2025 GTBTC Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: GTBTC's Market Position and Investment Value

Gate Wrapped BTC (GTBTC), as an on-chain BTC yield-generating asset issued by Gate Web3, has achieved significant milestones since its inception. As of 2025, GTBTC's market capitalization has reached $321,401,994, with a circulating supply of approximately 3,002.71 tokens, and a price hovering around $107,037.3. This asset, often referred to as a "yield-enhanced Bitcoin wrapper," is playing an increasingly crucial role in both CeFi and DeFi scenarios.

This article will comprehensively analyze GTBTC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. GTBTC Price History Review and Current Market Status

GTBTC Historical Price Evolution

- 2025: GTBTC launched on Gate.com, initial price fluctuations as the market adapted

- 2025 (October 6): GTBTC reached its all-time high of $125,918.6

- 2025 (October 10): GTBTC hit its all-time low of $101,942, showing significant volatility

GTBTC Current Market Situation

As of October 18, 2025, GTBTC is trading at $107,037.3, with a 24-hour trading volume of $31,579.56. The token has experienced a 1.93% decrease in the last 24 hours. GTBTC's market cap currently stands at $321,401,994.76, ranking it 210th in the cryptocurrency market.

The token has shown mixed performance across different timeframes:

- 1-hour change: +0.1%

- 24-hour change: -1.93%

- 7-day change: -4.79%

- 30-day change: -8.37%

GTBTC's current price is about 15% below its all-time high and 5% above its all-time low, both of which were recorded earlier this month. The token's circulating supply matches its total and maximum supply at 3,002.71022121 GTBTC.

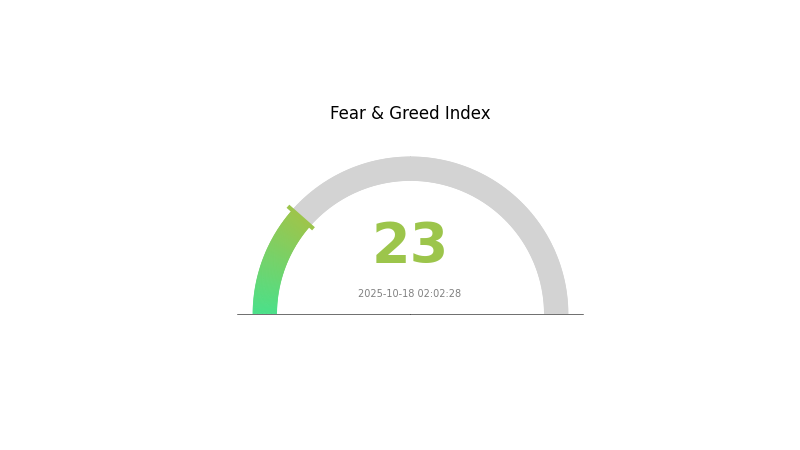

The overall market sentiment appears cautious, with the VIX index at 23, indicating "Extreme Fear" in the crypto market.

Click to view the current GTBTC market price

GTBTC Market Sentiment Indicator

2025-10-18 Fear and Greed Index: 23 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the Fear and Greed Index plummeting to 23. This stark indicator suggests investors are highly cautious, potentially creating oversold conditions. Historically, such extreme fear has often preceded market rebounds. However, it's crucial to approach with caution and conduct thorough research. Gate.com offers comprehensive tools and analysis to help navigate these turbulent market conditions. Remember, while fear may present opportunities, it's essential to invest responsibly and within your risk tolerance.

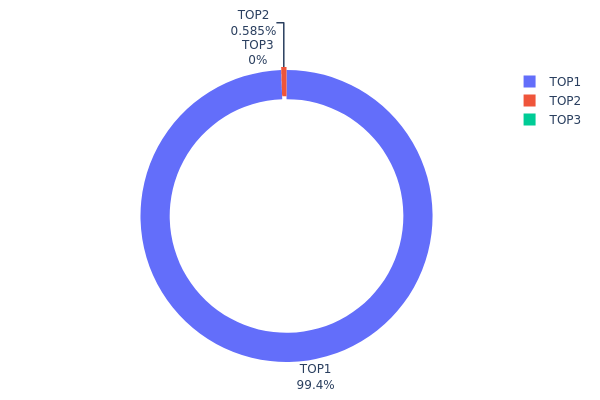

GTBTC Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of GTBTC tokens across different addresses. Analysis of this data reveals a highly centralized distribution pattern, with the top address holding an overwhelming 99.41% of the total supply, equivalent to 894.61 GTBTC tokens. The second-largest holder possesses a mere 0.58% of the supply, while all other addresses combined account for a negligible 0.01%.

This extreme concentration raises significant concerns about market stability and potential price manipulation. With a single address controlling virtually the entire supply, there is a substantial risk of market volatility should this holder decide to liquidate their position. Furthermore, such centralization undermines the principles of decentralization typically associated with cryptocurrency markets and may deter potential investors concerned about fair market practices.

The current distribution structure suggests a nascent or tightly controlled market for GTBTC, potentially indicating a need for increased circulation and wider adoption to improve market health and resilience. Investors and market participants should carefully consider these factors when assessing the long-term viability and trading dynamics of GTBTC.

Click to view the current GTBTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc882...84f071 | 894.61 | 99.41% |

| 2 | 0x0d07...b492fe | 5.26 | 0.58% |

| - | Others | -0 | 0.010000000000005% |

II. Key Factors Affecting Future GTBTC Price

Supply Mechanism

- Fixed Supply: GTBTC has a fixed maximum supply, which creates scarcity and potentially drives up value over time.

- Historical Pattern: Previous supply reductions have typically led to price increases due to reduced selling pressure.

- Current Impact: The upcoming supply reduction is expected to have a positive impact on GTBTC's price, assuming demand remains stable or increases.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions have been increasing their GTBTC holdings, signaling growing confidence in the asset.

- Corporate Adoption: Several Fortune 500 companies have added GTBTC to their balance sheets as a store of value.

- National Policies: Some countries have begun recognizing GTBTC as legal tender, potentially increasing its global adoption and demand.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' continued loose monetary policies may drive investors towards GTBTC as an alternative store of value.

- Inflation Hedging Properties: GTBTC has shown resilience during inflationary periods, attracting investors seeking to protect their wealth.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions have historically increased interest in GTBTC as a safe-haven asset.

Technical Development and Ecosystem Building

- Layer 2 Solutions: Implementation of Layer 2 scaling solutions is expected to improve transaction speeds and reduce fees, potentially increasing GTBTC's utility.

- Smart Contract Functionality: Planned upgrades to enable smart contract capabilities on the GTBTC network could expand its use cases and attract more developers.

- Ecosystem Applications: Decentralized finance (DeFi) platforms and non-fungible token (NFT) marketplaces built on GTBTC are gaining traction, enhancing its ecosystem value.

III. GTBTC Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $95,263 - $107,037

- Neutral estimate: $107,037 - $118,811

- Optimistic estimate: $118,811 - $130,585 (requires sustained market growth)

2027-2028 Outlook

- Market phase expectation: Potential bull market continuation

- Price range forecast:

- 2027: $113,702 - $185,583

- 2028: $98,045 - $210,323

- Key catalysts: Increased institutional adoption, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $184,230 - $193,442 (assuming steady market growth)

- Optimistic scenario: $202,653 - $272,753 (with favorable regulatory environment)

- Transformative scenario: $272,753+ (extreme positive market conditions)

- 2030-12-31: GTBTC $193,442 (potential year-end target)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 130585.51 | 107037.3 | 95263.2 | 0 |

| 2026 | 142573.68 | 118811.4 | 61781.93 | 11 |

| 2027 | 185583.41 | 130692.54 | 113702.51 | 22 |

| 2028 | 210323.51 | 158137.98 | 98045.55 | 47 |

| 2029 | 202653.82 | 184230.74 | 169492.28 | 72 |

| 2030 | 272753.62 | 193442.28 | 102524.41 | 80 |

IV. GTBTC Professional Investment Strategies and Risk Management

GTBTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking BTC exposure with yield

- Operation suggestions:

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to manage downside risk

- Take profits at predetermined price targets

GTBTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-5% of crypto portfolio

- Moderate investors: 5-10% of crypto portfolio

- Aggressive investors: 10-20% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance GTBTC with other crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for GTBTC

GTBTC Market Risks

- Price volatility: GTBTC value closely tied to BTC price fluctuations

- Liquidity risk: Potential challenges in large-volume trades

- Yield fluctuations: Changes in BTC staking rewards may impact GTBTC value

GTBTC Regulatory Risks

- Regulatory uncertainty: Evolving crypto regulations may affect GTBTC operations

- Cross-border restrictions: Potential limitations on GTBTC accessibility in certain jurisdictions

- Tax implications: Unclear tax treatment of GTBTC yields in some countries

GTBTC Technical Risks

- Smart contract vulnerabilities: Potential for exploits in underlying protocols

- Blockchain network congestion: May affect GTBTC transactions during high-volume periods

- Integration risks: Challenges in maintaining compatibility across multiple blockchains

VI. Conclusion and Action Recommendations

GTBTC Investment Value Assessment

GTBTC offers a unique proposition for BTC holders seeking yield while maintaining liquidity. Long-term value lies in its ability to generate passive income, while short-term risks include market volatility and regulatory uncertainties.

GTBTC Investment Recommendations

✅ Beginners: Start with a small allocation, focus on understanding the staking process ✅ Experienced investors: Consider GTBTC as part of a diversified crypto yield strategy ✅ Institutional investors: Explore GTBTC for treasury management and yield optimization

GTBTC Participation Methods

- Direct purchase: Buy GTBTC on Gate.com spot market

- BTC staking: Stake BTC on Gate.com to mint GTBTC

- DeFi integration: Use GTBTC in supported DeFi protocols for additional yield opportunities

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is GBTC stock a buy?

Yes, GBTC stock could be a good buy in 2025. With Bitcoin's growing adoption and potential price increases, GBTC offers exposure to Bitcoin in a traditional investment vehicle.

How many GBTC equals 1 bitcoin?

1 GBTC share represents approximately 0.00092 bitcoin. This means about 1,087 GBTC shares equal 1 bitcoin.

How much will $1 bitcoin be worth in 2025?

Based on current trends and expert predictions, $1 of Bitcoin in 2025 could be worth approximately $0.000015, assuming Bitcoin reaches around $65,000 per coin.

Why is GBTC going down?

GBTC is declining due to market volatility, reduced investor confidence, and competition from spot Bitcoin ETFs. Regulatory uncertainties and overall crypto market trends also contribute to its downward movement.

Share

Content