2025 CVX Price Prediction: Bullish Outlook as DeFi Adoption Accelerates

Introduction: CVX's Market Position and Investment Value

Convex Finance (CVX), as a key player in the DeFi yield optimization sector, has made significant strides since its inception in 2021. As of 2025, CVX's market capitalization has reached $188,988,572, with a circulating supply of approximately 81,990,703 tokens, and a price hovering around $2.305. This asset, often referred to as the "yield booster," is playing an increasingly crucial role in maximizing returns for Curve Finance liquidity providers.

This article will provide a comprehensive analysis of CVX's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. CVX Price History Review and Current Market Status

CVX Historical Price Evolution Trajectory

- 2021: CVX launched, price fluctuated around initial levels

- 2022: Reached all-time high of $60.09 on January 2nd, followed by significant decline

- 2025: Hit all-time low of $1.36 on October 11th, showing extreme market volatility

CVX Current Market Situation

As of October 19, 2025, CVX is trading at $2.305, with a 24-hour trading volume of $57,956.77575. The token has experienced a slight decline of 1.2% in the past 24 hours. CVX's market cap currently stands at $188,988,572.08, ranking it 281st in the crypto market. The circulating supply is 81,990,703.72 CVX, which represents 81.99% of the total supply of 99,928,999.53 CVX. Despite the recent dip, CVX has shown resilience over the past week with a 7.10% increase. However, it's important to note the significant 44.5% decrease over the last 30 days, indicating high volatility in the medium term. The current price represents a 96.16% decrease from its all-time high and a 69.49% increase from its all-time low.

Click to view the current CVX market price

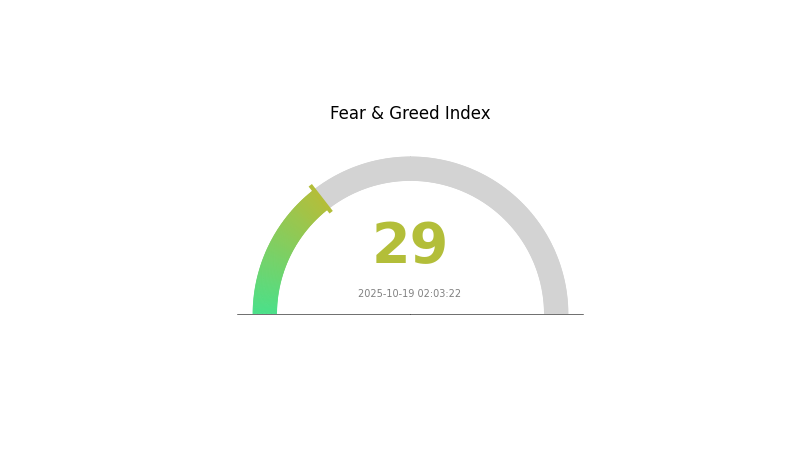

CVX Market Sentiment Indicator

2025-10-19 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment is currently in the "Fear" zone, with a reading of 29 on the Fear and Greed Index. This indicates a cautious mood among investors, potentially presenting buying opportunities for those with a long-term perspective. However, it's crucial to remain vigilant and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results. Stay informed and trade responsibly.

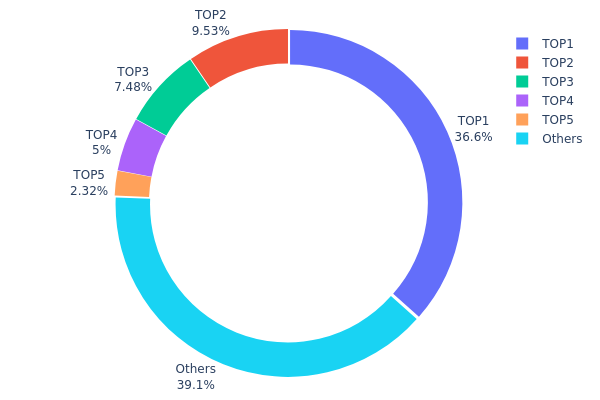

CVX Holdings Distribution

The address holdings distribution data provides valuable insights into the concentration of CVX tokens among different wallet addresses. According to the data, the top address holds a significant 36.55% of the total CVX supply, with the top five addresses collectively controlling 60.87% of all tokens. This high concentration raises concerns about the centralization of CVX ownership.

Such a concentrated distribution could potentially impact market dynamics and price volatility. The dominance of a few large holders may lead to increased price fluctuations if they decide to make substantial trades. Moreover, this concentration could potentially allow for market manipulation, as large holders may have the ability to influence token prices through their trading activities.

This distribution pattern suggests that CVX's on-chain structure may be less decentralized than ideal for a cryptocurrency project. While the presence of numerous smaller holders (39.13% held by "Others") indicates some level of distribution, the significant concentration among top addresses could pose risks to the overall stability and fairness of the CVX ecosystem.

Click to view the current CVX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x72a1...2db86e | 36524.70K | 36.55% |

| 2 | 0xcf50...139332 | 9521.76K | 9.52% |

| 3 | 0x1389...541bb7 | 7476.01K | 7.48% |

| 4 | 0xf977...41acec | 5000.00K | 5.00% |

| 5 | 0x5f46...d60605 | 2318.43K | 2.32% |

| - | Others | 39088.08K | 39.13% |

II. Key Factors Affecting Future CVX Price

Supply Mechanism

- Emissions Schedule: CVX has a fixed supply cap with a decreasing emission rate over time.

- Historical Pattern: Previous supply reductions have generally led to price increases due to scarcity.

- Current Impact: The ongoing reduction in new CVX emissions is expected to create upward price pressure.

Institutional and Whale Dynamics

- Institutional Holdings: Several major crypto funds have been accumulating CVX positions.

Macroeconomic Environment

- Inflation Hedging Properties: CVX has shown some correlation with inflation hedging assets, potentially attracting investors during high inflation periods.

Technological Development and Ecosystem Building

- Curve v2 Integration: CVX is adapting to support Curve's v2 pools, expanding its utility.

- Ecosystem Applications: CVX is central to various DeFi protocols leveraging Curve, including yield optimizers and lending platforms.

III. CVX Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $1.26 - $2.00

- Neutral forecast: $2.00 - $2.60

- Optimistic forecast: $2.60 - $3.43 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range predictions:

- 2027: $2.55 - $4.14

- 2028: $3.01 - $4.74

- Key catalysts: Increasing adoption of DeFi platforms, potential protocol upgrades

2029-2030 Long-term Outlook

- Base scenario: $3.56 - $4.22 (assuming steady market growth)

- Optimistic scenario: $4.22 - $5.03 (assuming strong DeFi sector performance)

- Transformative scenario: $5.03+ (extreme favorable conditions in crypto markets)

- 2030-12-31: CVX $4.22 (potential year-end closing price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 3.43445 | 2.305 | 1.26775 | 0 |

| 2026 | 3.01321 | 2.86973 | 1.52095 | 24 |

| 2027 | 4.14747 | 2.94147 | 2.55908 | 27 |

| 2028 | 4.74959 | 3.54447 | 3.0128 | 53 |

| 2029 | 4.31291 | 4.14703 | 3.56644 | 79 |

| 2030 | 5.03366 | 4.22997 | 2.36878 | 83 |

IV. Professional CVX Investment Strategies and Risk Management

CVX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate CVX during market dips

- Stake CVX to earn platform fees

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor Curve ecosystem developments for potential price catalysts

CVX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance CVX with other DeFi and non-DeFi assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, regular security audits

V. Potential Risks and Challenges for CVX

CVX Market Risks

- High volatility: CVX price can experience significant fluctuations

- Liquidity risk: Potential difficulties in large-scale buying or selling

- Correlation with broader crypto market trends

CVX Regulatory Risks

- Uncertain regulatory environment for DeFi projects

- Potential classification as a security

- Cross-border regulatory challenges

CVX Technical Risks

- Smart contract vulnerabilities

- Potential exploits in the Convex Finance platform

- Scalability issues on the Ethereum network

VI. Conclusion and Action Recommendations

CVX Investment Value Assessment

CVX presents a high-risk, high-reward opportunity within the DeFi ecosystem. Long-term value is tied to Convex Finance's success in the Curve ecosystem, while short-term volatility remains a significant risk.

CVX Investment Recommendations

✅ Beginners: Consider small, experimental positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Evaluate CVX as part of a diversified DeFi portfolio

CVX Participation Methods

- Direct purchase: Buy CVX on Gate.com

- Staking: Participate in Convex Finance platform to earn rewards

- Yield farming: Explore CVX-related liquidity pools for additional returns

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price target for CVX in 2025?

Based on market analysis and current trends, the price target for CVX in 2025 is projected to reach $50-$60 per token.

Is CVX expected to go up?

Yes, CVX is expected to go up. The token's utility in the Curve ecosystem and growing DeFi adoption suggest potential price appreciation in the coming years.

What is the price prediction for CVX in 2026?

Based on current trends and market analysis, CVX is predicted to reach around $25-$30 by 2026, potentially seeing a 2-3x growth from its current value.

How much will the velodrome coin price be in 2030?

Based on market trends and potential growth, Velodrome coin price could reach $5 to $10 by 2030, assuming continued adoption and ecosystem expansion.

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

SWELL vs RUNE: Comparing Two Leading DeFi Protocols in the Cross-Chain Liquidity Race

2025 ALCX Price Prediction: Future Outlook and Market Analysis for Alchemix Token

2025 CAKE Price Prediction: Bullish Trends and Key Factors Driving PancakeSwap's Token Value

SPO vs SNX: Comparing Two Leading DeFi Protocols for Yield Farming and Staking

How Does AVAX Token Flow Affect Its Market Cap in 2025?

BTC Option Flows Explained, Why Bitcoin Above 93,000 Suggests a Bullish Start to 2026

Bitcoin Options Traders Eye USD $100,000 as Derivatives Signal Market Reset

What Is GLD ETF, Understanding Gold Price Exposure and Structure

SMH ETF Explained, How Semiconductor Sector Investing Works

Samsung Q4 Profit Jumps 160 Percent, How the AI Chip Boom Is Reshaping Markets