2025 ICP Fiyat Tahmini: Benimseme ve geliştirme hızla artarken yükseliş beklentisi öne çıkıyor

Giriş: ICP'nin Piyasa Konumu ve Yatırım Potansiyeli

Internet Computer (ICP), merkeziyetsiz bir halka açık ağ oluşturmayı hedefleyen öncü Layer-1 protokolü olarak, 2021'de piyasaya sürülmesinden bu yana önemli bir gelişim sergiledi. 2025 yılı itibarıyla ICP'nin piyasa değeri 1,8 milyar dolara, dolaşımdaki arzı ise yaklaşık 539.218.489 tokene ulaştı. Fiyatı 3,34 dolar civarında seyrediyor. "Dünya Bilgisayarı" olarak anılan bu varlık, merkeziyetsiz uygulamaların barındırılmasında ve halka açık internet işlevlerinin sağlanmasında giderek daha kritik bir rol üstleniyor.

Bu makalede, ICP'nin 2025-2030 dönemindeki fiyat hareketleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında detaylı biçimde incelenerek, yatırımcılara profesyonel fiyat öngörüleri ve uygulamaya dönük yatırım stratejileri sunulacaktır.

I. ICP Fiyat Geçmişi ve Güncel Piyasa Durumu

ICP Tarihi Fiyat Gelişimi

- 2021: ICP, 11 Mayıs 2021'de 700,65 dolarlık zirveyle piyasaya çıktı

- 2022-2024: Uzun soluklu kripto ayı piyasasında fiyat istikrarlı biçimde geriledi

- 2025: 11 Ekim 2025'te 2,23 dolarla tarihi dip seviyeye ulaştı

ICP Güncel Piyasa Durumu

16 Ekim 2025 itibarıyla ICP, 3,34 dolar seviyesinden işlem görüyor ve kripto para piyasasında 63. sırada yer alıyor. Token son 24 saatte %3,88 oranında değer kaybederken, işlem hacmi 2.546.325,69 dolar. ICP'nin güncel piyasa değeri 1.800.989.754,59 dolar olup, toplam kripto piyasasının %0,045'ini oluşturuyor.

Token yakın dönemde yüksek volatilite sergiledi:

- 1 saatlik değişim: +%0,99

- 7 günlük değişim: -%25,56

- 30 günlük değişim: -%28,38

- 1 yıllık değişim: -%58,74

Bu rakamlar, kısa vadede bir toparlanmaya işaret ederken uzun vadede genel bir düşüş trendini gösteriyor. Mevcut fiyat, zirve seviyesi olan 700,65 doların çok altında ve %99,52 oranında gerilemiş durumda.

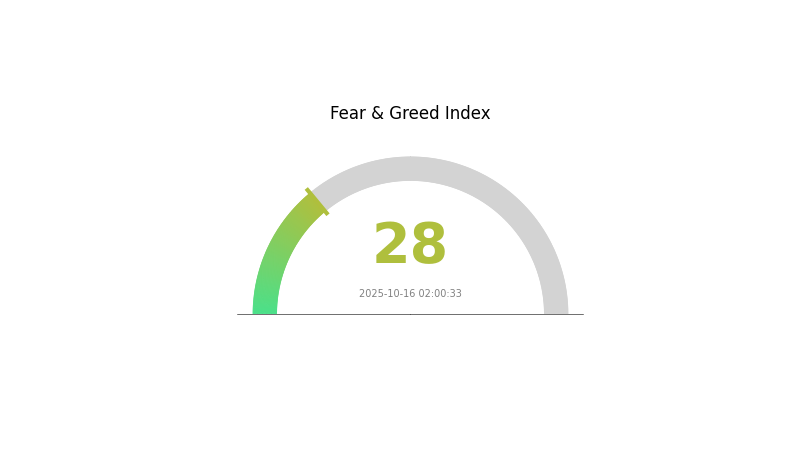

Piyasa duyarlılığı ise, VIX endeksinin 28 olduğu ve "Korku" olarak tanımlandığı bir ortamda, yatırımcıların ihtiyatlı davrandığını gösteriyor.

Güncel ICP piyasa fiyatını görmek için tıklayın

ICP Piyasa Duyarlılık Göstergesi

2025-10-16 Korku ve Açgözlülük Endeksi: 28 (Korku)

Kripto para piyasasında şu an korku hakim. Korku ve Açgözlülük Endeksi 28 seviyesinde. Bu durum, yatırımcıların temkinli davrandığını ve uzun vadeli bakış açısına sahip olanlar için potansiyel alım fırsatları doğurabileceğini gösteriyor. Ancak, yatırım kararları öncesinde detaylı araştırma yapmak ve dikkatli olmak şart. Piyasa duyarlılığı hızla değişebileceği için kripto dünyasındaki güncel gelişmeleri yakından takip etmek önemlidir.

ICP Varlık Dağılımı

ICP'nin adres bazlı varlık dağılımı, son derece yoğunlaşmış bir sahiplik yapısına işaret ediyor. Bu durum, az sayıda adresin ICP arzının büyük bölümünü elinde tuttuğunu ve piyasa dinamikleri ile fiyat hareketleri üzerinde etkili olabileceğini gösteriyor.

Tabloda detaylı veri bulunmasa da, üstteki adreslerin toplam ICP arzının kayda değer kısmını elinde bulundurduğu öngörülebilir. Varlıkların az sayıda elde toplanması, ICP piyasasında volatiliteyi artırabilir; çünkü büyük sahiplerin işlemleri fiyat üzerinde ciddi etki yaratabilir. Aynı zamanda, bu durum piyasa manipülasyonu ihtimalini gündeme getirir; büyük sahipler trendleri yönlendirebilir.

Piyasa yapısı açısından bu yoğunlaşma, ICP için merkeziyetsizliğin düşük seviyede olduğunu gösteriyor. Blockchain ağlarında dağıtık sahiplik hedeflenirken, şu anki dağılım token arzında merkezileşmeyi işaret ediyor. ICP ekosisteminde yönetişim amaçlı kullanıldığı takdirde, bu durum ağın dayanıklılığı ve karar süreçleri açısından önem taşır.

| En Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. ICP'nin Gelecek Fiyatını Etkileyecek Temel Faktörler

Makroekonomik Ortam

-

Para Politikası Etkisi: Federal Reserve'in para politikası, ICP fiyatında belirleyici rol oynuyor. Fed'in faiz oranları ve niceliksel gevşeme yaklaşımı, ICP gibi kripto varlıklara yatırım akışını ve piyasa duyarlılığını etkilemeye devam edecek.

-

Enflasyona Karşı Koruma: ICP, dijital bir varlık olarak, özellikle geleneksel para birimlerinin değer kaybı yaşadığı genişlemeci para politikası dönemlerinde, enflasyona karşı koruma alternatifi olarak görülebilir.

Teknik Gelişim ve Ekosistem İnşası

- Ekosistem Uygulamaları: Internet Computer protokolü üzerinde geliştirilen merkeziyetsiz uygulamalar (DApp) ve projeler, ICP'nin benimsenmesini ve değerini belirleyecek ana unsur olacak. Ekosistemin büyümesi, ICP fiyatını yukarı çekebilir.

III. 2025-2030 Dönemi ICP Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 3,05 - 3,36 dolar

- Tarafsız tahmin: 3,36 - 3,65 dolar

- İyimser tahmin: 3,65 - 3,90 dolar (güçlü piyasa toparlanması halinde)

2027-2028 Görünümü

- Piyasa aşaması: Olası boğa dönemi

- Fiyat tahmin aralığı:

- 2027: 2,90 - 6,24 dolar

- 2028: 4,73 - 6,96 dolar

- Kilit katalizörler: Internet Computer protokolünün benimsenmesinde artış, olumlu düzenleyici ortam

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 6,14 - 7,64 dolar (blokzincir benimsemesi istikrarlı şekilde artarsa)

- İyimser senaryo: 7,64 - 9,15 dolar (ICP'nin merkeziyetsiz uygulamalarda yaygın kullanımı)

- Dönüştürücü senaryo: 9,15 - 9,48 dolar (büyük kurumsal benimseme gibi olumlu koşullar)

- 2030-12-31: ICP 7,64 dolar (2025'e göre %128 artış potansiyeli)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 3,89876 | 3,361 | 3,05851 | 0 |

| 2026 | 5,15443 | 3,62988 | 2,68611 | 8 |

| 2027 | 6,23686 | 4,39215 | 2,89882 | 31 |

| 2028 | 6,962 | 5,31451 | 4,72991 | 59 |

| 2029 | 9,146 | 6,13826 | 4,41954 | 83 |

| 2030 | 9,47624 | 7,64213 | 5,7316 | 128 |

IV. ICP için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ICP Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun olanlar: Merkeziyetsiz internet altyapısının uzun vadeli potansiyeline inananlar

- Uygulama önerileri:

- ICP'ye düzenli sabit tutarla (DCA) yatırım yapın

- Piyasa dalgalanmalarında tutmaya devam edin, proje gelişimine odaklanın

- Tokenlarınızı güvenli ve kişisel cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını tespit edin

- RSI: Aşırı alım/satım seviyelerini analiz edin

- Swing trade için temel noktalar:

- Proje duyurularını ve ekosistem gelişmelerini takip edin

- Teknik göstergelere göre net giriş-çıkış noktaları belirleyin

ICP Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Orta seviye yatırımcılar: Kripto portföyünün %3-5'i

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

(2) Riskten Koruma Yöntemleri

- Diversifikasyon: Birden fazla Layer 1 protokolüne yatırım yapın

- Stop-loss emirleri: Olası zararları sınırlamak için kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutmak için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki aşamalı doğrulama ve güçlü, benzersiz şifreler kullanın

V. ICP için Potansiyel Riskler ve Zorluklar

ICP Piyasa Riskleri

- Yüksek volatilite: ICP fiyatı sert dalgalanabilir

- Rekabet: Diğer Layer 1 protokolleri pazar payı kazanabilir

- Benimseme riski: Internet Computer ekosisteminin beklenen hızda yaygınlaşmaması

ICP Düzenleyici Riskler

- Düzenleyici belirsizlik: Merkeziyetsiz ağların daha fazla incelemeye maruz kalması

- Uyum zorlukları: Küresel kripto regülasyonlarına uyum sağlama süreçleri

- Jeopolitik faktörler: Uluslararası politikaların blokzincir teknolojileri üzerindeki etkisi

ICP Teknik Riskler

- Ölçeklenebilirlik: Artan ağ yüküne karşı potansiyel sınırlamalar

- Güvenlik açıkları: Protokolde henüz tespit edilmemiş riskler

- Merkeziyetçilik: Ağın gerçek merkeziyetsizliğinin sağlanması

VI. Sonuç ve Eylem Önerileri

ICP Yatırım Değeri Değerlendirmesi

ICP, merkeziyetsiz internet altyapısı olarak benzersiz bir değer sunuyor; fakat kısa vadede volatilite ve benimseme zorlukları ile karşı karşıya. Proje, hedeflerine ulaşırsa uzun vadeli potansiyeli yüksek.

ICP Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Projeyi anlamak için küçük ve düzenli tutarlı yatırımlarla başlayın ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ile stratejik trade'i birleştirin ✅ Kurumsal yatırımcılar: Detaylı inceleme yaparak ICP'yi çeşitlendirilmiş portföye dahil etmeyi değerlendirin

ICP Alım-Satım Katılım Yöntemleri

- Spot alım-satım: ICP'yi Gate.com gibi güvenilir borsalarda alıp satın

- Staking: Ağ yönetimine katılarak ödül kazanın

- DeFi entegrasyonu: Internet Computer ekosisteminde merkeziyetsiz finans fırsatlarını keşfedin

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi niteliği taşımamaktadır. Yatırımcılar, kararlarını kendi risk profillerine göre dikkatlice vermeli ve profesyonel danışmanlık almalıdır. Asla kaybetmeyi göze alamayacağınız miktarda yatırım yapmayın.

Sıkça Sorulan Sorular

ICP 100 dolara ulaşabilir mi?

Evet, ICP 100 dolara ulaşabilir. Kesin olmamakla birlikte, proje Web3 ekosisteminde inovasyon ve yaygın benimseme sağlarsa bu mümkün olabilir.

2025'te ICP coin ne kadar olacak?

Mevcut piyasa trendlerine göre ICP coin'in 2025'te 3,44 - 3,73 dolar aralığında işlem görmesi, ortalama fiyatının ise yaklaşık 3,59 dolar olması bekleniyor.

ICP 1000 dolara çıkabilir mi?

ICP'nin büyüme potansiyeli olsa da 1000 dolara ulaşması pek olası görünmüyor. Güncel piyasa tahminleri temkinli seyretmekte ve yakında bu seviyelere ulaşmasının beklenmediğini gösteriyor.

2030'da ICP'nin değeri ne olacak?

Piyasa trendleri ve uzman analizlerine göre ICP'nin 2030'da ortalama değeri 79,49 dolar olacak; fiyatın 63,18 ile 95,81 dolar aralığında dalgalanması öngörülüyor.

2025 ICP Fiyat Tahmini: Halving Sonrası Döngüde Büyüme Dinamiklerinin ve Pazar Potansiyelinin Değerlendirilmesi

2025 AR Fiyat Tahmini: Arweave Ekosisteminde Büyüme Faktörleri ile Piyasa Dinamiklerinin Analizi

2025 API3 Fiyat Tahmini: Merkeziyetsiz Oracle Token’ı için Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 STORJ Fiyat Tahmini: Merkeziyetsiz Depolama Pazarında Gelecekteki Büyüme Potansiyelinin Analizi

2025 AKT Fiyat Tahmini: Bulut bilişim sektöründe Akash Network'ün tokeni için olumlu ve yükseliş odaklı bir görünüm

2025 BAS Fiyat Tahmini: Piyasa Trendleri ve Blokzincir Tabanlı Varlık Tokenleri İçin Geleceğe Bakış

Do Kwon'un Hapis Cezası, Terra ve LUNA'nın Mirası İçin Yeni Bir Bölümü İşaret Ediyor

Xenea Günlük Quiz Yanıtı 14 Aralık 2025

Kripto Terminolojisini Anlama: Yeni Başlayanlar İçin Rehber

NFT’lerde Yeni Bir Dönem: Soulbound Token’ların Temelini Kavramak

Blockchain Teknolojisinde Tendermint’in Konsensüs Mekanizmasını Anlamak