2025 LA Price Prediction: Analyzing Future Market Trends and Investment Opportunities in Los Angeles Real Estate

Introduction: LA's Market Position and Investment Value

Lagrange (LA), as a Zero-Knowledge Coprocessing protocol enabling verifiable computations at big data scale across various blockchains, has made significant strides since its inception. As of 2025, Lagrange's market capitalization has reached $68,708,000, with a circulating supply of approximately 193,000,000 tokens, and a price hovering around $0.356. This asset, often referred to as the "ZK Coprocessing innovator," is playing an increasingly crucial role in cross-chain interoperability and big data computations.

This article will provide a comprehensive analysis of Lagrange's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. LA Price History Review and Current Market Status

LA Historical Price Evolution Trajectory

- 2025: Launch of Lagrange protocol, price reached ATH of $2.2 on September 18

- 2025: Market correction, price dropped to ATL of $0.2836 on September 1

- 2025: Recovery phase, price stabilized around $0.356 by September 28

LA Current Market Situation

As of September 28, 2025, LA is trading at $0.356, experiencing a 24-hour decline of 4.58%. The token's market cap stands at $68,708,000, ranking 565th in the overall cryptocurrency market. LA's 24-hour trading volume is $321,166.606399, indicating moderate market activity. The circulating supply is 193,000,000 LA, which represents 19.3% of the total supply of 1,000,000,000 tokens. Over the past week, LA has seen a decrease of 6.68%, while showing a 9.74% increase over the last 30 days. The current price is significantly below its all-time high of $2.2, suggesting potential for growth if market conditions improve.

Click to view the current LA market price

LA Market Sentiment Indicator

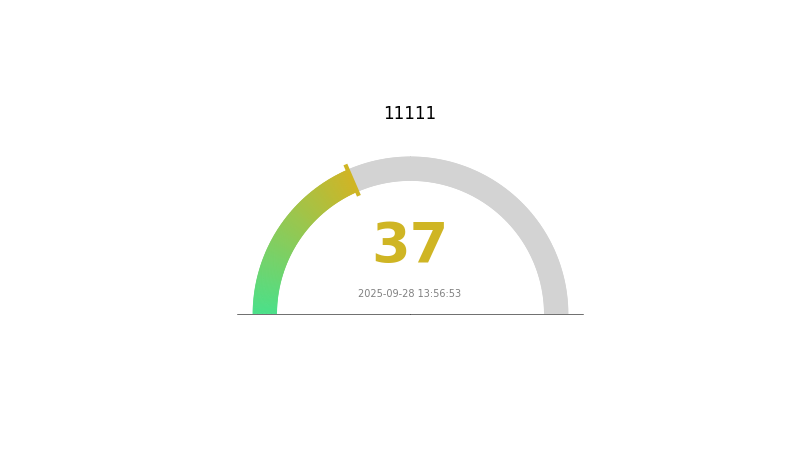

2025-09-28 Fear and Greed Index: 37 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index at 37. This indicates a cautious mood among investors, possibly due to recent market fluctuations or global economic factors. During such periods, some traders may see opportunities for potential long-term investments, while others might adopt a more conservative approach. It's crucial for investors to stay informed and consider their risk tolerance when making decisions. Remember, market sentiment can shift quickly, so regular monitoring is advisable.

LA Holdings Distribution

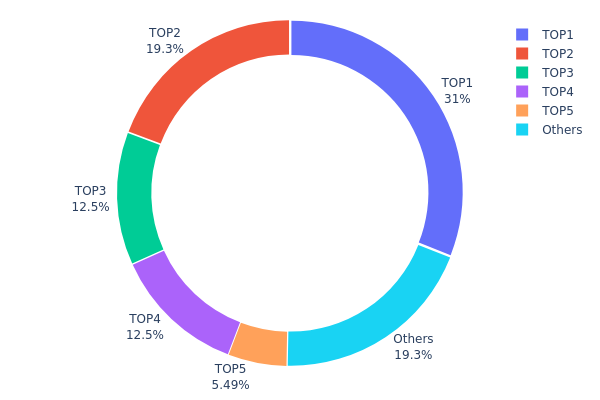

The address holdings distribution data provides crucial insights into the concentration of LA tokens among various wallet addresses. Analysis of this data reveals a highly concentrated ownership structure, with the top 5 addresses controlling 80.69% of the total LA supply.

The largest holder possesses 31% of all LA tokens, while the second-largest holds 19.30%. This concentration raises concerns about potential market manipulation and price volatility. With such a significant portion of tokens in few hands, any large-scale transactions or changes in holding patterns could have substantial impacts on LA's market dynamics.

This high concentration level suggests a relatively low degree of decentralization for LA. While this may provide some stability in terms of reduced selling pressure from smaller holders, it also presents risks of market dominance by a few major players. Investors should be aware that this concentration could lead to increased price volatility and potentially affect the overall market structure of LA.

Click to view the current LA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xaec3...87c073 | 297767.25K | 31.00% |

| 2 | 0xcd1a...89f9dc | 185362.38K | 19.30% |

| 3 | 0x1891...231738 | 119578.37K | 12.45% |

| 4 | 0x9c13...3c3a83 | 119578.37K | 12.45% |

| 5 | 0x269e...249105 | 52759.40K | 5.49% |

| - | Others | 185228.07K | 19.31% |

II. Core Factors Affecting LA's Future Price

Supply Mechanism

-

Blockchain Technology Upgrades: Continuous upgrades and optimizations of blockchain technology will be a core driver for LA's future development. With advancements in smart contracts, sidechain technology, and Layer 2 scaling solutions, LA is expected to improve in transactions and applications.

-

Historical Patterns: Previous technological upgrades have typically led to increased adoption and value for blockchain-based assets.

-

Current Impact: The ongoing development of blockchain infrastructure is likely to enhance LA's utility and potentially drive demand.

Institutional and Whale Activity

-

Enterprise Adoption: Major companies are increasingly exploring blockchain technology applications, which could potentially include LA in their initiatives.

-

Government Policies: National-level policies regarding cryptocurrency and blockchain technology will significantly impact LA's regulatory environment and adoption potential.

Macroeconomic Environment

-

Monetary Policy Impact: The Federal Reserve's decisions on interest rates and monetary supply will influence overall market liquidity and potentially LA's valuation.

-

Inflation Hedging Properties: In an inflationary environment, cryptocurrencies like LA may be viewed as potential hedges, affecting demand.

-

Geopolitical Factors: International tensions and economic policies can impact global investment flows, potentially affecting LA's market.

Technological Development and Ecosystem Building

-

Layer 2 Solutions: Implementation of Layer 2 scaling solutions could significantly improve LA's transaction speed and cost-efficiency.

-

Cross-chain Interoperability: Advancements in cross-chain technology may expand LA's utility across different blockchain networks.

-

Ecosystem Applications: Development of decentralized applications (DApps) and services within LA's ecosystem could drive adoption and value.

III. LA Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.3368 - $0.3583

- Neutral forecast: $0.3583 - $0.4192

- Optimistic forecast: $0.4192 - $0.4801 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.3055 - $0.7404

- 2028: $0.5787 - $0.6982

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.6636 - $0.7101 (assuming steady market growth)

- Optimistic scenario: $0.7565 - $0.8308 (with strong bullish momentum)

- Transformative scenario: $0.8308 - $1.0000 (with breakthrough applications and mass adoption)

- 2030-12-31: LA $0.7101 (potential year-end price target)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.48012 | 0.3583 | 0.3368 | 0 |

| 2026 | 0.61624 | 0.41921 | 0.33956 | 17 |

| 2027 | 0.74035 | 0.51773 | 0.30546 | 45 |

| 2028 | 0.69823 | 0.62904 | 0.57871 | 76 |

| 2029 | 0.75654 | 0.66363 | 0.38491 | 86 |

| 2030 | 0.8308 | 0.71009 | 0.46156 | 99 |

IV. Professional Investment Strategies and Risk Management for LA

LA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate LA tokens during market dips

- Set price targets and regularly review portfolio allocation

- Store tokens in secure hardware wallets or reputable custody solutions

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor LA's correlation with major cryptocurrencies and overall market sentiment

- Set strict stop-loss orders to manage downside risk

LA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets and traditional markets

- Option strategies: Consider using options to protect against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for LA

LA Market Risks

- Volatility: LA may experience significant price fluctuations

- Liquidity: Limited trading volume may impact ability to enter/exit positions

- Competition: Other ZK-based protocols may emerge and challenge LA's market position

LA Regulatory Risks

- Regulatory uncertainty: Changing crypto regulations may impact LA's adoption and usage

- Cross-border compliance: Varying regulations across jurisdictions may limit LA's global reach

- Security token classification: Potential for LA to be classified as a security in some regions

LA Technical Risks

- Smart contract vulnerabilities: Potential for exploits in LA's underlying smart contracts

- Scalability challenges: LA may face difficulties in scaling its network as adoption grows

- Interoperability issues: Compatibility problems with other blockchain networks could limit LA's effectiveness

VI. Conclusion and Action Recommendations

LA Investment Value Assessment

Lagrange (LA) presents a promising long-term value proposition as a zero-knowledge coprocessing protocol enabling verifiable computations at big data scale across blockchains. However, short-term risks include market volatility, regulatory uncertainties, and potential technical challenges.

LA Investment Recommendations

✅ Beginners: Start with small, regular investments to build a position over time ✅ Experienced investors: Consider a balanced approach, combining long-term holding with tactical trading around key support/resistance levels ✅ Institutional investors: Explore strategic partnerships or integrations with LA technology while maintaining a diversified crypto portfolio

LA Participation Methods

- Spot trading: Purchase LA tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- Ecosystem engagement: Explore opportunities to utilize LA's technology in decentralized applications or cross-chain solutions

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for LA token?

As of 2025, LA token is predicted to reach a low of $0.68, an average of $0.79, and a high of $0.91.

Is Lagrange a good investment?

Yes, Lagrange (LA) is a promising investment. It's expected to reach $2.90 by 2030, driven by its role in blockchain infrastructure and current market trends.

How much is Lagrange coin worth today?

As of 2025-09-28, Lagrange coin is worth $0.3653 USD, with a market cap of $70.49 million. The price has increased 0.51% in the last 24 hours.

What crypto has the highest price prediction?

Bitcoin (BTC) has the highest price prediction for 2025, followed closely by Ethereum (ETH). These predictions are based on current market trends and expert analysis.

2025 VFY Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Viction's Whitepaper Logic: Driving 75.6% Growth with Zero-Gas Innovations in 2025

2025 APT Price Prediction: Key Factors That Could Drive Aptos Token to New Heights

2025 KAS Price Prediction: Analyzing Key Factors Driving the Future Value of Kaspa

2025 CORE Price Prediction: Analyzing Growth Potential and Market Factors for Widespread Adoption

2025 ZKPrice Prediction: Analyzing Market Trends and Growth Potential for Zero-Knowledge Protocols

What is TWAP (Time-Weighted Average Price) Strategy and How Does It Work

How to Delete My Account

What is P2P Trading on a Leading Platform?

BTC Option Flows Explained, Why Bitcoin Above 93,000 Suggests a Bullish Start to 2026

Bitcoin Options Traders Eye USD $100,000 as Derivatives Signal Market Reset