2025 LOE Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: LOE's Market Position and Investment Value

Legends of Elysium (LOE) has established itself as a pioneering free-to-play fusion of Trading Card & Board Game in the blockchain gaming sector. Since its inception in 2021, LOE has made significant strides in reshaping the future of gaming and onboarding players to web3. As of 2025, LOE's market capitalization stands at $128,379.83, with a circulating supply of approximately 95,805,841.95 tokens, and a price hovering around $0.00134. This asset, dubbed as the "Web3 Gaming Revolution," is playing an increasingly crucial role in the intersection of traditional gaming and blockchain technology.

This article will provide a comprehensive analysis of LOE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. LOE Price History Review and Current Market Status

LOE Historical Price Evolution

- 2024: ATH reached $0.447 on March 29, marking a significant milestone

- 2025: Steep decline throughout the year, price dropped over 90% from ATH

- 2025: Market cycle bottomed out, price hit ATL of $0.0012 on November 24

LOE Current Market Situation

As of November 29, 2025, LOE is trading at $0.00134, showing a 1.28% increase in the last 24 hours. The token has experienced significant volatility, with a 24-hour trading volume of $11,734.25. LOE's market capitalization currently stands at $128,379.83, ranking it #4633 in the cryptocurrency market. The circulating supply is 95,805,841.95 LOE, which represents 47.9% of the total supply of 199,000,000 LOE. Despite the recent 24-hour gain, LOE has seen substantial losses over longer periods, with a 31.4% decrease in the past 30 days and a staggering 92.11% drop over the past year. The current price is 99.7% below its all-time high, indicating a prolonged bearish trend.

Click to view the current LOE market price

LOE Market Sentiment Indicator

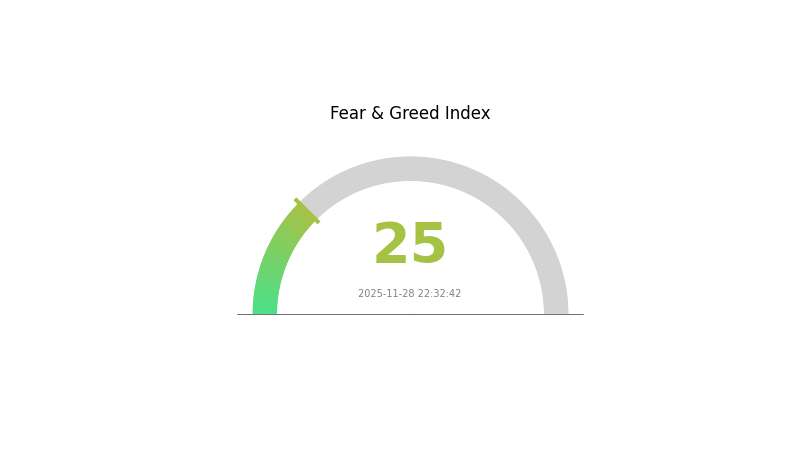

2025-11-28 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 25. This heightened level of anxiety suggests that investors are particularly cautious and risk-averse. Such extreme fear often presents potential buying opportunities for contrarian investors, as assets may be undervalued. However, it's crucial to conduct thorough research and exercise caution before making any investment decisions. Keep an eye on market trends and fundamental factors that could influence price movements in the coming days.

LOE Holdings Distribution

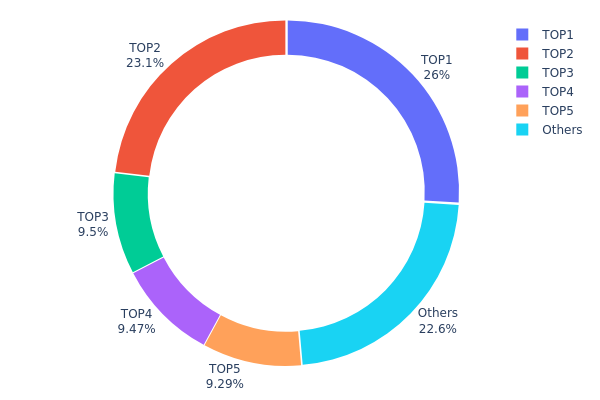

The address holdings distribution data for LOE reveals a highly concentrated ownership structure. The top five addresses collectively hold 77.38% of the total supply, with the largest holder possessing 26% alone. This concentration is further emphasized by the second-largest holder controlling 23.13% of the tokens.

Such a concentrated distribution raises concerns about market stability and potential price manipulation. With nearly half of the supply controlled by just two addresses, there's a risk of significant market impact if these holders decide to sell or move their tokens. This concentration also suggests a low level of decentralization, which may be contrary to the principles of many blockchain projects.

The current distribution pattern indicates a market structure that could be susceptible to volatility. While the presence of large holders can sometimes provide stability, it also introduces the risk of sudden, large-scale movements affecting the entire LOE ecosystem. Investors and market participants should be aware of this concentration when considering LOE's on-chain stability and overall market dynamics.

Click to view the current LOE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe33b...adfcdb | 52000.00K | 26.00% |

| 2 | 0x65d5...59c7e8 | 46263.18K | 23.13% |

| 3 | 0xf067...b98e47 | 18991.05K | 9.49% |

| 4 | 0x0d07...b492fe | 18942.74K | 9.47% |

| 5 | 0x0529...c553b7 | 18588.37K | 9.29% |

| - | Others | 45214.66K | 22.62% |

II. Key Factors Affecting LOE's Future Price

Supply Mechanism

- Halving: The LOE network implements a halving mechanism, where the block reward is reduced by half at regular intervals.

- Historical Pattern: Previous halvings have historically led to price increases due to reduced supply inflation.

- Current Impact: The upcoming halving is expected to create upward pressure on LOE's price as new supply decreases.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions have been increasing their LOE holdings, signaling growing mainstream adoption.

- Corporate Adoption: Several Fortune 500 companies have added LOE to their balance sheets as a treasury reserve asset.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' ongoing quantitative easing policies may drive investors towards LOE as a hedge against fiat currency devaluation.

- Inflation Hedge Properties: LOE has shown potential as an inflation hedge, attracting investors during periods of high inflation.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions have increased LOE's appeal as a borderless, decentralized asset.

Technical Development and Ecosystem Growth

- Layer 2 Solutions: Implementation of layer 2 scaling solutions is expected to improve transaction speed and reduce fees, potentially driving adoption.

- Smart Contract Upgrades: Enhancements to LOE's smart contract capabilities could expand its use cases in decentralized finance (DeFi) applications.

- Ecosystem Applications: The LOE ecosystem has seen growth in DeFi protocols, NFT platforms, and decentralized exchanges, broadening its utility and appeal.

III. LOE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00114 - $0.00125

- Neutral prediction: $0.00125 - $0.00145

- Optimistic prediction: $0.00145 - $0.00157 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00105 - $0.00269

- 2028: $0.00166 - $0.00328

- Key catalysts: Increased adoption and market expansion

2029-2030 Long-term Outlook

- Base scenario: $0.00245 - $0.00285 (assuming steady market growth)

- Optimistic scenario: $0.00285 - $0.00293 (assuming strong market performance)

- Transformative scenario: Above $0.00293 (extremely favorable market conditions)

- 2030-12-31: LOE $0.00282 (potential stabilization point)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00157 | 0.00135 | 0.00114 | 0 |

| 2026 | 0.00215 | 0.00146 | 0.00086 | 8 |

| 2027 | 0.00269 | 0.0018 | 0.00105 | 34 |

| 2028 | 0.00328 | 0.00225 | 0.00166 | 67 |

| 2029 | 0.00287 | 0.00276 | 0.00155 | 106 |

| 2030 | 0.00293 | 0.00282 | 0.00245 | 110 |

IV. Professional Investment Strategies and Risk Management for LOE

LOE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and blockchain gaming enthusiasts

- Operation suggestions:

- Accumulate LOE tokens during market dips

- Stay informed about Legends of Elysium game development and updates

- Store tokens in a secure Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor game adoption metrics and user growth

- Track trading volume and liquidity changes

LOE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance LOE with other gaming tokens and blue-chip cryptocurrencies

- Stop-loss orders: Set appropriate levels to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for LOE

LOE Market Risks

- High volatility: Gaming tokens can experience significant price swings

- Competition: Other blockchain games may impact LOE's market share

- Market sentiment: Changes in overall crypto market sentiment can affect LOE's price

LOE Regulatory Risks

- Uncertain regulations: Potential changes in cryptocurrency regulations may impact LOE

- Gaming laws: Evolving regulations around blockchain gaming could affect adoption

- Tax implications: Unclear tax treatment of gaming tokens in various jurisdictions

LOE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Scalability issues: Challenges in handling increased user load on the game platform

- Blockchain network congestion: High fees or slow transactions on the Polygon network

VI. Conclusion and Action Recommendations

LOE Investment Value Assessment

Legends of Elysium (LOE) presents a unique opportunity in the blockchain gaming sector, with potential for growth as the game develops and attracts users. However, investors should be aware of the high volatility and risks associated with early-stage gaming projects.

LOE Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about the game and blockchain technology ✅ Experienced investors: Consider a balanced approach, allocating a portion of their gaming token portfolio to LOE ✅ Institutional investors: Conduct thorough due diligence on the game's development progress and user metrics before making significant investments

LOE Trading Participation Methods

- Spot trading: Buy and sell LOE tokens on Gate.com

- Staking: Participate in staking programs if offered by the Legends of Elysium platform

- In-game purchases: Utilize LOE tokens within the game ecosystem for items and features

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is the stock market expected to go up in 2025?

Yes, the stock market is expected to show positive growth in 2025, with many analysts predicting a bullish trend due to economic recovery and technological advancements.

Which LOW price share is best to buy today?

Based on current market trends and analysis, the best LOW price share to buy today is likely the one with the lowest price-to-earnings ratio and highest growth potential in the Web3 and cryptocurrency sector.

What is the target price for Lowe's stock?

Based on current market trends and analyst projections, the target price for Lowe's stock is estimated to be around $250-$275 per share by the end of 2026.

What is Nvidia's price target?

Nvidia's price target is estimated to be around $800-$850 per share by the end of 2025, based on strong AI chip demand and market growth projections.

2025 BEPRO Price Prediction: Expert Analysis and Market Forecast for the Coming Year

What Does GM Mean ?

Jasmy Coin and bull run

What is Moni

What is XAI: Exploring the World of Explainable Artificial Intelligence

What is XAI: Exploring the World of Explainable Artificial Intelligence and Its Impact on Decision-Making Systems

How do RSI, MACD, and Bollinger Bands signals indicate ZEC price trends in 2026?

Vitalik Buterin’s 2026 Centrifugal Force: How Ethereum Pushes Back Against Centralized Powers and Market Challenges

What is token economics model? How do token distribution, inflation mechanisms, and governance create crypto value?

What is Shiba Inu (SHIB) fundamental analysis: whitepaper logic, use cases, and 2030 price prediction?

U.S. Spot Crypto ETF Market Surge: Trading Volume Tops $2 Trillion, Revealing a New Trading Paradigm