2025 GLM Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: GLM'nin Piyasa Konumu ve Yatırım Potansiyeli

Golem (GLM), merkeziyetsiz hesaplama gücü kiralama platformu olarak, 2016’daki lansmanından beri önemli adımlar attı. 2025 yılı itibarıyla Golem’in piyasa değeri 176.200.000 dolar, dolaşımdaki arzı yaklaşık 1.000.000.000 token ve birim fiyatı 0,1762 dolar civarındadır. “Hesaplamanın Ethereum’u” olarak anılan bu varlık, merkeziyetsiz bilgi işlem kaynakları alanında giderek daha kritik bir rol üstlenmektedir.

Bu makale, Golem’in 2025’ten 2030’a kadar olan fiyat hareketlerini, tarihsel trendleri, piyasa arz-talep dengelerini, ekosistem gelişimini ve makroekonomik faktörleri bir araya getirerek, yatırımcılar için profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. GLM Fiyat Geçmişi ve Güncel Piyasa Durumu

GLM'nin Tarihsel Fiyat Seyri

- 2016: GLM, ICO fiyatı olan 0,0105 dolarla piyasaya çıktı; 12 Aralık’ta tüm zamanların en düşük seviyesi olan 0,00913753 dolara geriledi.

- 2018: 13 Nisan’da GLM, 1,32 dolar ile en yüksek seviyesini gördü ve önemli bir kilometre taşına ulaştı.

- 2020: 19 Kasım’da GNT token GLM olarak yeniden markalandı ve piyasa varlığını sürdürdü.

GLM Güncel Piyasa Durumu

19 Ekim 2025 tarihi itibarıyla GLM, 0,1762 dolardan işlem görüyor; piyasa değeri 176.200.000 dolar. Son 24 saatte %0,22’lik artış ile hafif bir pozitif seyir izliyor. Bununla birlikte, son 30 günde %29,94 oranında ve son bir yılda %47,4 oranında ciddi bir düşüş yaşandı; bu da orta-uzun vadede negatif bir trendi işaret ediyor.

Mevcut fiyat, zirve seviyesinin oldukça altında; piyasa koşulları iyileşirse büyüme potansiyeli mevcut. 24 saatlik işlem hacmi 92.602,51 dolar olup, piyasa aktivitesi orta seviyede. Dolaşımdaki arz, toplam arz olan 1.000.000.000 GLM’ye eşit; token maksimum dağıtımına ulaştı.

Güncel GLM piyasa fiyatını görmek için tıklayın

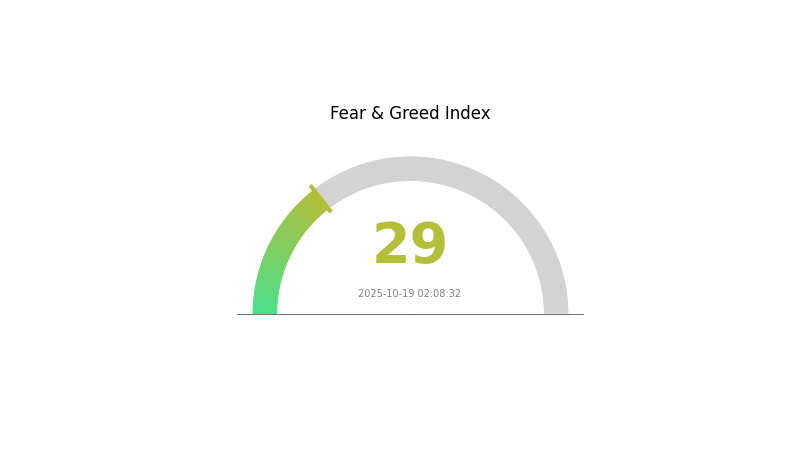

GLM Piyasa Duyarlılık Göstergesi

2025-10-19 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında duyarlılık temkinli; Korku ve Açgözlülük Endeksi 29 seviyesinde ve korku sinyali veriyor. Yatırımcılar çekingen davranıyor ve bu durum, zıt strateji uygulayanlar için potansiyel alım fırsatları doğurabilir. Yine de, karar verirken titiz araştırma yapmak ve temkinli hareket etmek önemli. Piyasa duyarlılığı hızlı değişebilir; genel trendleri ve kripto dünyasındaki gelişmeleri sürekli takip etmek faydalı olacaktır.

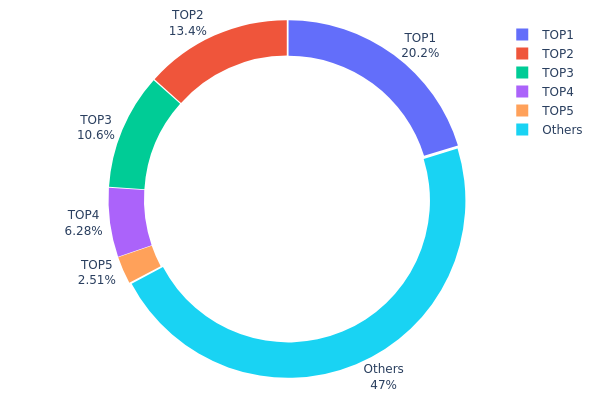

GLM Varlık Dağılımı

GLM adres dağılım verileri, sahipliğin yoğun şekilde birkaç adreste toplandığını gösteriyor. En büyük adres toplam arzın %20,24’ünü elinde tutarken, ilk beş adres GLM’nin %52,99’una sahip. Bu yoğunlaşma, dağılımda belirgin bir dengesizliğe neden oluyor.

Böyle bir dağılım, piyasa dinamiklerini doğrudan etkileyebilir. Beş adresin yarıdan fazla tokena sahip olması, fiyat dalgalanması ve manipülasyon riskini artırıyor. “Balina” statüsündeki büyük sahipler, yüksek hacimli alım-satım işlemleriyle fiyatları etkileyebilir. Ayrıca, bu yapı merkeziyetsizlik konusunda da endişe uyandırıyor; az sayıda aktör ağ üzerinde etkin söz sahibi konumda.

Bunun yanında, GLM tokenlarının %47,01’i diğer adresler arasında dağıtılmış durumda ve bu daha geniş katılımı gösteriyor. Bu yapı belli bir dengelenme sağlasa da genel tablo hala merkeziyetçi. Bu dağılım, GLM’nin zincir üzerindeki istikrarını ve uzun vadeli potansiyelini değerlendiren yatırımcılar için önemli bir unsur.

Güncel GLM Varlık Dağılımını görmek için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8791...af117c | 161.074,94K | 20,24% |

| 2 | 0x413e...9c303f | 106.599,41K | 13,39% |

| 3 | 0x70a0...10e476 | 84.101,45K | 10,57% |

| 4 | 0x7da8...7f6cf9 | 50.001,00K | 6,28% |

| 5 | 0x5a52...70efcb | 20.000,00K | 2,51% |

| - | Others | 373.849,46K | 47,01% |

II. GLM’nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Teknik Gelişim ve Ekosistem Oluşumu

-

Golem Network Güncellemeleri: Golem Network altyapısında yapılan sürekli iyileştirmeler, GLM tokenlarının faydasını ve talebini artırabilir.

-

Ekosistem Uygulamaları: Golem Network, dağıtık hesaplama kaynaklarını kullanan merkeziyetsiz uygulamaları (DApp) destekleyerek GLM kullanımını ve değerini yükseltebilir.

III. GLM 2025-2030 Fiyat Öngörüleri

2025 Görünümü

- Temkinli tahmin: 0,1496 - 0,176 dolar

- Tarafsız tahmin: 0,176 - 0,20 dolar

- İyimser tahmin: 0,20 - 0,24112 dolar (güçlü piyasa duyarlılığı ve proje gelişmeleri ile)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan volatiliteyle büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,18443 - 0,26917 dolar

- 2028: 0,14515 - 0,32141 dolar

- Temel katalizörler: Teknolojik ilerlemeler, GLM’nin yapay zeka uygulamalarında daha yaygın kullanımı

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,2903 - 0,29466 dolar (istikrarlı piyasa büyümesi ile)

- İyimser senaryo: 0,29901 - 0,33002 dolar (olumlu piyasa şartları ve GLM kullanımının artması ile)

- Dönüştürücü senaryo: 0,35 - 0,40 dolar (GLM’nin yapay zeka teknolojisinde bir atılım sağlaması halinde)

- 2030-12-31: GLM 0,33002 dolar (mevcut projeksiyonlara göre olası zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,24112 | 0,176 | 0,1496 | 0 |

| 2026 | 0,2899 | 0,20856 | 0,12514 | 18 |

| 2027 | 0,26917 | 0,24923 | 0,18443 | 41 |

| 2028 | 0,32141 | 0,2592 | 0,14515 | 46 |

| 2029 | 0,29901 | 0,2903 | 0,16838 | 64 |

| 2030 | 0,33002 | 0,29466 | 0,22099 | 67 |

IV. GLM Profesyonel Yatırım Stratejileri ve Risk Yönetimi

GLM Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli bakış açısına ve yüksek risk toleransına sahip yatırımcılar

- Uygulama önerileri:

- Piyasa geri çekilmelerinde GLM biriktirin

- Fiyat hedefleri belirleyip portföyünüzü periyodik olarak dengeleyin

- GLM’lerinizi güvenli soğuk cüzdanlarda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve potansiyel giriş/çıkış noktalarını tespit edin

- RSI (Göreli Güç Endeksi): Aşırı alım/satım sinyallerini takip edin

- Dalgalı al-sat için kilit noktalar:

- Golem ağında benimsenme ve gelişim adımlarını izleyin

- Merkeziyetsiz bilgi işlem sektöründeki eğilimleri takip edin

GLM Risk Yönetim Sistemi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımları farklı kripto para ve geleneksel varlıklara yaymak

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için önceden çıkış noktaları belirlemek

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Donanım cüzdanları ile uzun vadeli saklama

- Güvenlik tedbirleri: İki faktörlü kimlik doğrulama, güçlü şifreler ve düzenli yazılım güncellemeleri

V. GLM için Olası Riskler ve Zorluklar

GLM Piyasa Riskleri

- Volatilite: Kripto piyasalarında yüksek fiyat dalgalanması

- Rekabet: Yeni merkeziyetsiz bilgi işlem platformları Golem’in konumunu zorlayabilir

- Likidite: Başlıca kripto paralara göre daha düşük hacim, fiyat istikrarını azaltabilir

GLM Düzenleyici Riskler

- Belirsiz regülasyonlar: Gelişen kripto regülasyonları GLM’nin benimsenmesini ve kullanımını etkileyebilir

- Sınır ötesi kısıtlamalar: GLM’nin uluslararası transferlerinde potansiyel sınırlamalar

- Vergi etkileri: Farklı ülkelerde GLM işlemlerinin vergiye tabi olup olmadığı belirsiz

GLM Teknik Riskler

- Akıllı sözleşme açıkları: Ethereum tabanlı sözleşmelerde güvenlik zafiyetleri olabilir

- Ölçeklenebilirlik engelleri: Golem ağının işleme kapasitesi sınırlı kalabilir

- Ağ saldırıları: %51 saldırısı ve diğer kötü niyetli aktiviteler riski

VI. Sonuç ve Eylem Önerileri

GLM Yatırım Değeri Analizi

GLM, merkeziyetsiz bilgi işlem alanında benzersiz bir değer sunuyor ve uzun vadeli büyüme potansiyeline sahip. Ancak, kısa vadede volatilite ve regülasyon belirsizlikleri önemli riskler barındırıyor.

GLM Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasa dinamiklerini anlamak için küçük ve düzenli yatırımlar yapın ✅ Deneyimli yatırımcılar: Portföyünüzün bir bölümünü GLM’ye ayırarak dengeli strateji izleyin ✅ Kurumsal yatırımcılar: Detaylı analiz yapın ve GLM’yi çeşitlendirilmiş kripto portföyüne dahil edin

GLM Alım-Satım Katılım Yöntemleri

- Spot işlemler: GLM’yi Gate.com spot piyasasında alıp satabilirsiniz

- Staking: Uygun ise GLM staking programlarına katılın

- DeFi entegrasyonu: GLM tokenıyla merkeziyetsiz finans çözümlerini keşfedin

Kripto yatırımları çok yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre karar vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

GLM coin’in geleceği nedir?

GLM coin, Web3 ekosisteminde güçlü bir potansiyele sahip. Yapay zeka ve merkeziyetsiz bilgi işlem alanının büyümesiyle, GLM’nin dağıtık ağlardaki rolü 2025’e kadar değer ve benimsenme açısından önemli bir artış sağlayabilir.

GRT'nin 2025 tahmini fiyatı nedir?

Piyasa trendleri ve uzman analizlerine göre, GRT fiyatı 2025’te yaklaşık 2,50 - 3,00 dolar bandına ulaşabilir ve uzun vadeli yatırımcılar için yüksek büyüme potansiyeli gösterebilir.

Golem Network iyi mi?

Evet, Golem Network olumlu bir projedir. Merkeziyetsiz bilgi işlem gücü sunarak kullanıcıların atıl kaynaklarını kiralamasına olanak tanır. Yenilikçi yaklaşımı ve büyüme potansiyeli ile blokzincir sektöründe sağlam bir projedir.

Golem’e yatırım yapmanın riskleri neler?

Riskler arasında piyasa volatilitesi, regülasyon değişiklikleri, teknik zorluklar ve merkeziyetsiz bilgi işlem alanındaki rekabet bulunur. Golem’in başarısı, ağ benimsenmesi ve büyümesine bağlıdır.

FET Nedir: Alan-Etkili Transistörler ve Modern Elektronikteki Uygulamaları

SkyAI ($SKYAI) nedir? MCP altyapısını ve on-chain AI'deki rolünü keşfetmek.

ChainOpera AI'nin (COAI) Beyaz Kitabının altında yatan temel mantık nedir?

GAI vs RUNE: Dijital varlık piyasalarını dönüştüren iki devrim niteliğindeki blockchain protokolünün karşı karşıya gelişi

WAI ve VET: Web Erişilebilirliği İnisiyatifi ile Mesleki Eğitim ve Öğretimin Karşılaştırılması

Fetch.ai'nin White Paper'daki mantığı, temel değerini nasıl şekillendiriyor?

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak