2025 IP Price Prediction: Analyzing Market Trends and Future Valuations in the Digital Asset Landscape

Introduction: IP's Market Position and Investment Value

Story Network (IP), as a purpose-built L1 focused on tokenizing intelligence in the form of IP, has achieved significant milestones since its inception. As of 2025, Story Network's market capitalization has reached $1.5365 billion, with a circulating supply of approximately 250,000,000 tokens, and a price hovering around $6.146. This asset, hailed as the "IP Tokenization Pioneer," is playing an increasingly crucial role in the fields of scientific, creative, and brand IP monetization.

This article will comprehensively analyze Story Network's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. IP Price History Review and Current Market Status

IP Historical Price Evolution

- 2025 (September 21): All-time high reached at $14.93

- 2025 (October 10): All-time low recorded at $1.1

- 2025 (October): Significant market volatility, price fluctuating between ATH and ATL

IP Current Market Situation

As of October 16, 2025, IP is trading at $6.146, representing a 58.84% decrease from its all-time high. The token has shown mixed performance across different timeframes:

- 1 Hour: +2.63% increase

- 24 Hours: -6.7% decrease

- 7 Days: -32.22% significant drop

- 30 Days: -35.80% substantial decline

- 1 Year: +51.58% overall growth

The current market capitalization stands at $1,536,500,000, with a circulating supply of 250,000,000 IP tokens. The 24-hour trading volume is $9,795,129.66, indicating moderate market activity. The fully diluted valuation is $6,146,000,000, suggesting potential for future growth if the total supply is released.

Click to view current IP market price

IP Market Sentiment Index

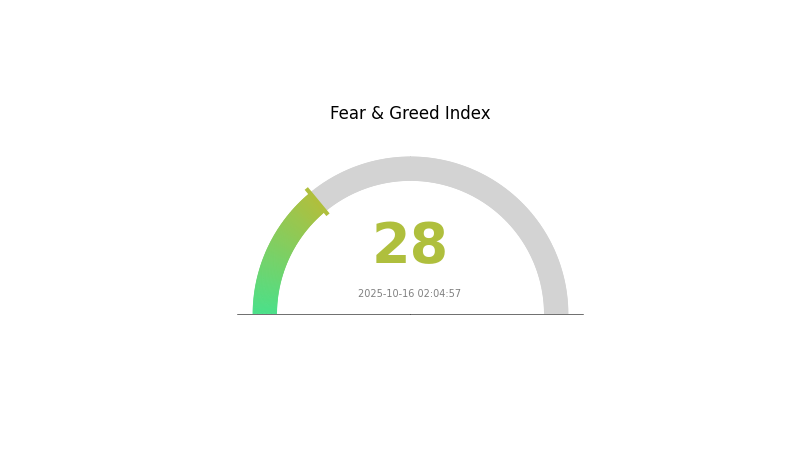

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index registering at 28. This suggests that investors are cautious and uncertain about market conditions. During such times, it's crucial to remain vigilant and avoid making impulsive decisions. While fear may present buying opportunities for some, it's essential to conduct thorough research and consider your risk tolerance before making any investment moves. Keep an eye on market trends and stay informed to navigate this challenging period effectively.

IP Holdings Distribution

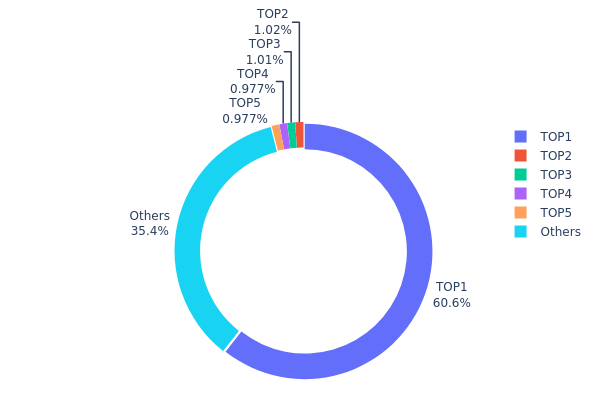

The address holdings distribution data provides crucial insights into the concentration of IP tokens across various addresses. Analyzing this data reveals a significant concentration, with the top address holding 60.63% of the total supply, equivalent to 606,139.26K tokens. This high concentration in a single address raises concerns about centralization and potential market manipulation.

The subsequent top holders possess considerably smaller portions, each accounting for approximately 1% or less of the total supply. Collectively, the top 5 addresses control 64.59% of the IP tokens, while the remaining 35.41% is distributed among other addresses. This distribution pattern indicates a highly centralized token ownership structure, which could potentially impact market dynamics and price volatility. Such concentration may lead to increased susceptibility to large-scale sell-offs or coordinated market actions by major holders.

From a market perspective, this level of concentration suggests a relatively low degree of decentralization in the IP token ecosystem. It also implies that the on-chain structural stability could be vulnerable to decisions made by a small number of large token holders. Potential investors and market participants should be aware of these dynamics when considering their involvement with the IP token.

Click to view the current IP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...000000 | 606139.26K | 60.63% |

| 2 | 0x2503...E22539 | 10209.50K | 1.02% |

| 3 | 0xCB02...68A83a | 10063.50K | 1.00% |

| 4 | 0x3d9d...5C58F1 | 9770.25K | 0.97% |

| 5 | 0xd389...bDdf0f | 9765.44K | 0.97% |

| - | Others | 353642.35K | 35.41% |

II. Key Factors Affecting Future IP Prices

Supply Mechanism

- Halving: Bitcoin's supply is programmed to be cut in half approximately every four years, reducing the rate at which new coins are created.

- Historical patterns: Previous halvings have generally led to price increases in the long term due to reduced supply growth.

- Current impact: The next halving is expected in 2024, which may contribute to upward price pressure if demand remains strong.

Institutional and Whale Dynamics

- Institutional holdings: Major companies like MicroStrategy and Tesla have added Bitcoin to their balance sheets, increasing mainstream adoption.

- Corporate adoption: Several companies now accept Bitcoin as payment, including Microsoft and AT&T, indicating growing real-world use cases.

- Government policies: Countries like El Salvador have adopted Bitcoin as legal tender, while others are developing regulatory frameworks, influencing global adoption trends.

Macroeconomic Environment

- Monetary policy impact: Central bank policies, particularly those of the Federal Reserve, can affect Bitcoin's attractiveness as an inflation hedge.

- Inflation hedging properties: Bitcoin is often viewed as a store of value in inflationary environments, potentially driving demand during economic uncertainty.

- Geopolitical factors: Global conflicts and economic sanctions can increase Bitcoin's appeal as a borderless, censorship-resistant asset.

Technological Developments and Ecosystem Growth

- Lightning Network: This second-layer solution aims to improve Bitcoin's scalability and transaction speed, potentially increasing its utility for everyday transactions.

- Taproot upgrade: Implemented in 2021, this upgrade enhances Bitcoin's privacy and smart contract capabilities, potentially expanding its use cases.

- DeFi applications: The growing decentralized finance ecosystem built on Bitcoin, such as wrapped Bitcoin on other blockchains, expands its utility beyond a store of value.

III. IP Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $3.49 - $5.00

- Neutral prediction: $5.00 - $6.50

- Optimistic prediction: $6.50 - $7.90 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential consolidation phase followed by renewed growth

- Price range forecast:

- 2027: $4.79 - $10.18

- 2028: $5.34 - $11.43

- Key catalysts: Technological advancements, expanded use cases, and broader market trends

2030 Long-term Outlook

- Base scenario: $9.00 - $12.00 (assuming steady market growth and adoption)

- Optimistic scenario: $12.00 - $14.05 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $14.05+ (unprecedented breakthroughs and mainstream integration)

- 2030-12-31: IP $11.80 (potential year-end target based on average prediction)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 7.90254 | 6.126 | 3.49182 | 0 |

| 2026 | 10.10055 | 7.01427 | 3.85785 | 14 |

| 2027 | 10.18332 | 8.55741 | 4.79215 | 39 |

| 2028 | 11.43184 | 9.37036 | 5.34111 | 52 |

| 2029 | 13.2094 | 10.4011 | 7.59281 | 69 |

| 2030 | 14.04825 | 11.80525 | 6.13873 | 92 |

IV. IP Professional Investment Strategies and Risk Management

IP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high-risk tolerance

- Operation suggestions:

- Accumulate IP tokens during market dips

- Set price alerts for significant market movements

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Measure overbought or oversold conditions

- Key points for swing trading:

- Monitor IP's correlation with broader crypto market trends

- Set strict stop-loss orders to manage downside risk

IP Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for IP

IP Market Risks

- High volatility: Significant price swings common in the crypto market

- Liquidity risk: Potential difficulty in selling large amounts quickly

- Market sentiment: Susceptible to rapid shifts based on news or social media

IP Regulatory Risks

- Uncertain regulatory landscape: Potential for sudden regulatory changes

- Cross-border compliance: Varying regulations across different jurisdictions

- Tax implications: Evolving tax laws for crypto assets

IP Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Possible transaction delays during high activity periods

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

IP Investment Value Assessment

IP shows potential as a unique blockchain solution for intellectual property management, but faces significant market volatility and regulatory uncertainties in the short term.

IP Investment Recommendations

✅ Beginners: Start with small positions, focus on education and market understanding ✅ Experienced investors: Consider allocating a portion of the crypto portfolio to IP, monitor closely ✅ Institutional investors: Conduct thorough due diligence, consider IP as part of a diversified crypto strategy

IP Trading Participation Methods

- Spot trading: Direct purchase and sale of IP tokens on Gate.com

- Staking: Participate in Staking programs if available for potential passive income

- DeFi integration: Explore decentralized finance opportunities involving IP tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is IP crypto price prediction?

IP crypto price prediction is a forecast of future IP token values. Analysts expect IP to reach $6.44-$22.17 by 2035 and $22.12-$58.64 by 2040, based on historical crypto market trends.

Will 1inch reach $10?

Yes, 1inch has already reached $10. This milestone reflects strong market performance and growing investor confidence in the project.

How much will pi cost in 2030?

Based on current projections, Pi could reach $6.00 by 2030, with an average price around $4.50, assuming continued adoption and ecosystem growth.

Does Story IP have a future?

Yes, Story IP shows promise. It combines AI with intellectual property, gaining popularity on platforms like Gate.com. Its listing and active trading indicate growing interest and potential for future growth.

Share

Content