2025 LWA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: LWA's Market Position and Investment Value

LumiWave (LWA), as a Web3 IP platform powered by Sui, has been transforming traditional intellectual property into new content such as NFTs and blockchain games since its inception. As of 2025, LWA's market capitalization has reached $4,176,119, with a circulating supply of approximately 770,075,466 tokens, and a price hovering around $0.005423. This asset, known as a "Web3 IP innovator," is playing an increasingly crucial role in the creation of new ecosystems for the IP business.

This article will provide a comprehensive analysis of LWA's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. LWA Price History Review and Current Market Status

LWA Historical Price Evolution

- 2024: LWA launched, reaching its all-time high of $1 on May 23, 2024

- 2025: Significant market downturn, price dropped by over 80% year-to-date

LWA Current Market Situation

LWA is currently trading at $0.005423, representing a 99.46% decline from its all-time high. The token has experienced a negative trend across multiple timeframes:

- 1 hour: +0.33%

- 24 hours: -0.71%

- 7 days: -13.36%

- 30 days: -31.36%

- 1 year: -80.12%

The token's market capitalization stands at $4,176,119, ranking it 1684th in the global cryptocurrency market. LWA's 24-hour trading volume is $10,346, indicating relatively low liquidity. The circulating supply matches the total and maximum supply at 770,075,466 LWA tokens.

Click to view the current LWA market price

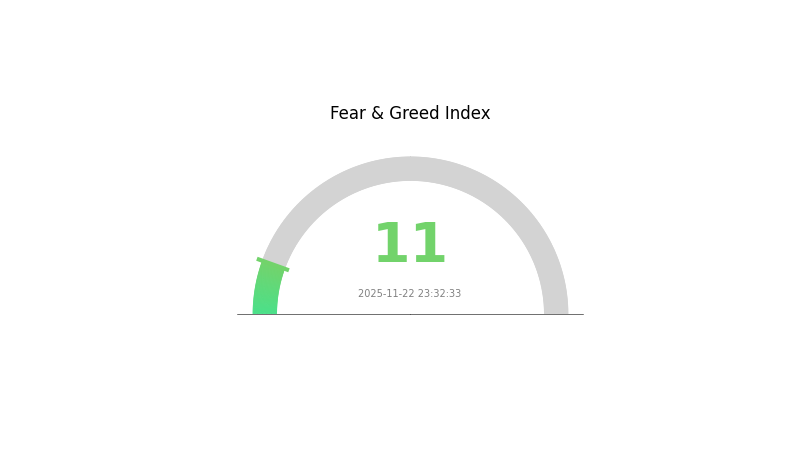

LWA Market Sentiment Indicator

2025-11-22 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment has plunged into extreme fear territory, with the Fear and Greed Index registering a mere 11 points. This significant drop suggests a high level of pessimism among investors, potentially indicating oversold conditions. While such extreme fear often precedes market bottoms, it's crucial to approach with caution. Savvy traders might view this as an opportunity to accumulate, adhering to the adage "be fearful when others are greedy, and greedy when others are fearful." However, always conduct thorough research and manage risks carefully in these volatile market conditions.

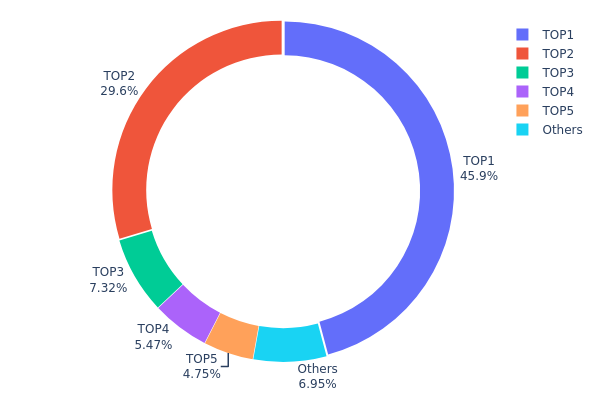

LWA Holdings Distribution

The address holdings distribution data provides insights into the concentration of LWA tokens among different wallet addresses. Analysis of this data reveals a highly centralized distribution pattern, with the top five addresses controlling 93.02% of the total supply.

The top two addresses alone hold 75.49% of all LWA tokens, with the largest holder possessing 45.86% and the second-largest 29.63%. This extreme concentration raises concerns about potential market manipulation and price volatility. Such a distribution structure could lead to significant price swings if large holders decide to sell or move their holdings.

This level of centralization also suggests a low degree of decentralization in the LWA ecosystem, which may impact its overall stability and resistance to external influences. While this concentration might provide some short-term price stability, it also presents risks to the long-term health and adoption of the token.

Click to view the current LWA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x605f...d42700 | 353203.09K | 45.86% |

| 2 | 0x260e...bc8317 | 228248.62K | 29.63% |

| 3 | 0x1cb5...d9f4c5 | 56406.71K | 7.32% |

| 4 | 0x11fb...414178 | 42145.15K | 5.47% |

| 5 | 0x6605...af081e | 36561.93K | 4.74% |

| - | Others | 53509.97K | 6.98% |

II. Core Factors Affecting LWA's Future Price

Supply Mechanism

- Fixed Supply: LWA has a fixed total supply, which could potentially create scarcity and impact price over time.

- Historical Pattern: As the supply remains constant, any increase in demand typically leads to price appreciation.

- Current Impact: The fixed supply mechanism continues to be a fundamental factor in LWA's price dynamics.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, LWA may be viewed as a potential hedge against inflation, similar to other digital assets.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions could influence investor sentiment towards cryptocurrencies like LWA.

Technical Development and Ecosystem Building

- Ecosystem Applications: The growth of decentralized applications (DApps) and projects built on the LWA network could drive adoption and potentially impact its value.

III. LWA Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00422 - $0.00541

- Neutral forecast: $0.00541 - $0.00584

- Optimistic forecast: $0.00584 - $0.00627 (requires positive market sentiment)

2026-2027 Outlook

- Market phase expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.00490 - $0.00613

- 2027: $0.00539 - $0.00772

- Key catalysts: Increased adoption and potential technological improvements

2028-2030 Long-term Outlook

- Base scenario: $0.00685 - $0.00918 (assuming steady market growth)

- Optimistic scenario: $0.00918 - $0.01027 (assuming strong market performance)

- Transformative scenario: $0.01027 - $0.01200 (assuming breakthrough innovations)

- 2030-12-31: LWA $0.00982 (potential peak before year-end consolidation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00627 | 0.00541 | 0.00422 | 0 |

| 2026 | 0.00613 | 0.00584 | 0.0049 | 7 |

| 2027 | 0.00772 | 0.00598 | 0.00539 | 10 |

| 2028 | 0.00932 | 0.00685 | 0.0048 | 26 |

| 2029 | 0.01027 | 0.00808 | 0.0076 | 49 |

| 2030 | 0.00982 | 0.00918 | 0.00578 | 69 |

IV. Professional Investment Strategies and Risk Management for LWA

LWA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors interested in Web3 IP platforms and blockchain gaming

- Operation suggestions:

- Accumulate LWA tokens during market dips

- Monitor LumiWave's project developments and partnerships

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Pay attention to news and updates from the LumiWave team

LWA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Web3 and gaming tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, keep private keys offline

V. Potential Risks and Challenges for LWA

LWA Market Risks

- High volatility: LWA price may experience significant fluctuations

- Limited liquidity: Trading volume may be low, affecting entry and exit

- Market sentiment: Broader crypto market trends can impact LWA's performance

LWA Regulatory Risks

- Uncertain regulations: Evolving crypto regulations may affect LWA's operations

- IP licensing issues: Potential legal challenges related to intellectual property rights

- Cross-border compliance: Varying regulations across different jurisdictions

LWA Technical Risks

- Smart contract vulnerabilities: Potential security issues in the token contract

- Scalability challenges: The Sui blockchain may face scalability issues as usage grows

- Interoperability concerns: Limited cross-chain functionality may restrict adoption

VI. Conclusion and Action Recommendations

LWA Investment Value Assessment

LWA presents a unique opportunity in the Web3 IP and blockchain gaming space, but carries significant risks due to its early-stage nature and market volatility. Long-term potential exists if LumiWave successfully integrates traditional IP with blockchain technology.

LWA Investment Recommendations

✅ Beginners: Consider small, exploratory investments to understand the project ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider strategic partnerships

LWA Trading Participation Methods

- Spot trading: Buy and sell LWA tokens on supported exchanges

- Staking: Participate in staking programs if offered by LumiWave

- NFT purchases: Engage with LumiWave's ecosystem through NFT offerings

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

While it's impossible to predict with certainty, low-cap altcoins with strong fundamentals and innovative technology have the highest potential for massive gains. Always do thorough research before investing.

Can illuvium reach $1000?

Yes, Illuvium could potentially reach $1000 in the future. With its innovative gameplay and growing ecosystem, it has the potential for significant price appreciation.

Does Bluzelle have a future?

Yes, Bluzelle has a promising future. As a decentralized database service, it's well-positioned to meet growing demand for secure, scalable data storage in Web3. Its innovative technology and strong team suggest potential for long-term growth and adoption in the blockchain ecosystem.

Can Coti reach $10?

While ambitious, reaching $10 is possible for Coti in the long term with strong adoption and market growth. However, it would require significant ecosystem expansion and broader crypto market bullishness.

Is Adventure Gold (AGLD) a Good Investment?: Analyzing the Long-Term Potential of this Gaming Token in the NFT Ecosystem

Is Dogami (DOGA) a good investment?: Analyzing the Potential and Risks of this NFT Gaming Token

Is CeluvPlay (CELB) a good investment?: Analyzing the potential of this emerging entertainment platform in the Korean market

Is WORLDSHARDS (SHARDS) a good investment?: Analyzing the potential and risks of this new blockchain gaming token

Is Nifty Island (ISLAND) a good investment?: A Comprehensive Analysis of Risk, Market Potential, and Long-term Viability for Crypto Investors

2025 DOGA Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Are There Any Taxes for Crypto in Canada?

How Does Fed Policy and Inflation Impact Crypto Prices in 2026?

How to Use MACD, RSI, and Bollinger Bands for Crypto Trading in 2026?

VOID vs ATOM: Understanding the Fundamental Differences Between Emptiness and Matter in Modern Physics

What are the consequences of setting up a mining farm at home?