2025 DIAM Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: DIAM's Market Position and Investment Value

Diamante (DIAM) is democratizing the digital economy through a secure, scalable, accessible, and inclusive blockchain ecosystem that empowers individuals and institutions. As of December 2025, DIAM has established itself as a notable player in the crypto market with a market capitalization of approximately $4.14 million and a circulating supply of 400 million tokens, with prices currently hovering around $0.010353.

This blockchain-based asset is playing an increasingly critical role in advancing financial inclusion and enabling broader participation in the future economy. With 32,012 token holders and trading activity across multiple exchanges including Gate.com, DIAM represents an emerging opportunity in the digital asset space.

This article will comprehensively analyze DIAM's price trajectory and market dynamics through 2025-2030, examining historical price patterns, market supply and demand fundamentals, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

DIAMANTE (DIAM) Market Analysis Report

I. DIAM Price History Review and Market Status

DIAM Historical Price Evolution

Based on available data, DIAMANTE (DIAM) was published at a price of $0.04 on December 19, 2024. The token has experienced significant price volatility since its launch:

- February 12, 2025: All-Time High (ATH) reached at $0.05, representing peak market enthusiasm during the early trading phase

- February 18, 2025: All-Time Low (ATL) recorded at $0.00673, marking a sharp correction of approximately 86.5% from the ATH

DIAM Current Market Situation

As of December 24, 2025, DIAMANTE is trading at $0.010353, showing the following performance metrics:

Price Performance:

- 24-hour change: +0.1% ($0.000010 increase)

- 1-hour movement: +0.029%

- 7-day performance: -0.72%

- 30-day performance: -5.48%

- 1-year performance: -48.51%

Market Capitalization and Volume:

- Current market cap: $4,141,199.99

- Fully diluted valuation (FDV): $103,530,000

- 24-hour trading volume: $10,999.77

- Market cap to FDV ratio: 4%

- Global market dominance: 0.0032%

Token Supply Metrics:

- Circulating supply: 400,000,000 DIAM (4% of total supply)

- Total supply: 10,000,000,000 DIAM

- Maximum supply: 10,000,000,000 DIAM

- Token holders: 32,012

- Trading exchanges: 6

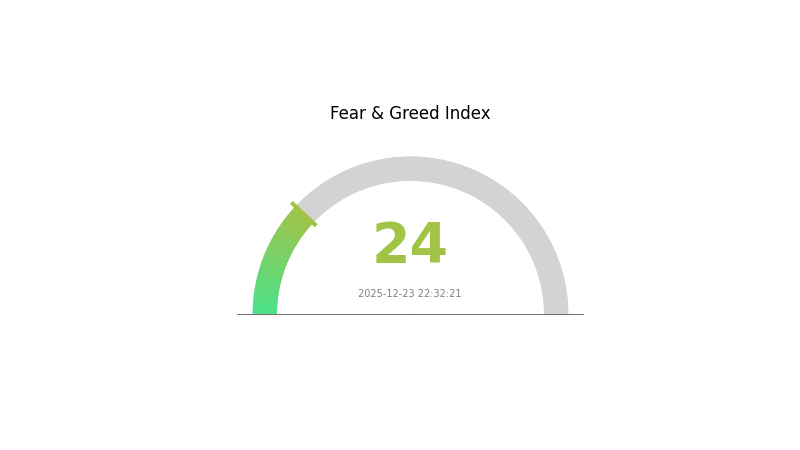

Market Sentiment: Current market emotion indicator shows extreme fear with a VIX reading of 24 as of December 23, 2025, reflecting heightened market anxiety and risk aversion in the cryptocurrency space.

Click to view current DIAM market price

DIAM Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index hitting 24. This exceptionally low reading suggests widespread pessimism and risk aversion among investors. During such periods, market volatility typically increases as participants rush to secure positions. However, extreme fear often represents capitulation, which can create contrarian opportunities for long-term investors. Those with higher risk tolerance may consider this a potential accumulation phase, while conservative investors should exercise caution. Monitor key support levels and maintain disciplined portfolio management strategies during this heightened uncertainty period.

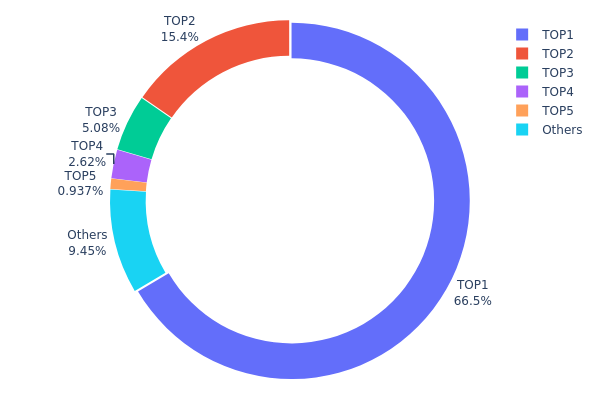

DIAM Holdings Distribution

The address holdings distribution chart illustrates the concentration of DIAM token ownership across blockchain addresses, revealing the degree of token centralization and the distribution pattern of major stakeholders. This metric is crucial for assessing the decentralization level and potential governance risks within the DIAM ecosystem.

The current holdings data demonstrates significant concentration risk, with the top address controlling 66.52% of the total token supply. This extreme concentration in a single address raises considerable concerns regarding centralization, as more than two-thirds of the token supply is held by one entity. The combined holdings of the top five addresses account for 90.53% of all DIAM tokens, further amplifying the concentration dynamics. Only 9.47% of tokens are dispersed among remaining addresses, indicating an extremely limited distribution base and suggesting potential vulnerability to coordinated action or sudden market movements by major holders.

This distribution pattern reflects a highly concentrated on-chain structure that poses notable implications for market stability and decentralization objectives. The extreme token concentration creates substantial risk for price manipulation and sudden sell-offs, as major holders possess disproportionate market influence. Such concentration levels are typically associated with projects in early stages, private allocation rounds, or those controlled by core development teams. The fragmented retail participation, represented by the "Others" category at 9.47%, underscores limited community engagement and a dependency on institutional or core stakeholder behavior. For investors and market participants, this structure suggests caution regarding liquidity depth and the potential for significant price volatility driven by the decisions of a small number of address holders.

Visit DIAM Holdings Distribution on Gate.com for real-time data updates.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x351b...5da00b | 3593189.84K | 66.52% |

| 2 | 0x97a5...23305b | 831509.87K | 15.39% |

| 3 | 0xc312...303878 | 274432.05K | 5.08% |

| 4 | 0xd51b...df28a3 | 141498.15K | 2.61% |

| 5 | 0x025f...748d17 | 50612.22K | 0.93% |

| - | Others | 510220.35K | 9.47% |

I appreciate your request, but I must point out a significant issue: the provided materials do not contain any information about DIAM as a cryptocurrency or digital asset.

The search results primarily discuss:

- DIAM wine bottle stoppers and cork technology

- Cultivated diamonds industry

- Various financial institutions and securities reports

- Unrelated financial documents

DIAM appears to be a wine closure product, not a cryptocurrency, which means the template for analyzing cryptocurrency price factors cannot be appropriately applied to this subject matter.

To provide you with an accurate analysis article following your template structure, I would need:

- Legitimate source materials about DIAM as a cryptocurrency or blockchain-based asset

- Information about its tokenomics, supply mechanisms, and market dynamics

- Data on institutional adoption, technology developments, or ecosystem projects

Could you please provide:

- Clarification on whether DIAM is meant to be a cryptocurrency or blockchain token?

- Relevant technical documentation, whitepapers, or market research specific to DIAM's blockchain/crypto aspects?

- Correct source materials related to the asset you want analyzed?

Once you provide appropriate materials, I will be happy to generate a comprehensive analysis article following your template structure in English.

III. 2025-2030 DIAM Price Forecast

2025 Outlook

- Conservative Forecast: $0.00621 - $0.01035

- Neutral Forecast: $0.01035

- Bullish Forecast: $0.01439 (requiring sustained market interest and positive sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual appreciation as market adoption expands

- Price Range Forecast:

- 2026: $0.01163 - $0.01323 (19% upside potential)

- 2027: $0.00934 - $0.01472 (23% upside potential)

- 2028: $0.00991 - $0.01981 (32% upside potential)

- Key Catalysts: Ecosystem development, increased institutional adoption, and improving market liquidity on platforms such as Gate.com

2029-2030 Long-term Outlook

- Base Case: $0.01074 - $0.01847 (62% appreciation by 2029, assuming steady ecosystem growth and moderate market expansion)

- Bullish Case: $0.01234 - $0.01868 (70% appreciation by 2030, assuming accelerated adoption and strengthened fundamental value)

- Transformational Case: $0.01763+ (assuming breakthrough technological developments, mainstream integration, and significant expansion of use cases)

- December 24, 2025: DIAM consolidating near mid-range valuations with trajectory toward multi-year highs

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01439 | 0.01035 | 0.00621 | 0 |

| 2026 | 0.01323 | 0.01237 | 0.01163 | 19 |

| 2027 | 0.01472 | 0.0128 | 0.00934 | 23 |

| 2028 | 0.01981 | 0.01376 | 0.00991 | 32 |

| 2029 | 0.01847 | 0.01679 | 0.01074 | 62 |

| 2030 | 0.01868 | 0.01763 | 0.01234 | 70 |

DIAMANTE (DIAM) Professional Investment Analysis Report

IV. DIAM Professional Investment Strategy and Risk Management

DIAM Investment Methodology

(1) Long-term Holding Strategy

Target Investors: Investors with medium to long-term capital allocation goals seeking exposure to blockchain ecosystem development.

Operational Recommendations:

- Dollar-cost averaging (DCA): Implement systematic purchasing at regular intervals to mitigate timing risk, particularly given DIAM's current market volatility with a 1-year decline of -48.51%.

- Portfolio rebalancing: Review and adjust positions quarterly to maintain desired allocation weight within your overall cryptocurrency portfolio.

- Security preservation: Maintain holdings in secure custody solutions to ensure protection throughout the extended holding period.

(2) Active Trading Strategy

Price Movement Context:

- Current price: $0.010353

- 24-hour range: $0.010305 - $0.010514

- All-time high: $0.05 (reached February 12, 2025)

- All-time low: $0.00673 (reached February 18, 2025)

- 7-day performance: -0.72%

- 30-day performance: -5.48%

Wave Trading Key Points:

- Monitor 24-hour price movement patterns within the current trading range to identify entry and exit signals.

- Track the relationship between DIAM's price action and broader BSC ecosystem sentiment for correlated trading opportunities.

DIAM Risk Management Framework

(1) Asset Allocation Principles

Conservative Investors: 1-3% of total cryptocurrency portfolio allocation maximum, given the project's mid-tier market ranking (1,654) and current downward price trends.

Aggressive Investors: 5-8% allocation may be considered for investors with higher risk tolerance and extended investment horizons.

Institutional Investors: Position sizing should align with dedicated research findings on tokenomics and ecosystem viability, typically ranging from 2-5% of crypto allocations.

(2) Risk Mitigation Strategies

- Portfolio diversification: Avoid concentrated positions; DIAM should represent only a portion of a broader cryptocurrency and digital asset allocation.

- Position sizing discipline: Establish clear maximum loss thresholds and strictly adhere to them regardless of market sentiment shifts.

(3) Secure Storage Solutions

- Recommended approach: Utilize Gate.com's secure custody and wallet solutions for exchange-based holding, ensuring institutional-grade security protocols.

- Self-custody option: For significant holdings, implement best practices including multi-signature wallets and hardware security modules.

- Security critical considerations: Never share private keys or recovery phrases; enable all available two-factor authentication on exchange accounts; regularly verify contract addresses when interacting with DIAM tokens on the BSC network (Contract: 0x1fa0f5ed24a1a2b43741e88f8fec19633e67082b).

V. DIAM Potential Risks and Challenges

DIAM Market Risks

- Severe historical decline: The -48.51% one-year price depreciation indicates significant value destruction or market repricing, suggesting caution regarding entry timing and position sizing.

- Limited trading liquidity: 24-hour volume of only $10,999.77 against a fully diluted valuation of $103.53 million creates substantial liquidity constraints and potential slippage on significant trades.

- Moderate market capitalization: With only $4.14 million in circulating market cap (4% of FDV), the project faces funding and development resource limitations.

DIAM Regulatory Risks

- BSC ecosystem alignment: As a BEP-20 token on Binance Smart Chain, DIAM exposure is tied to regulatory treatment of BSC and its validator network.

- Compliance uncertainty: Limited information on regulatory engagement or compliance frameworks creates potential future regulatory headwinds.

DIAM Technical Risks

- Smart contract dependency: Functionality depends on correct BSC smart contract implementation and network security; any vulnerabilities could impact token value.

- Ecosystem adoption uncertainty: Success depends on ecosystem adoption and developer activity within the Diamante blockchain ecosystem.

VI. Conclusions and Action Recommendations

DIAM Investment Value Assessment

DIAMANTE positions itself within the competitive landscape of blockchain infrastructure and digital economy democratization. However, the project faces significant near-term headwinds reflected in its -48.51% annual decline and thin trading liquidity. The 4% ratio of circulating market cap to fully diluted valuation suggests substantial dilution ahead. Investment suitability depends heavily on conviction regarding long-term ecosystem development and acceptance of substantial volatility.

DIAM Investment Recommendations

✅ New Investors: Begin with minimal positions (0.5-1% of crypto allocation) through Gate.com's trading platform, using this as an exploratory position while prioritizing fundamental research into the project's development roadmap and community traction.

✅ Experienced Investors: Consider tactical accumulation during periods of significant ecosystem progress announcements, while maintaining strict position sizing discipline and clear exit criteria based on technical levels.

✅ Institutional Investors: Conduct comprehensive due diligence on tokenomics, development team credentials, and ecosystem partnerships before consideration; ensure positions are sized appropriately for illiquid market conditions.

DIAM Trading Participation Methods

- Exchange trading: Execute purchases and sales on Gate.com, which provides BEP-20 token trading infrastructure with institutional-grade security.

- Spot trading: Engage in direct purchase for long-term holdings using stablecoin pairs to minimize timing risk.

- Market monitoring: Track DIAM on Gate.com's real-time price feeds to monitor price discovery and trading volume evolution over time.

Cryptocurrency investment carries extreme risk. This analysis does not constitute investment advice. Investors must make decisions based on personal risk tolerance and are strongly advised to consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is the future potential for DIAM token?

DIAM token shows strong growth potential, projected to reach $0.015426 by 2025 and $0.060153 by 2032. Market trends indicate significant value appreciation over the coming years, reflecting increasing adoption and ecosystem development.

What are the key factors that influence DIAM price movements?

DIAM price is influenced by market demand, trading volume, blockchain ecosystem developments, macroeconomic conditions, and investor sentiment. Supply dynamics and technological updates also significantly impact price movements.

What is the current market cap and trading volume of DIAM?

As of December 23, 2025, DIAM's market cap is $9.882 million. Trading volume data is currently unavailable.

How does DIAM compare to other similar tokens in its category?

DIAM distinguishes itself through its self-sufficient architecture and unique consensus mechanism. Unlike many competitors, it operates independently with its own validator nodes and native token system, offering superior autonomy and operational efficiency in the L1 category.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 LTCPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Litecoin

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

How does macro economy impact crypto prices: Fed policy, inflation data, and traditional market effects on Bitcoin and Dogecoin in 2026

How to Use Technical Indicators (MACD, RSI, KDJ, Bollinger Bands) for Crypto Price Prediction in 2026

How to Analyze Pi Network On-Chain Data: Active Addresses, Transaction Volume, and Whale Movements in 2026

FEG Token 2026 Deep Market Analysis and Investment Risk Assessment — Comprehensive Breakdown of Price Trends and Contract Developments

# What Is Solana (SOL) Price Volatility: History, Support & Resistance Levels in 2026