2025 FDUSD Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: FDUSD's Market Position and Investment Value

First Digital USD (FDUSD), as a fiat-backed stablecoin, has achieved significant milestones since its launch in 2023. As of 2025, FDUSD's market capitalization has reached $1,448,544,294, with a circulating supply of approximately 1,452,465,952.2 tokens, maintaining a price around $0.9973. This asset, known as a "secure and efficient digital dollar," is playing an increasingly crucial role in facilitating financial transactions and cross-border payments.

This article will comprehensively analyze FDUSD's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

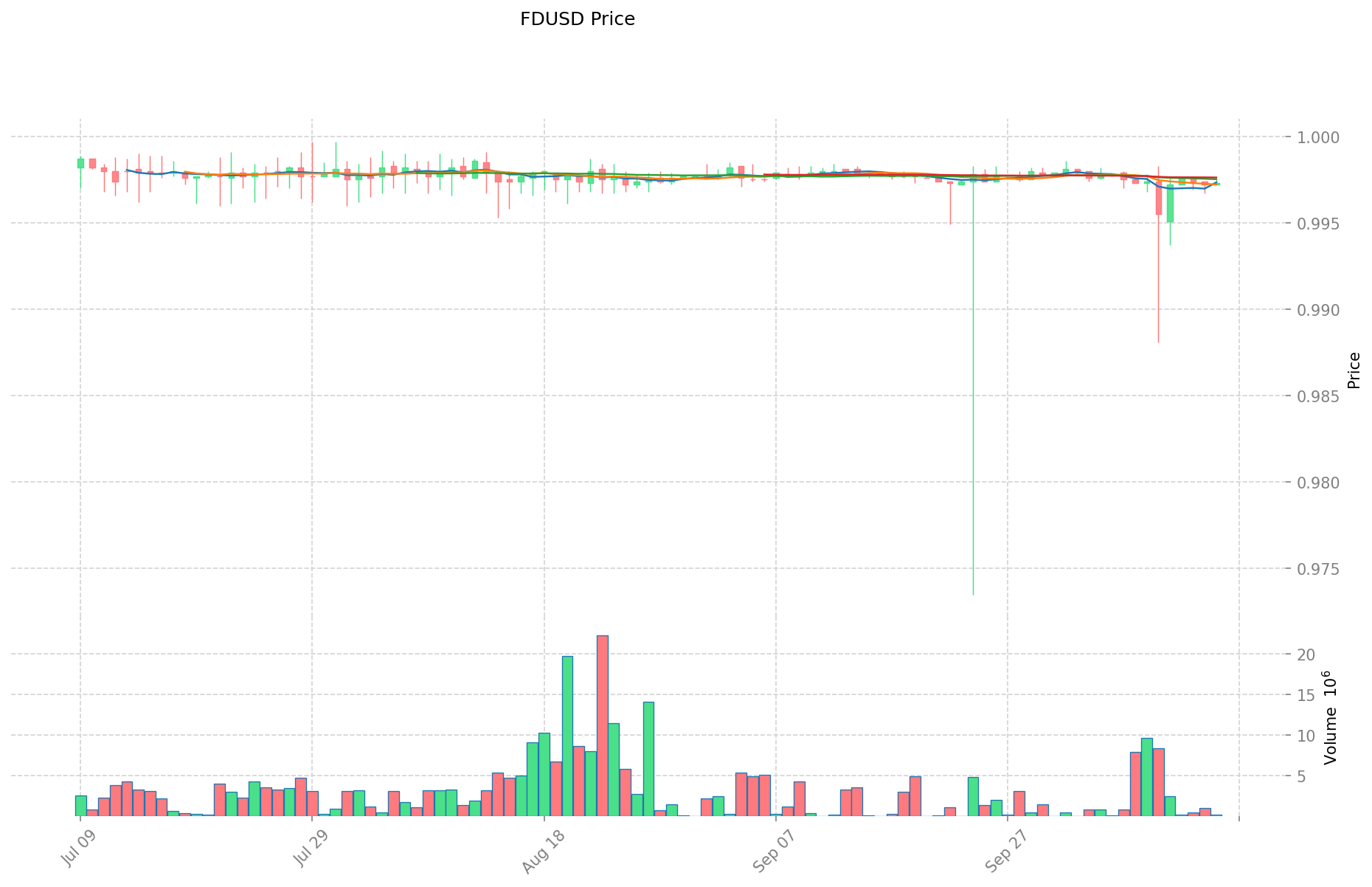

I. FDUSD Price History Review and Current Market Status

FDUSD Historical Price Evolution Trajectory

- 2023: FDUSD launched, price stabilized around $1

- 2024: Reached all-time high of $1.0093 on December 24th

- 2025: Experienced a dip to $0.8799 on April 2nd, lowest point in its history

FDUSD Current Market Situation

As of October 16, 2025, FDUSD is trading at $0.9973, maintaining its peg close to $1. The 24-hour trading volume stands at $217,920.63, indicating moderate market activity. With a market cap of $1,448,544,294, FDUSD ranks 78th in the cryptocurrency market. The coin has shown stability over the past 24 hours with a slight increase of 0.01%. Its 7-day performance shows a positive trend with a 0.032% increase, while the 30-day and 1-year metrics show minor decreases of -0.069% and -0.06% respectively. The circulating supply matches the total supply at 1,452,465,952.2 FDUSD, with no maximum supply limit.

Click to view the current FDUSD market price

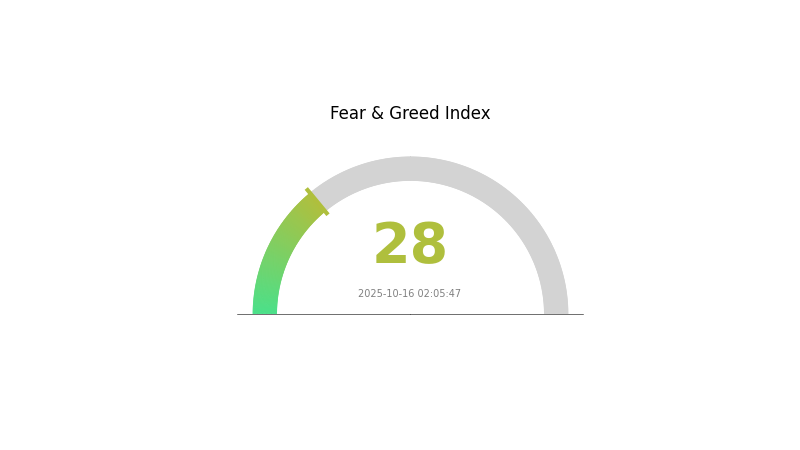

FDUSD Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, as indicated by the Fear and Greed Index reading of 28. This suggests investors are becoming increasingly cautious and risk-averse. Such sentiment often precedes potential buying opportunities, as assets may be undervalued. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Keep an eye on market trends and stay informed about the latest developments in the crypto space to navigate these uncertain times effectively.

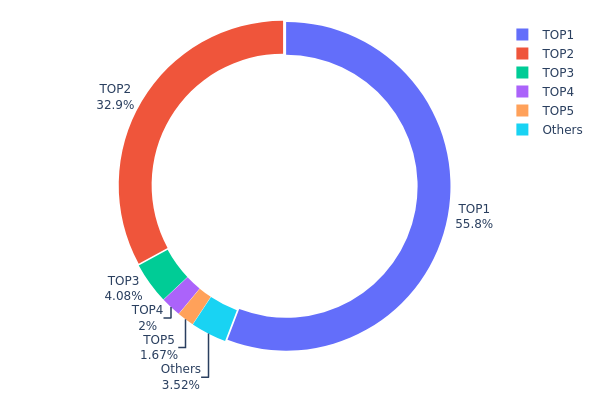

FDUSD Holdings Distribution

The address holdings distribution data for FDUSD reveals a highly concentrated ownership structure. The top two addresses collectively hold 88.72% of the total supply, with the largest address controlling 55.80% and the second-largest holding 32.92%. This extreme concentration raises concerns about potential market manipulation and volatility.

Such a concentrated distribution could have significant implications for FDUSD's market dynamics. The dominance of a few large holders may lead to increased price volatility if they decide to make substantial moves. Moreover, this concentration undermines the principle of decentralization, which is often valued in the cryptocurrency space.

The current distribution pattern suggests a relatively low level of on-chain structural stability for FDUSD. With over 90% of the supply controlled by just five addresses, the token's circulation and liquidity could be heavily influenced by the decisions of these major holders. This scenario warrants careful monitoring by market participants and potential investors.

Click to view the current FDUSD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa7c0...e2592d | 430344.68K | 55.80% |

| 2 | 0x47ac...a6d503 | 253891.38K | 32.92% |

| 3 | 0x28c6...f21d60 | 31448.47K | 4.07% |

| 4 | 0x0546...bfe2c9 | 15427.58K | 2.00% |

| 5 | 0x4368...26f042 | 12866.22K | 1.66% |

| - | Others | 27133.38K | 3.55% |

II. Key Factors Influencing FDUSD's Future Price

Supply Mechanism

- Reserve Backing: FDUSD's value is fully backed by US Treasury bonds, providing a stable foundation for its price.

- Current Impact: The transparent reserve structure, with ISIN numbers of treasury bonds publicly disclosed, enhances trust and stability in FDUSD's value.

Institutional and Large Holder Dynamics

- Corporate Adoption: First Digital Trust (FDT), the issuer of FDUSD, maintains partnerships with major financial institutions, potentially influencing adoption and price stability.

- National Policies: Regulatory developments in Hong Kong and other jurisdictions may impact FDUSD's operations and market position.

Macroeconomic Environment

- Monetary Policy Impact: Changes in US Treasury bond yields directly affect FDUSD's reserve value and potential returns.

- Geopolitical Factors: International tensions and regulatory shifts in the crypto space can influence investor sentiment towards stablecoins like FDUSD.

Technical Development and Ecosystem Building

- Trust and Transparency: Ongoing audits and public disclosures of reserve assets are crucial for maintaining user confidence in FDUSD.

- Ecosystem Applications: FDUSD's integration into payment systems and financial services platforms could drive adoption and price stability.

III. FDUSD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.83 - $0.90

- Neutral prediction: $0.90 - $1.00

- Optimistic prediction: $1.00 - $1.17 (requires stable market conditions)

2026-2028 Outlook

- Market phase expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.84 - $1.41

- 2027: $1.01 - $1.64

- 2028: $1.15 - $2.15

- Key catalysts: Increased adoption of stablecoins, regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $1.70 - $1.90 (assuming steady market growth)

- Optimistic scenario: $1.90 - $2.24 (with widespread adoption)

- Transformative scenario: $2.24+ (under extremely favorable conditions)

- 2030-12-31: FDUSD $1.85 (potential stabilization point)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.16684 | 0.9973 | 0.83773 | 0 |

| 2026 | 1.40669 | 1.08207 | 0.84401 | 8 |

| 2027 | 1.64258 | 1.24438 | 1.00795 | 24 |

| 2028 | 2.15079 | 1.44348 | 1.15479 | 44 |

| 2029 | 1.90496 | 1.79714 | 1.20408 | 80 |

| 2030 | 2.23977 | 1.85105 | 1.18467 | 85 |

IV. Professional Investment Strategies and Risk Management for FDUSD

FDUSD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable value preservation

- Operation suggestions:

- Regularly purchase FDUSD to average out market fluctuations

- Hold FDUSD as a part of a diversified stablecoin portfolio

- Store FDUSD in secure wallets with proper backup measures

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term price movements against long-term trends

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Pay attention to market sentiment and news affecting USD-pegged stablecoins

- Set strict stop-loss and take-profit levels

FDUSD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of total portfolio

- Moderate investors: 10-20% of total portfolio

- Aggressive investors: 20-30% of total portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple stablecoins and traditional assets

- Collateralization: Use FDUSD as collateral for low-risk yield farming strategies

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet solution: Use reputable multi-signature wallets for enhanced security

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update wallet software

V. Potential Risks and Challenges for FDUSD

FDUSD Market Risks

- Liquidity risk: Potential difficulties in converting large amounts of FDUSD to fiat during market stress

- Competitive pressure: Emergence of new stablecoins with superior features or backing

- Market sentiment shifts: Sudden loss of confidence in stablecoins could impact FDUSD's stability

FDUSD Regulatory Risks

- Regulatory crackdowns: Increased scrutiny of stablecoins by financial authorities

- Compliance challenges: Potential difficulties in meeting evolving regulatory requirements

- Cross-border restrictions: Limitations on FDUSD usage in certain jurisdictions

FDUSD Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the underlying code

- Cybersecurity threats: Risks of hacking or unauthorized access to FDUSD reserves

- Blockchain network congestion: Possible delays in transactions during high network activity

VI. Conclusion and Action Recommendations

FDUSD Investment Value Assessment

FDUSD offers a stable store of value with potential for efficient cross-border transactions. However, investors should remain cautious of regulatory uncertainties and market risks associated with stablecoins.

FDUSD Investment Recommendations

✅ Beginners: Start with small allocations to understand stablecoin dynamics

✅ Experienced investors: Use FDUSD for portfolio stabilization and as a trading pair

✅ Institutional investors: Consider FDUSD for treasury management and international transactions

FDUSD Participation Methods

- Direct purchase: Buy FDUSD on Gate.com or other supported exchanges

- Yield farming: Explore DeFi platforms that offer yields on FDUSD deposits

- Payment usage: Utilize FDUSD for cross-border transactions or e-commerce payments where accepted

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is FDUSD a stable coin?

Yes, FDUSD is a stablecoin pegged to the US dollar. It's fully backed by cash and cash equivalents, maintaining a stable 1:1 value with USD.

What is the price prediction for Fdusd coin in 2030?

Based on a 5% annual growth rate, the price prediction for FDUSD coin in 2030 is $1.27.

Who is behind FDUSD?

First Digital Labs, a Hong Kong-based company, is behind FDUSD. They created this stablecoin and are now expanding its presence across various platforms.

Can Dogecoin reach $3?

While reaching $3 is ambitious, it's not impossible. Dogecoin's growth potential, coupled with market trends and community support, suggests it could hit this target in the long term.

Share

Content