2025 ENJ Price Prediction: Analyzing Market Trends and Potential Growth Factors for Enjin Coin

Introduction: ENJ's Market Position and Investment Value

Enjin Coin (ENJ), as a leading platform in the online gaming community creation space, has made significant strides since its inception in 2009. As of 2025, ENJ's market capitalization has reached $86,110,473, with a circulating supply of approximately 1,893,786,529 coins, and a price hovering around $0.04547. This asset, often referred to as the "gaming ecosystem enabler," is playing an increasingly crucial role in the virtual goods and gaming community sectors.

This article will comprehensively analyze ENJ's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ENJ Price History Review and Current Market Status

ENJ Historical Price Evolution

- 2017: ENJ launched, price reached ATL of $0.01865964 on November 12

- 2021: Bull market peak, ENJ hit ATH of $4.82 on November 25

- 2022-2023: Crypto winter, price declined significantly from ATH

ENJ Current Market Situation

As of October 21, 2025, ENJ is trading at $0.04547, down 0.39% in the last 24 hours. The coin has seen a substantial decline over the past year, dropping 73.03% from its price a year ago. ENJ's market cap stands at $86,110,473, ranking it 447th among cryptocurrencies. The current price is 99.06% below its all-time high, indicating a prolonged bearish trend. Trading volume in the past 24 hours is $35,796.77, suggesting moderate market activity. The market sentiment appears bearish, with short-term and long-term price trends showing consistent declines across various timeframes.

Click to view the current ENJ market price

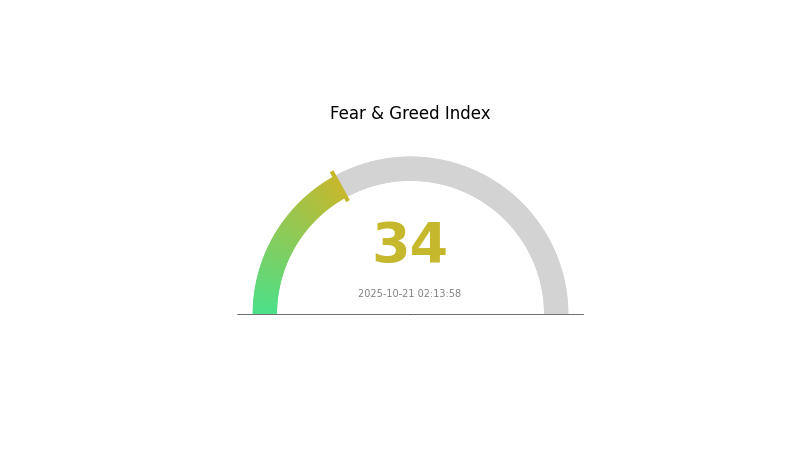

ENJ Market Sentiment Indicator

2025-10-21 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 34, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. During such periods, it's crucial to conduct thorough research and consider dollar-cost averaging strategies. Remember, market cycles are natural, and extreme fear often precedes potential rebounds. Stay informed, manage risks wisely, and consider using Gate.com's advanced trading tools to navigate these uncertain times.

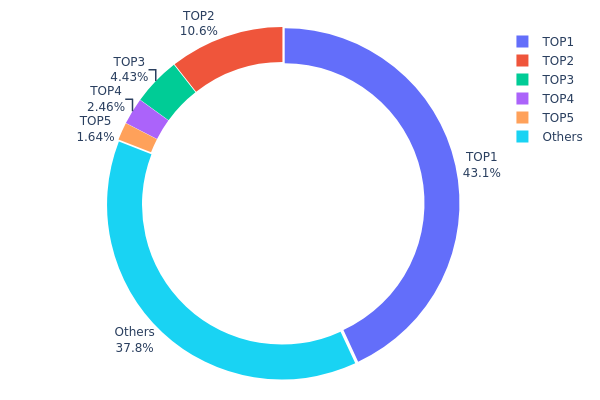

ENJ Holdings Distribution

The address holdings distribution data for ENJ reveals significant concentration among top addresses. The largest holder, a burn address (0x0000...00dead), contains 43.09% of the total supply, effectively removing these tokens from circulation. The second-largest address holds 10.58%, while the top 5 addresses collectively control 62.18% of ENJ tokens.

This concentration pattern indicates a relatively centralized distribution for ENJ. With over 60% of tokens held by just five addresses, there's potential for these large holders to exert substantial influence on market dynamics. The high concentration in a few wallets could lead to increased volatility if large transactions occur. However, the significant portion in the burn address may provide some stability by reducing circulating supply.

The current distribution suggests a moderate level of decentralization for ENJ, with 37.82% held by smaller addresses. This structure implies a balance between major stakeholders and broader community participation, which could contribute to the token's long-term stability and adoption potential.

Click to view the current ENJ Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 430973.84K | 43.09% |

| 2 | 0xf977...41acec | 105873.12K | 10.58% |

| 3 | 0xd4e6...888127 | 44285.55K | 4.42% |

| 4 | 0x3727...866be8 | 24610.77K | 2.46% |

| 5 | 0xf30b...0f0eb0 | 16360.78K | 1.63% |

| - | Others | 377895.94K | 37.82% |

II. Key Factors Affecting ENJ's Future Price

Supply Mechanism

- Daily Minting: 100,000 new PIXEL tokens are minted daily and distributed to active players who participate in activities beneficial to the Pixels ecosystem.

- Current Impact: The controlled and predictable supply of PIXEL tokens may help stabilize ENJ's price in the long term.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's policy adjustments have slowed the growth of Enjin Coin's price in 2023, along with the broader cryptocurrency market.

Technological Development and Ecosystem Building

- NFT Market Growth: The development of the NFT market in recent years has been a significant factor influencing ENJ's price.

- Ecosystem Applications: Gamefi projects such as SAND, MANA, GALA, ENJ, RON, PIXEL, ACE, ILV, and MAGIC are part of the broader ecosystem that could impact ENJ's future price.

III. ENJ Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02685 - $0.0455

- Neutral prediction: $0.0455 - $0.05

- Optimistic prediction: $0.05 - $0.06097 (requires strong market recovery and increased adoption of ENJ in gaming)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2027: $0.04083 - $0.07601

- 2028: $0.05831 - $0.09579

- Key catalysts: Expansion of ENJ ecosystem, integration with more gaming platforms

2029-2030 Long-term Outlook

- Base scenario: $0.07021 - $0.09293 (assuming steady growth in the gaming and NFT markets)

- Optimistic scenario: $0.09293 - $0.10325 (with widespread adoption of ENJ in mainstream gaming)

- Transformative scenario: $0.10222 - $0.12 (extreme favorable conditions such as major partnerships and technological breakthroughs)

- 2030-12-31: ENJ $0.10222 (potential peak based on current projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06097 | 0.0455 | 0.02685 | 0 |

| 2026 | 0.0724 | 0.05324 | 0.03939 | 17 |

| 2027 | 0.07601 | 0.06282 | 0.04083 | 38 |

| 2028 | 0.09579 | 0.06941 | 0.05831 | 52 |

| 2029 | 0.10325 | 0.0826 | 0.07021 | 81 |

| 2030 | 0.10222 | 0.09293 | 0.07062 | 104 |

IV. ENJ Professional Investment Strategies and Risk Management

ENJ Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and blockchain gaming enthusiasts

- Operation suggestions:

- Accumulate ENJ during market dips

- Hold for at least 2-3 years to capture potential gaming industry growth

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

ENJ Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens

- Options: Consider using options contracts to hedge downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords

V. ENJ Potential Risks and Challenges

ENJ Market Risks

- High volatility: ENJ price can experience significant fluctuations

- Gaming industry dependency: ENJ value is tied to blockchain gaming adoption

- Competition: Other gaming tokens may gain market share

ENJ Regulatory Risks

- Uncertain regulations: Crypto regulations may impact ENJ's utility and value

- Cross-border restrictions: International regulations may limit ENJ's global use

- Tax implications: Unclear tax treatment of gaming tokens in some jurisdictions

ENJ Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the ENJ ecosystem

- Scalability challenges: High network congestion could impact user experience

- Interoperability issues: Compatibility problems with other blockchain networks

VI. Conclusion and Action Recommendations

ENJ Investment Value Assessment

ENJ offers long-term potential in the growing blockchain gaming sector but faces short-term volatility and regulatory uncertainties.

ENJ Investment Recommendations

✅ Beginners: Start with small positions and focus on education ✅ Experienced investors: Consider allocating 5-10% of crypto portfolio to ENJ ✅ Institutional investors: Explore strategic partnerships within the gaming industry

ENJ Trading Participation Methods

- Spot trading: Buy and sell ENJ on Gate.com's spot market

- Staking: Participate in ENJ staking programs for passive income

- DeFi: Explore decentralized finance options using ENJ tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does ENJ Coin have a future?

ENJ Coin's future looks promising. It's predicted to increase by 4.36% and reach $0.07619 by October 2025, showing potential for growth in the coming years.

What will Enjin be worth in 2025?

Based on market analysis, Enjin Coin is projected to reach a maximum price of $4.13 and a minimum of $2.60 by the end of 2025.

How high will an ENJ go?

ENJ could potentially reach a high of $0.16182 by the end of 2025, based on current market trends and forecasts.

Will Enjin reach $10?

Enjin could potentially reach $10 in the future, given its strong position in the gaming and NFT sectors. However, exact price predictions are uncertain and depend on market conditions and adoption rates.

2025 CWS Price Prediction: Analyzing Market Trends and Potential Growth Factors for Crowns

2025 GCOIN Price Prediction: Analyzing Potential Growth and Market Trends for the Digital Asset

KARRAT vs ENJ: A Comprehensive Comparison of Two Leading Gaming Token Projects

2025 AGLD Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 OSHI Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 CTA Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Ethereum Scalability Optimization: Vitalik Buterin's Vision for 2025 and Beyond

How to Stake Algorand: Staking Rewards and Best Platforms

XRP Stands Out: Crypto Funds Experience $1.94 Billion in Outflows

Bitcoin vs Ethereum: Which cryptocurrency best fits your needs?

Gradient Network Airdrop: Latest Updates, How to Join, and What's Next