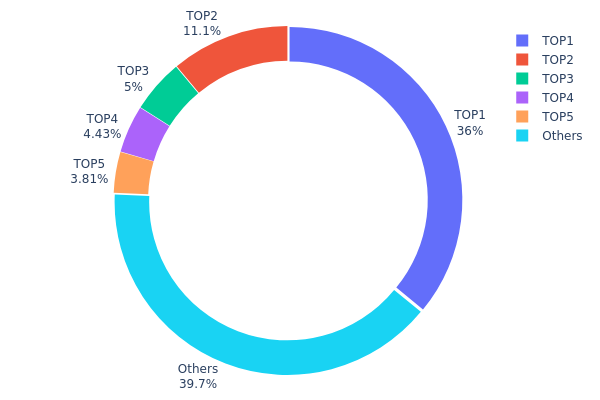

CTA Holdings Distribution

The address holdings distribution data provides insights into the concentration of CTA tokens among different addresses. Analysis of this data reveals a significant concentration of tokens in a few top addresses. The top address holds 35.95% of all CTA tokens, while the top 5 addresses collectively control 60.23% of the supply.

This high concentration of tokens in a small number of addresses raises concerns about market centralization and potential price manipulation. The top address, holding over one-third of the total supply, has substantial influence over the token's market dynamics. Such concentration could lead to increased volatility and susceptibility to large sell-offs or accumulation events.

However, it's worth noting that 39.77% of tokens are distributed among other addresses, indicating some level of decentralization. This distribution pattern suggests a market structure where major holders have significant sway, but there's still room for broader participation. The current holdings distribution reflects a partially centralized ecosystem, which may impact the token's long-term stability and adoption potential.

Click to view the current CTA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6522...837e90 | 179779.21K | 35.95% |

| 2 | 0xfb9c...d2717b | 55311.32K | 11.06% |

| 3 | 0xac5c...33a87d | 24999.97K | 4.99% |

| 4 | 0xc882...84f071 | 22139.33K | 4.42% |

| 5 | 0xcda9...a68adc | 19074.00K | 3.81% |

| - | Others | 198696.16K | 39.77% |

II. Key Factors Affecting Future CTA Prices

Supply Mechanism

- Market Volatility: CTA strategies rely heavily on market trends and momentum. Increased volatility can amplify the impact of these strategies on prices.

- Historical Pattern: In the past, periods of high market volatility have typically led to more significant price movements in CTA-related assets.

- Current Impact: The ongoing market uncertainties and potential for increased volatility may create more opportunities for CTA strategies, potentially leading to larger price swings.

Institutional and Large Investor Dynamics

- Institutional Holdings: As of 2024, global CTA-managed assets exceeded $350 billion, with a significant portion in the US market.

- Corporate Adoption: Commodity Trading Advisors (CTAs) are increasingly being adopted by large financial institutions for risk management and portfolio diversification.

- National Policies: CTAs are regulated by the Commodity Futures Trading Commission (CFTC) and monitored by the National Futures Association (NFA) in the United States.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially those of the Federal Reserve, significantly influence CTA performance. The transition to a rate-cutting cycle can increase volatility in commodity markets.

- Inflation Hedging Properties: CTAs often perform well during inflationary periods due to their exposure to commodity markets, which tend to appreciate with inflation.

- Geopolitical Factors: International trade tensions, such as tariff policies, can create volatility in commodity markets, potentially benefiting CTA strategies.

Technological Development and Ecosystem Building

- Algorithmic Trading Advancements: Improvements in machine learning and data analysis are enhancing the predictive capabilities of CTA strategies.

- Market Access Expansion: The growing availability of electronic trading platforms is increasing market access for CTAs, potentially leading to more diverse trading opportunities.

- Ecosystem Applications: CTAs are expanding their reach into new markets and asset classes, including cryptocurrencies and other digital assets, broadening their impact on various financial ecosystems.

III. CTA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02286 - $0.03500

- Neutral prediction: $0.03500 - $0.04500

- Optimistic prediction: $0.04500 - $0.05063 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential consolidation phase followed by gradual growth

- Price range forecast:

- 2027: $0.02605 - $0.05452

- 2028: $0.04573 - $0.05600

- Key catalysts: Technological advancements, wider industry partnerships, and improved market conditions

2030 Long-term Outlook

- Base scenario: $0.05500 - $0.06500 (assuming steady market growth and adoption)

- Optimistic scenario: $0.06500 - $0.08023 (assuming strong bullish market and widespread integration)

- Transformative scenario: $0.08000 - $0.10000 (extreme favorable conditions such as major institutional adoption)

- 2030-12-31: CTA $0.05772 (average predicted price for 2030)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05063 | 0.04083 | 0.02286 | 0 |

| 2026 | 0.05076 | 0.04573 | 0.03704 | 12 |

| 2027 | 0.05452 | 0.04824 | 0.02605 | 18 |

| 2028 | 0.056 | 0.05138 | 0.04573 | 25 |

| 2029 | 0.06175 | 0.05369 | 0.02899 | 31 |

| 2030 | 0.08023 | 0.05772 | 0.04791 | 41 |

IV. Professional Investment Strategies and Risk Management for CTA

CTA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and NFT enthusiasts

- Operation suggestions:

- Accumulate CTA tokens during market dips

- Participate actively in the Cross The Ages game ecosystem

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor game updates and new feature releases

- Track NFT sales volume and prices within the ecosystem

CTA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different gaming tokens

- Stop-loss orders: Set appropriate stop-loss levels to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for CTA

CTA Market Risks

- Volatility: Gaming tokens can experience significant price swings

- Competition: Emergence of new blockchain gaming projects

- User adoption: Dependency on continuous growth of the player base

CTA Regulatory Risks

- NFT regulations: Potential changes in NFT classification and taxation

- Gaming laws: Varying regulations across different jurisdictions

- Token classification: Risk of being classified as a security

CTA Technical Risks

- Smart contract vulnerabilities: Potential exploits in the token contract

- Scalability issues: Challenges in handling increased network traffic

- Interoperability: Limitations in cross-chain functionality

VI. Conclusion and Action Recommendations

CTA Investment Value Assessment

CTA presents a unique opportunity in the blockchain gaming sector, with potential for long-term growth. However, investors should be aware of the high volatility and regulatory uncertainties in the short term.

CTA Investment Recommendations

✅ Beginners: Start with small investments, focus on learning the game ecosystem ✅ Experienced investors: Consider a balanced approach, combining token holding with active game participation ✅ Institutional investors: Conduct thorough due diligence on the project's development roadmap and team

CTA Trading Participation Methods

- Spot trading: Buy and sell CTA tokens on Gate.com

- Staking: Participate in staking programs if available

- In-game activities: Earn CTA tokens through gameplay and NFT trading

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Constellation crypto in 2025?

Based on market indicators, Constellation crypto is predicted to trade between $0.071531 and $0.076001 by the end of 2025.

How much is the CTA token worth?

As of 2025-10-05, the CTA token is worth $0.27053. This price reflects current market conditions and trends in the crypto space.

Would hamster kombat coin reach $1?

While Hamster Kombat's price has surged significantly, reaching $1 remains uncertain. Current trends suggest potential, but market volatility is high. No guarantees can be made.

What is the price prediction for Coti in 2050?

Based on a 5% annual growth rate, COTI is predicted to reach $0.1486 by 2050. This long-term forecast assumes steady market expansion over the years.

2025 FEAR Price Prediction: Navigating Volatility in the Crypto Fear Index Token Market

B3 vs FLOW: Comparing Two Innovative Blockchain Protocols for Scalability and Performance

AVNT vs ENJ: A Comparative Analysis of Two Promising Blockchain Gaming Tokens

2025 DOMI Price Prediction: Analyzing Market Trends and Potential Growth Factors

GODL vs ENJ: A Comparison of Two Blockchain Gaming Tokens

Is Legends of Elysium (LOE) a good investment?: Analyzing the potential and risks of this blockchain-based card game

What is Maximal Extractable Value (MEV)?

5 Tips to Safeguard Your Crypto Assets from Hackers

Fan Token Platform: Complete Guide to Digital Fan Engagement

What is Mango Network? A Complete Guide to MGO Token and Multi-VM Blockchain Infrastructure

What Are Crypto Whales and How to Identify Them?