2025 FRIEND Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Introduction: Market Position and Investment Value of FRIEND

FRIEND (FRIEND) is a SocialFi token built on the Base Layer 2 network, launched in 2024 as part of the Friend.tech protocol. Since its inception, this innovative social trading asset has transformed user influence on Twitter into tradable tokens. As of December 2025, FRIEND has a market capitalization of approximately $2.66 million with a circulating supply of 92.42 million tokens, currently trading at $0.0287 per token. This asset, recognized as a "social trading protocol," is increasingly playing a pivotal role in bridging social influence and decentralized finance.

This article will provide a comprehensive analysis of FRIEND's price trajectory from 2024 through 2030, incorporating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

I. FRIEND Price History Review and Market Status

FRIEND Historical Price Evolution Trajectory

- May 8, 2024: FRIEND reached its all-time high (ATH) of $5.00, marking the peak of market enthusiasm following the project's launch in April 2024.

- December 5, 2025: FRIEND hit its all-time low (ATL) of $0.02111, representing a significant decline from its historical peak.

- 2025: Extended bear market conditions, with the token declining approximately 65.83% over the one-year period.

FRIEND Current Market Situation

As of December 25, 2025, FRIEND is trading at $0.0287, reflecting a 24-hour decline of 5.81%. The token has experienced substantial negative momentum, with a 7-day decrease of 22.66% and a particularly severe 30-day decline of 82.61%, illustrating sustained downward pressure in recent weeks.

The current market capitalization stands at approximately $2.66 million, with a circulating supply of 92,422,200 tokens out of a total supply of 92,620,365 tokens. The trading volume for the past 24 hours is $11,616.09, indicating relatively modest liquidity. The token maintains a market dominance of 0.000083%, reflecting its minimal share of the broader cryptocurrency market.

FRIEND demonstrates a circulating supply ratio of 108.98%, and the fully diluted valuation (FDV) equals the current market cap at $2,658,204.48. The token is held by 82,575 addresses, suggesting a moderately distributed holder base.

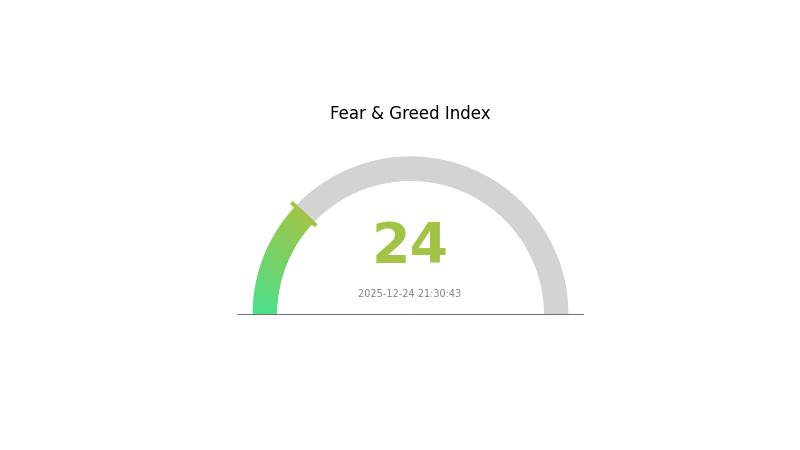

Current market sentiment indicators show extreme fear conditions (VIX rating of 24 as of December 24, 2025), reflecting heightened volatility and risk aversion across the broader market environment.

View current FRIEND market price

FRIEND Market Sentiment Indicator

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of 24. This signals significant market pessimism and investor anxiety. During such periods, long-term investors often view market weakness as potential buying opportunities, as prices may be oversold. However, caution is advised as extreme fear can precede further volatility. Monitor market trends closely on Gate.com for real-time data and sentiment analysis to make informed investment decisions during this period of heightened uncertainty.

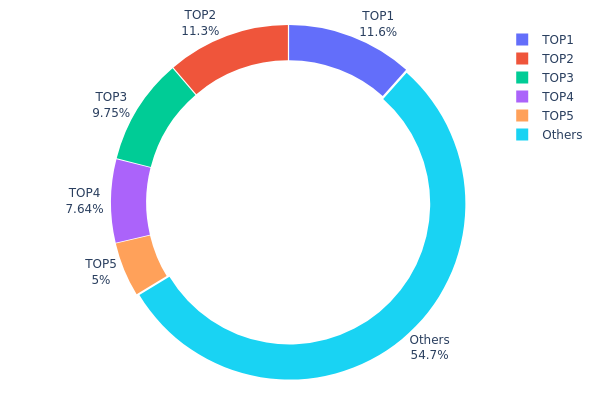

FRIEND Holdings Distribution

The address holdings distribution chart illustrates the concentration of FRIEND tokens across the blockchain network by tracking the top token holders and their respective ownership percentages. This metric serves as a crucial indicator for assessing tokenomic health, decentralization levels, and potential market manipulation risks within the ecosystem.

Current data reveals a moderately concentrated distribution pattern. The top five addresses collectively control approximately 45.25% of total FRIEND supply, with the leading address (0x020c...a35872) holding 11.59% and the second-largest holder (0x7cfc...ef4acf) maintaining 11.28%. While this concentration level raises notable considerations, it remains within acceptable ranges for established token ecosystems. The remaining 54.75% of tokens distributed among other addresses demonstrates substantial fragmentation, suggesting that no single entity possesses overwhelming control over the asset's total supply.

The current distribution structure presents both stabilizing and destabilizing implications for market dynamics. While the concentration among the top five holders does create potential liquidity risks and could theoretically facilitate coordinated price movements, the substantial tail of distributed holdings among dispersed addresses mitigates extreme centralization concerns. This bifurcated structure indicates a reasonably healthy ecosystem where early investors and significant stakeholders maintain meaningful positions, while the majority of supply remains widely distributed. Such architecture generally supports market stability and reduces the likelihood of catastrophic price manipulation, though ongoing monitoring of these major holders' behavioral patterns remains essential for comprehensive risk assessment.

For real-time tracking of FRIEND holdings distribution, visit Gate.com Crypto Holdings Data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x020c...a35872 | 11000.03K | 11.59% |

| 2 | 0x7cfc...ef4acf | 10710.36K | 11.28% |

| 3 | 0x2078...be0929 | 9249.41K | 9.74% |

| 4 | 0xdfda...5ac1a1 | 7253.17K | 7.64% |

| 5 | 0xbdbd...80909f | 4744.93K | 5.00% |

| - | Others | 51927.23K | 54.75% |

II. Core Factors Influencing FRIEND's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Central bank policies, particularly Federal Reserve decisions, significantly influence cryptocurrency asset prices. Interest rate hikes typically redirect capital flows toward low-risk assets, putting downward pressure on cryptocurrencies like FRIEND. Conversely, monetary easing and liquidity expansion tend to support price appreciation.

-

Inflation Hedge Properties: During inflationary environments, cryptocurrencies may serve as alternative value stores alongside traditional hedging assets.

-

Geopolitical Factors: International political uncertainties and trade tensions can drive risk-aversion sentiment, potentially affecting cryptocurrency market dynamics and investor allocation decisions.

Regulatory Environment

-

Policy Uncertainty: Different countries maintain vastly different regulatory approaches toward cryptocurrencies. Supportive policies with favorable legislation tend to trigger price increases, while announcements of stricter regulations or trading restrictions can trigger market panic and rapid price declines. Policy inconsistency remains a major driver of cryptocurrency price volatility.

-

Government Initiatives: Government support for cryptocurrency adoption, such as strategic reserve considerations or regulatory framework improvements, can significantly boost market confidence and attract institutional capital.

Market Competition and Sentiment

-

Competitive Landscape: The cryptocurrency market features intense competition among projects. Projects with superior technology and clear competitive advantages attract capital inflows, while projects lacking differentiation face significant downside risks.

-

Influencer Impact: Celebrity and prominent figure endorsements or criticisms can dramatically amplify market movements. Social media sentiment from influential personalities can trigger rapid price swings, either positive or negative.

-

Speculative Trading: High volatility and speculative trading activity characterize the FRIEND market. Algorithmic trading programs, technical analysis-driven trend following, and psychological price levels (support and resistance zones) can amplify price fluctuations beyond fundamental drivers.

III. 2025-2030 FRIEND Price Forecast

2025 Outlook

- Conservative Forecast: $0.02554 - $0.0287

- Neutral Forecast: $0.0287

- Optimistic Forecast: $0.04018 (requiring sustained market demand and ecosystem development)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with progressive value accumulation driven by continued platform adoption and utility expansion.

- Price Range Predictions:

- 2026: $0.01998 - $0.04271 (20% upside potential)

- 2027: $0.03086 - $0.04436 (34% cumulative growth)

- 2028: $0.03234 - $0.05888 (44% cumulative appreciation)

- Key Catalysts: Enhanced tokenomics implementation, increased user engagement metrics, strategic partnerships within the Web3 ecosystem, and improved liquidity conditions on major platforms such as Gate.com.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.04817 - $0.05569 (74% cumulative gain by 2029, assuming steady ecosystem maturation and moderate market expansion)

- Optimistic Scenario: $0.05293 - $0.06775 (84% cumulative gain by 2030, with accelerated adoption and successful protocol upgrades)

- Transformation Scenario: Extended upside potential (contingent upon breakthrough utility adoption, significant institutional participation, and fundamental shifts in market sentiment)

- December 25, 2025: FRIEND stabilizing within mid-range parameters (consolidation phase initiated)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04018 | 0.0287 | 0.02554 | 0 |

| 2026 | 0.04271 | 0.03444 | 0.01998 | 20 |

| 2027 | 0.04436 | 0.03857 | 0.03086 | 34 |

| 2028 | 0.05888 | 0.04147 | 0.03234 | 44 |

| 2029 | 0.05569 | 0.05017 | 0.04817 | 74 |

| 2030 | 0.06775 | 0.05293 | 0.04764 | 84 |

Friend.tech (FRIEND) Investment Strategy and Risk Management Report

IV. FRIEND Professional Investment Strategy and Risk Management

FRIEND Investment Methodology

(1) Long-term Holding Strategy

- Target Investor Profile: Investors with strong belief in SocialFi ecosystem adoption and willing to hold through market volatility

- Operational Recommendations:

- Establish initial position during market downturns when FRIEND trades significantly below historical highs

- Maintain consistent holding period of 12-24 months to capture potential platform growth and user adoption cycles

- Reinvest any accumulated rewards or trading gains to compound returns over time

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support/Resistance Levels: Monitor key price points at $0.0287 (current price), $0.02705 (24h low), and $0.0311 (24h high) for entry and exit signals

- Volume Analysis: Track the 24-hour trading volume of approximately 11,616 FRIEND to identify liquidity conditions and breakout opportunities

-

Wave Trading Key Points:

- Execute buy positions during oversold market conditions, particularly when 7-day decline exceeds -20%

- Establish exit strategy at predetermined profit targets or when negative sentiment indicators emerge

FRIEND Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Active Investors: 3-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation

(2) Risk Hedging Approaches

- Dollar-Cost Averaging (DCA): Execute purchases over extended periods to reduce timing risk and mitigate impact of price volatility

- Position Sizing: Limit individual position size to prevent catastrophic losses and maintain portfolio stability during market corrections

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate Web3 Wallet for active trading and frequent transactions with security features

- Cold Storage Method: Transfer FRIEND to hardware wallets for long-term holdings exceeding 12 months

- Security Considerations: Utilize multi-signature authentication, enable withdrawal whitelisting, maintain backup seed phrases in secure locations, and never share private keys or recovery phrases with any third parties

V. FRIEND Potential Risks and Challenges

FRIEND Market Risk

- Extreme Price Volatility: FRIEND has experienced an 82.61% decline over the past 30 days and 65.83% year-over-year decline, demonstrating significant price instability and susceptibility to market sentiment shifts

- Low Trading Liquidity: With relatively limited daily trading volume of 11,616 tokens and only one major exchange listing, large transactions may encounter slippage and execution challenges

- Speculative Market Dynamics: As a SocialFi token, FRIEND remains highly susceptible to social media trends and influencer sentiment, creating unpredictable price movements detached from fundamental value

FRIEND Regulatory Risk

- Uncertain Regulatory Status: SocialFi protocols may face increased regulatory scrutiny regarding securities classification, tokenomics transparency, and consumer protection standards

- Platform Dependency Risk: Regulatory actions against Twitter/X or shifts in their API policies could directly impact Friend.tech's operational viability

- Jurisdictional Compliance: Different regions may impose varying requirements on social trading protocols, creating operational uncertainty and potential market access restrictions

FRIEND Technology Risk

- Smart Contract Vulnerability: As a blockchain-based application on Base network, Friend.tech faces inherent smart contract security risks including potential bugs, exploits, or security audits revealing critical flaws

- Base Network Dependency: Friend.tech relies entirely on the Base Layer 2 network; any technical failures, security breaches, or network downtime would directly interrupt service operations

- User Adoption Challenges: The protocol requires sustained user engagement and network effects; declining user activity or loss of key influencers could undermine platform value proposition

VI. Conclusions and Action Recommendations

FRIEND Investment Value Assessment

Friend.tech represents a speculative asset within the emerging SocialFi category, attempting to tokenize social influence on decentralized platforms. The project demonstrates significant technological innovation but operates within an unproven market segment. The current market valuation of approximately $2.66 million reflects substantial depreciation from its May 2024 peak of $5.00 per token. While the underlying concept of social token trading maintains long-term conceptual merit, near-term prospects remain challenged by regulatory uncertainty, limited user adoption, and persistent market headwinds. Investment decisions should prioritize risk management over return maximization given the high-volatility nature and early-stage development status of this asset class.

FRIEND Investment Recommendations

✅ Beginners: Approach FRIEND with extreme caution; limit portfolio allocation to 1% or less and only invest capital you can afford to lose entirely. Consider starting with minimal purchases to understand market mechanics before scaling positions.

✅ Experienced Investors: Implement disciplined dollar-cost averaging strategies during significant market corrections and maintain strict stop-loss orders at -15% to -20% below entry prices. Utilize technical analysis tools to identify high-probability entry points aligned with broader market sentiment.

✅ Institutional Investors: Conduct comprehensive due diligence on Friend.tech's technical architecture, regulatory landscape, and competitive positioning within the SocialFi ecosystem. Structure positions as speculative venture-capital style allocations rather than core holdings, and establish clear exit criteria based on fundamental business metrics.

FRIEND Trading Participation Methods

- Gate.com Exchange Trading: Execute spot purchases and sales of FRIEND directly through Gate.com's trading interface with competitive fee structures and multiple trading pairs

- Limit Orders: Establish predetermined price levels where automatic buy orders execute, enabling strategic accumulation at optimal price points without requiring continuous market monitoring

- Portfolio Tracking Tools: Monitor real-time FRIEND price movements, maintain accurate cost-basis records, and track performance metrics through Gate.com's portfolio management features

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must evaluate their personal risk tolerance, financial circumstances, and investment objectives before making decisions. Always consult qualified financial advisors before committing capital. Never invest amounts exceeding your capacity to absorb complete financial loss.

FAQ

What is FRIEND token and what is its current price?

FRIEND token is a cryptocurrency asset built on the Friend.tech protocol. Its current price is approximately $0.03725, with a 24-hour decrease of 1.63%. The token facilitates transactions and governance within the Friend.tech ecosystem.

What are the price predictions for FRIEND token in 2025?

In 2025, FRIEND token is predicted to reach approximately $0.16604. With a market capitalization of $15,345,782 and circulating supply of 92,422,200 tokens, the token shows potential growth driven by market trends and ecosystem development.

What factors could influence FRIEND token price in the future?

FRIEND token price is influenced by supply and demand dynamics, community growth, protocol upgrades, market sentiment, and broader cryptocurrency market trends. Transaction volume and ecosystem adoption also play significant roles in price movements.

How does FRIEND token compare to other similar crypto tokens?

FRIEND token offers unique community-driven features with strong utility in its ecosystem. While it has lower market cap than Bitcoin, it demonstrates solid performance metrics and growing adoption. FRIEND distinguishes itself through innovative tokenomics and active developer support, making it competitive within mid-tier crypto projects.

What is the market cap and trading volume of FRIEND token?

As of December 24, 2025, FRIEND token has a market cap of $3.53 million with a 24-hour trading volume of $2,396.87. The token maintains a relatively modest market presence within the Web3 ecosystem.

2025 CORE Price Prediction: Analyzing Growth Potential and Market Factors for Widespread Adoption

2025 CKBPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Nervos Network's Native Token

Is Friend.tech (FRIEND) a Good Investment?: Analyzing Growth Potential and Risks in the Social Token Market

2025 LOOM Price Prediction: Analyzing Market Trends and Growth Potential for the Blockchain Platform

2025 P00LS Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Creator Token

2025 RLY Price Prediction: Bullish Trends and Market Catalysts for Rally's Future Growth

Chainlink vs XRP: How Chainlink Surpasses XRP in Institutional Blockchain Adoption

Cardano's Midnight Blockchain: Unlocking Privacy with ZK-SNARKs and NIGHT Tokens

Ethereum's $39M Revenue Drop: Network Crisis or Strategic Evolution?

Những trò lừa đảo rút tiền và đầu tư tiền mã hóa lớn mà bạn cần biết

Bitcoin Loophole