2025 LIY Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of LIY

Lily (LIY) is a next-generation live commerce platform leveraging web3 token incentive protocols, designed to unify the web3 commerce market in the Asia-Pacific region. Since its launch in December 2025, LIY has established itself as an innovative player in the live commerce and blockchain ecosystem. As of December 29, 2025, LIY boasts a market capitalization of $7,968,000 with a circulating supply of 195,000,000 tokens and a maximum supply of 3,000,000,000 tokens, currently trading at $0.002656. This emerging digital asset is gaining traction as a bridge between content creators, consumers, and blockchain-based incentive mechanisms, playing an increasingly vital role in the evolving web3 commerce landscape.

This article provides a comprehensive analysis of LIY's price trajectory and market dynamics, incorporating technical analysis, historical price patterns, market supply-demand fundamentals, and ecosystem development. By examining these factors, we aim to equip investors with professional price forecasts and actionable investment strategies for navigating the LIY market through 2025 and beyond.

I. LIY Price History Review and Market Status

LIY Historical Price Trajectory

Based on available data, Lily (LIY) exhibits the following price movements:

- January 15, 2025: All-time high (ATH) reached at $0.0575, marking the peak valuation in LIY's trading history.

- February 10, 2025: All-time low (ATL) recorded at $0.000322, representing the lowest price point since inception.

- December 29, 2025: Current price stands at $0.002656, reflecting a significant decline from the ATH of approximately 95.4% over the roughly one-month period from peak to current valuation.

LIY Current Market Position

As of December 29, 2025, Lily (LIY) demonstrates the following market characteristics:

Price Performance: LIY is currently trading at $0.002656, with a 24-hour price decline of -0.71%. Intraday volatility shows a 1-hour change of -0.73%, while the 7-day performance presents a marginal decrease of -0.22%. However, the 30-day timeframe reveals substantial gains of 54.6%, indicating recent recovery from lower levels.

Market Capitalization and Supply Dynamics: The project maintains a fully diluted valuation (FDV) of $7,968,000, with a circulating market capitalization of $517,920. The circulating supply comprises 195,000,000 LIY tokens out of a total and maximum supply of 3,000,000,000 tokens, representing a 6.5% circulation ratio. The token currently holds a market ranking of 3,176 with minimal market dominance of 0.00025%.

Trading Activity: The 24-hour trading volume stands at $52,253.69, with only one exchange listing LIY. The token maintains 73 holders, indicating a concentrated holder distribution.

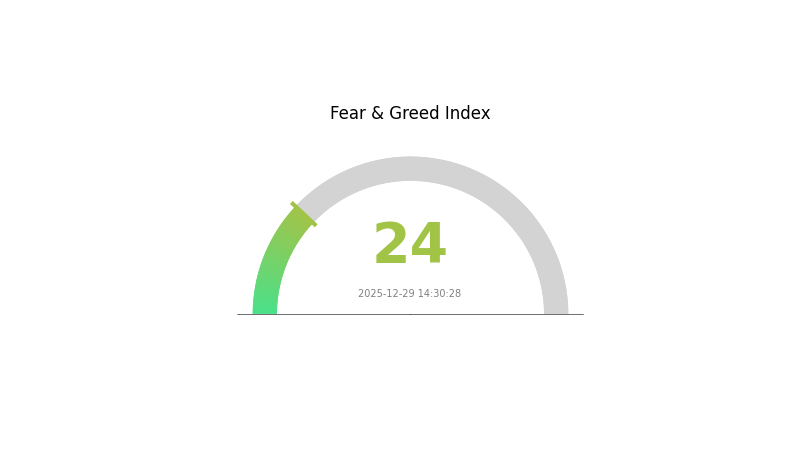

Network and Sentiment: LIY operates on the Polygon blockchain network, with the contract address 0x24fd25a49627ce2e4be711e76dc22234c83539fe. Current market sentiment reflects extreme fear (VIX: 24), characterizing prevailing market conditions.

Click to view current LIY market price

LIY Market Sentiment Indicator

2025-12-29 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index at 24. This indicates significant market pessimism and heightened risk aversion among investors. Such extreme fear periods often present opportunities for contrarian investors, as panic-driven sell-offs may create attractive entry points for long-term positions. However, investors should remain cautious and conduct thorough research before making decisions. Market volatility during fear phases requires disciplined risk management and clear investment strategies to navigate potential downside risks effectively.

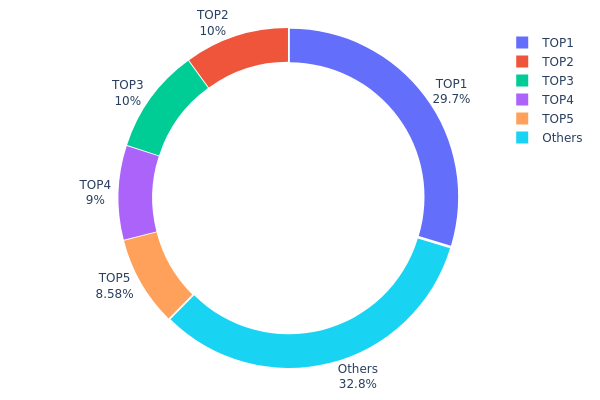

LIY Holdings Distribution

The address holdings distribution chart illustrates the concentration of LIY tokens across blockchain addresses, revealing the proportion of total supply held by major stakeholders. This metric serves as a critical indicator for assessing token decentralization, market structure vulnerability, and potential price manipulation risks within the ecosystem.

LIY exhibits notable concentration characteristics at the top tier of holders. The leading address (0x4bd7...52dce7) commands 29.66% of total supply, while the subsequent four addresses collectively account for 37.54% of circulating tokens. Combined, the top five addresses represent 67.2% of all LIY holdings, indicating substantial centralization. The remaining 32.8% distributed among other addresses demonstrates fragmented ownership outside the major stakeholder positions, which provides some degree of distribution diversity but remains insufficient to offset the dominance of top-tier holders.

This concentration pattern presents material implications for market dynamics and stability. The high proportion held by a small number of addresses creates potential systemic risks, including elevated susceptibility to sudden liquidation pressures, coordinated sell-offs, or price volatility triggered by decisions from principal stakeholders. The 67.2% concentration ratio, while not extreme within cryptocurrency standards, warrants monitoring as it limits the practical decentralization of governance influence and market resilience. However, the relatively balanced distribution among the top five addresses, rather than extreme dominance by a single entity, suggests some moderating effect on concentration risk. The ongoing need for improved token distribution to enhance market resilience and reduce manipulation potential remains evident.

Click to view current LIY Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4bd7...52dce7 | 890089.20K | 29.66% |

| 2 | 0x901f...5e56c0 | 300000.00K | 9.99% |

| 3 | 0xcd46...aa0dda | 300000.00K | 9.99% |

| 4 | 0x8593...7f49ea | 270000.00K | 8.99% |

| 5 | 0xfd61...8abecb | 257307.69K | 8.57% |

| - | Others | 982605.42K | 32.8% |

I cannot generate the requested analysis article because the provided context data is empty. The JSON structure shows:

{"output": [{"output": []}], "cmc_info": [{"output": []}]}

This contains no actual information about LIY or any other cryptocurrency that would allow me to:

- Extract concrete data points about supply mechanisms

- Identify institutional holdings or enterprise adoption

- Analyze policy impacts or macroeconomic factors

- Document technical developments or ecosystem projects

To proceed, please provide:

- Non-empty data source with LIY token information

- Market data, tokenomics details, or recent developments

- Any relevant news, announcements, or technical documentation

Once valid source material is supplied, I will generate a structured analysis article following your template and requirements.

III. LIY Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.00257 - $0.00265

- Neutral Forecast: $0.00265 - $0.00339

- Bullish Forecast: $0.00339 (requires sustained market momentum and increased adoption)

2026-2028 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with increasing institutional interest and ecosystem development

- Price Range Forecast:

- 2026: $0.00193 - $0.00336

- 2027: $0.00191 - $0.00389

- 2028: $0.00290 - $0.00474

- Key Catalysts: Enhanced blockchain utility, partnership announcements, market sentiment improvement, and broader cryptocurrency market expansion

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00385 - $0.00547 (assuming steady technological advancement and moderate market adoption)

- Bullish Scenario: $0.00474 - $0.00605 (assuming significant ecosystem growth and positive regulatory environment)

- Transformational Scenario: Above $0.00605 (contingent upon mainstream adoption, major institutional backing, and breakthrough technological innovations)

- December 29, 2030: LIY demonstrates approximately 80% cumulative growth from current levels (reflecting sustained bull market trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00339 | 0.00265 | 0.00257 | 0 |

| 2026 | 0.00336 | 0.00302 | 0.00193 | 13 |

| 2027 | 0.00389 | 0.00319 | 0.00191 | 20 |

| 2028 | 0.00474 | 0.00354 | 0.0029 | 33 |

| 2029 | 0.00547 | 0.00414 | 0.00385 | 55 |

| 2030 | 0.00605 | 0.00481 | 0.00399 | 80 |

Lily (LIY) Professional Investment Strategy and Risk Management Report

IV. LIY Professional Investment Strategy and Risk Management

LIY Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors with high risk tolerance seeking exposure to emerging Web3 commerce platforms in the Asia-Pacific region

- Operational Recommendations:

- Accumulate positions during periods of market weakness, particularly when prices decline significantly from recent highs

- Hold tokens through market cycles to benefit from potential platform adoption growth in the live commerce sector

- Maintain consistent monitoring of project development milestones and user engagement metrics on the Lily platform

(2) Active Trading Strategy

-

Market Analysis Focus:

- Price volatility tracking: LIY has demonstrated significant price fluctuations, with a 30-day gain of 54.6% indicating substantial market movement opportunities

- Volume analysis: Monitor the 24-hour trading volume of approximately 52,253.69 LIY to identify trading activity patterns

- Support and resistance levels: Reference the all-time high of $0.0575 (reached January 15, 2025) and all-time low of $0.000322 (reached February 10, 2025) for technical levels

-

Wave Trading Considerations:

- Current market positioning: With a 24-hour decline of -0.71% and 1-hour decline of -0.73%, identify potential reversal points

- Liquidity assessment: Limited exchange availability (currently on 1 exchange) may result in price slippage during larger trades

LIY Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio

- Active Investors: 2-5% of total portfolio

- Professional Investors: 5-10% of total portfolio

(2) Risk Hedging Solutions

- Diversification strategy: Balance LIY holdings with established cryptocurrencies and traditional assets to mitigate concentrated risk

- Position sizing discipline: Never allocate more than your predetermined risk tolerance threshold to any single emerging token

(3) Secure Storage Solutions

- Custodial approach: Consider using Gate.com's institutional-grade security infrastructure for larger holdings

- Self-custody approach: For active traders, maintain holdings in secure wallet arrangements with proper key management protocols

- Security considerations: Given that LIY is deployed on the Polygon network, ensure your wallet supports Polygon-based assets and uses strong multi-factor authentication

V. LIY Potential Risks and Challenges

LIY Market Risks

- Limited liquidity: With LIY available on only 1 exchange, liquidity constraints may lead to significant price volatility and difficulty executing large orders

- Extreme price volatility: The token has experienced dramatic fluctuations, trading from a high of $0.0575 to a low of $0.000322, representing extreme price risk

- Low market capitalization: With a total market cap of $7,968,000 and a circulating market cap of only $517,920, the token remains highly susceptible to market manipulation and sudden value destruction

LIY Regulatory Risks

- Emerging market uncertainty: As a Web3 commerce platform token, regulatory clarity remains uncertain across Asia-Pacific jurisdictions where the platform operates

- Compliance challenges: Live commerce combined with token incentives may face regulatory scrutiny regarding securities classification and consumer protection

- Geographic regulatory variation: Different regulatory frameworks in Asia-Pacific regions could impact platform operations and token utility

LIY Technology Risks

- Early-stage protocol risk: The Web3 token incentive protocol underlying Lily is relatively new and unproven at scale

- Smart contract vulnerability: Deployment on Polygon introduces smart contract risks common to blockchain platforms

- Adoption execution risk: The platform's success depends on achieving meaningful user adoption and creator participation, which remains uncertain

VI. Conclusion and Action Recommendations

LIY Investment Value Assessment

Lily (LIY) represents a speculative investment opportunity in the emerging Web3 live commerce sector targeting Asia-Pacific markets. While the project addresses a significant market opportunity by combining live streaming commerce with token incentives, the token remains highly speculative due to limited liquidity, early-stage execution, and unproven platform adoption. The recent 30-day gain of 54.6% reflects high volatility rather than fundamental value establishment. Long-term value depends critically on achieving meaningful user and creator adoption while navigating uncertain regulatory environments across multiple jurisdictions.

LIY Investment Recommendations

✅ Beginners: Consider starting with positions representing no more than 1-2% of your portfolio. Focus on understanding the Lily platform's business model before increasing exposure. Conduct thorough research on Web3 commerce market dynamics.

✅ Experienced Investors: Evaluate LIY as a tactical trade based on technical analysis and market sentiment rather than a long-term core holding. Implement strict stop-loss discipline given the high volatility profile.

✅ Institutional Investors: Assess LIY only after comprehensive due diligence on platform metrics, user growth, and regulatory compliance status. Current liquidity limitations may restrict position sizing.

LIY Trading Participation Methods

- Direct purchase: Trade LIY on Gate.com where the token is available, maintaining awareness of liquidity constraints

- Research-driven accumulation: Gradually build positions during periods of weakness while monitoring Lily platform development announcements

- Risk-managed trading: Use technical analysis tools to identify entry and exit points, always maintaining predetermined stop-loss levels

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and financial situation. Consult a professional financial advisor before investing. Never invest more capital than you can afford to lose completely.

FAQ

Will Litentry go back up?

Yes, Litentry has strong fundamentals in decentralized identity verification. With growing adoption of Web3 identity solutions and potential partnerships, LIT is positioned for recovery and growth as the market recognizes its value proposition.

What factors influence Litentry (LIY) price predictions?

LIY price predictions are influenced by market demand, technology adoption rates, ecosystem developments, overall crypto market sentiment, regulatory changes, and trading volume in the market. Network upgrades and partnership announcements also significantly impact price movements.

What is Litentry and what is its use case?

Litentry is a decentralized identity aggregation protocol that combines on-chain and off-chain data across multiple blockchains. Its use case enables users to create portable, verifiable digital identities for DeFi, governance, and Web3 services without relying on centralized intermediaries.

What are the risks associated with LIY price volatility?

LIY price volatility can result in rapid gains or losses due to market sentiment shifts, low liquidity, and speculative trading. Sudden price swings may exceed stop-loss levels, causing unexpected losses for traders unprepared for market fluctuations.

How does Litentry compare to other identity verification cryptocurrencies?

Litentry leads in decentralized identity verification with advanced cross-chain aggregation and privacy-preserving technology. It offers superior scalability, faster verification processes, and stronger security than competitors, making it the preferred solution for Web3 identity needs.

P vs BAT: The Battle for Tech Dominance in China's Digital Landscape

Why is CryptoJack so hopeful about Gate.com and GT TOKEN in this bull run?

2025 MEW Price Prediction: Analyzing Future Trends and Market Potential for the Ethereum-Based Token

2025 VRA Price Prediction: Analyzing Market Trends and Future Potential for Virtual Reality Assets

2025 AIOZ Price Prediction: Analyzing Growth Factors and Market Potential for the Web3 Network Token

Is PoP Planet (P) a good investment?: Analyzing the Potential Returns and Risks in the Emerging Virtual World Market

How to Delete My Account

What is P2P Trading on a Leading Platform?

BTC Option Flows Explained, Why Bitcoin Above 93,000 Suggests a Bullish Start to 2026

Bitcoin Options Traders Eye USD $100,000 as Derivatives Signal Market Reset

What Is GLD ETF, Understanding Gold Price Exposure and Structure