2025 ENS Fiyat Tahmini: Merkeziyetsiz Alan Adlarının Geleceğinde Yol Almak

Giriş: ENS’in Piyasa Konumu ve Yatırım Değeri

Ethereum Name Service (ENS), Ethereum blokzinciri üzerinde dağıtık, açık ve genişletilebilir bir isimlendirme sistemi olarak 2017’den bu yana kayda değer başarılar elde etti. 2025 itibarıyla ENS’in piyasa değeri 520.202.201 dolar, dolaşımdaki arzı yaklaşık 33.165.585 token ve fiyatı 15,685 dolar civarında seyrediyor. “Web3’ün DNS’i” olarak anılan bu varlık, blokzincir adreslerini sadeleştirerek merkeziyetsiz webde kullanıcı deneyimini iyileştirmede giderek daha önemli bir rol üstleniyor.

Bu makale; ENS’in 2025-2030 yıllarındaki fiyat hareketlerini, tarihsel trendler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler kapsamında detaylı şekilde analiz ederek yatırımcılara profesyonel değer tahminleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. ENS Fiyat Geçmişi ve Güncel Piyasa Durumu

ENS Tarihsel Fiyat Seyri

- 2021: ENS token lansmanı, 11 Kasım’da tüm zamanların en yüksek seviyesi olan 83,4 dolara ulaştı

- 2023: Piyasa gerilemesi, 19 Ekim’de tüm zamanların en düşük seviyesi olan 6,69 dolara indi

- 2025: Fiyat toparlandı ve istikrar kazandı, şu anda 15,685 dolardan işlem görüyor

ENS’in Güncel Piyasa Durumu

17 Ekim 2025 tarihinde ENS, 15,685 dolardan işlem görüyor ve son 24 saatte %4,07 oranında değer kaybetti. Token’ın piyasa değeri 520.202.201 dolar olup, kripto para piyasasında 146’ncı sırada yer alıyor. ENS’in dolaşımdaki arzı 33.165.585, toplam arzı ise 100.000.000 adettir. 24 saatlik işlem hacmi 2.505.346 dolar ile orta düzeyde piyasa faaliyeti gösteriyor. Son fiyat düşüşüne rağmen ENS, %33,17’lik piyasa değeri/fully diluted ratio oranıyla dayanıklılığını korudu. Token’ın fiyatı son bir haftada %24,7, son bir ayda ise %33,73 gerileyerek kısa vadede düşüş eğilimine işaret ediyor.

Güncel ENS piyasa fiyatını görmek için tıklayın

ENS Piyasa Duyarlılığı Göstergesi

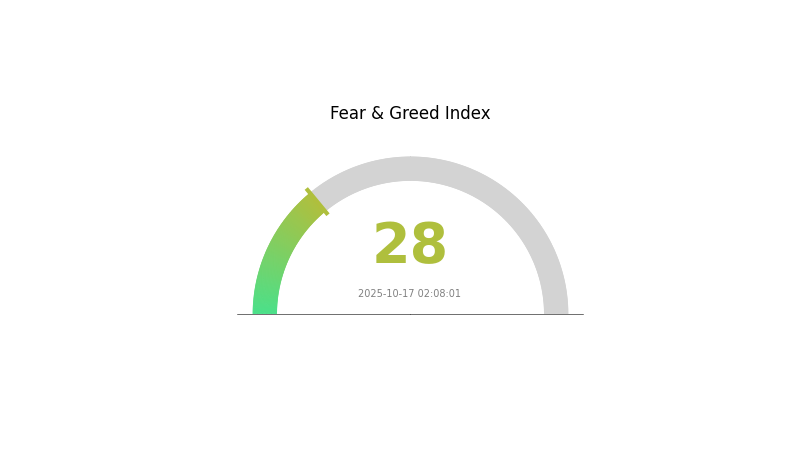

2025-10-17 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 28 olarak ölçüldü. Yatırımcılar arasında temkinli bir hava var ve “başkaları korkuyorken açgözlü ol” ilkesini benimseyenler için bu durum bir alım fırsatı anlamına gelebilir. Yine de yatırım kararınızı vermeden önce kapsamlı araştırma yapmalı ve kendi risk toleransınızı göz önünde bulundurmalısınız. Unutmayın, piyasa duyarlılığı hızla değişebilir ve geçmiş performans geleceği garanti etmez.

ENS Varlık Dağılımı

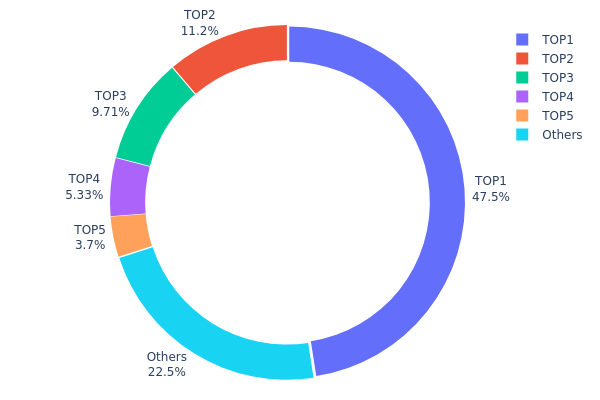

Adres varlık dağılımı verileri, ENS tokenlarının az sayıda üst adres arasında ciddi oranda yoğunlaştığını gösteriyor. En üst adres toplam arzın %47,54’ünü elinde bulunduruyor; bu da yüksek merkezileşmeye işaret ediyor. İlk beş adres toplamda ENS tokenlarının %77,49’unu kontrol ederken, kalan %22,51 ise diğer sahipler arasında dağılmış durumda.

Bu yoğunlaşma, piyasa kırılganlığı ve olası fiyat manipülasyonu risklerini gündeme getiriyor. Arzın neredeyse yarısının tek bir varlıkta olması, bu sahibin büyük hacimli hareketleri ENS’in piyasa dinamiklerini önemli ölçüde etkileyebilir. Yoğunlaşma, merkeziyetsizliğin düşük olduğu anlamına gelir ve bu durum birçok blokzincir projesinin temel ilkeleriyle çelişebilir.

Bununla birlikte, en üst adres haricinde birden fazla büyük sahibin bulunması, belirli ölçüde dağıtılmış kontrol sağlar. Ancak mevcut dağılım modeli, ENS’in zincir üstü yapısı ve fiyat istikrarının az sayıda kilit oyuncunun hareketlerinden etkilenebileceğini ve bunun uzun vadeli piyasa davranışına ve benimsenmesine tesir edeceğini göstermektedir.

Güncel ENS Varlık Dağılımı için tıklayın

| Üst | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0xd7a0...4df23f | 47.545,53K | 47,54% |

| 2 | 0x2454...84059d | 11.224,85K | 11,22% |

| 3 | 0xfe89...2d44b7 | 9.711,04K | 9,71% |

| 4 | 0x690f...9606f2 | 5.329,78K | 5,32% |

| 5 | 0xf977...41acec | 3.700,58K | 3,70% |

| - | Diğerleri | 22.488,22K | 22,51% |

II. ENS’in Gelecek Fiyatını Etkileyen Temel Faktörler

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimsenme: Web3 alanında merkeziyetsiz alan hizmetleri için ENS’i kullanan önde gelen şirketler

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Enflasyonist ortamlarda dijital varlık olarak performansı

Teknolojik Gelişim ve Ekosistem İnşası

- ENS v2 Yükseltmesi: Güncelleme içeriği ve ENS ekosistemine etkisi

- Ekosistem Uygulamaları: ENS alanlarını kullanan başlıca DApp’ler ve ekosistem projeleri

III. 2025-2030 ENS Fiyat Öngörüsü

2025 Görünümü

- Temkinli senaryo: 11,27 - 15,65 dolar

- Tarafsız senaryo: 15,65 - 19,49 dolar

- İyimser senaryo: 19,49 - 23,32 dolar (Web3 benimsenmesinde sürekli büyüme gerektirir)

2027-2028 Görünümü

- Piyasa beklentisi: Konsolidasyon evresi sonrasında istikrarlı büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 19,12 - 29,61 dolar

- 2028: 20,07 - 36,62 dolar

- Temel tetikleyiciler: ENS’in merkeziyetsiz uygulamalar ve geniş Web3 ekosisteminde entegrasyonunun artması

2030 Uzun Vadeli Görünüm

- Temel senaryo: 33,63 - 40,00 dolar (Web3 benimsenmesinin istikrarlı büyümesiyle)

- İyimser senaryo: 40,00 - 50,11 dolar (merkeziyetsiz teknolojilerin hızlı benimsenmesiyle)

- Dönüşüm senaryosu: 50,11 - 60,00 dolar (ENS’in birçok blokzincirde dijital kimlik standardı haline gelmesiyle)

- 2030-12-31: ENS 33,63 dolar (2025 ortalama fiyatına kıyasla %114 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış Oranı |

|---|---|---|---|---|

| 2025 | 23,32446 | 15,654 | 11,27088 | 0 |

| 2026 | 21,63305 | 19,48923 | 14,81181 | 24 |

| 2027 | 29,60804 | 20,56114 | 19,12186 | 31 |

| 2028 | 36,6235 | 25,08459 | 20,06767 | 59 |

| 2029 | 36,40777 | 30,85404 | 17,89535 | 96 |

| 2030 | 50,11005 | 33,63091 | 20,85116 | 114 |

IV. ENS Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ENS Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- Operasyon önerileri:

- Piyasa gerilemelerinde ENS token biriktirin

- ENS yönetişimine katılarak ek ödüller kazanın

- Tokenları güvenli, saklama gerektirmeyen bir cüzdanda muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama: Eğilimleri ve potansiyel giriş/çıkış noktalarını belirlemek için kullanılır

- Göreli Güç Endeksi (RSI): Aşırı alım/aşırı satım durumunu izler

- Dalgalı alım-satım için temel noktalar:

- Teknik göstergelere dayalı net giriş ve çıkış noktaları belirleyin

- ENS ekosistem gelişmelerini olası fiyat tetikleyicileri açısından takip edin

ENS Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Aggresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyoneller: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımlarınızı birden fazla kripto varlığına yayın

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk depolama çözümü: Uzun vadeli tutumlar için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki faktörlü kimlik doğrulamayı etkinleştirin, güçlü şifreler kullanın

V. ENS’in Karşılaşabileceği Riskler ve Zorluklar

ENS Piyasa Riskleri

- Oynaklık: ENS fiyatı ciddi dalgalanmalara maruz kalabilir

- Rekabet: Yeni blokzincir isimlendirme sistemleri ortaya çıkabilir

- Benimsenme: Yavaş kullanıcı adaptasyonu token değerini olumsuz etkileyebilir

ENS Düzenleyici Riskleri

- Belirsiz düzenlemeler: Olumsuz yasal değişiklik riski

- Sınır ötesi karmaşıklıklar: Farklı ülkelerde değişen hukuki statü

- Vergilendirme belirsizliği: ENS tokenlarının vergisel muamelesinde değişimler

ENS Teknik Riskleri

- Akıllı sözleşme açıkları: Sömürü veya hata riski

- Ölçeklenebilirlik sorunları: Ethereum ağında tıkanıklık ENS’in performansını etkileyebilir

- Yükseltme güçlükleri: Sistem genelinde iyileştirmeleri hayata geçirmede zorluklar

VI. Sonuç ve Eylem Önerileri

ENS’in Yatırım Değerinin Değerlendirilmesi

ENS, Web3 ekosisteminin temel altyapısı olarak uzun vadede ciddi potansiyele sahipken, kısa vadede fiyat dalgalanması ve benimsenme zorluklarıyla karşı karşıyadır. Değer önerisi Ethereum’daki önde gelen isimlendirme sistemi olmasına dayanırken, piyasa oynaklığı ve düzenleyici belirsizlikler ana risk unsurlarıdır.

ENS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük ve düzenli yatırımlarla yavaş yavaş pozisyon oluşturun ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ile aktif alım-satımı birlikte değerlendirin ✅ Kurumsal yatırımcılar: ENS’i çeşitlendirilmiş bir kripto portföyünde uzun vadeli faydasına odaklanarak değerlendirin

ENS Alım-Satım Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden ENS token alımı

- Stake etme: ENS yönetişimine katılarak ödül kazanma

- DeFi entegrasyonu: ENS’i çeşitli merkeziyetsiz finans uygulamalarında kullanma

Kripto para yatırımları son derece yüksek risk içerir ve bu makale yatırım tavsiyesi niteliği taşımamaktadır. Yatırımcılar, kendi risk profillerine göre dikkatli hareket etmeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırım yapmayın.

SSS

ENS iyi bir yatırım mı?

Evet, ENS güçlü bir yatırım olarak değerlendiriliyor. Analistler “Güçlü Al” görüşünde olup, çoğunlukla Web3 ve kripto para alanında sağlam bir yatırım olarak öneriyor.

ENS’in geleceği nedir?

ENS, Web3 kimliğinin temel unsuru haline gelerek dijital güvenliği ve kullanıcı dostu gezinmeyi artıracak. Gelişmiş merkeziyetsiz protokollerle bütünleşerek kripto ekosistemindeki rolünü genişletecek.

ENS’e yatırımın riskleri nelerdir?

Başlıca riskler; piyasa oynaklığı, likidite sorunları, sınırlı geçmiş, belirsiz talep ve olası çatallanmadır. Bu unsurlar ENS’in değer ve istikrarını ciddi şekilde etkileyebilir.

Ethereum’un 2030 fiyat tahmini nedir?

Ethereum’un 2030 fiyatının, akıllı sözleşmelerde %70 pazar payı varsayımıyla 11.800 dolara ulaşacağı tahmin edilmektedir.

Ethereum Kurucusu Vitalik Buterin: Yaş, Geçmiş ve Başarılar

2Z ve GRT: Yükselen Teknoloji Pazarında Hakimiyet Savaşı

ENS vs GMX: Web3’te Hangi Merkeziyetsiz Alan Adı Sistemi Hakimiyet Kuracak?

2025 GEL Fiyat Tahmini: Gürcistan Larisi, Başlıca Para Birimleri Karşısında Güç kazanacak mı?

Yearn Finance'in yETH Saldırısı: 3 Milyon Dolar Tornado Cash'e Aktarıldı - DeFi Güvenlik Analizi

Blockchain veri akışlarıyla DeFi'nin potansiyelini ortaya çıkarmak

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması