2025 FYN Price Prediction: Bullish Trends and Market Factors Shaping the Future of this Emerging Cryptocurrency

Introduction: FYN's Market Position and Investment Value

Affyn (FYN), as a sustainable play-to-earn metaverse project on the Polygon blockchain, has been integrating the advantages of virtual and real worlds since its inception in 2022. As of 2025, Affyn's market capitalization has reached $428,456.98, with a circulating supply of approximately 383,922,023 tokens, and a price hovering around $0.001116. This asset, dubbed the "cross-border token," is playing an increasingly crucial role in uniting individuals and masses in a metaverse where virtual and real worlds converge.

This article will comprehensively analyze Affyn's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. FYN Price History Review and Current Market Status

FYN Historical Price Evolution

- 2022: Initial launch, price peaked at $0.193639 on March 22, 2024

- 2024: Market volatility, price fluctuated between all-time high and subsequent decline

- 2025: Bearish trend, price dropped to an all-time low of $0.0008266 on July 4, 2025

FYN Current Market Situation

As of October 31, 2025, FYN is trading at $0.001116, representing a significant decrease from its all-time high. The token has experienced a 7.22% decline in the past 24 hours and a substantial 79.94% drop over the past year. However, there are signs of short-term recovery, with a 3.69% increase over the past week and a 2.07% gain in the last 30 days. The current market capitalization stands at $428,456.98, with a circulating supply of 383,922,023 FYN tokens. The fully diluted market cap is $1,116,000, indicating potential for growth if market conditions improve.

Click to view the current FYN market price

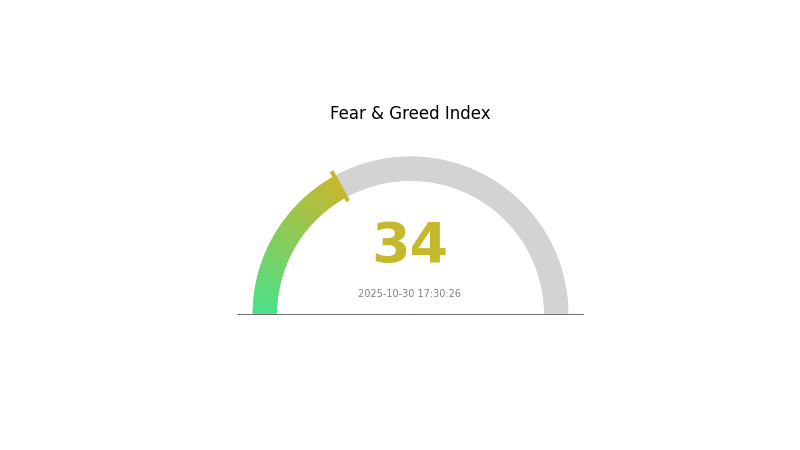

FYN Market Sentiment Indicator

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 34, indicating a state of fear. This suggests that investors are showing hesitancy and uncertainty about current market conditions. During such periods, some traders may view this as a potential buying opportunity, adhering to the contrarian approach of being greedy when others are fearful. However, it's crucial to conduct thorough research and risk assessment before making any investment decisions in this volatile market environment.

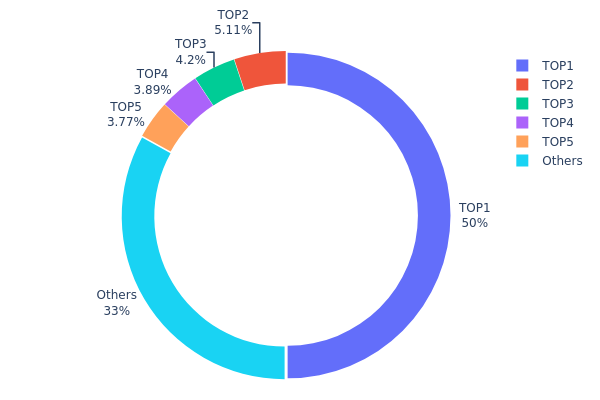

FYN Holdings Distribution

The address holdings distribution chart for FYN reveals a highly concentrated ownership structure. The top address holds a staggering 49.99% of the total supply, indicating a significant centralization of control. The subsequent four largest addresses collectively hold an additional 16.95% of FYN tokens, bringing the total concentration in the top five addresses to 66.94%.

This level of concentration raises concerns about market stability and potential price manipulation. With nearly half of the tokens controlled by a single entity, there's a risk of large-scale sell-offs or buying pressure that could dramatically impact FYN's market price. Moreover, the high concentration in few hands may undermine the project's claims of decentralization and could deter potential investors worried about uneven token distribution.

The remaining 33.06% distributed among other addresses suggests a limited spread of ownership among smaller holders. This structure implies that FYN's on-chain stability and resistance to market shocks could be compromised, as decisions or actions by the top holders could have outsized effects on the token's ecosystem and value proposition.

Click to view the current FYN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4d6b...47d51f | 499999.86K | 49.99% |

| 2 | 0x36d3...348e09 | 51108.42K | 5.11% |

| 3 | 0x6aa5...dd8666 | 41963.45K | 4.19% |

| 4 | 0xa5a5...e26763 | 38924.00K | 3.89% |

| 5 | 0x76fa...894413 | 37660.62K | 3.76% |

| - | Others | 330343.66K | 33.06% |

II. Key Factors Influencing FYN's Future Price

Supply Mechanism

- Liquidity Changes: Changes in liquidity by adding or removing from the pool can easily affect the price.

- Historical Pattern: Larger pools tend to have smaller price fluctuations and lower slippage, while smaller pools experience higher volatility.

- Current Impact: The current liquidity situation of FYN may influence its price stability and trading efficiency.

Institutional and Whale Dynamics

- Profitable Staking Program: FYN offers a staking program with potential earnings of up to 15% by the end of Year 2, which could attract institutional interest.

Macroeconomic Environment

- Inflation Hedging Properties: As with many cryptocurrencies, FYN's performance in inflationary environments may be a factor in its price movement.

Technological Development and Ecosystem Building

- Market Sentiment: Investor sentiment and views on price trends can influence FYN's value, potentially leading to divergences between price action and technical indicators.

- Ecosystem Applications: The development of DApps and ecosystem projects within the FYN network could impact its future price.

III. FYN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00083 - $0.00112

- Neutral prediction: $0.00112 - $0.00134

- Optimistic prediction: $0.00134 - $0.00156 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00077 - $0.00164

- 2028: $0.00101 - $0.00162

- Key catalysts: Technological advancements, expanded use cases, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.00146 - $0.00163 (assuming steady market growth and project development)

- Optimistic scenario: $0.00163 - $0.00219 (assuming strong market performance and significant project milestones)

- Transformative scenario: $0.00219 - $0.00250 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: FYN $0.00219 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00156 | 0.00112 | 0.00083 | 0 |

| 2026 | 0.00157 | 0.00134 | 0.00076 | 20 |

| 2027 | 0.00164 | 0.00145 | 0.00077 | 30 |

| 2028 | 0.00162 | 0.00155 | 0.00101 | 38 |

| 2029 | 0.00167 | 0.00159 | 0.00146 | 42 |

| 2030 | 0.00219 | 0.00163 | 0.00124 | 45 |

IV. Professional Investment Strategies and Risk Management for FYN

FYN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate FYN tokens during market dips

- Set a target holding period of at least 2-3 years

- Store tokens in a secure hardware wallet or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor project developments and partnerships

- Set stop-loss orders to manage downside risk

FYN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for FYN

FYN Market Risks

- High volatility: FYN price may experience significant fluctuations

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to overall crypto market trends

FYN Regulatory Risks

- Uncertain regulatory landscape: Potential for increased oversight

- Cross-border compliance: Varying regulations across jurisdictions

- Token classification: Risk of being classified as a security

FYN Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ability to handle increased user adoption

- Interoperability issues: Compatibility with other blockchain networks

VI. Conclusion and Action Recommendations

FYN Investment Value Assessment

FYN presents a high-risk, high-reward opportunity in the metaverse and gaming sector. Long-term potential exists, but investors should be prepared for significant short-term volatility and regulatory uncertainties.

FYN Investment Recommendations

✅ Beginners: Start with small, affordable investments and focus on learning ✅ Experienced investors: Consider a balanced approach with regular portfolio rebalancing ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large positions

FYN Trading Participation Methods

- Spot trading: Purchase FYN tokens on Gate.com

- Dollar-cost averaging: Set up recurring purchases to spread risk over time

- Staking: Explore potential staking opportunities if available on the platform

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can fun tokens reach $1 dollar?

While FUN tokens have growth potential, reaching $1 is uncertain. Current projections suggest it may reach $0.16, depending on market trends and adoption in gaming and gambling sectors.

Can yearn finance reach $1 million?

While highly improbable, it's not impossible. A major crypto bull run and significant market changes could potentially push YFI to $1 million, but current fundamentals suggest it's unlikely.

Will FET reach $5?

FET reaching $5 is possible but challenging. It would require significant market growth, increased adoption of AI technologies, and strong performance in the crypto sector. While not impossible, it's a ambitious target given current market conditions.

Does Fun Token have a future?

Yes, Fun Token has potential for future growth. Its use in financial instruments and availability of futures trading indicate market interest and suggest a promising outlook for the token.

2025 MV Price Prediction: Analyzing Market Trends and Technological Advancements in the Electric Vehicle Sector

SLN vs SAND: Comparing Two Popular Cryptocurrencies in the Metaverse Space

2025 KT Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is NightVerse.Game (NVG) a good investment?: Analyzing the potential and risks of this emerging metaverse token

PUMP vs MANA: Which Cryptocurrency Has the Better Growth Potential in 2023?

2025 MV Price Prediction: Analyzing Market Trends and Future Prospects for the Electric Vehicle Industry

What are Crypto Derivatives Market Signals and How Do Futures Open Interest, Funding Rates, and Liquidation Data Predict Price Movements?

What is EDEN Crypto Market Overview: Price, Market Cap, and 24H Trading Volume?

What is Bitcoin Halving? A Complete Overview of This Key Cryptocurrency Event

What Is LYN (Everlyn AI) Token: Fundamentals Analysis, Whitepaper Logic, and Use Cases Explained

World's Most Famous Traders in Stocks and Cryptocurrency: Masters of the Market