2025 EIGEN Fiyat Tahmini: Yükselen kripto para birimi için piyasa trendlerini ve potansiyel büyüme faktörlerini analiz etmek

Giriş: EIGEN’in Piyasa Konumu ve Yatırım Potansiyeli

Eigenlayer (EIGEN), kriptoekonomik güvenlikte öncü protokol olarak, kuruluşundan bu yana kayda değer bir yol kat etti. 2025 yılı itibarıyla EIGEN’in piyasa değeri $460.942.096’ya ulaştı; dolaşımdaki token sayısı yaklaşık 387.378.852 ve fiyatı $1,1899 civarında bulunuyor. “Restaking inovasyonunun öncüsü” olarak adlandırılan bu varlık, Ethereum’un konsensüs katmanını güçlendirmede ve kriptoekonomik güvenliği çeşitli uygulamalara yaymada giderek daha önemli bir rol üstleniyor.

Bu makalede, EIGEN’in 2025-2030 dönemi fiyat hareketleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler göz önünde bulundurularak derinlemesine analiz edilecek, yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. EIGEN Fiyat Geçmişi ve Mevcut Piyasa Durumu

EIGEN Tarihsel Fiyat Seyri

- 2024: EIGEN, 17 Aralık’ta $5,658 ile tüm zamanların en yüksek seviyesini gördü; bu, proje açısından önemli bir kilometre taşı oldu.

- 2025: Piyasa geriledi ve EIGEN, 10 Ekim’de $0,4947 ile tüm zamanların en düşük seviyesine indi.

- 2025: EIGEN toparlanma göstererek 17 Ekim itibarıyla $1,1899 seviyesine ulaştı.

EIGEN Güncel Piyasa Durumu

17 Ekim 2025 tarihinde EIGEN, $1,1899 seviyesinden işlem görüyor. Token, son 24 saatte %4,9 ve son bir haftada %33,73 oranında değer kaybetti. Güncel piyasa değeri $460.942.096; EIGEN, kripto para piyasasında 164. sırada yer alıyor. 24 saatlik işlem hacmi $10.585.351 olup, orta seviyede piyasa aktivitesine işaret ediyor. Dolaşımdaki EIGEN miktarı 387.378.852 ve bu, toplam arzın %23,15’ini oluşturuyor (toplam arz: 1.673.646.668). Tam seyreltilmiş piyasa değeri $1.991.472.170. Son dönemdeki aşağı yönlü fiyat hareketine rağmen EIGEN, %0,051 pazar hakimiyetini sürdürüyor.

Mevcut EIGEN piyasa fiyatı için tıklayın

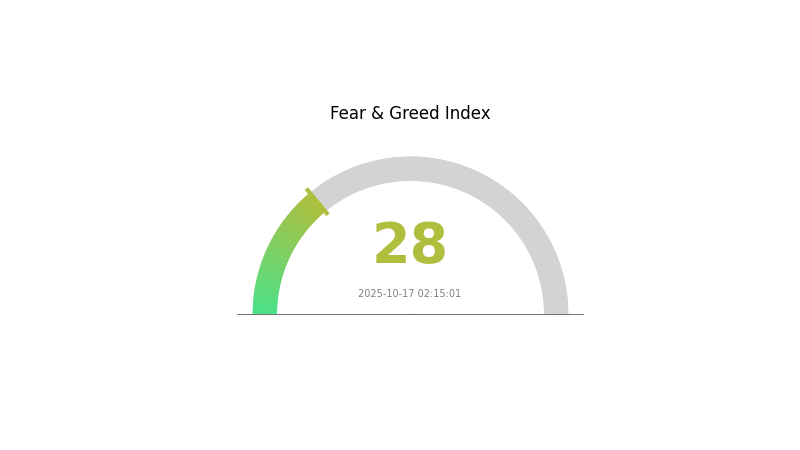

EIGEN Piyasa Duyarlılığı Göstergesi

17 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Mevcut Korku ve Açgözlülük Endeksi için tıklayın

Kripto para piyasasında hâkim olan duygu şu anda korku; EIGEN endeksi 28 seviyesinde. Bu, yatırımcıların piyasaya temkinli ve belirsiz yaklaştığını gösteriyor. Bu gibi dönemlerde bazıları, “Başkaları açgözlü olduğunda korkak, başkaları korkak olduğunda açgözlü ol” stratejisiyle alım fırsatı görebilir. Ancak, böyle dalgalı bir ortamda yatırım kararı almadan önce kapsamlı araştırma yapmak ve risk toleransınızı dikkate almak kritik önem taşır.

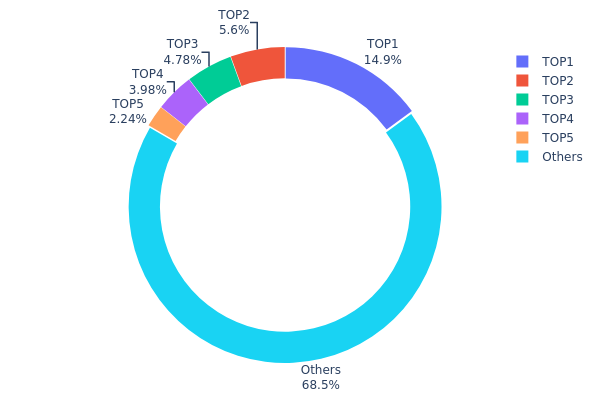

EIGEN Varlık Dağılımı

EIGEN adres varlık dağılımı verileri, orta derecede yoğunlaşmış bir sahiplik yapısına işaret ediyor. En büyük adres toplam arzın %14,93’ünü kontrol ediyor; onu izleyen dört büyük adresin her biri %2,24 ile %5,59 arasında paya sahip. İlk beş adres toplamda EIGEN tokenlarının %31,52’sini elinde bulundururken, kalan %68,48 ise diğer yatırımcılara yayılmış durumda.

Bu yoğunlaşma, piyasada hiçbir tekil aktörün ezici bir kontrole sahip olmadığını; dengeli bir yapı olduğunu gösteriyor. Ancak %15’e yakın paya sahip büyük bir adres, piyasa dinamiklerini etkileyebilir. Dağılım modeli, makul seviyede merkeziyetsizlik ve bunun fiyat istikrarı ile manipülasyon riskini azaltma potansiyeli olduğunu gösteriyor. Yine de, başta gelen adreslerin önemli hareketleri kısa vadeli volatiliteye sebep olabilir.

Sonuç olarak, mevcut EIGEN varlık dağılımı zincir üstü sağlıklı bir yapı ve büyük yatırımcılarla küçük yatırımcılar arasında iyi bir denge yansıtıyor. Bu durum, piyasa likiditesini destekler ve uzun vadeli ekosistem istikrarı sağlayabilir; fakat büyük sahiplerin adımları konusunda dikkatli olmak gerekir.

Mevcut EIGEN Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x5f55...7a19d7 | 262.113,05K | 14,93% |

| 2 | 0xec53...061f83 | 98.278,22K | 5,59% |

| 3 | 0x8778...25a60f | 83.934,23K | 4,78% |

| 4 | 0xf977...41acec | 69.876,95K | 3,98% |

| 5 | 0x34bc...67a026 | 39.403,64K | 2,24% |

| - | Diğerleri | 1.201.999,74K | 68,48% |

II. EIGEN’in Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Staking Ölçeği: Havuzda stake edilen toplam varlık miktarı belirleyicidir. Büyük staking ölçeği daha yüksek güvenlik sağlar ve kullanıcı çekim gücünü artırır.

- Tarihsel Seyir: Geçmişteki arz değişimleri EIGEN fiyatını etkilemiştir; stake artışı genellikle fiyat yükselişiyle paralellik gösterir.

- Güncel Etki: EigenLayer’daki staking hacminin beklenen büyümesi, EIGEN fiyatı üzerinde yukarı yönlü baskı yaratacaktır.

Kurumsal ve Büyük Yatırımcı Hareketleri

- Kurumsal Benimseme: EigenLayer’ın güvenlik ve verimlilik için kurumsal entegrasyonu, EIGEN talebini artırabilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: EIGEN’in enflasyonist dönemlerdeki performansı yakından izlenecek ve dijital bir değer saklama aracı olarak öne çıkabilir.

Teknik Gelişim ve Ekosistem İnşası

- Restaking Teknolojisi: Restaking’in yenilikçi yapısı, sermaye verimliliğini ve güvenliği artırarak EIGEN’in değerini yükseltebilir.

- Aktif Doğrulayıcı Hizmetleri (AVS): AVS’nin geliştirilmesi ve yaygınlaşması, EigenLayer’ın kullanım alanını ve EIGEN talebini önemli ölçüde artırabilir.

- Ekosistem Uygulamaları: EigenLayer üzerinde geliştirilen köprüler ve veri erişim katmanları gibi projeler, EIGEN’in işlevselliğini ve değerini artırabilir.

III. EIGEN Fiyat Tahmini: 2025-2030 Dönemi

2025 Öngörüsü

- Temkinli tahmin: $0,90 - $1,00

- Tarafsız tahmin: $1,10 - $1,20

- İyimser tahmin: $1,30 - $1,43 (olumlu piyasa koşullarıyla)

2027 Orta Vadeli Öngörü

- Piyasa fazı: Olası büyüme dönemi

- Fiyat aralığı tahminleri:

- 2026: $0,71 - $1,61

- 2027: $1,12 - $2,03

- Kilit katalizörler: Benimseme artışı, teknolojik yenilikler

2030 Uzun Vadeli Öngörü

- Temel senaryo: $2,20 - $2,30 (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: $2,30 - $2,46 (güçlü ekosistem gelişimiyle)

- Dönüştürücü senaryo: $2,46 - $2,50 (çığır açan kullanım ve kitlesel benimsemeyle)

- 31 Aralık 2030: EIGEN $2,30 (2025’e göre %93 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 1,4268 | 1,189 | 0,90364 | 0 |

| 2026 | 1,60872 | 1,3079 | 0,70627 | 9 |

| 2027 | 2,02705 | 1,45831 | 1,1229 | 22 |

| 2028 | 2,49203 | 1,74268 | 1,51613 | 46 |

| 2029 | 2,4773 | 2,11735 | 1,20689 | 77 |

| 2030 | 2,45814 | 2,29733 | 2,20544 | 93 |

IV. EIGEN İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

EIGEN Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: EigenLayer teknolojisine uzun vadeli güven duyan yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde EIGEN token biriktirin

- Stake ederek ek ödül kazanın

- Tokenlarınızı güvenli donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını saptamak için

- RSI: Aşırı alım ve aşırı satım bölgelerini takip etmek için

- Dalgalı alım-satım için kritik noktalar:

- Teknik göstergelere göre açık giriş-çıkış noktaları belirleyin

- EigenLayer projesi gelişmelerini ve piyasa duyarlılığını izleyin

EIGEN Risk Yönetimi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: EIGEN’i farklı kripto varlıklarla dengeleyin

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için seviyeler belirleyin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli saklama için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki faktörlü doğrulama aktif edin, güçlü şifreler kullanın

V. EIGEN İçin Potansiyel Riskler ve Zorluklar

EIGEN Piyasa Riskleri

- Yüksek volatilite: EIGEN fiyatında büyük dalgalanmalar görülebilir

- Piyasa duyarlılığı: Olumsuz haberler veya genel piyasa düşüşleri EIGEN’i etkileyebilir

- Rekabet: Benzer projelerin varlığı EIGEN’in pazar payını azaltabilir

EIGEN Regülasyon Riskleri

- Düzenleyici belirsizlikler: Kripto düzenlemeleri EIGEN’in operasyonlarını değiştirebilir

- Uyum gereklilikleri: Artan regülasyon ek uyum maliyetleri doğurabilir

- Bölgesel kısıtlamalar: Bazı ülkelerde EIGEN işlemlerine sınırlama getirilebilir

EIGEN Teknik Riskler

- Akıllı kontrat açıkları: EigenLayer’ın akıllı kontratlarında hata veya istismar riski

- Ölçeklenebilirlik sorunları: Ağ büyüdükçe teknik zorluklar ortaya çıkabilir

- Birlikte çalışabilirlik riskleri: Diğer blokzincirlerle uyumsuzluk yaşanabilir

VI. Sonuç ve Eylem Önerileri

EIGEN Yatırım Değeri Analizi

EIGEN, Ethereum ekosisteminde restaking mekanizmasıyla ayırt edici bir değer sunuyor. Ancak, yatırımcıların bu görece yeni projedeki yüksek oynaklık ve risklerin farkında olması gerekir.

EIGEN Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, EigenLayer teknolojisini öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Tutma ve alım-satım yaklaşımlarını dengeli kullanın ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın ve EIGEN’i çeşitlendirilmiş portföye dahil etmeyi değerlendirin

EIGEN Alım-Satım Yöntemleri

- Spot alım-satım: Gate.com üzerinden EIGEN alın ve satın

- Staking: Ek ödüller için EIGEN staking programlarına katılın

- DeFi entegrasyonu: EigenLayer tabanlı DeFi uygulamalarını inceleyin

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk toleranslarına göre dikkatle vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

Eigen coin için fiyat tahmini nedir?

Uzmanlar, EIGEN fiyatının 2025 Ekim ayında $0,833 - $1,20 aralığında olacağını ve potansiyel olarak $1,02 seviyesine çıkabileceğini öngörüyor. 2033’te ise ortalama $39,47’ye ulaşması bekleniyor.

2040 yılında Eigen için fiyat tahmini nedir?

Mevcut piyasa analizine göre, Eigen’ın fiyatı 2040’ta yaklaşık $270 seviyesine ulaşacak; bu da uzun vadede güçlü büyüme potansiyeli gösteriyor.

Eigen Layer’ın geleceği var mı?

Evet, Eigen Layer DeFi’nin geleceği açısından umut verici. Ölçeklenebilirlik ve birlikte çalışabilirlikteki yenilikçi yaklaşımı, blokzincir altyapısında devrim yaratabilir ve yaygın benimseme ile değer artışına yol açabilir.

Bir EIGEN tokenı kaç değerinde?

17 Ekim 2025 itibarıyla bir EIGEN token yaklaşık 0,000303 ETH değerindedir. Yani 1 ETH, yaklaşık 3.300 EIGEN token ile takas edilebilir.

2025 WEETH Fiyat Tahmini: Gelişen DeFi Ekosisteminde Piyasa Trendlerini ve Büyüme Potansiyelini Analiz Etmek

Swell Network (SWELL) Yatırım İçin Uygun mu? Likit Stake Ekosisteminde Potansiyel Getiri ve Piyasa Konumunun Değerlendirilmesi

2025 STETH Fiyat Tahmini: Lido Stake Edilmiş Ethereum’a Yönelik Piyasa Trendleri ve Uzman Tahminlerinin Analizi

2025'te ETH Staking: Zincir Üstü Seçenekler ve En İyi Platformlar

Uniswap Fiyat Analizi 2025: DeFi Pazar Pozisyonu ve Uzun Vadeli Yatırım Beklentileri

ETH'nizi maksimize edin: Gate'in on-chain Staking'i 2025'te %5.82 yıllık getirisi sunuyor.

Ethereum 2.0: Yatırım İçin Kapsamlı Rehber