2025 FTN Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: FTN's Market Position and Investment Value

Fasttoken (FTN), as the official cryptocurrency of the Fastex ecosystem, has established itself as a significant player in the blockchain industry since its inception. As of 2025, FTN's market capitalization has reached $804,607,251, with a circulating supply of approximately 433,516,838 tokens and a price hovering around $1.856. This asset, known as the "Fastex ecosystem native token," is playing an increasingly crucial role in settling business arrangements, gaming, and facilitating transactions on the Bahamut blockchain.

This article will provide a comprehensive analysis of FTN's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. FTN Price History Review and Current Market Status

FTN Historical Price Evolution

- 2023: Project launch, price reached an all-time low of $0.5 on November 1

- 2024: Market recovery, FTN hit its all-time high of $5.217 on December 16

- 2025: Market correction, price fluctuated between the historical high and low

FTN Current Market Situation

As of October 16, 2025, FTN is trading at $1.856, with a 24-hour trading volume of $61,997.85. The token has seen a slight increase of 0.7% in the past 24 hours. FTN's market capitalization stands at $804,607,251.70, ranking it 110th in the overall cryptocurrency market. The current price is significantly below its all-time high, indicating a bearish trend in the medium term. However, the token has shown some resilience with a 5.04% increase over the past week, suggesting potential short-term bullish momentum.

Click to view the current FTN market price

FTN Market Sentiment Indicator

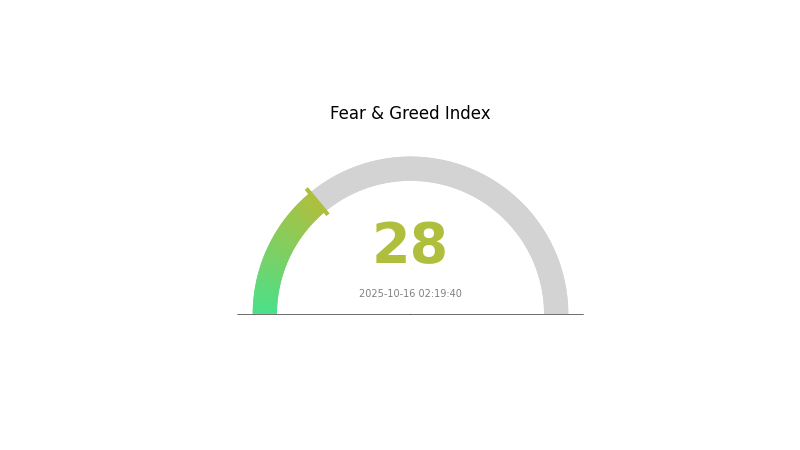

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 28, indicating a state of fear. This suggests investors are wary and potentially looking for buying opportunities. During such periods, it's crucial to stay informed and make rational decisions. Remember, market cycles are natural, and extreme fear can sometimes present value opportunities for long-term investors. However, always conduct thorough research and consider your risk tolerance before making any investment decisions.

FTN Holdings Distribution

The address holdings distribution data for FTN reveals an interesting pattern in token concentration. This metric provides insight into how tokens are distributed among different wallet addresses, offering a snapshot of ownership concentration within the FTN ecosystem.

Based on the provided data, it appears that the FTN token distribution is currently lacking significant concentration among top holders. This suggests a relatively decentralized ownership structure, which can be interpreted as a positive sign for the project's overall health and market stability. The absence of large individual holdings reduces the risk of market manipulation and sudden price volatility caused by the actions of a few major players.

This distributed ownership pattern may contribute to a more resilient market structure for FTN. It potentially indicates a diverse user base and could be seen as a reflection of broader adoption. However, it's important to note that while a dispersed distribution can be beneficial, it may also result in slower decision-making processes for governance-related matters if FTN implements any on-chain voting mechanisms.

Click to view the current FTN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing FTN's Future Price

Supply Mechanism

- Current Impact: As the Fountain ecosystem continues to expand and improve, the value foundation of FTN tokens is expected to become increasingly stable.

Institutional and Whale Dynamics

- National Policies: Macroeconomic policy impacts have been observed to affect the crypto market, including FTN.

Macroeconomic Environment

- Monetary Policy Impact: Investors should pay attention to macroeconomic policies as they can significantly influence FTN's price.

- Geopolitical Factors: International tensions, such as U.S.-China relations, can impact the broader crypto market, potentially affecting FTN.

Technical Development and Ecosystem Building

- Ecosystem Applications: The expansion of the Fountain ecosystem is a key factor in strengthening FTN's value proposition.

III. FTN Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $1.68 - $1.85

- Neutral forecast: $1.85 - $2.20

- Optimistic forecast: $2.20 - $2.56 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased adoption

- Price range predictions:

- 2027: $1.81 - $2.78

- 2028: $1.44 - $2.65

- Key catalysts: Technological advancements, ecosystem expansion, and market cycles

2030 Long-term Outlook

- Base scenario: $2.46 - $2.83 (assuming steady market growth)

- Optimistic scenario: $2.83 - $3.51 (assuming strong project performance and market conditions)

- Transformative scenario: $3.51+ (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: FTN $3.51 (potential peak price under favorable conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.56128 | 1.856 | 1.68896 | 0 |

| 2026 | 2.31907 | 2.20864 | 1.19267 | 19 |

| 2027 | 2.78454 | 2.26386 | 1.81108 | 21 |

| 2028 | 2.65041 | 2.5242 | 1.43879 | 36 |

| 2029 | 3.07889 | 2.5873 | 1.83699 | 39 |

| 2030 | 3.51304 | 2.8331 | 2.4648 | 52 |

IV. Professional FTN Investment Strategies and Risk Management

FTN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and long-term vision

- Operation suggestions:

- Accumulate FTN during market dips

- Set price targets and stick to the plan

- Store FTN in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps in identifying overbought or oversold conditions

- Key points for swing trading:

- Monitor FTN's correlation with major cryptocurrencies

- Set stop-loss orders to manage downside risk

FTN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for FTN

FTN Market Risks

- Volatility: High price fluctuations common in crypto markets

- Liquidity risk: Potential difficulty in selling large amounts without affecting price

- Market sentiment: Susceptibility to rapid shifts in investor sentiment

FTN Regulatory Risks

- Regulatory uncertainty: Potential for new regulations affecting FTN's use or value

- Cross-border restrictions: Varying legal status in different jurisdictions

- Compliance challenges: Evolving AML/KYC requirements for crypto assets

FTN Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability issues: Possible network congestion during high demand periods

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

FTN Investment Value Assessment

FTN presents a unique value proposition within the Fastex ecosystem, backed by SoftConstruct's extensive network. However, it faces short-term volatility and regulatory uncertainties common to the crypto market.

FTN Investment Recommendations

✅ Beginners: Start with small positions, focus on education and understanding the Fastex ecosystem ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Conduct thorough due diligence, potentially engage in larger positions with proper risk management

FTN Participation Methods

- Spot trading: Buy and sell FTN on Gate.com

- Staking: Participate in staking programs if available on the Fastex platform

- Ecosystem participation: Utilize FTN within the Fastex ecosystem to gain practical experience

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is 1 FTN in dollars?

As of October 16, 2025, 1 FTN is worth approximately $1.80. This price may fluctuate based on market conditions.

What crypto has the highest price prediction?

Bitcoin (BTC) has the highest price prediction for 2025, followed by Ethereum (ETH) and Solana (SOL).

What is the future of flux coin?

The future of Flux coin looks promising. With ongoing development and network expansion, its market position is strengthening. Increasing adoption and current trends indicate potential for continued growth and value appreciation.

What is the price prediction for Solana in 2030?

By 2030, Solana is projected to trade between $1,004 and $1,258, with an average price of $1,042. This growth depends on institutional investment and technological advancements.

Share

Content