2025 MAVIA Price Prediction: Future Growth Analysis and Potential ROI for Investors

Introduction: MAVIA's Market Position and Investment Value

Heroes of Mavia (MAVIA), as a Web3 mobile base-builder strategy game, has made significant strides since its inception. As of 2025, MAVIA's market capitalization has reached $14,624,920, with a circulating supply of approximately 111,931,126 tokens, and a price hovering around $0.13066. This asset, often referred to as a "Web3 gaming pioneer," is playing an increasingly crucial role in the blockchain gaming sector.

This article will provide a comprehensive analysis of MAVIA's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MAVIA Price History Review and Current Market Status

MAVIA Historical Price Evolution

- 2024: MAVIA reached its all-time high of $10.83 on February 18, marking a significant milestone in its price history.

- 2025: The token experienced a substantial decline, hitting its all-time low of $0.0949 on March 11.

- 2025: Market cycle shifted, with the price recovering from its low point to the current level.

MAVIA Current Market Situation

As of October 7, 2025, MAVIA is trading at $0.13066, showing a 1.94% increase in the last 24 hours. The token has experienced a notable 9.81% gain over the past week, indicating a short-term positive momentum. However, the 30-day performance shows a 5.2% decrease, suggesting some volatility in the medium term.

MAVIA's market capitalization currently stands at $14,624,920, with a circulating supply of 111,931,126 tokens. The fully diluted market cap is $32,665,000, based on the maximum supply of 250,000,000 MAVIA tokens. The token's trading volume in the last 24 hours is $523,203, reflecting moderate market activity.

Despite the recent positive short-term trend, MAVIA is still significantly below its all-time high, with a 90.29% decrease from its peak price over the past year. This substantial decline highlights the challenging market conditions the token has faced since its peak.

Click to view the current MAVIA market price

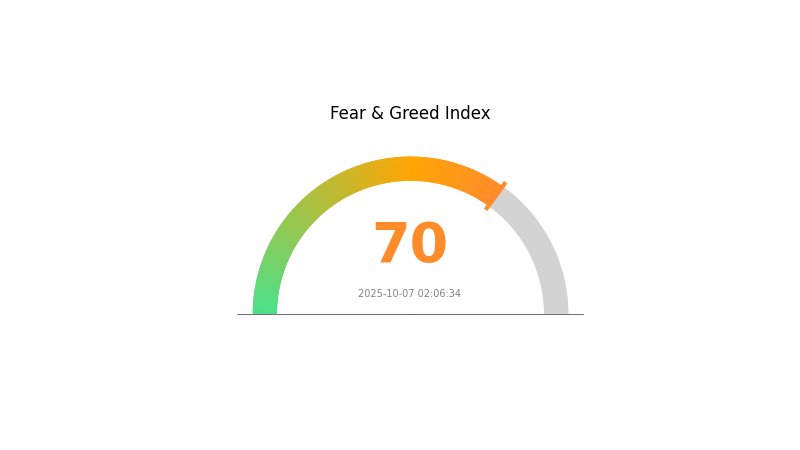

MAVIA Market Sentiment Indicator

2025-10-07 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently in a state of greed, with the Fear and Greed Index reaching 70. This indicates strong bullish sentiment among investors, potentially driven by recent positive developments or price increases. However, traders should exercise caution as extreme greed can sometimes precede market corrections. It's crucial to maintain a balanced approach, conduct thorough research, and consider risk management strategies when making investment decisions in such a market climate.

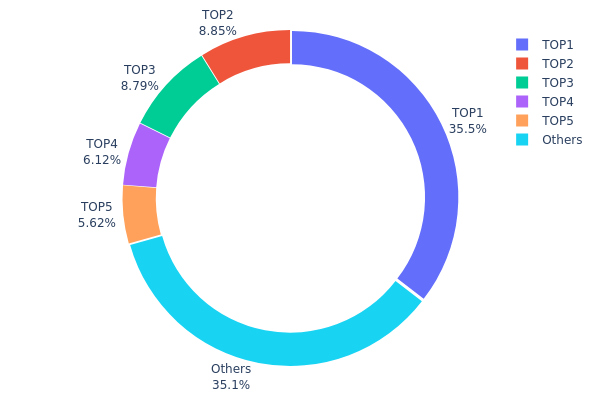

MAVIA Holdings Distribution

The address holdings distribution data for MAVIA reveals a significant concentration of tokens among a few top addresses. The leading address holds 35.45% of the total supply, with the top five addresses collectively controlling 64.82% of MAVIA tokens. This high level of concentration suggests a relatively centralized ownership structure.

Such concentration raises concerns about potential market manipulation and price volatility. With a single address holding over one-third of the supply, there's a risk of large-scale sell-offs or acquisitions significantly impacting the token's price. The top holders have substantial influence over the token's circulating supply and, consequently, its market dynamics.

This distribution pattern indicates a low degree of decentralization for MAVIA at present. While this concentration might provide some stability in the short term, it also poses risks to the token's long-term sustainability and fair market operations. Potential investors should be aware of this ownership structure when considering MAVIA's market behavior and future prospects.

Click to view the current MAVIA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6d04...45be6e | 88645.32K | 35.45% |

| 2 | 0xf42a...36f173 | 22135.26K | 8.85% |

| 3 | 0xe6c2...7abd4d | 21987.44K | 8.79% |

| 4 | 0x0d07...b492fe | 15309.13K | 6.12% |

| 5 | 0x7a1c...bdbacc | 14049.99K | 5.61% |

| - | Others | 87872.86K | 35.18% |

II. Key Factors Affecting MAVIA's Future Price

Market Acceptance and Sentiment

-

Market Recognition: The value of MAVIA tokens will be influenced by the market's acceptance and recognition of blockchain games. As blockchain technology becomes more widespread, the demand for decentralized games may gradually increase, potentially improving MAVIA's prospects.

-

Investor Sentiment: Investor sentiment and confidence have a direct impact on MAVIA's price trends. When the market receives news about MAVIA's widespread adoption or significant technological breakthroughs, it can lead to price fluctuations.

Technical Development and Ecosystem Building

-

Game Success: The core of MAVIA is its cryptocurrency integrated into the market, enhancing the play-to-earn model. The success and popularity of the Heroes of Mavia game will be crucial in driving demand for MAVIA tokens.

-

Technological Innovation: Any major technological advancements or updates to the MAVIA platform could significantly impact its price. Innovations that improve gameplay, user experience, or blockchain integration may attract more users and investors.

-

Ecosystem Growth: The development of a robust ecosystem around MAVIA, including partnerships, additional features, or integration with other blockchain projects, could enhance its value proposition and affect its price.

Macroeconomic Factors

-

Cryptocurrency Market Trends: As part of the broader cryptocurrency market, MAVIA's price may be influenced by overall market trends, including Bitcoin's performance and general sentiment towards digital assets.

-

Regulatory Environment: Changes in regulations regarding cryptocurrency and blockchain gaming in key markets could impact MAVIA's adoption and, consequently, its price.

Supply and Demand Dynamics

-

Token Utility: The utility of MAVIA tokens within the game ecosystem, including any staking mechanisms or governance rights, can affect demand and price.

-

Token Distribution: The distribution strategy of MAVIA tokens, including any lockup periods or vesting schedules for team and investor allocations, may influence supply dynamics and price stability.

III. MAVIA Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $0.10595 - $0.12

- Neutral estimate: $0.12 - $0.13

- Optimistic estimate: $0.13 - $0.14126 (requires strong market momentum)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.13057 - $0.18015

- 2028: $0.15544 - $0.23489

- Key catalysts: Increased adoption, technological improvements

2029-2030 Long-term Outlook

- Base scenario: $0.20381 - $0.23132 (assuming steady market growth)

- Optimistic scenario: $0.25883 - $0.29146 (with favorable market conditions)

- Transformative scenario: $0.30 - $0.35 (with exceptional project developments and market uptake)

- 2030-12-31: MAVIA $0.23132 (77% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.14126 | 0.1308 | 0.10595 | 0 |

| 2026 | 0.19453 | 0.13603 | 0.09114 | 4 |

| 2027 | 0.18015 | 0.16528 | 0.13057 | 26 |

| 2028 | 0.23489 | 0.17272 | 0.15544 | 32 |

| 2029 | 0.25883 | 0.20381 | 0.15285 | 55 |

| 2030 | 0.29146 | 0.23132 | 0.21744 | 77 |

IV. MAVIA Professional Investment Strategies and Risk Management

MAVIA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and blockchain gaming enthusiasts

- Operation suggestions:

- Accumulate MAVIA tokens during market dips

- Hold tokens for at least 1-2 years to capture potential growth

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor game development updates and user adoption metrics

MAVIA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. MAVIA Potential Risks and Challenges

MAVIA Market Risks

- Volatility: High price fluctuations common in crypto gaming tokens

- Competition: Increasing number of blockchain games entering the market

- User adoption: Uncertainty in maintaining long-term player engagement

MAVIA Regulatory Risks

- Unclear regulations: Potential for regulatory changes affecting blockchain gaming

- Cross-border restrictions: Varying legal status of crypto gaming in different jurisdictions

- Token classification: Risk of MAVIA being classified as a security

MAVIA Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the game's code

- Scalability issues: Challenges in handling increased user load on the network

- Interoperability: Potential difficulties in integrating with other blockchain platforms

VI. Conclusion and Action Recommendations

MAVIA Investment Value Assessment

MAVIA presents a high-risk, high-reward opportunity in the blockchain gaming sector. Long-term value depends on successful game development and user adoption, while short-term risks include market volatility and regulatory uncertainties.

MAVIA Investment Recommendations

✅ Beginners: Start with small, affordable investments; focus on learning about blockchain gaming ✅ Experienced investors: Consider allocating a portion of your crypto portfolio based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence; consider MAVIA as part of a diversified gaming token portfolio

MAVIA Trading Participation Methods

- Spot trading: Buy and sell MAVIA tokens on Gate.com

- Staking: Participate in staking programs if offered by the Heroes of Mavia platform

- In-game purchases: Use MAVIA tokens for in-game assets and transactions

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MAVIA coin used for?

MAVIA coin is used in Heroes of Mavia game for governance, purchasing in-game items, and participating in tournaments. It's the main currency in the game's ecosystem.

How much is the MAVIA coin worth?

As of October 7, 2025, the MAVIA coin is worth $0.13. The price has seen a slight decrease of 0.08% in the past 24 hours.

What meme coin will explode in 2025 price prediction?

Pepe Coin is predicted to explode in 2025, with its deflationary nature and growing popularity driving its value. It has already reached a $860 million market cap and continues to gain traction.

What happened to the Heroes of Mavia?

Heroes of Mavia received a major update, HQ 10, in 2025. The game is now available on iOS and Android, offering new features for players to upgrade and dominate.

2025 GAME2Price Prediction: Analyzing Market Trends and Future Valuation Potential for the Gaming Token

2025 BIGTIME Price Prediction: Analysis of Growth Potential and Market Factors Influencing the Gaming Token's Future Value

2025 FORESTPrice Prediction: Analyzing Market Trends and Environmental Factors Shaping the Future of Sustainable Forestry

2025 LOE Price Prediction: Navigating the Future of Cryptocurrency Investments

2025 WOD Price Prediction: Analyzing Market Trends and Expert Forecasts for World of Demons Tokens

Is Ember Sword (EMBER) a good investment?: Analyzing the potential and risks of this blockchain-based MMORPG token

What Is Tokenomics: Token Distribution, Inflation Models, Burn Mechanisms, and Governance Explained

How Does Aethir Build One of Web3's Most Active Communities With 800+ Tribe Members and 5000+ Content Posts?

Is Hiblocks (HIBS) a good investment?: A Comprehensive Analysis of Potential Returns, Market Position, and Risk Factors

Is Istanbul Basaksehir Fan Token (IBFK) a good investment?: A Comprehensive Analysis of Risks, Benefits, and Market Potential

What is JELLYJELLY market cap and trading volume in 2026?