2025 DYDX Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: DYDX'in Piyasa Konumu ve Yatırım Değeri

DYDX (DYDX), merkeziyetsiz bir türev işlemleri protokolü olarak kuruluşundan bu yana kayda değer başarılara imza attı. 2025 yılı itibarıyla DYDX’in piyasa değeri 263.512.614 $ seviyesinde, dolaşımdaki arzı yaklaşık 790.379.768 token, fiyatı ise 0,3334 $ civarında seyrediyor. "DeFi türevlerinin öncüsü" olarak anılan bu varlık, merkeziyetsiz finans ve kripto para ticaretinde giderek daha önemli bir rol üstleniyor.

Bu makalede, DYDX’in 2025-2030 yılları arasındaki fiyat eğilimleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında analiz edilerek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. DYDX Fiyat Geçmişi ve Mevcut Piyasa Durumu

DYDX Tarihsel Fiyat Gelişimi

- 2024: 8 Mart 2024’te 4,52 $ ile tüm zamanların en yüksek seviyesine ulaştı

- 2025: 11 Ekim 2025’te 0,126201 $ ile tüm zamanların en düşük seviyesini gördü

- 2025: Son 24 saatte fiyat 0,3079 $ ile 0,3426 $ arasında dalgalandı

DYDX Güncel Piyasa Görünümü

18 Ekim 2025 itibarıyla DYDX, 0,3334 $ seviyesinden işlem görüyor ve son 24 saatte %2,05’lik bir gerileme yaşadı. Token’ın piyasa değeri 263.512.614,83 $ olup kripto piyasasında 238. sırada yer alıyor. Dolaşımdaki arz 790.379.768,53 DYDX ile toplam arzın %79,04’üne (958.342.751 DYDX) karşılık geliyor. Tam seyreltilmiş piyasa değeri ise 333.400.000 $ seviyesinde bulunuyor.

DYDX son dönemde yüksek volatiliteye sahne oldu; son bir haftada %1,65 yükselirken, son 30 günde %49,95’lik kayda değer bir düşüş yaşandı. Yıllık performans ise %65,06 geriledi; bu da token için zorlu bir piyasa ortamı anlamına geliyor.

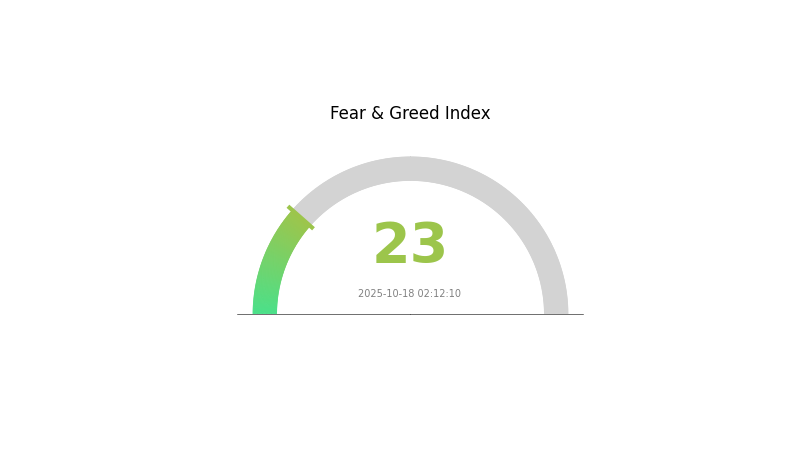

Kripto para piyasasında güncel hissiyat "Aşırı Korku" olarak öne çıkıyor ve VIX endeksi 23 seviyesinde, yatırımcılar arasında temkinli ve olası bir ayı piyasası beklentisinin baskın olduğunu gösteriyor.

Güncel DYDX piyasa fiyatını görüntülemek için tıklayın

DYDX Piyasa Hissiyatı Göstergesi

2025-10-18 Korku ve Açgözlülük Endeksi: 23 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksi'ni görmek için tıklayın

Kripto piyasasında aşırı korku hakim; Korku ve Açgözlülük Endeksi 23 seviyesine gerilemiş durumda. Bu derece kötümserlik, tecrübeli yatırımcılar için özgün fırsatlar sunabilir. Çoğu yatırımcı panikle satış yaparken, karşıt görüşlüler bunu bir giriş fırsatı olarak görebilir. Ancak, dikkatli olmak ve kapsamlı analiz yapmak büyük önem taşır. Unutmayın: Piyasa hissiyatı hızla değişebilir ve geçmiş performans geleceğin garantisi değildir. Bilgili kalın, Gate.com’da akıllıca işlem yapın.

DYDX Varlık Dağılımı

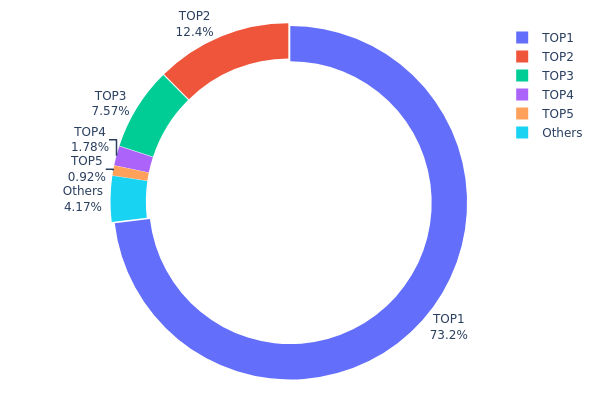

Adres bazlı dağılım verileri, DYDX’in sahipliğinin son derece yoğunlaştığını gösteriyor. En büyük adres, toplam arzın %73,15’ini elinde tutuyor; bu da ciddi bir merkezileşmeye işaret ediyor. İkinci ve üçüncü en büyük adresler ise sırasıyla %12,41 ve %7,56 ile sahiplikte yoğunluğu artırıyor.

Bu tür bir yoğunlaşma, piyasa istikrarı ve fiyat manipülasyonu riskini büyütüyor. Toplam tokenların %93’ünden fazlası yalnızca üç adreste; bu da büyük satışlar veya piyasa hareketlerinin birkaç büyük sahip tarafından tetiklenebileceği anlamına geliyor. Yoğunlaşma, volatiliteyi artırabilir ve küçük yatırımcıların piyasaya olan güvenini azaltabilir.

Piyasa yapısı açısından bakıldığında, bu dağılım DYDX için düşük merkeziyetsizlik seviyesini gösteriyor. Blokzincir teknolojisinin hedefi dağıtık sahiplik olsa da, DYDX’in mevcut durumu bu idealden uzak. Sahiplikteki bu yoğunlaşma, yönetişim kararlarını ve ekosistemin gelişim yönünü etkileyerek uzun vadeli istikrarı ve benimsenmeyi olumsuz etkileyebilir.

Güncel DYDX varlık dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x46b2...5ddfa9 | 731.503,69K | 73,15% |

| 2 | 0x0000...000001 | 124.128,55K | 12,41% |

| 3 | 0xb943...37292f | 75.682,30K | 7,56% |

| 4 | 0x08a9...5767d8 | 17.824,84K | 1,78% |

| 5 | 0x0000...000002 | 9.203,65K | 0,92% |

| - | Diğerleri | 41.656,97K | 4,18% |

II. DYDX’in Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Token Dağılımı: DYDX token’ları, alım-satım ödülleri, likidite sağlayıcı teşvikleri ve yönetişim katılımı gibi mekanizmalarla dağıtılır.

- Tarihsel Model: Geçmiş arz değişiklikleri fiyat hareketlerini etkiledi; dolaşımdaki arzın artışı genellikle volatilite ile ilişkili.

- Mevcut Etki: Süregelen token dağıtımı, dolaşımdaki arzı kademeli olarak artıracak ve piyasa dinamiklerini şekillendirebilir.

Kurumsal ve Balina Dinamikleri

- Kurumsal Varlıklar: Bazı kripto yatırım şirketleri ve DeFi odaklı fonlar DYDX’e ilgi gösteriyor, bu da uzun vadeli talebi istikrara kavuşturabilir.

- Kurumsal Benimseme: DeFi platformları ve merkeziyetsiz borsalar dYdX’in layer 2 protokolüyle entegrasyon arayışında ve bu, token’ın kullanım alanını artırıyor.

Makroekonomik Çevre

- Para Politikası Etkisi: Merkez bankalarının, özellikle Fed’in politikaları kripto piyasası hissiyatını ve DYDX fiyatını etkileyebilir.

- Enflasyona Karşı Koruma Özellikleri: DYDX, DeFi token’ı olarak enflasyona karşı koruma aracı olarak da değerlendirilebilir.

Teknik Gelişim ve Ekosistem Oluşturma

- Layer 2 Ölçeklendirme: dYdX’in layer 2 çözümleriyle işlem hızını artırma ve maliyetleri düşürme odağı, daha fazla kullanıcı çekebilir.

- Çapraz Zincir Uyumluluğu: Diğer blokzincirlerle birlikte çalışabilirliğin artırılması, DYDX’in kullanım alanını ve kullanıcı tabanını genişletebilir.

- Ekosistem Uygulamaları: dYdX ekosistemi; sürekli vadeli sözleşmeler ve spot işlemler gibi çeşitli DeFi uygulamalarını içeriyor ve bu da token talebini güçlendiriyor.

III. 2025-2030 DYDX Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,22908 $ - 0,30 $

- Tarafsız tahmin: 0,30 $ - 0,35 $

- İyimser tahmin: 0,35 $ - 0,39176 $ (uygun piyasa koşulları ve artan benimseme gerektirir)

2027-2028 Görünümü

- Büyüme aşaması ve artan oynaklık bekleniyor

- Fiyat tahmin aralığı:

- 2027: 0,22961 $ - 0,43797 $

- 2028: 0,246 $ - 0,53085 $

- Kilit katalizörler: DeFi sektörünün büyümesi, düzenleyici netleşme ve teknolojik ilerlemeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,48122 $ - 0,54859 $ (istikrarlı piyasa büyümesi ve benimseme varsayımı)

- İyimser senaryo: 0,54859 $ - 0,65000 $ (güçlü DeFi performansı varsayımı)

- Dönüştürücü senaryo: 0,65000 $ - 0,72602 $ (çığır açıcı yenilikler ve kitlesel benimseme varsayımı)

- 2030-12-31: DYDX 0,51491 $ (olası yıl sonu ortalama fiyat)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,39176 | 0,332 | 0,22908 | 0 |

| 2026 | 0,48854 | 0,36188 | 0,25693 | 8 |

| 2027 | 0,43797 | 0,42521 | 0,22961 | 27 |

| 2028 | 0,53085 | 0,43159 | 0,246 | 29 |

| 2029 | 0,54859 | 0,48122 | 0,25986 | 44 |

| 2030 | 0,72602 | 0,51491 | 0,48916 | 54 |

IV. DYDX İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

DYDX Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli perspektife ve yüksek risk toleransına sahip olanlar

- Uygulama önerileri:

- Kısa vadeli dalgalanmayı azaltmak için ortalama maliyet (DCA) yöntemi kullanın

- Projeden uzun vadeli fayda sağlamak amacıyla en az 3-5 yıl elde tutun

- DYDX token’larınızı güvenli, saklayıcı olmayan bir cüzdanda muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve giriş/çıkış noktalarını belirlemek için kullanın

- RSI: Aşırı alım/aşırı satım durumlarını değerlendirmede yardımcı olur

- Dalgalı işlemler için ana noktalar:

- DYDX’in genel kripto piyasasıyla korelasyonunu izleyin

- Riskleri yönetmek için sıkı zarar-durdur emirleri koyun

DYDX Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcı: Kripto portföyünün %1-3’ü

- Orta seviyede yatırımcı: Kripto portföyünün %3-5’i

- Agresif yatırımcı: Kripto portföyünün %5-10’u

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımlarınızı birden çok kripto varlığına dağıtın

- Zarar-durdur emirleri: Potansiyel kaybı sınırlandırmak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 Cüzdan’ı kullanın

- Soğuk depolama: Uzun vadeli saklama için donanım cüzdanı tercih edin

- Güvenlik önlemleri: İki aşamalı doğrulamayı etkinleştirin, güçlü şifreler kullanın

V. DYDX’e Yönelik Potansiyel Riskler ve Zorluklar

DYDX Piyasa Riskleri

- Yüksek volatilite: Kripto piyasalarında sık rastlanan büyük fiyat dalgalanmaları

- Likidite riski: Büyük işlemlerin fiyatı etkilemeden gerçekleştirilememesi riski

- Korelasyon riski: DYDX, genel kripto piyasasının hissiyatından etkilenebilir

DYDX Düzenleyici Riskler

- Bilinmez düzenleyici ortam: DEX platformlarını etkileyebilecek yeni düzenlemeler olasılığı

- Sınır ötesi uyumluluk: Farklı ülkelerdeki düzenlemelere uyum zorluğu

- Vergilendirme karmaşıklığı: Kripto ve DeFi işlemleri için sürekli değişen vergi kuralları

DYDX Teknik Riskler

- Akıllı sözleşme açıkları: Protokol kodunda olası güvenlik açıkları

- Ölçeklenebilirlik sorunları: Yoğun dönemde ağ tıkanıklığı riski

- Çapraz zincir uyumluluğu: Zincirler arası etkileşimde yaşanabilecek riskler

VI. Sonuç ve Eylem Önerileri

DYDX Yatırım Değeri Değerlendirmesi

DYDX, merkeziyetsiz türev işlemler alanında yüksek riskli fakat yüksek potansiyelli bir yatırım fırsatı sunuyor. Yenilikçi özellikleri ve büyüme potansiyeline rağmen, yatırımcılar kripto piyasasındaki yüksek volatilite ve düzenleyici belirsizlikleri göz önünde bulundurmalıdır.

DYDX Yatırım Önerileri

✅ Yeni başlayanlar: Kapsamlı araştırmayla küçük ve deneme amaçlı pozisyonlar açın ✅ Deneyimli yatırımcılar: Uygun risk yönetimiyle dengeli bir strateji uygulayın ✅ Kurumsal yatırımcılar: Detaylı durum tespiti yaparak çeşitlendirilmiş portföye eklemeyi değerlendirin

DYDX İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com’da DYDX token’ı alıp tutun

- DeFi staking: dYdX ekosisteminde getiri çiftçiliği fırsatlarına katılın

- Yönetişim: DYDX token’larıyla protokol yönetişimine dahil olun

Kripto para yatırımları çok yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk toleransınıza göre alın ve profesyonel finansal danışmanlara danışın. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

dYdX’in geleceği nasıl?

dYdX’in geleceği; artan benimseme, teknolojik gelişmeler ve merkeziyetsiz türev işlemler alanında genişleyen uygulamalarla umut vaat ediyor. DeFi ekosisteminde lider platformlardan biri olabilir.

dYdX ne kadar yükselebilir?

dYdX, artan kullanıcı benimsemesi, piyasa büyümesi ve protokol iyileştirmeleriyle 2026’ya kadar 50-100 $ aralığına ulaşabilir.

dYdX alınır mı?

Evet, dYdX alınmaya değer. Lider merkeziyetsiz borsalardan biri olarak DeFi alanında güçlü büyüme potansiyeline sahip. Yenilikçi özellikleri ve artan benimsenmesiyle kripto piyasasında cazip bir yatırım imkânı sunuyor.

2040 için dYdX fiyat tahmini nedir?

Mevcut trendler ve potansiyel büyüme dikkate alındığında, dYdX platformunun gelişimi ve DeFi’nin yaygınlaşmasıyla 2040’ta 500-1.000 $ seviyelerine ulaşabilir.

HYPE nedir: Sosyal medya trendleri ve viral içeriğin arkasındaki psikoloji

2025 POL Fiyat Tahmini: DeFi Benimsenmesi Hızlanırken Olumlu Beklenti

2025 CELR Fiyat Tahmini: Celer Network’ün Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

2025 ACX Fiyat Tahmini: Yükselen Trendler ve ACX Token'ın Geleceğine Yön Veren Temel Etkenler

2025'te Kripto Rekabet Analizi Pazar Payını Nasıl Yükseltir?

HGET nedir: Redis Hash Alanı Getirme Komutunun Detaylı Açıklaması

LayerZero (ZRO) Token’ını Anlamak: Arz ve Dolaşımdaki Duruma Dair Analiz

Bitcoin Ordinals Pazar Yerlerinde Nasıl Yol Alınır: Kapsamlı Rehber

Kripto Borç Verme Çözümleriyle Getirilerinizi Maksimuma Çıkarın