2025 DOT Price Prediction: Will Polkadot Reach $100 Amid Growing Adoption?

Introduction: DOT's Market Position and Investment Value

Polkadot (DOT), as a leading blockchain interoperability platform, has achieved significant milestones since its inception in 2020. As of 2025, Polkadot's market capitalization has reached $4,921,489,404.98, with a circulating supply of approximately 1,522,267,060 tokens, and a price hovering around $3.233. This asset, often referred to as the "Internet of Blockchains," is playing an increasingly crucial role in connecting diverse blockchain networks and facilitating cross-chain communication.

This article will comprehensively analyze Polkadot's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

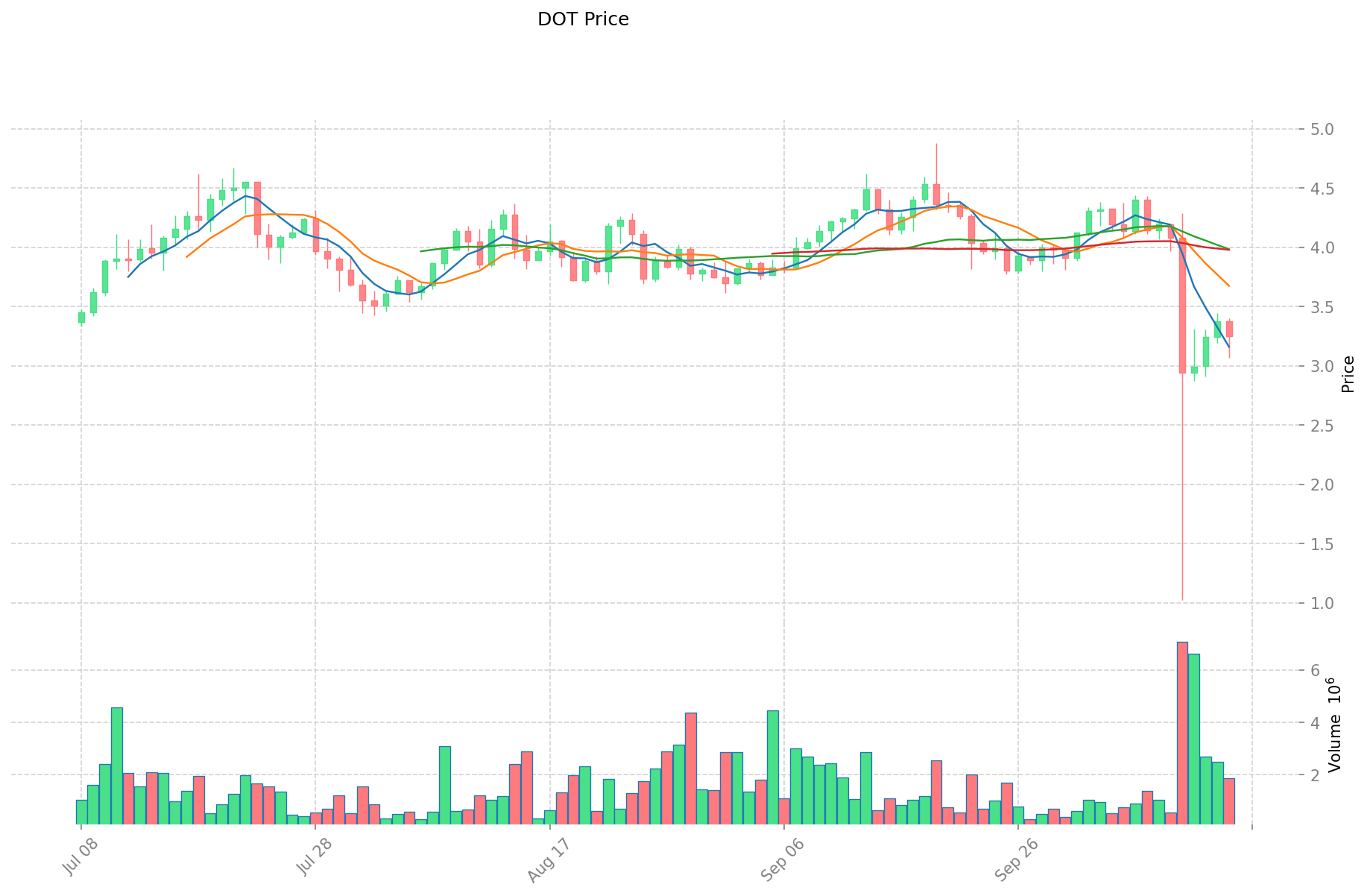

I. DOT Price History Review and Current Market Status

DOT Historical Price Evolution

- 2020: Polkadot mainnet launch, price started at $1.76

- 2021: Bull market peak, price reached all-time high of $54.98 on November 4

- 2025: Market downturn, price dropped to all-time low of $2.13 on October 11

DOT Current Market Situation

As of October 15, 2025, DOT is trading at $3.233, ranking 33rd in the cryptocurrency market with a market capitalization of $4,921,489,404. The token has experienced a 2.16% decrease in the last 24 hours, with a trading volume of $5,848,938. DOT's price is currently 94.12% below its all-time high and 51.78% above its all-time low. The market sentiment index indicates a "Fear" level of 34, suggesting caution among investors. Over the past week, DOT has seen a significant decline of 22.11%, while its 30-day and 1-year performances show drops of 24.99% and 25.83% respectively.

Click to view the current DOT market price

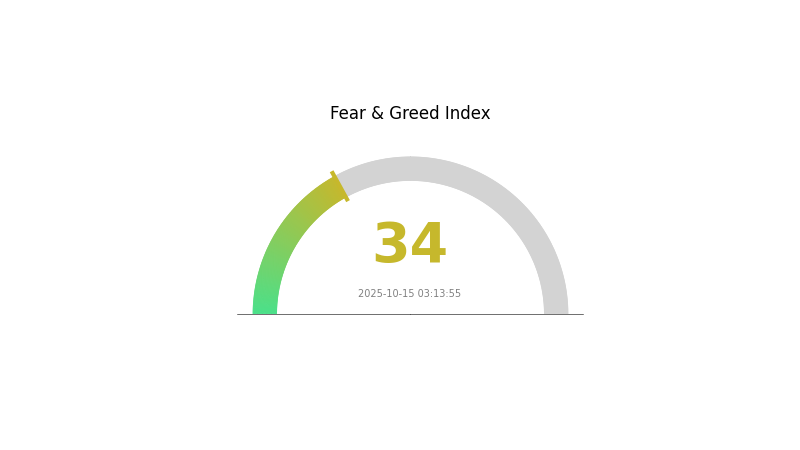

DOT Market Sentiment Index

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment for DOT remains in the "Fear" zone, with the index at 34. This indicates a cautious approach among investors. During such periods, some traders view it as a potential buying opportunity, adhering to the contrarian strategy of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and consider multiple factors before making investment decisions. Gate.com offers comprehensive market data to assist traders in navigating these uncertain times.

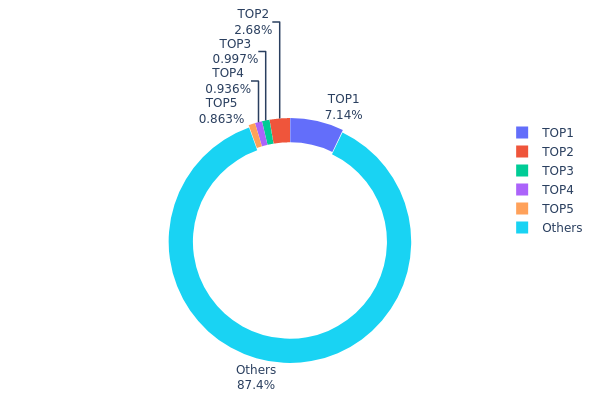

DOT Holdings Distribution

The address holdings distribution data provides insights into the concentration of DOT tokens across different addresses. Analysis of the provided data reveals that the top 5 addresses collectively hold 12.58% of the total DOT supply, with the largest holder possessing 7.13%. This distribution pattern indicates a moderate level of concentration, as the majority of tokens (87.42%) are held by addresses outside the top 5.

While there is some concentration at the top, it does not appear to be excessive. The distribution suggests a relatively balanced ownership structure, which is generally positive for market stability. However, the presence of a single address holding over 7% of the supply could potentially influence market dynamics if large transactions occur. The current distribution pattern implies a reasonable level of decentralization, which aligns with Polkadot's governance model and ecosystem objectives.

Overall, this holdings distribution reflects a market structure that balances between having influential stakeholders and maintaining a broad base of token holders. This equilibrium can contribute to a more resilient network and reduce the risk of market manipulation, although vigilance is still warranted regarding the actions of larger holders.

Click to view the current DOT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 16ZL8y...9czzBD | 116103.16K | 7.13% |

| 2 | 13Z7Kj...iPz8JT | 43597.45K | 2.67% |

| 3 | 12ouvK...TRs1ab | 16230.00K | 0.99% |

| 4 | 112RLy...Wz5Xui | 15225.62K | 0.93% |

| 5 | 11yLs2...yDWQjc | 14044.27K | 0.86% |

| - | Others | 1421941.40K | 87.42% |

II. Key Factors Influencing DOT's Future Price

Supply Mechanism

- Token Burn: The Polkadot network periodically burns DOT tokens, potentially reducing supply and increasing scarcity.

- Historical Pattern: Previous token burns have generally led to short-term price increases.

- Current Impact: Upcoming token burns may create upward pressure on DOT's price.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions have been increasing their DOT holdings, signaling growing confidence in the project.

- Enterprise Adoption: Several Fortune 500 companies are exploring Polkadot's technology for blockchain interoperability solutions.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' shift towards more accommodative policies could increase demand for alternative assets like DOT.

- Inflation Hedge Properties: DOT has shown some potential as an inflation hedge, attracting investors during periods of high inflation.

Technological Developments and Ecosystem Growth

- Polkadot 2.0: The upcoming major upgrade aims to enhance scalability and interoperability, potentially driving DOT's value.

- Parachain Expansion: The continuous addition of new parachains to the Polkadot network increases utility and demand for DOT.

- Ecosystem Applications: Growing DeFi and NFT projects on Polkadot are creating more use cases for DOT, potentially boosting its value.

III. DOT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.77 - $3.23

- Neutral prediction: $3.23 - $4.00

- Optimistic prediction: $4.00 - $4.59 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market cycle

- Price range forecast:

- 2027: $4.15 - $5.48

- 2028: $4.50 - $6.93

- Key catalysts: Ecosystem growth, increased parachain activity, and broader blockchain adoption

2029-2030 Long-term Outlook

- Base scenario: $5.93 - $7.30 (assuming steady growth and adoption)

- Optimistic scenario: $7.30 - $8.67 (with accelerated ecosystem expansion)

- Transformative scenario: $8.67 - $10.74 (with breakthrough applications and mass adoption)

- 2030-12-31: DOT $10.74 (potential peak if market conditions are highly favorable)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4.58802 | 3.231 | 1.77705 | 0 |

| 2026 | 4.92598 | 3.90951 | 3.08851 | 20 |

| 2027 | 5.47801 | 4.41775 | 4.15268 | 36 |

| 2028 | 6.92703 | 4.94788 | 4.50257 | 52 |

| 2029 | 8.66868 | 5.93745 | 3.68122 | 82 |

| 2030 | 10.73551 | 7.30306 | 6.28064 | 125 |

IV. Professional DOT Investment Strategies and Risk Management

DOT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a long-term perspective

- Operation suggestions:

- Dollar-cost average into DOT over time

- Hold through market cycles, focusing on fundamentals

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages: Use to identify trends and support/resistance levels

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop losses to manage risk

DOT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Polkadot wallet

- Security precautions: Use 2FA, backup seed phrases securely

V. Potential Risks and Challenges for DOT

DOT Market Risks

- High volatility: Significant price swings common in crypto markets

- Competition: Other layer-1 blockchains vying for market share

- Market sentiment: Susceptible to broader crypto market trends

DOT Regulatory Risks

- Uncertain regulations: Potential for unfavorable regulatory actions

- Cross-border compliance: Varying regulations across jurisdictions

- Securities classification: Risk of being classified as a security

DOT Technical Risks

- Smart contract vulnerabilities: Potential for exploits in parachain code

- Scalability challenges: Maintaining performance as network grows

- Interoperability issues: Difficulties in cross-chain communication

VI. Conclusion and Action Recommendations

DOT Investment Value Assessment

Polkadot offers long-term potential as a leading interoperability solution, but faces short-term volatility and competitive pressures. Its unique parachain model and strong developer ecosystem provide a solid foundation for growth.

DOT Investment Recommendations

✅ Beginners: Start with small, regular investments to build exposure

✅ Experienced investors: Consider a core holding with active management around it

✅ Institutional investors: Explore staking and parachain opportunities for yield

DOT Trading Participation Methods

- Spot trading: Buy and hold DOT on Gate.com

- Staking: Participate in network security and earn rewards

- Parachain auctions: Support projects building on Polkadot

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Dot reach $100?

Based on current projections, DOT reaching $100 appears highly unlikely. The highest price prediction for DOT by 2030 is just $1.61, far below the $100 mark.

What is the price prediction for DOT in 2025?

Based on current forecasts, DOT price in 2025 is expected to range between $4.01 and $13.90, with potential for significant market fluctuations.

Can Polkadot reach $50?

Yes, Polkadot has potential to reach $50. Analysts predict favorable market conditions, and current trends suggest it could happen in the near future.

What will a dot be worth in 5 years?

Based on current projections, DOT could be worth around $7.10 in 5 years. This estimate considers potential market growth and technological advancements in the Polkadot ecosystem.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

2025 NANO Price Prediction: Market Analysis and Growth Potential for the Digital Currency

2025 FTNPrice Prediction: Analyzing Market Trends, Tokenomics and Growth Potential of FTN in the Next Bull Cycle

What is CANTO?

What are the major security risks and vulnerabilities threatening Bitcoin Cash (BCH) in 2026?

How Do Exchange Inflows and Outflows Affect Bitcoin Cash (BCH) Price and Holdings Concentration?

Dịch vụ Tên Solana: Hướng dẫn đầy đủ về Coin SNS

Long Short là gì?