2025 IMX Fiyat Tahmini: Layer 2 teknolojisinin hızla benimsenmesiyle yükseliş görünümü

Giriş: IMX’in Piyasa Konumu ve Yatırım Potansiyeli

Immutable (IMX), Ethereum üzerinde NFT’ler için ikinci katman (L2) ölçeklenebilirlik çözümü olarak, kuruluşundan bu yana sektörde önemli başarılar elde etti. 2025 yılı itibarıyla Immutable’ın piyasa değeri 1,03 milyar dolara ulaşırken, dolaşımdaki token miktarı yaklaşık 1.940.000.000 ve fiyatı 0,5307 dolar civarında seyrediyor. “NFT ölçeklendirme çözümü” olarak bilinen bu varlık, benzersiz tokenler ve blokzincir oyunları alanında giderek daha merkezi bir rol üstleniyor.

Bu makalede, IMX’in 2025-2030 yılları arasındaki fiyat hareketleri; geçmiş veriler, piyasa dengesi, ekosistem gelişimi ve makroekonomik etkenler doğrultusunda detaylı olarak incelenecek ve yatırımcılara profesyonel fiyat öngörüleriyle birlikte uygulamaya yönelik yatırım stratejileri sunulacaktır.

I. IMX Fiyat Geçmişi ve Güncel Piyasa Durumu

IMX Fiyatının Tarihsel Seyri

- 2021: IMX, 26 Kasım’da tüm zamanların en yüksek seviyesi olan 9,52 dolara ulaştı.

- 2025: IMX, 11 Ekim’de tüm zamanların en düşük seviyesi olan 0,334412 dolara geriledi.

IMX Güncel Piyasa Görünümü

16 Ekim 2025 tarihinde IMX, 0,5307 dolardan işlem görmektedir ve son 24 saatte %10,02 değer kaybetmiştir. Mevcut fiyat, zirve seviyesinden uzaklaşırken piyasa değeri 1.061.400.000 dolara ulaşmıştır. Dolaşımdaki IMX miktarı 1.939.938.090,3898141 olup, bu rakam maksimum arzın %97’sine tekabül ediyor (2.000.000.000 token). Son bir haftada %24,24, son 30 günde ise %16,84 oranında düşüş yaşanmıştır; fiyat hareketleri oldukça dalgalıdır. Bununla birlikte, son bir saat içinde %0,97’lik hafif bir toparlanma gözlemlenmiştir.

Güncel IMX piyasa fiyatını görmek için tıklayın

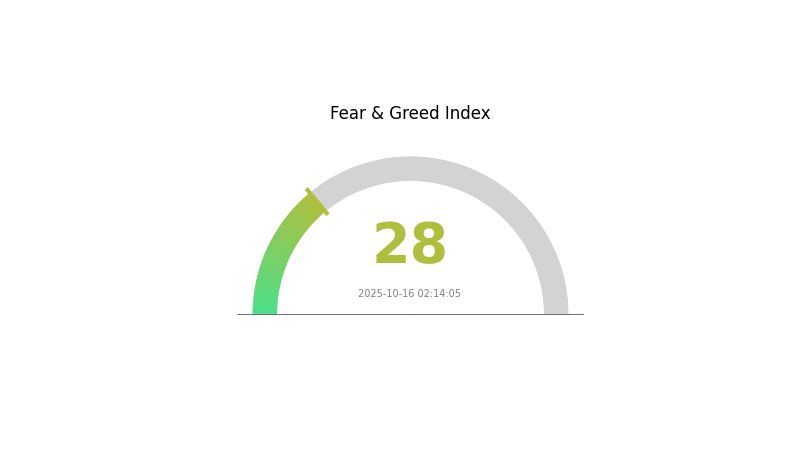

IMX Piyasa Duyarlılığı Göstergesi

16 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık temkinli; Korku ve Açgözlülük Endeksi 28 ile korku seviyesini gösteriyor. Bu, yatırımcıların çekingen davrandığını ve olası alım fırsatlarını kolladığını ifade eder. Korku aşırı satışa işaret edebilir; ancak yatırım öncesinde kapsamlı analiz yapmak kritiktir. Piyasa duyarlılığı hızla değişebilir; bu gösterge diğer analiz araçlarıyla birlikte değerlendirilmelidir. Gate.com’da bilinçli ve temkinli işlem yapın.

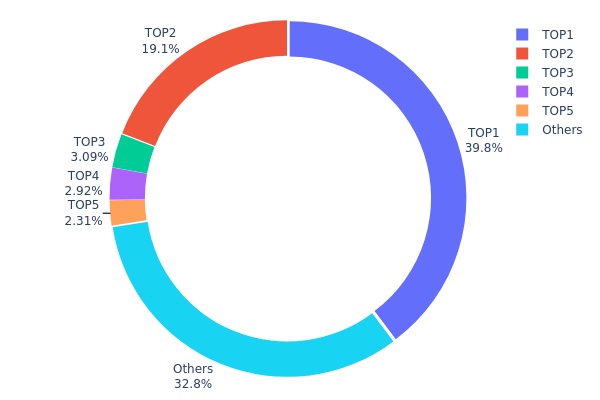

IMX Mülkiyet Dağılımı

IMX’in adres bazlı mülkiyet dağılımı, son derece yoğunlaşmış bir sahiplik yapısını ortaya koyuyor. En büyük adres toplam arzın %39,75’ini, ikinci en büyük adres ise %19,12’sini elinde tutuyor. Bu iki adres, IMX’in neredeyse %59’unu kontrol ediyor. Sonraki üç büyük adresin her biri %2 ila %3 paya sahip; en büyük 5 adresin toplamı yaklaşık %67,19’a ulaşıyor.

Böylesi yüksek yoğunlaşma, IMX’in merkeziyetsizliği ve piyasa istikrarı açısından soru işaretleri doğuruyor. Az sayıdaki adresin büyük miktarda tokeni kontrol etmesi, piyasada manipülasyon ve ani fiyat değişimi riskini artırıyor. Bu ana sahiplerin herhangi bir hareketi, tokenin fiyatı ve işlem hacmi üzerinde ciddi etkilere yol açabilir.

Mevcut dağılım, IMX’in zincir üstü yapısının nispeten merkezileştiğini gösteriyor; bu durum hem dayanıklılık hem de yönetim açısından etkili. Yoğunlaşmış sahiplik, geliştirme faaliyetlerinde koordinasyon sağlayabilir; ancak uzun vadeli istikrarı riske atabilir ve büyük sahiplerin etkisinden endişe eden küçük yatırımcıların ilgisini azaltabilir.

Güncel IMX Mülkiyet Dağılımı için tıklayın

| En Büyük | Adres | Miktar | Oran (%) |

|---|---|---|---|

| 1 | 0x971f...bf94a0 | 795.029,85K | 39,75% |

| 2 | 0x1465...6c5741 | 382.453,41K | 19,12% |

| 3 | 0xf977...41acec | 61.814,23K | 3,09% |

| 4 | 0x2f77...13e62e | 58.414,66K | 2,92% |

| 5 | 0xba5e...d13eb6 | 46.259,69K | 2,31% |

| - | Diğerleri | 656.028,16K | 32,81% |

II. IMX’in Gelecek Fiyatını Etkileyecek Temel Unsurlar

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Mülkiyet: Kurumsal yatırımcıların IMX’i geniş çapta biriktirmesi, güçlü bir talep oluşturdu.

- Kurumsal Benimseme: BNB Chain ekosisteminin büyümesi, IMX’in değerine doğrudan katkı sağladı.

- Devlet Politikaları: Düzenleyici ortamın esnemesi, IMX’in son fiyat hareketlerinin başlıca nedeni oldu.

Makroekonomik Ortam

- Para Politikası Etkisi: ABD Merkez Bankası (Federal Reserve) gibi büyük merkez bankalarının politika beklentileri, IMX fiyatını doğrudan etkiliyor.

- Enflasyona Karşı Koruma: IMX, mevcut ekonomik koşullarda enflasyona karşı koruyucu varlık olarak ön plana çıktı.

- Jeopolitik Faktörler: Küresel jeopolitik gerilimler, IMX dahil kripto piyasalarda işlem dinamiklerini belirliyor.

Teknik Gelişim ve Ekosistem Büyümesi

- Performans Güncellemeleri: BNB Chain ekosistemindeki teknik yükseltmeler, IMX’in performansını artırarak fiyatı olumlu etkiledi.

- Ekosistem Uygulamaları: BNB Chain’deki Toplam Kilitli Değer (TVL) sürekli artıyor ve platform üzerindeki uygulamaların yaygınlaşmasını gösteriyor.

III. 2025-2030 Dönemi IMX Fiyat Tahminleri

2025 Görünümü

- Temkinli öngörü: 0,51149 - 0,53280 dolar

- Tarafsız öngörü: 0,53280 - 0,56210 dolar

- İyimser öngörü: 0,56210 - 0,59141 dolar (pozitif piyasa havası ve proje gelişmeleriyle)

2027-2028 Görünümü

- Piyasa evresi: Artan benimsemeyle büyüme potansiyeli

- Fiyat aralığı tahminleri:

- 2027: 0,36517 - 0,73633 dolar

- 2028: 0,46056 - 0,74091 dolar

- Ana tetikleyiciler: Ekosistem genişlemesi, teknolojik ilerleme ve piyasa trendleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,70420 - 0,74645 dolar (istikrarlı büyüme ve benimseme olduğu varsayıldığında)

- İyimser senaryo: 0,78870 - 0,98531 dolar (güçlü piyasa ve proje başarısıyla)

- Dönüştürücü senaryo: 0,98531 dolar üzeri (çığır açan gelişmeler ve kitlesel benimsemeyle)

- 31 Aralık 2030: IMX 0,74645 dolar (2030 sonu için potansiyel ortalama fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,59141 | 0,5328 | 0,51149 | 0 |

| 2026 | 0,63518 | 0,5621 | 0,44406 | 5 |

| 2027 | 0,73633 | 0,59864 | 0,36517 | 12 |

| 2028 | 0,74091 | 0,66748 | 0,46056 | 25 |

| 2029 | 0,7887 | 0,7042 | 0,66194 | 32 |

| 2030 | 0,98531 | 0,74645 | 0,58969 | 40 |

IV. IMX İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

IMX Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Kime uygun: NFT ve blokzincir oyunlarına uzun vadeli inanan yatırımcılar

- Operasyonel öneriler:

- IMX birikimi için maliyet ortalaması yöntemi kullanın (DCA)

- Piyasa dalgalanmalarında projeye odaklanarak elinizde tutun

- Tokenlerinizi donanım cüzdanı veya güvenilir saklama hizmetinde muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli ortalamalar: Trend ve olası dönüş noktalarını saptamak için

- RSI: Aşırı alım/aşırı satım durumlarını izlemek için

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- Teknik göstergelere göre net giriş-çıkış noktası belirleyin

- Kesin stop-loss emirleriyle riski sınırlandırın

IMX Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Orta düzey yatırımcılar: Kripto portföyünün %3-7’si

- Agresif yatırımcılar: Kripto portföyünün %7-15’i

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: IMX’i farklı kripto varlıklar ve geleneksel yatırımlarla dengeleyin

- Opsiyon stratejileri: Mümkünse opsiyonlarla aşağı yönlü riski sınırlandırın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli için donanım cüzdanı kullanın

- Güvenlik: İki faktörlü doğrulama, güçlü parola ve oltalama saldırılarına karşı dikkat

V. IMX İçin Potansiyel Riskler ve Zorluklar

IMX Piyasa Riskleri

- Oynaklık: Kripto piyasasında sık yaşanan yüksek fiyat dalgalanmaları

- Rekabet: Yeni NFT ve oyun platformları IMX’in pazar payını etkileyebilir

- Piyasa duyarlılığı: Genel kripto piyasasındaki değişimler IMX fiyatını etkileyebilir

IMX Düzenleyici Riskler

- Bilinmeyen düzenlemeler: NFT ve oyun tokenleri için yeni yasa ihtimali

- Uyum zorlukları: Küresel düzenleyici çerçevelere uyum sağlama gerekliliği

- Vergi etkileri: Kripto varlıklar ve NFT’ler için değişen vergi düzenlemeleri

IMX Teknik Riskler

- Akıllı sözleşme açıkları: Temel teknolojide potansiyel güvenlik riskleri

- Ölçeklenebilirlik zorlukları: Artan ağ yükünü yönetme sorunları

- Birlikte çalışabilirlik: Diğer blokzincirlerle uyumluluk sıkıntıları

VI. Sonuç ve Eylem Önerileri

IMX Yatırım Potansiyeli Değerlendirmesi

IMX, NFT ve blokzincir tabanlı oyun sektöründe özgün bir değer sunar. Uzun vadeli potansiyeli güçlü olsa da, kısa vadede oynaklık ve piyasa riskleri dikkatlice değerlendirilmelidir.

IMX Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasa dinamiklerini anlamak için küçük, düzenli yatırımlar yapın ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ve stratejik alım-satımı birleştiren dengeli bir yaklaşım uygulayın ✅ Kurumsal yatırımcılar: IMX’i çeşitlendirilmiş kripto portföyüne dahil edin ve NFT ekosistemindeki rolünü dikkate alın

IMX Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com’da IMX alın ve satın

- Staking: Uygun olan yerlerde IMX staking programlarına katılım sağlayın

- NFT alım-satımı: IMX destekli NFT pazarlarında işlem yaparak ekosistemi keşfedin

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına uygun kararlar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Kaybedebileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

IMX iyi bir proje mi?

IMX, gelişmiş NFT ticareti ve blokzincir tabanlı oyun platformuyla potansiyel sunuyor. İleri teknolojisi ve büyüyen pazar payı, özellikle oyun ve NFT alanına yatırım yapmak isteyenler için cazip bir seçenek haline getiriyor.

IMX neden değer kaybediyor?

IMX’in düşüşü piyasa oynaklığı ve beklenen akıllı sözleşme güncellemelerinden kaynaklanıyor. Bu gerileme, kritik denetimin tamamlanmasıyla aynı döneme denk gelerek yatırımcıların yaklaşan değişimlere dair endişesini yansıtıyor.

IMX bir oyun tokeni mi?

Evet, IMX bir oyun tokenidir. GameFi sektöründe önemli bir rol oynar, NFT’leri destekler ve kripto oyun alanında güçlü bir potansiyele sahiptir.

IMX’e yatırımın riskleri nelerdir?

IMX yatırımı yüksek oynaklık, düzenleyici belirsizlikler ve olası teknik zaaflar içerir. Piyasa duyarlılığı, fiyatlarda ani dalgalanmalara yol açabilir.

WEMIX ve IMX: İki Lider Blockchain Oyun Platformunun Karşılaştırmalı Analizi

GMEE vs IMX: Oyun Blockchain Teknolojisinde Liderlik Yarışı

Open Loot Açıklandı: Temel Beyaz Kağıt Mantığı ve Oyun Uygulamaları

GUNZ White Paper Analizi: Temel Mantık ve Kullanım Durumları Ortaya Çıktı

OIK nedir

XAI Kripto Nedir

Şubat 2025’te İzlenmesi Gereken Yeni Dijital Varlıklar

2023 Bitcoin Piyasa Görünümü: Robert Kiyosaki'nin Değerlendirmeleri

SONIC nedir: Yüksek hızlı kirpiyi ve oyun kültürü üzerindeki etkisini anlamak için kapsamlı bir rehber

2025 ABD Fiyat Tahmini: Uzmanların Analiziyle Piyasa Eğilimleri ve Gelecek Yıla Yönelik Ekonomik Öngörüler