2025 DOGE Price Prediction: Analyzing Potential Growth and Market Trends for Dogecoin

Introduction: DOGE's Market Position and Investment Value

Dogecoin (DOGE), as a leading meme-inspired cryptocurrency, has achieved remarkable success since its inception in 2013. As of 2025, Dogecoin's market capitalization has reached $31,044,635,504, with a circulating supply of approximately 151,333,896,384 coins, and a price hovering around $0.20514. This asset, often dubbed the "people's crypto," is playing an increasingly crucial role in digital payments and online tipping.

This article will comprehensively analyze Dogecoin's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. DOGE Price History Review and Current Market Status

DOGE Historical Price Evolution

- 2013: Dogecoin launched on December 8, initial price around $0.000559

- 2021: Reached all-time high of $0.731578 on May 8, driven by social media hype

- 2022-2023: Market correction phase, price fluctuated between $0.05 and $0.15

DOGE Current Market Situation

As of October 15, 2025, Dogecoin (DOGE) is trading at $0.20514, ranking 10th in the global cryptocurrency market. The current price represents a 71.96% decline from its all-time high but remains significantly higher than its all-time low of $0.0000869.

In the past 24 hours, DOGE has experienced a slight decrease of 1.77%, with a trading volume of $71,351,377. The market capitalization stands at $31,044,635,504, accounting for 0.76% of the total cryptocurrency market.

Short-term price trends show mixed signals:

- 1-hour change: +0.69%

- 7-day change: -17.71%

- 30-day change: -26.29%

Despite recent declines, DOGE has shown strong performance over the past year with a 76.13% increase, indicating sustained long-term interest in the meme-inspired cryptocurrency.

Click to view the current DOGE market price

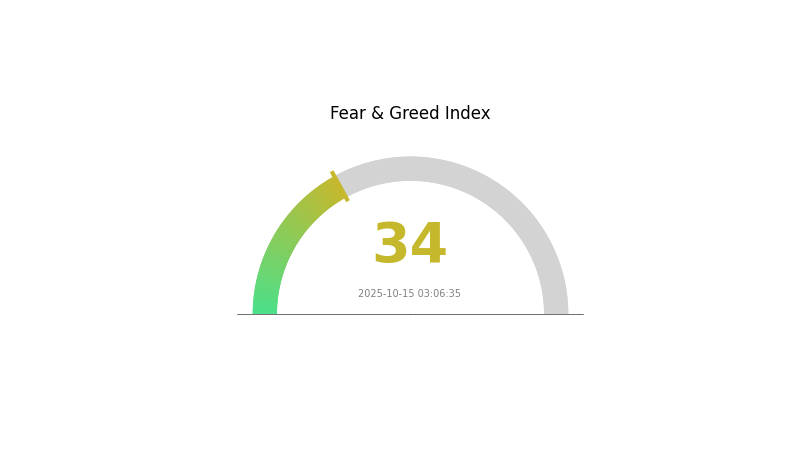

DOGE Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment for DOGE is currently in the "Fear" zone, with a Fear and Greed Index reading of 34. This indicates a cautious mood among investors, potentially presenting buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. Always conduct thorough research and consider your risk tolerance before making investment decisions. Gate.com offers comprehensive tools and data to help you navigate these market conditions effectively.

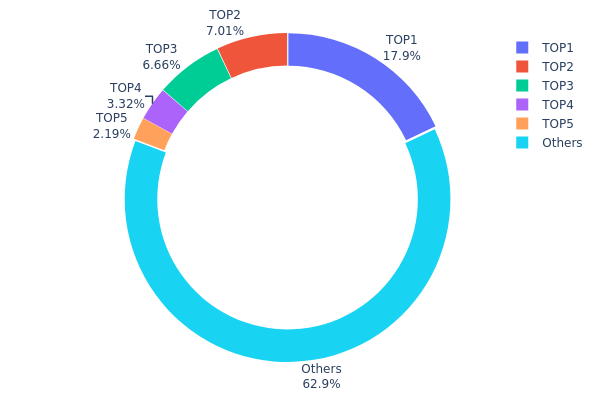

DOGE Holdings Distribution

The address holdings distribution chart provides insights into the concentration of DOGE ownership across different wallet addresses. Based on the data, DOGE exhibits a relatively high level of concentration, with the top 5 addresses holding 37.13% of the total supply. The largest single address controls 17.95% of all DOGE tokens, indicating a significant concentration of wealth.

This level of concentration could potentially impact market dynamics. The presence of large holders, often referred to as "whales," may lead to increased price volatility if they decide to move substantial amounts of DOGE. Moreover, it raises concerns about potential market manipulation, as these major holders could potentially influence price movements through large-scale buying or selling activities.

Despite the concentration at the top, it's noteworthy that 62.87% of DOGE is distributed among "Others," suggesting a degree of decentralization among smaller holders. This distribution pattern reflects a mixed market structure, balancing between centralized large holders and a more diverse base of smaller investors, which could contribute to the overall stability of the DOGE ecosystem.

Click to view the current DOGE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | DEgDVF...s1pMke | 27164003.43K | 17.95% |

| 2 | DE5opa...X6EToX | 10614629.63K | 7.01% |

| 3 | D8ZEVb...bd66TX | 10086993.21K | 6.66% |

| 4 | DDTtqn...iXYdGG | 5031001.97K | 3.32% |

| 5 | AC8azE...gmP5hQ | 3311716.60K | 2.19% |

| - | Others | 95143261.56K | 62.87% |

II. Key Factors Influencing DOGE's Future Price

Supply Mechanism

- Inflationary Model: DOGE has an unlimited supply with a fixed annual issuance rate, which could potentially lead to long-term price dilution.

- Historical Pattern: Past supply increases have generally led to short-term price volatility but haven't significantly impacted long-term growth.

- Current Impact: The ongoing inflationary supply may put downward pressure on price, but community demand could offset this effect.

Institutional and Whale Dynamics

- Institutional Holdings: Major corporations like CleanCore Solutions have added significant DOGE holdings to their reserves, demonstrating growing institutional interest.

- Corporate Adoption: Companies such as Tesla and SpaceX have shown support by accepting DOGE as a payment method for certain products and services.

Macroeconomic Environment

- Inflation Hedging Properties: DOGE has shown some potential as an inflation hedge, though its effectiveness is less established compared to more traditional cryptocurrencies.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions may drive investors towards cryptocurrencies, potentially benefiting DOGE.

Technical Development and Ecosystem Building

- Network Upgrade: Dogecoin's network is upgrading to a 500-millisecond indexing speed, significantly improving UTXO chain speed and programmability.

- Ecosystem Applications: The Dogecoin Foundation's corporate arm, House of Doge, plans to list on NASDAQ and develop merchant services, payment infrastructure, and other DOGE-based applications.

III. DOGE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.17789 - $0.19000

- Neutral prediction: $0.20447 - $0.21000

- Optimistic prediction: $0.21500 - $0.21878 (requires sustained market momentum)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.21848 - $0.33141

- 2028: $0.27979 - $0.29998

- Key catalysts: Wider adoption in digital payments, positive developments in the crypto market

2030 Long-term Outlook

- Base scenario: $0.29000 - $0.33393 (assuming steady market growth)

- Optimistic scenario: $0.33393 - $0.40000 (with increased mainstream adoption)

- Transformative scenario: $0.40000 - $0.46751 (with significant technological advancements and widespread integration)

- 2030-12-31: DOGE $0.46751 (potential peak based on favorable market conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.21878 | 0.20447 | 0.17789 | 0 |

| 2026 | 0.27935 | 0.21163 | 0.10793 | 3 |

| 2027 | 0.33141 | 0.24549 | 0.21848 | 19 |

| 2028 | 0.29998 | 0.28845 | 0.27979 | 40 |

| 2029 | 0.37365 | 0.29422 | 0.17653 | 43 |

| 2030 | 0.46751 | 0.33393 | 0.17699 | 62 |

IV. DOGE Professional Investment Strategies and Risk Management

DOGE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with high risk tolerance

- Operation suggestions:

- Accumulate DOGE during market dips

- Set price targets and take partial profits

- Store in secure cold wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and support/resistance levels

- RSI: Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor social media sentiment

- Watch for celebrity endorsements

DOGE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Use two-factor authentication, avoid public Wi-Fi

V. DOGE Potential Risks and Challenges

DOGE Market Risks

- High volatility: Significant price swings

- Meme-driven demand: Susceptible to social media trends

- Market manipulation: Potential for pump-and-dump schemes

DOGE Regulatory Risks

- Uncertain regulations: Potential for stricter government oversight

- Tax implications: Evolving cryptocurrency tax laws

- Bank restrictions: Possible limitations on crypto-related transactions

DOGE Technical Risks

- Network congestion: Potential for slow transactions during high demand

- Security vulnerabilities: Risk of hacks or exploits

- Scalability issues: Challenges in handling increased transaction volume

VI. Conclusion and Action Recommendations

DOGE Investment Value Assessment

DOGE offers speculative potential but carries high risk due to its meme-driven nature and market volatility. Long-term value depends on community support and potential use cases.

DOGE Investment Recommendations

✅ Beginners: Invest small amounts to learn about crypto markets

✅ Experienced investors: Consider DOGE as a high-risk, high-reward portion of a diversified portfolio

✅ Institutional investors: Approach with caution, focus on short-term trading opportunities

DOGE Trading Participation Methods

- Spot trading: Buy and sell DOGE on Gate.com

- Futures trading: Trade DOGE derivatives for leveraged exposure

- Staking: Participate in DOGE staking programs if available

Cryptocurrency investments are extremely risky, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will 1 Dogecoin cost in 2025?

Based on market trends and community engagement, 1 Dogecoin is predicted to cost approximately $0.10 in 2025. However, prices may fluctuate due to various factors.

Will DOGE reach 1 USD?

Based on projections, DOGE could reach $1.07 by end of 2025 if trading volume increases. Long-term predictions suggest it may hit $1 in the future, depending on market conditions and adoption.

Will DOGE hit $10?

Based on current trends, DOGE reaching $10 by 2025 is unlikely. Analysts project a more realistic range of $0.80 to $1.10, depending on its utility growth and market conditions.

How much will DOGE be worth in 2030?

Based on current trends and market analysis, DOGE is projected to reach $0.269549 by 2030. This forecast suggests a potential increase in value over the coming years.

Billionaire Blowup: Musk vs. Trump Sends Crypto Reeling

Can DOGE Reach $10

2025 SPX Price Prediction: Key Factors That Could Drive the S&P 500 to New Heights

2025 DOGE Price Prediction: Navigating the Future Landscape of Dogecoin in a Maturing Crypto Market

Doge Day 2025: Impact on Dogecoin Price and Trading Opportunities

2025 MPrice Prediction: Analyzing Macroeconomic Factors and Market Trends Influencing Future Digital Asset Valuations

2025 HGET Price Prediction: Expert Analysis and Market Forecast for Huobi Global Exchange Token

What Is Tokenomics: Token Distribution, Inflation Models, Burn Mechanisms, and Governance Explained

How Does Aethir Build One of Web3's Most Active Communities With 800+ Tribe Members and 5000+ Content Posts?

Is Hiblocks (HIBS) a good investment?: A Comprehensive Analysis of Potential Returns, Market Position, and Risk Factors

Is Istanbul Basaksehir Fan Token (IBFK) a good investment?: A Comprehensive Analysis of Risks, Benefits, and Market Potential