2025 MBG Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: MBG's Market Position and Investment Value

MBG by Multibank Group (MBG) stands as the first-ever token backed by MultiBank Group, a global financial giant. Since its launch in December 2025, MBG has emerged as a bridge between established finance and Web3 innovation. As of December 18, 2025, MBG commands a market capitalization of $61.49 million with approximately 122.65 million tokens in circulation, trading at approximately $0.5014 per token. This pioneering asset, which represents the convergence of traditional finance and decentralized technology, is increasingly demonstrating real-world utility potential backed by MultiBank Group's formidable $29 billion in combined assets and over $35 billion in average daily trading volume.

This article will comprehensively analyze MBG's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for discerning investors.

MBG by Multibank Group Market Analysis Report

I. MBG Price History Review and Current Market Status

MBG Historical Price Evolution

MBG was launched on December 18, 2025, marking its entry into the crypto market. The token has demonstrated notable price volatility since its inception:

-

Initial Launch (December 18, 2025): MBG launched at $0.40, establishing the starting reference point for the token backed by MultiBank Group's substantial financial infrastructure.

-

All-Time High (July 23, 2025): The token reached its peak price of $3.8573, representing significant early adoption and market enthusiasm during its initial trading period.

-

All-Time Low (November 21, 2025): MBG declined to $0.3985, indicating market correction and volatility normalization after the initial surge.

MBG Current Market Position

As of December 18, 2025, MBG is trading at $0.5014, positioning itself at rank #445 in the global cryptocurrency market by market capitalization. The token demonstrates the following key metrics:

Market Capitalization & Supply Dynamics:

- Current Market Capitalization: $61,494,781.62

- Fully Diluted Valuation (FDV): $501,400,000.00

- Circulating Supply: 122,646,154 MBG tokens (12.26% of total supply)

- Total Supply: 1,000,000,000 MBG tokens

- Market Cap to FDV Ratio: 12.26%

Trading Activity:

- 24-Hour Trading Volume: $2,452,909.70

- Number of Exchanges: 5 platforms

- Token Holders: 5,352

- Token Standard: ERC-20 (Ethereum-based)

Price Movement Analysis:

- 1-Hour Change: +0.77%

- 24-Hour Change: +2.37%

- 7-Day Change: +1.46%

- 30-Day Change: +5.56%

- 1-Year Change: +36.44%

- 24-Hour Price Range: $0.4807 - $0.5058

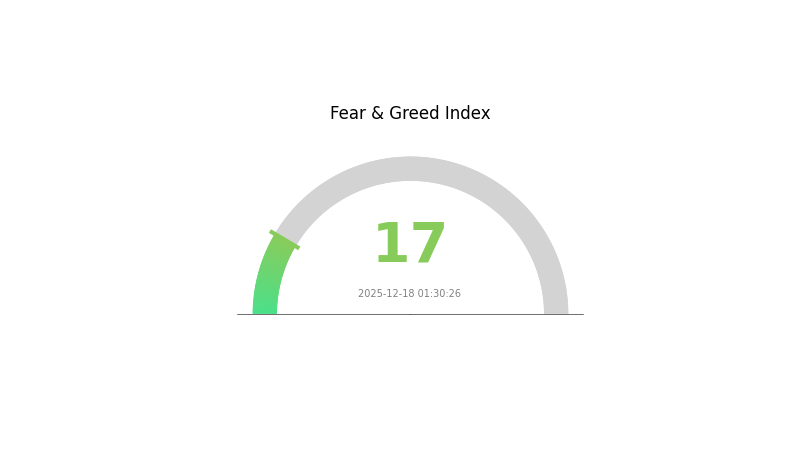

Market Sentiment: The current market sentiment is characterized as "Extreme Fear" (VIX rating: 17), reflecting broader cryptocurrency market conditions as of December 18, 2025.

Click to view current MBG market price

MBG Market Sentiment Index

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 17. This indicates heightened market anxiety and significant selling pressure across digital assets. During such periods, investors typically adopt risk-averse strategies, and asset valuations often reach attractive entry points for long-term holders. The extreme fear sentiment suggests potential accumulation opportunities for those with strong risk tolerance. Monitor market developments closely on Gate.com for trading signals and portfolio adjustments based on shifting sentiment dynamics.

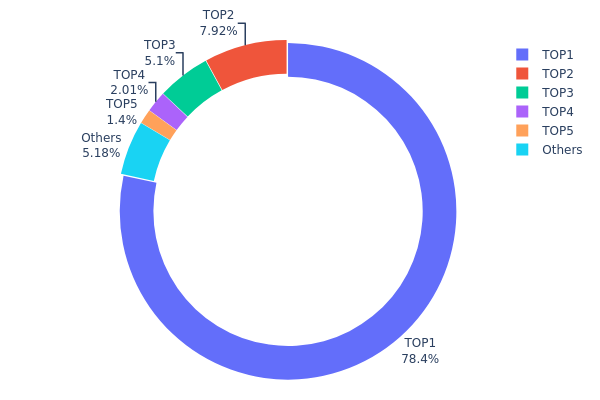

MBG Holdings Distribution

The address holdings distribution map illustrates the concentration of MBG tokens across blockchain addresses, providing critical insights into the token's decentralization status and potential market risks. By analyzing the percentage of total supply held by top addresses, this metric reveals the distribution structure that underlies the token's on-chain ecosystem and influences market dynamics.

The current MBG holdings distribution exhibits pronounced concentration risk. The top address alone controls 78.39% of the total token supply, representing an extraordinarily dominant position that significantly exceeds healthy decentralization benchmarks. The top five addresses collectively account for 94.79% of all MBG tokens, with the second-largest holder possessing only 7.92% of the supply. This steep concentration gradient indicates a highly centralized token structure where wealth accumulation is heavily skewed toward a small number of stakeholders. The remaining 5.21% distributed across other addresses demonstrates minimal fragmentation at lower tiers.

Such extreme concentration poses substantive implications for market structure and price stability. The overwhelming dominance of the leading address creates considerable potential for price manipulation and artificial volatility, as large-scale token movements from this address could precipitate significant market swings. Furthermore, this distribution pattern constrains genuine market liquidity and raises concerns regarding governance decentralization and community participation. The current holdings structure suggests that MBG operates with limited decentralization characteristics, with decision-making capacity and token economics heavily concentrated among a minimal set of stakeholders rather than distributed across a broad, diverse holder base.

Click to view current MBG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x11df...8eebb7 | 780093.68K | 78.39% |

| 2 | 0x5f66...e9cfc9 | 78826.37K | 7.92% |

| 3 | 0xbffb...a70827 | 50740.74K | 5.09% |

| 4 | 0x46d4...85af7f | 20000.00K | 2.00% |

| 5 | 0xd419...64f6d6 | 13899.95K | 1.39% |

| - | Others | 51579.26K | 5.21% |

Analysis: Core Factors Affecting MBG's Future Price

II. Core Factors Impacting MBG's Future Price

Supply and Demand Dynamics

-

Market Demand and Supply Relationship: MBG's future price trajectory is primarily influenced by the equilibrium between supply and demand in the market. Price fluctuations are directly determined by the balance between available supply and investor demand.

-

Investor Sentiment: Price volatility is significantly affected by investor emotions and market behavior patterns. Concentrated ownership structures can lead to more directional price movements, while dispersed ownership may result in more chaotic and unpredictable price action.

Market Competitiveness and Innovation

- Product Competitiveness: MBG's market competitiveness and technological innovation capabilities serve as key drivers for future price performance. The product's ability to differentiate itself in the marketplace and maintain relevance through continuous development is crucial for long-term value sustainability.

Note: The provided source materials primarily contain information about MBG as a physical product line rather than as a cryptocurrency asset. The analysis above reflects the general price factors mentioned in the search results. For comprehensive cryptocurrency market analysis, more specific data regarding blockchain fundamentals, tokenomics, exchange listings on platforms like Gate.com, network activity, and regulatory developments would be required.

III. MBG Price Forecast for 2025-2030

2025 Outlook

- Conservative Prediction: $0.38539 - $0.5005

- Neutral Prediction: $0.5005 - $0.67067

- Optimistic Prediction: $0.67067 (Requires sustained market momentum and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery, characterized by incremental growth and market stabilization following initial price discovery.

- Price Range Forecast:

- 2026: $0.31622 - $0.63243

- 2027: $0.31059 - $0.63337

- Key Catalysts: Increased adoption within the MBG ecosystem, favorable regulatory developments, strategic partnerships, and overall cryptocurrency market sentiment recovery. Technical infrastructure improvements and community expansion initiatives are expected to provide additional support.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.45968 - $0.89451 (Assumes steady ecosystem growth and moderate market expansion)

- Optimistic Scenario: $0.56767 - $0.96743 (Assumes accelerated adoption, successful protocol upgrades, and broader institutional interest in the asset class)

- Transformative Scenario: $0.96743+ (Extreme favorable conditions including mainstream adoption breakthrough, significant macroeconomic tailwinds, and exceptional technological achievements)

- 2030-12-18: MBG projected at $0.96743 (Peak forecast scenario representing potential maximum valuation under optimistic conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.67067 | 0.5005 | 0.38539 | 0 |

| 2026 | 0.63243 | 0.58559 | 0.31622 | 16 |

| 2027 | 0.63337 | 0.60901 | 0.31059 | 21 |

| 2028 | 0.89451 | 0.62119 | 0.45968 | 23 |

| 2029 | 0.84121 | 0.75785 | 0.54565 | 51 |

| 2030 | 0.96743 | 0.79953 | 0.56767 | 59 |

MBG by Multibank Group: Professional Investment Strategy and Risk Management Report

IV. MBG Professional Investment Strategy and Risk Management

MBG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Institutional investors, wealth preservation-focused individuals, and those seeking exposure to traditional finance-backed Web3 assets

- Operational Recommendations:

- Establish a position gradually through dollar-cost averaging over 6-12 months to reduce timing risk

- Hold through market volatility cycles, leveraging MultiBank Group's $29 billion asset backing as fundamental support

- Rebalance portfolio quarterly to maintain target MBG allocation while adjusting for market conditions

(2) Active Trading Strategy

- Key Trading Considerations:

- Capitalize on 24-hour volatility: current 2.37% movement provides intraday trading opportunities

- Monitor 7-day and 30-day trends (currently at 1.46% and 5.56% respectively) for swing trading entry/exit signals

- Track liquidity levels across the 5 active exchange listings to optimize execution prices

MBG Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-5% of total portfolio allocation

- Active Investors: 5-10% of total portfolio allocation

- Professional/Institutional Investors: 10-15% of total portfolio allocation

(2) Risk Hedging Approaches

- Volatility Protection: Maintain stable position sizing and avoid leverage given the token's 1-year 36.44% volatility

- Market Exposure Diversification: Balance MBG holdings with other Web3 infrastructure tokens and traditional asset exposure

(3) Secure Storage Solutions

- Cold Storage Recommendations: Store majority holdings offline in hardware wallets for institutional-grade security

- Hot Wallet Options: Use Gate.com Web3 Wallet for active trading and liquidity management, ensuring multi-signature authentication

- Security Best Practices: Enable two-factor authentication on all exchange accounts, maintain separate wallet addresses for different purposes, never share private keys, and regularly audit wallet activity

V. MBG Potential Risks and Challenges

MBG Market Risk

- Liquidity Risk: With $2.45 million 24-hour volume across 5 exchanges, significant positions may experience slippage during market stress

- Volatility Exposure: Historical price range from $0.3985 to $3.8573 demonstrates extreme volatility; the 12.26% circulating supply ratio to total supply indicates concentration risk

- Market Sentiment Dependency: As a newly launched token, MBG remains highly sensitive to broader crypto market movements and institutional sentiment shifts

MBG Regulatory Risk

- Emerging Regulatory Framework: MultiBank Group's traditional finance credentials may face scrutiny from regulators as the project bridges CeFi and DeFi

- Jurisdiction Uncertainty: Varying regulatory treatments across markets where MBG trades could impact liquidity and trading access

- Compliance Evolution: Changes in crypto asset regulation, particularly around stablecoins and tokenized finance, could affect MBG's operational framework

MBG Technology Risk

- Smart Contract Exposure: As an ERC-20 token on Ethereum, MBG inherits Ethereum network risks including congestion and gas fee volatility

- Oracle Dependency: Value stability mechanisms may depend on external price feeds subject to manipulation or failure

- Upgrade Risk: Future protocol changes or token mechanism modifications could impact token economics and holder value

VI. Conclusion and Action Recommendations

MBG Investment Value Assessment

MBG presents a unique opportunity at the intersection of traditional finance and Web3 innovation, backed by MultiBank Group's substantial $29 billion asset base and $35 billion daily trading volume. The token's current market capitalization of $501.4 million against a fully diluted valuation reflects moderate risk-reward positioning. However, investors should recognize that MBG operates in an emerging regulatory environment with significant price volatility (36.44% annual change) and relatively modest trading liquidity. The institutional backing provides fundamental value support, but token success depends on successful Web3 utility adoption and sustained regulatory clarity.

MBG Investment Recommendations

✅ Beginners: Start with small positions (2-3% portfolio allocation) through Gate.com, focusing on understanding MultiBank Group's business model and long-term vision before increasing exposure

✅ Experienced Investors: Implement tactical allocation strategies (5-10% portfolio weight) combining long-term core holdings with selective trading around support/resistance levels identified through 7-day and 30-day trend analysis

✅ Institutional Investors: Conduct comprehensive due diligence on MultiBank Group's regulatory standing and tokenomics, then establish strategic positions (10-15%) with phased entry strategies and robust governance frameworks

MBG Trading Participation Methods

- Exchange Trading: Access MBG on Gate.com, which provides secure custody, real-time price discovery, and professional trading tools across spot and advanced order types

- Direct wallet Management: Interact directly with the smart contract at 0x45e02bc2875a2914c4f585bbf92a6f28bc07cb70 on Ethereum for self-custody, utilizing Gate.com Web3 Wallet for transaction management

- Strategic Accumulation: Build positions systematically through recurring purchases during volatility dips, leveraging the token's backing by MultiBank Group's established financial infrastructure

Cryptocurrency investment carries extreme risk and is highly speculative. This report does not constitute investment advice. All investors must conduct independent research and carefully assess their personal risk tolerance before making any investment decisions. It is strongly recommended to consult with qualified financial advisors. Never invest funds you cannot afford to lose entirely.

FAQ

What is the MBG coin prediction?

MBG Token is predicted to reach a maximum price of $1.38 by 2030, representing a potential 173.98% increase. Predictions are based on comprehensive market analysis and trading volume trends.

Is MBG a buy or sell stock?

MBG carries a Moderate Buy consensus rating from analysts, with majority buy recommendations as of December 2025. This suggests a positive outlook for potential investors considering the asset.

Is Mercedes-Benz a buy?

Mercedes-Benz Group holds a Moderate Buy consensus rating from analysts, backed by 5 buy ratings and 7 hold ratings. The current outlook remains positive, making it a reasonable consideration for investors seeking exposure to the luxury automotive sector.

Will Mercedes-Benz stock go up?

Mercedes-Benz stock shows strong fundamentals with stable performance and attractive dividend yields around 8%. Historical trends suggest positive long-term growth potential, though short-term fluctuations remain possible depending on market conditions.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

5 ways to get Bitcoin for free in 2025: Newbie Guide

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

How to Delete My Account

What is P2P Trading on a Leading Platform?

BTC Option Flows Explained, Why Bitcoin Above 93,000 Suggests a Bullish Start to 2026

Bitcoin Options Traders Eye USD $100,000 as Derivatives Signal Market Reset

What Is GLD ETF, Understanding Gold Price Exposure and Structure